Sector Focus: Mining

Has the leopard changed its spots.

Bill Clinton once said, “The price of doing the same old thing is far higher than the price of change”. Given the recent strength of the resources sector, we thought it would be appropriate to assess whether renewed supply discipline can lead to sustained outperformance over the long term. As urbanization trends and middle classes in emerging markets expand, so will the need for infrastructure. Furthermore, the composition of such, needs to shift towards reduced carbon intensity and renewables. Therefore, we believe global infrastructure needs to be rethought and redeveloped, with the support of the mining sector.

During the early 2000s, mining companies were the darlings. Strong demand from emerging markets, especially China, saw these companies capture market share via capacity expansion. The idea of higher margins due to ‘economies of scale’ was a widespread belief. In 2015, it all came crashing down – some companies were forced into capital raises and asset sales as balance sheets blew out, covenants were breached, and rating agencies became increasingly critical of the sector’s prospects.

So where did it all go wrong? Shareholders began to reward businesses with growth pipelines and market share gains – the optimal level of production was the maximum level of production. The market was infatuated with strong volume growth, progressive dividend policies, and frowned upon ‘lazy’ balance sheets; but overlooked some key metrics: Return on Assets, Return on Equity and Free Cash Flow were all declining over this period.

‘Economies of scale’ benefit fixed cost businesses that add incremental volume at lower incremental costs. Once scale is reached, the J-curve effect takes hold and we see a rapid rise in profits. Does this hold true for mining? Does the same apply to businesses with exhaustible mineral resources and structural grade declines?

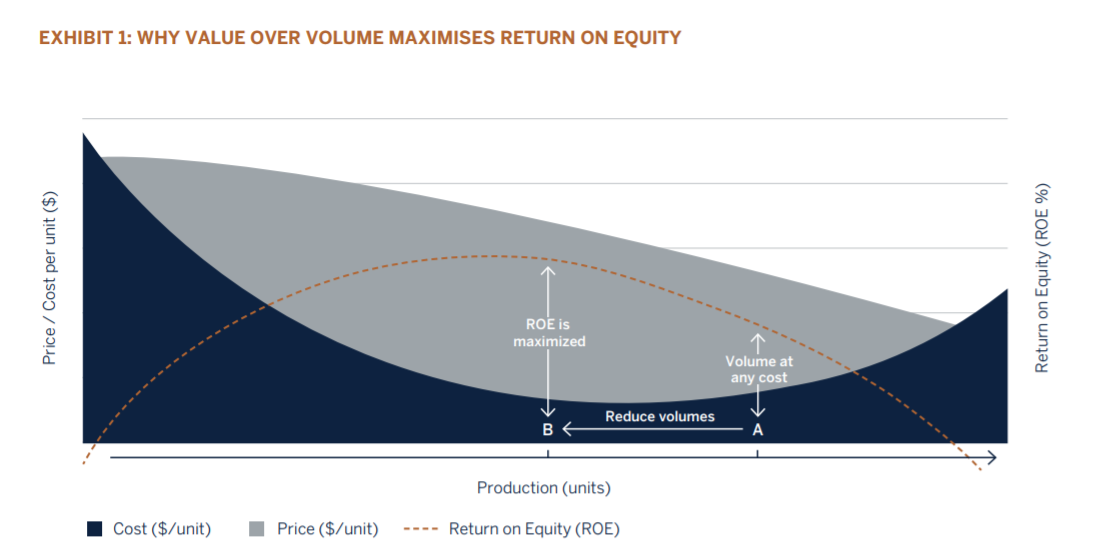

We are of the view that businesses with exhaustible mineral resources and structural grade declines face diseconomies of scale past a certain level of production. The cost curve starts increasing after a point and the marginal unit produced becomes disadvantageous to shareholders (Exhibit 1). The assumption in Exhibit 1 is a robust demand backdrop and predictable supply – both of which are inherently difficult to predict.

WHY DISECONOMIES OF SCALE?

Capacity expansions give rise to an oversupply and thus we see declining pricing profiles as more supply is introduced into the market. By producing volume at any cost this is effectively value transfer from the mines to the consumers.

Costs actually start to rise again as production is pushed beyond a certain level. Operating costs rise as there is greater competition for diesel, machinery, equipment and labour. The structural grade declines inherent in all ore bodies also result in higher strip ratio’s (the volume of waste material required to be moved to extract the same tonnage of ore), increasing costs further.

As capacity increases, so does depreciation. In industries where economies of scale are realized, increased depreciation is acceptable as the added marginal unit at lower overall costs still benefits the shareholder. However, this is not the case for businesses with diseconomies of scale.

LESSON IN CAPITAL ALLOCATION

As we saw in 2011-2015, shareholders began rewarding businesses with growth pipelines. Management continued to approve projects, justifying why the market could absorb the additional capacity. These expansion strategies were often on the back of optimistic feasibility studies and overpriced mergers and acquisitions. When demand inevitably pulled back, prices retreated, and significant impairments were realized.

In fact, if we just take the four better known, “quality” diversified global miners (Anglo American, BHP, Glencore and Rio Tinto) as proxies over period, the results are astonishing. Cumulatively, they impaired US$ 86.2bn of shareholders equity. This represents just under 50% of their total capital expenditure over the same period. Poor capital allocation was evident through: too much supply into the market; lack of cost discipline; delayed projects or even diversifying away from their core expertise. Exacerbated by a poorer demand profile than previously expected. Nevertheless, the common theme over this period was mass volume growth with little focus on efficiencies, resulting in weakening profitability metrics.

Fortunately, all is not lost with the global miners. Post the 2015 downturn, there has been a shift in focus in the industry. On the back of shareholder pressure (ironically, the same shareholders that pressured them for volume growth a few years earlier), management have increasingly focused on capital allocation. The emphasis has shifted to maximizing return on investment metrics, keeping returns to shareholders at the core of their capital allocation frameworks and refining portfolios to focus on tier 1 ‘flagship’ assets. Production was pulled back from point A to B in Exhibit 1 - overall volumes decreased, as the marginal ton was withdrawn, and the more profitable assets became a larger portion of contribution. The market was thus not pushed into surplus, and prices have been relatively stable. The reduced marginal volumes also allowed management to focus on efficiencies and thus keep costs under control.

DOES THIS MEAN MINING COMPANIES ARE NOW SOUND INVESTMENTS OVER THE LONG TERM?

If the mindset has structurally changed, do these companies now characterize sound investments for long term shareholders? We are of the view that they are better positioned at present, but only those with market leading positions and superior geology relative to peers.

According to Bernstein research, at the start of the twentieth century, mining a ton of copper would require the movement of 50 tons of rock, the consumption of 75 thousand litres of water and 250kwh of energy. At present, to extract that same ton of copper requires the movement of 800 tons of rock, 150 thousand litres of water and 4000kwh of energy. This is a clear reflection of how resource depletion and grade decline is making it more and more difficult for miners to extract resources for a more “metals intensive, electrified” world. Fortunately, technology and increased productivity to meet the demands have allowed continued volume growth despite these structural geological hurdles.

That said, large productivity advances to offset geological hurdles are going to be harder to realize in the future given that the step change in productivity has largely been attained. Initiatives such as BHP’s and Rio Tinto’s drive for autonomous operations as well as Anglo American’s ambition towards a “waterless mine” all benefit at the margin, but are not significant enough to offset the geological depletion in the long run.

If we contrast these productivity improvements that are insufficient to combat resource depletion and grade decline against the robust long-term global demand outlook, we should see commodity prices trend up in real terms, barring a step change in productivity gains. Senior executives of these mining companies now realize that the focus on volume at any cost leads to inefficient practices in terms of productivity.

If the miners maintain this new-found value mantra, then the incumbent miners with superior geology and flagship assets will generate superior returns over time, benefitting all stakeholders and will be sound investments over the long term – time will tell…