From our Fund Manager’s Desk

We regularly explore an investment theme that we see playing out in the Melville Douglas Global Equity Fund. This quarter Chris Willis, senior global equity analyst, highlights Artificial Intelligence and its impact on our investments.

Artificial intelligence (AI) is one of the most transformative technologies of our time. It is already having a major impact on a wide range of industries, and its potential is only just beginning to be realised. Business models will be forced to adapt and those that don’t may face existential risk. Chris explores this and why we believe the companies owned by the Global Equity Fund are positioned on the right side of this disruptive trend.

The AI Revolution

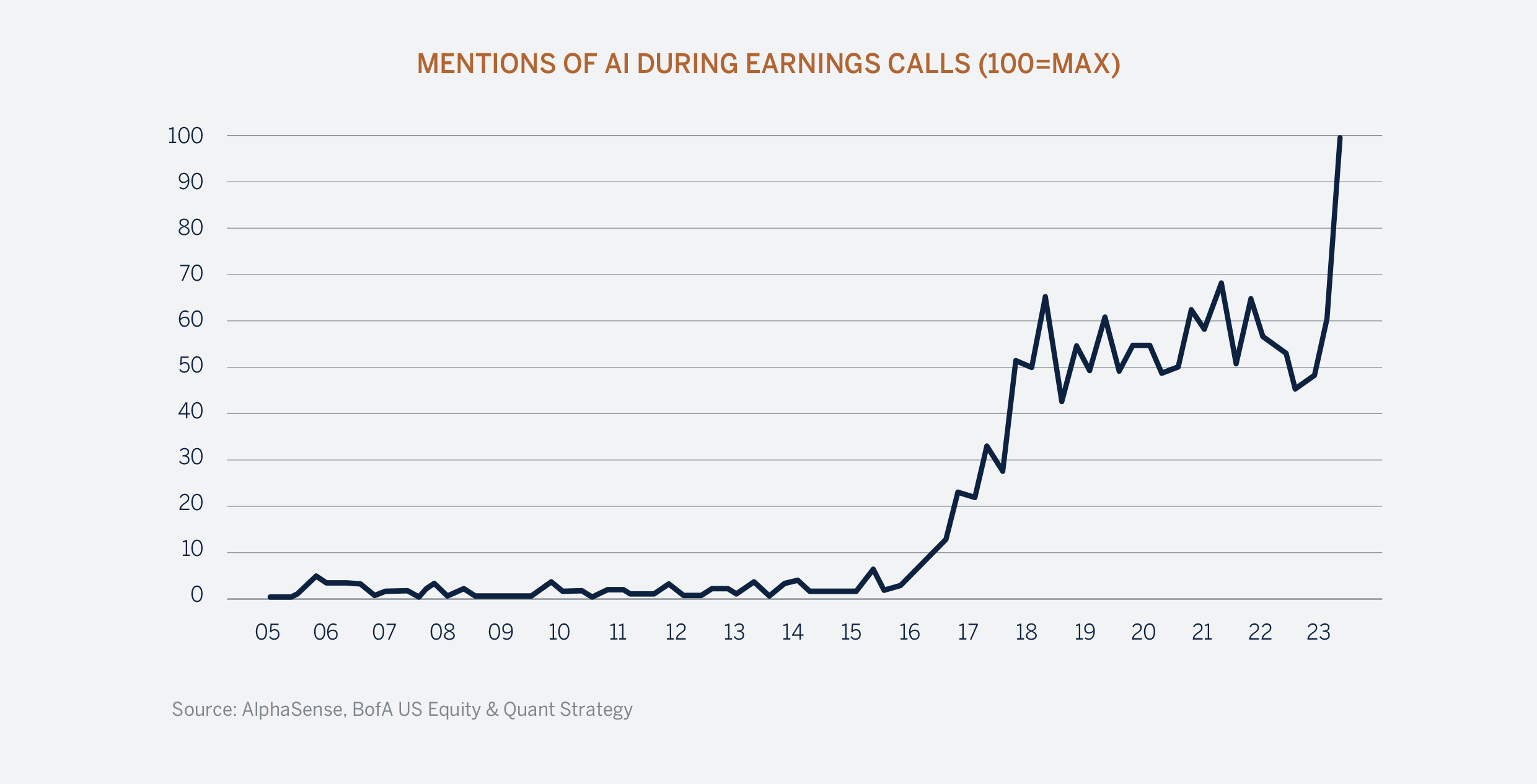

2023 has been dubbed the “breakout year for AI” by the Financial Times. Generative AI models such as ChatGPT and Google Bard have made AI accessible to the general public for the first time and led to a surge of interest in the potential applications. Public enthusiasm for AI has been unprecedented with ChatGPT reaching 100m users in under two months – seven months faster than TikTok and more than two years ahead of Instagram. The enthusiasm to talk about AI is not limited to the general public. Executives across all industries have used the opportunity to discuss their own AI plans. According to Bank of America, mentions of AI are up more than 85% this year, and seemingly every business must now have an AI strategy. This begs the question – is it all hype?

Generative AI models like ChatGPT are the result of decades of research but it’s only in the last few years that the technology has been close to meeting our ambitions – to mimic human intelligence. Recent advances in computing power (the hardware) and training methodologies (the software) have led to an explosion of innovation in the space. Large Language Models (LLMs) are the foundation on which generative AI is built. These models are trained on unfathomably large data sets and the training costs run into the tens if not hundreds of millions of dollars. If a human were to attempt to consume all this information, it would take him a million lifetimes.

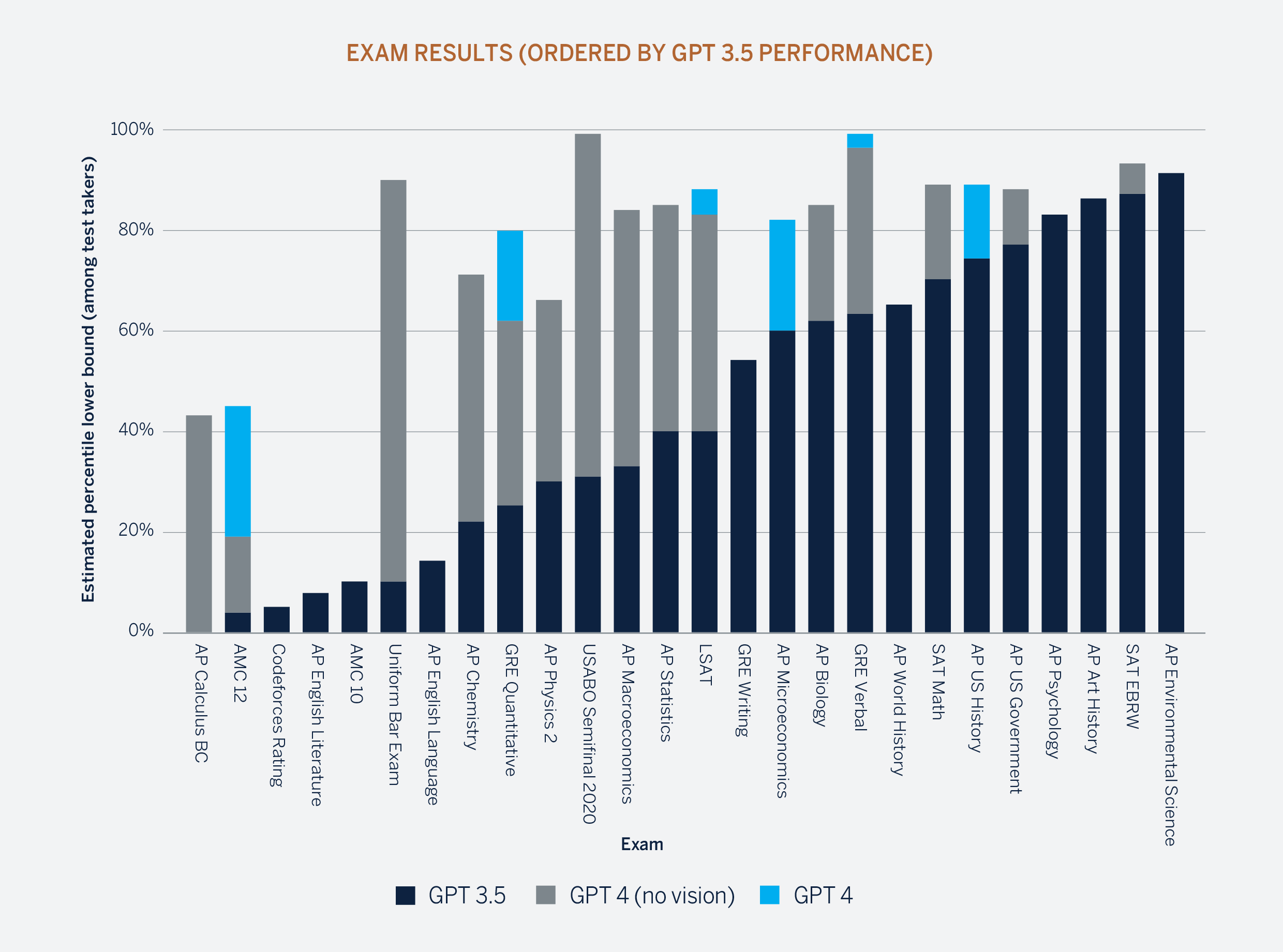

The rate of development in model design is not slowing down either. ChatGPT-3.5 was trained on a set of 175 billion parameters, and it is thought that the next generation ChatGPT-4 has been trained on closer to one trillion parameters. This huge increase in the training data has borne fruit for OpenAI, the developer of ChatGPT. When presented with a simulated bar exam (legal standard exam), GPT-4 achieved a score around the top 10% of test takers, by contrast, GPT-3.5’s score was in the bottom 10%.

As a result of these advances, AI is now capable of performing a wide range of tasks that were once thought to be the exclusive domain of humans. ChatGPT and Bard can generate text that is indistinguishable from human-written text, compose music, translate languages accurately, and write poetry or computer code.

Although generative AI is still relatively early in its development, it is clear that it has great potential and will likely disrupt and revolutionize entire industries.

The Next Chapter

Throughout human history, every major technological invention has had a positive impact on economic growth. AI should not be any different. A recent study by the McKinsey Global Institute found that AI could boost global GDP by up to $13 trillion by 2030. An additional 1.2% of global GDP per year. The equivalent of adding a UK size economy every two years.

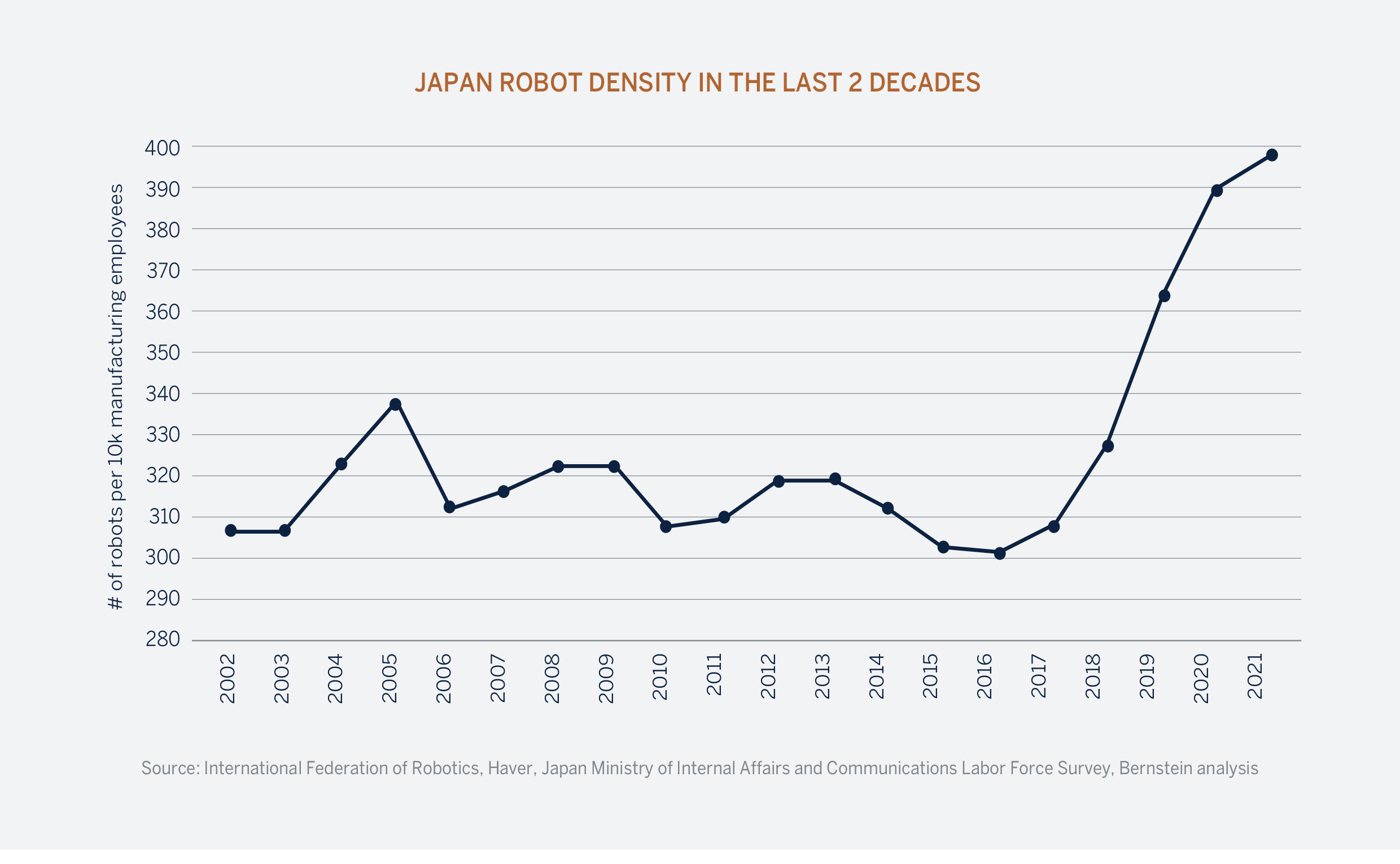

The underlying economic impact may only emerge gradually and be visible over time. To understand it better we can observe some trends that are already in place. In manufacturing, robotics and automation are being employed to automate tasks that are currentlyperformed by humans. This reduces waste and speeds up production resulting in higher output and lower costs.

Keyence, owned by the Melville Douglas Global Equity Fund, is a market leader in vision products, which are a key enabler for robotics. In Japan, the most advanced robotics market, the use of robots increased 30% in just four years after staying flat for almost two decades. The growth in new adoption is being driven by AI which has expanded the use case for robotics. We expect this trend to continue as more traditional manufacturing industries are automated and AI is deployed into new industries where robots can assist humans.

While AI has the potential to bring many benefits, there are also some risks associated with it. For example, some experts worry that AI could lead to mass unemployment, as machines become capable of performing many of the tasks that are currently done by humans. Morgan Stanley estimates that 25% of all labour will be impacted by current AI technology. With advancements in AI this is expected to grow to 44% in just three years.

Despite this risk, the potential benefit of AI far outweighs the downside. We believe it will have a net positive impact on the global economy and society. For example, AI could be used to develop new medical treatments, democratise access to the best education systems, self-driving cars will make our transportation systems more efficient, and it will increasingly play a role in achieving climate change goals.

The Gold Rush

There is an old investing adage which says that if you find yourself in a gold rush, rather than digging for the gold yourself, it is better to be selling picks and shovels. No other stock encapsulates the spirit of the 2023 AI boom quite like Nvidia. Demand for its H100 Graphics Processing Unit (GPU) has exploded, and the company has reported exceptional financial results. Nvidia has a strong technology advantage in GPUs, which are the preferred choice for accelerated computing. However, this lead is threatened by some of its largest customers who are developing their own chips. Firms like Meta, Amazon, Microsoft, and Alphabet are seeking to lessen their dependence on Nvidia and lower their AI infrastructure costs. New hardware options with the accompanying development software may permanently weaken Nvidia’s moat and lower the prospects for its future growth potential. Fortunately for us, the AI revolution has created opportunities in both hardware and software.

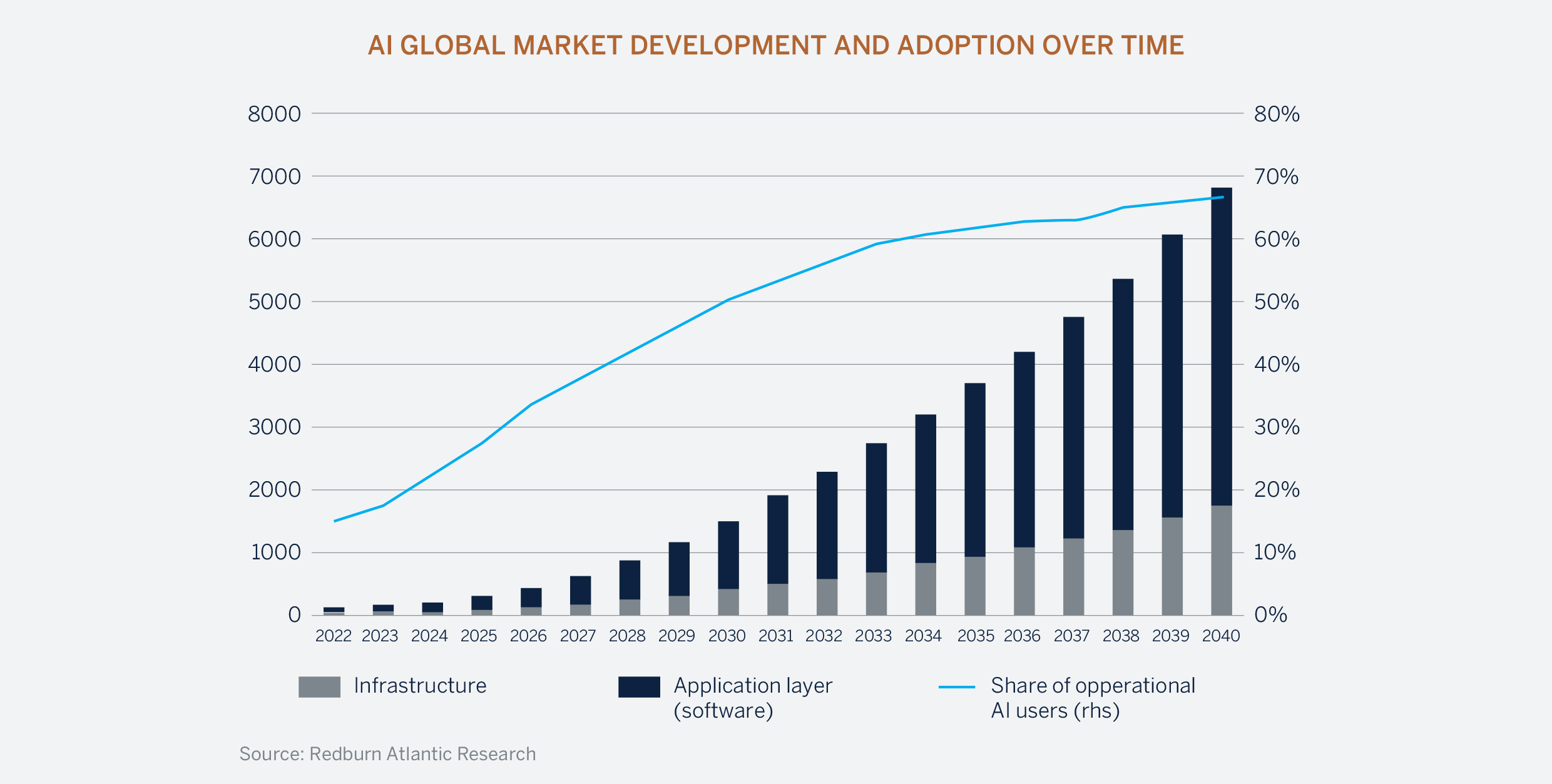

In the long term, we believe that more value will be created from the AI platforms and the applications built on them. Foundational models that gain adoption across consumer and enterprise will become mission-critical in a more AI-dependent world. With high switching costs it is likely that the early winners will maintain a long-term leadership position. Redburn Atlantic believes that the Global AI market could reach $7 trillion by 2040 and the majority of this nascent market will be in the application and software layer and not the infrastructure layer.

The cloud hyperscalers – Amazon Web Services, Microsoft Azure, and Google Cloud Platform – have a natural advantage and a large head start in the AI race. Cloud computing centralises an organisation’s data into one point of access. The cloud allows an organisation to run intensive workloads with that data and access it reliably and affordably. AI will bring new, and novel uses to that data and the cloud hyperscalers will have the infrastructure to do the work. The two services go hand in hand. Microsoft is particularly well positioned here as it is the largest enterprise software business globally and practically every business on earth is a user of Microsoft products.

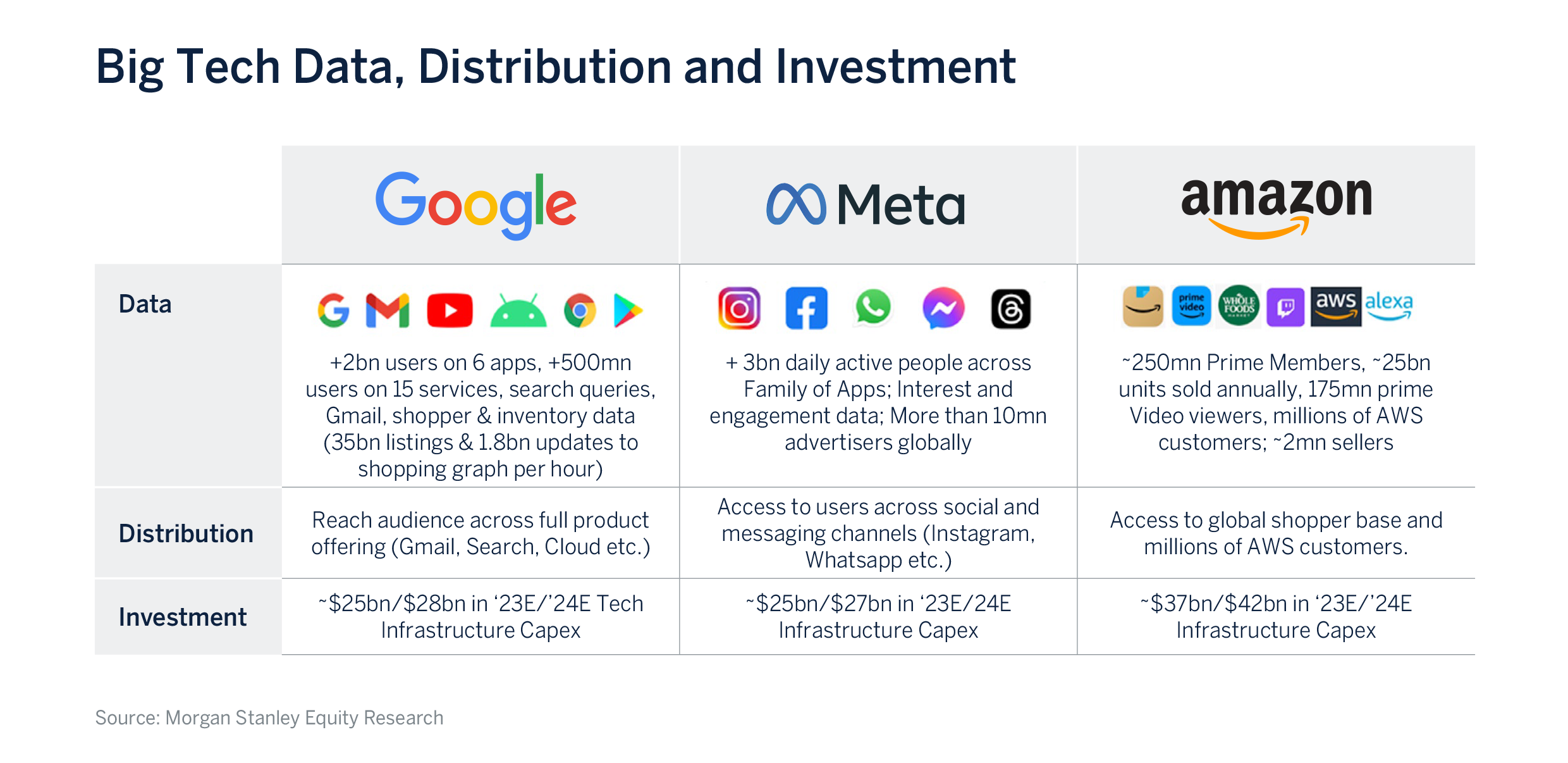

When it comes to generative AI – Meta Platforms, Amazon and Google (Alphabet) all have significant data and distribution advantages with massive networks of users. These tech giants also have the resources to invest ahead of demand at a scale that almost no other firm can.

The Hype Cycle

The enthusiasm we have seen for AI is unprecedented and somewhat reminiscent of more faddish trends like blockchain and autonomous vehicles. While these are real and important technologies, expectations of their adoption and growth rates became inflated and the reality has been much more muted.

Will AI be the same? We have real products and there is certainly real innovation, but it seems as though we are still some way off from meaningful revenue contribution from AI services and products. Amara’s Law seems to apply — the observation that when forecasting the impact of technology we tend to overestimate the effect in the short run and underestimate the effect in the long run.

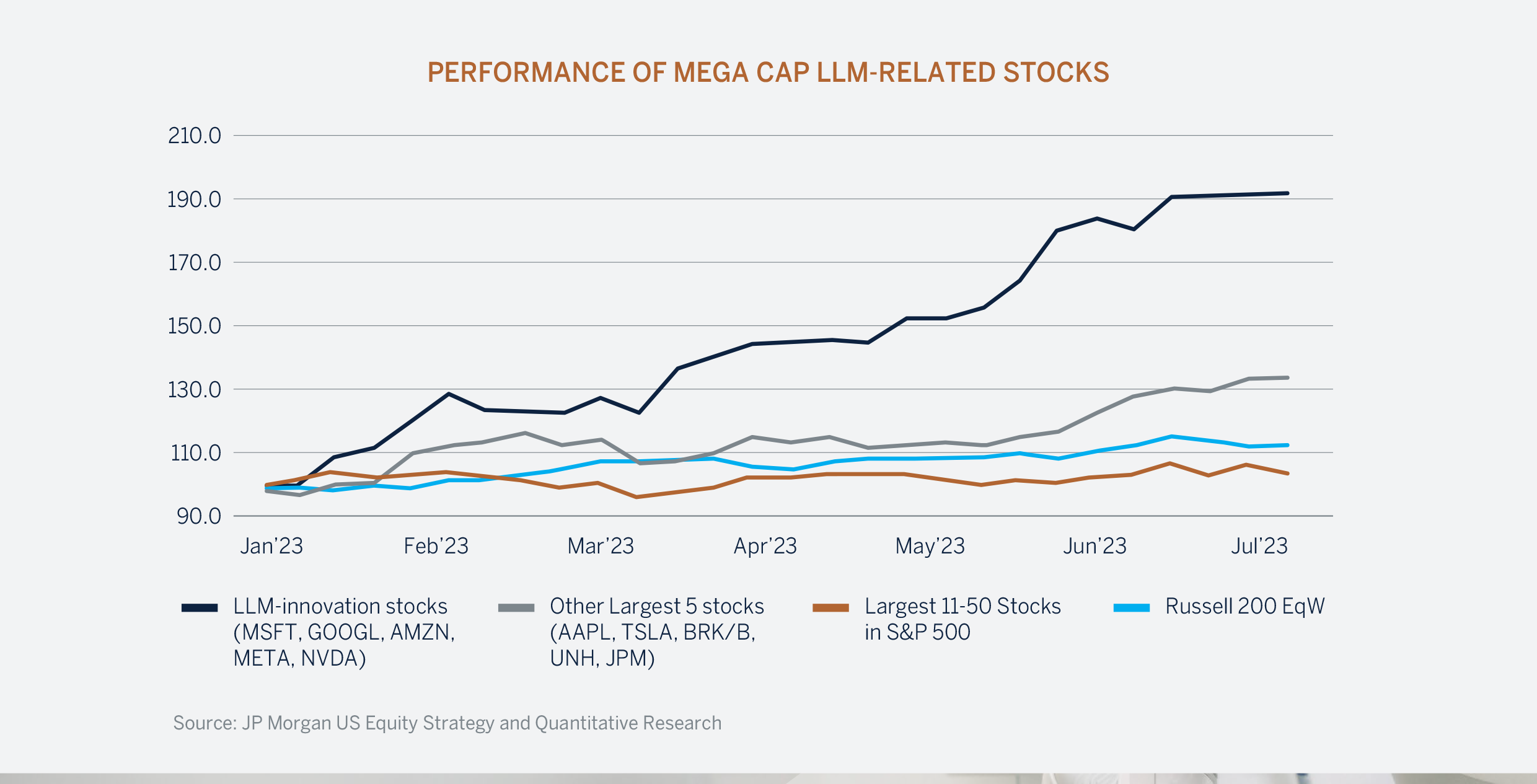

This observation reassures us that although the mega cap tech stocks have had an impressive 2023, there remains plenty of runway ahead.

We have a multi-year investment horizon and believe in the long-term transformative potential of artificial intelligence. The companies owned by the Global Equity Fund will play a significant role in surfacing this technology. This will lead to higher rates of earnings growth, and we believe superior returns in the future.