From our Fund Manager’s Desk

We regularly explore an investment theme that we see playing out in the Melville Douglas Global Equity Fund. This quarter Chris Willis, senior global equity analyst, highlights Taiwan Semiconductor Manufacturing Company and its place in the Global Equity Fund.

Taiwan Semiconductor Manufacturing Company (TSMC) is one of the most important companies in the world. Despite this, many of us have either never heard of it or don’t fully understand just what it is that they do. Semiconductors are the critical hardware behind almost all technology. Without these tiny microchips we wouldn’t have most of the conveniences and luxuries that make up our increasingly digitised lives. Chris explores this and why we believe TSMC is poised to not only benefit from the coming computing revolution but be a key driving force of it.

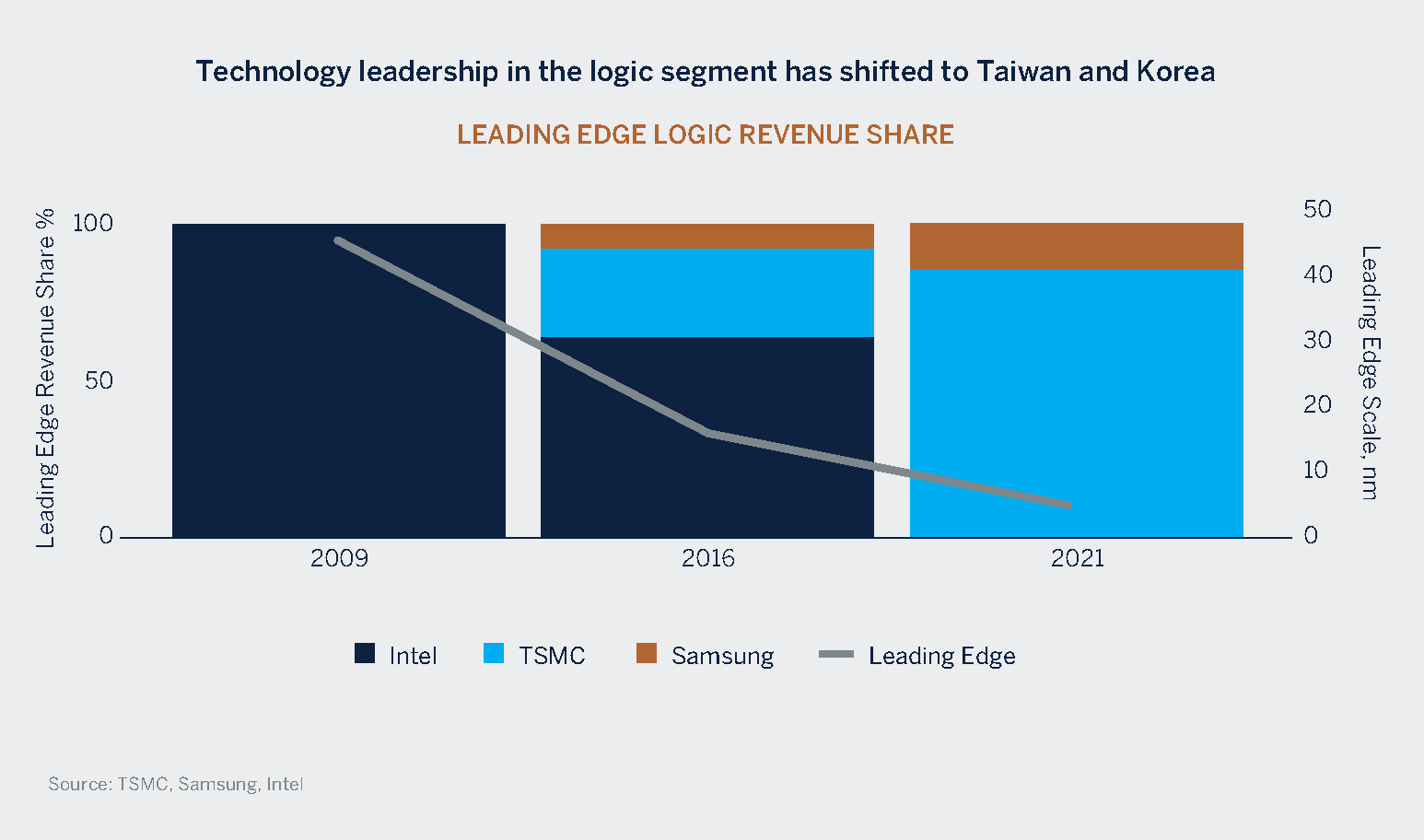

Founded in 1987, TSMC pioneered the fabless foundry model. This means they don't design their own chips but focus solely on perfecting the complex manufacturing process. This singular pursuit has allowed them to become the world's leading contract chipmaker. In producing the most advanced chips, known as leading edge, TSMC holds more than 90% market share and manufacturers for customers around the world. Over the past two decades they have surpassed industry giants like Intel and today hold a significant technological lead over them.

The company has grown to become such a major role player in the global semiconductor industry, that it’s often thought of as the most important company in the world. One that sits at the centre of a global supply chain producing microchips for everything from iPhones and autonomous vehicles to data centres and fighter jets. The importance of this supply chain came to light during COVID when disruptions to it resulted in production lines being shut down, and shortages of appliances and electronic devices being felt across the world. Increasingly, access to semiconductor supply has become a matter of national security and TSMC has found itself to be at the centre of all the interest.

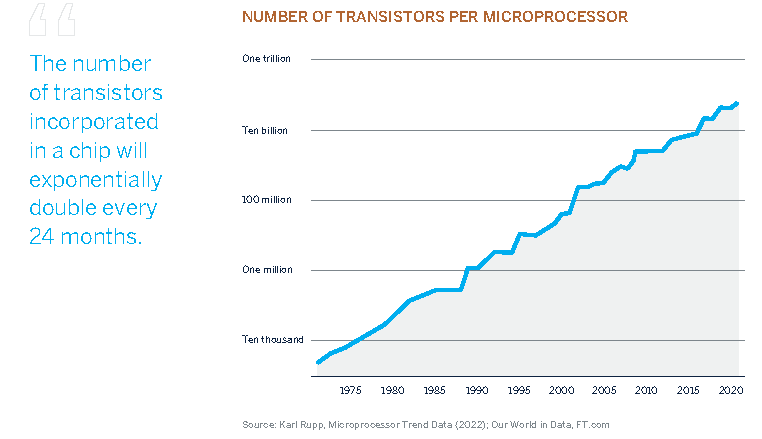

Semiconductors exist mostly out of sight, quietly powering our increasingly digitised lives. Without these engineering marvels much of today’s technology wouldn’t be possible. The development of semiconductors has come a long way from 1979 when Gordon Moore, the co-founder of Intel, described what was to become known as Moore’s Law:

This observation implies that the density of chips will double every two years, in effect doubling the computing power. This consistent improvement in semiconductor economics over the last 50 years has meant that computing costs have dramatically fallen. This has allowed us to cram more power into devices and at a cost that would have been difficult to imagine in the past. Consider the smartphone which weighs only a few hundred grams but is handily capable of replacing your desktop PC for most uses.

When Science and Industry Collide

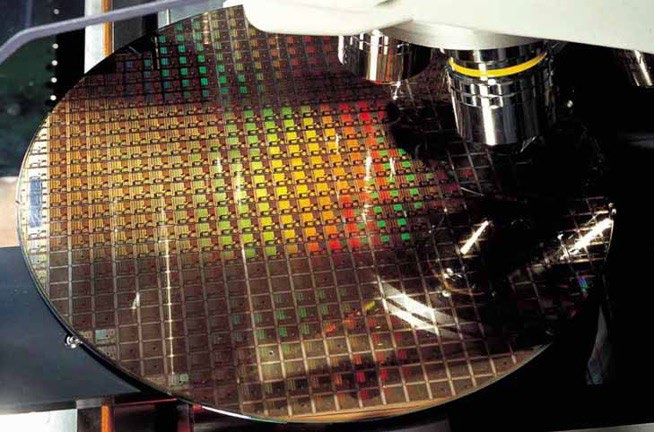

A microchip that is about as big as your thumb will consist of tens of billions of transistors. The most advanced chips now have up to 100 billion transistors. These nanoscale conductors, acting as electrical switches, are layered onto a semiconductive material like silicon, hence the name semiconductor. TSMC has mastered the art of manufacturing these chips. Doing so requires pushing the boundaries of science and advances take years of experimentation and require staggering levels of research and development spending.

The fabless foundry model that TSMC operates has allowed them to focus their R&D on perfecting the manufacturing process and scaling it to industrial levels. This is markedly different from the traditional business model of integrated design and manufacture (IDM), one pioneered by Intel and which served them well for more than 50 years.

By being independent and not competing directly with its chip design customers, TSMC has been able to partner with them to advance manufacturing at a faster rate. TSMC has used its neutral but indispensable position to streamline the industry supply chain by collaborating more and bringing it to act as if it were a single entity. This partnership model has ensured a steady pace of progress in developing new nodes and allowed TSMC to become the dominant leading edge manufacturer that it is today.

To continue to innovate and move Moore’s Law forward requires legions of peope. In order to do this well, experience matters most. TSMC is among a handful of dedicated foundries that possess the scientific and engineering knowhow to develop advanced manafacturing techniques and which today no other company has achieved at scale.

A modern fab costs between $10bn to $20bn to construct , an amount that grows proportionately with the complexity of the chips it produces. As this capital intensity has grown the table stakes to enter the industry have put chip manufacturing out of reach to new entrants. The smallest deficiencies in production can result in poor manufacturing yields and massive losses to customers and the foundry. TSMC has demonstrated that it is able to advance in chip manufacturing, moving into nanoscale and producing hundreds of millions of chips a year at industry leading yields.

The Future of Semiconductors

The density of chips is constantly increasing. McKinsey expects the global semiconductor industry to grow by 7% per year until 2030 with cloud computing, wireless communication and automotive electronics being responsible for 70% of the growth. Demand for automotive chips is expected to triple by 2030, rising by about $29bn per year. Motor vehicle IT systems are becoming more complex through the introduction of autonomous driving, connected cars, electric vehicles, and shared mobility. These technologies turn modern cars into rolling computers with an increasing density of chips and the need for high performance computing. At 80mph, the tolerance for chip failure or a system malfunction is near zero. As the world moves into an era of Artificial Intelligence (AI), the demand for computing resources to train and run AI applications is expected to explode. AI and automation will touch every industry and TSMC will be the primary manufacturer of chips for the fourth industrial revolution.

In the developed world, where smartphone penetration is almost universal, these devices have become indispensable to us. As we do even more with our mobiles the need for faster and more power efficient chips will grow. In developing markets, mobile connectivity remains a growth opportunity and the adoption of smartphones an even greater one. Many of the people in these low-income countries will never own a personal computer and so a smartphone will be their primary connection to the internet and the world. The ongoing roll out 5G and ultimately the adoption 6G will require hundreds of billions of dollars of new investment. TSMC will play a major role in producing the next generation of chips to connect the world and its citizens.

A Geopolitical Force

The shortages of chips in 2021 and 2022, brought to the fore the complicated and concentrated nature of the semiconductor supply chain. At the same time, geopolitical tensions have been rising and the strategic importance of semiconductor supply has been made clear by governments the world over. TSMC, being a neutral player and the key to security of supply, has been at the centre of a global expansion of production capacity. The company is undertaking a steady but meaningful diversification of production to new territories including the United States, Japan and the European Union. At the same time it continues to partner with Chinese semiconductor manufacturers.

The Accelerated Computing Era

Better performing chips power new technologies which in turn enable growth. The demand for advanced chips will not cool for the foreseeable future as they drive productivity in their applications. By achieving industry leading production yields and maintaining their plants at optimal utilisation rates, TSMC earns a superior return on its large investments. Their manufacturing prowress and constant reinvestment in R&D shields them from would be competitors. As we enter an era of accelerated computing, TSMC will lead in producing the tools for it. The potential to benefit from this tectonic shift is why we hold it in the Melville Douglas Global Equity Fund.