Hopes of economic soft landings increase as inflation ebbs

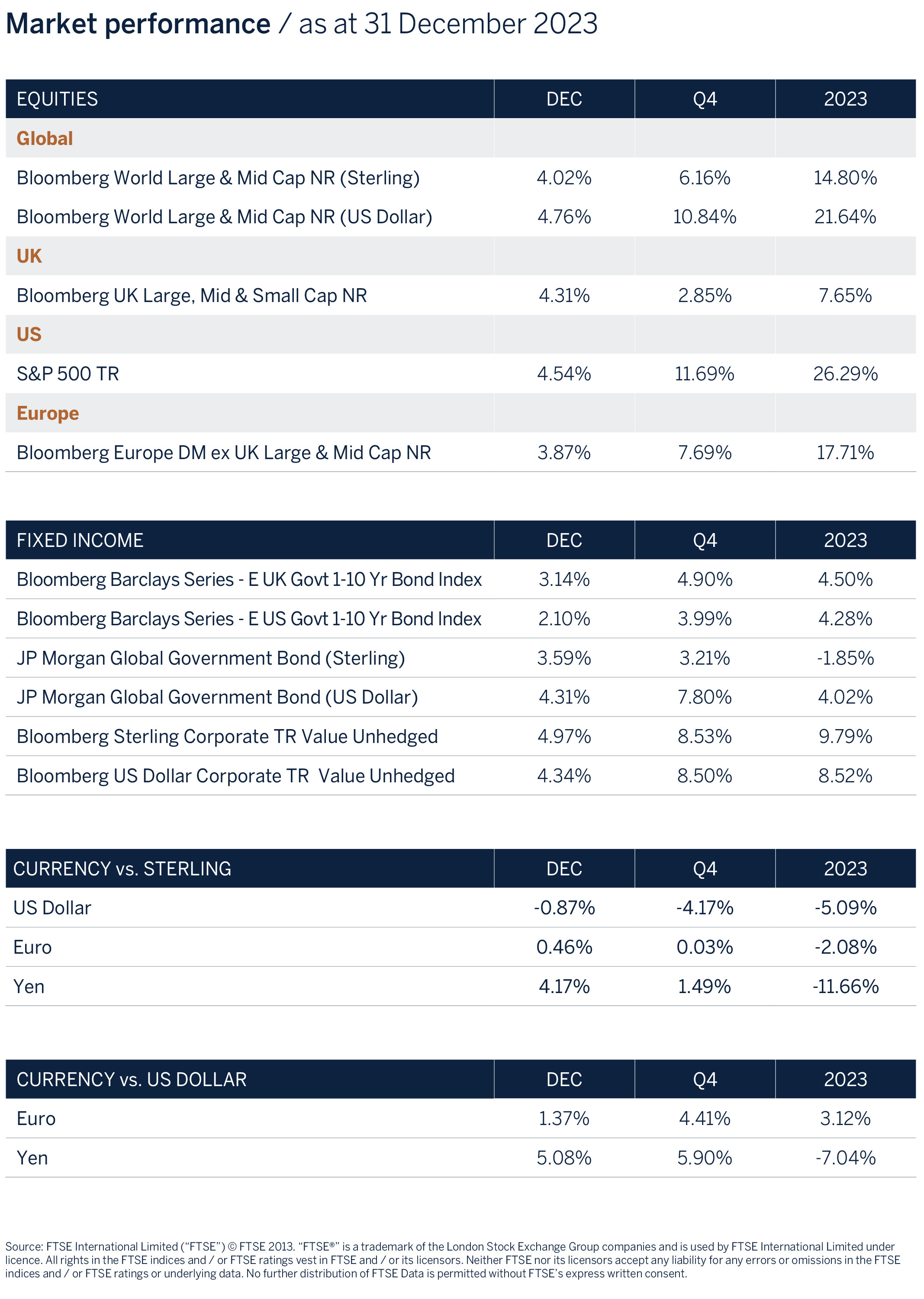

Financial markets bounced back extremely strongly during the final quarter of 2023 resulting in favourable returns for the year as a whole, despite the initial concerns of a potential hard landing in the first quarter. Global equities were one of the best performing asset classes during 2023 returning 22% in USD terms and nearly 15% in Sterling, an astonishing result and beyond that of market expectations given the fragile geopolitical and macro-economic backdrop the world found itself in.

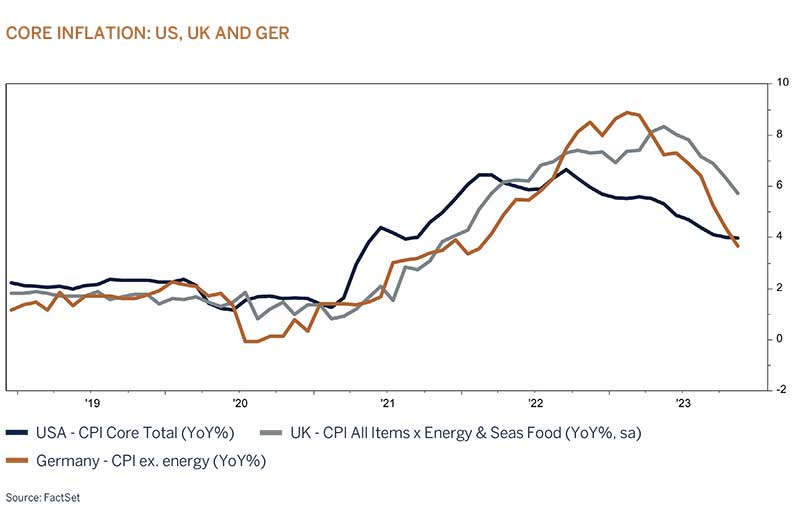

The key driver behind the recent positive uplift in asset prices has been the belief that a soft landing may be orchestrated by the US Federal Reserve (Fed). In conjunction to this, other global central banks look set to lower interest rates to a more accommodative stance earlier than previously forecast, as inflation data across developed economies continues to surprise to the downside.

Asset prices are now pricing in significantly lower interest rates over the next two years on the back of these softer than expected inflation prints, as energy and food prices have cooled off from their zenith in 2022. Bond prices climbed and yields declined sharply as investors scrambled to lock into high income yields which in turn supported equity valuations - a timely reminder that “Interest rates are to asset prices what gravity is to the apple” – Warren Buffet. Whether the strong performance from equity markets is sustainable remains to be seen, as the lagged effects from tighter financial and credit conditions are yet to fully play out. As such, investing in this market has become a tough balancing act as valuations (margin of safety) have become less supportive as earnings growth expectations appear to be on the optimistic side. Nevertheless, the more accommodative stance from central banks, combined with the bottoming in the corporate earnings cycle, will go a long way in reducing the tail risk of a potential hard landing and/or a dislocation in financial markets as economic growth moderates globally.

Equity markets are discounting a good outcome and seem slightly complacent despite the tail risks

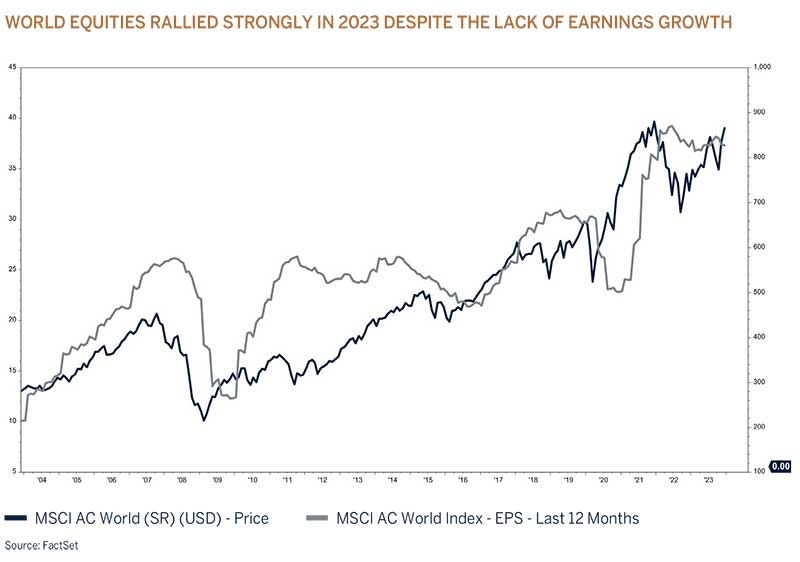

Equity markets delivered very strong performance during 2023, initially spurred on by the re-opening of China’s economy, but mainly driven by a handful of tech stocks (‘Magnificent 7’) that rallied largely thanks to their exposure to Artificial Intelligence (AI), before broadening out towards the end of the year as interest rate expectations were lowered. Returns were not necessarily driven by strong growth in underlying earnings, but rather an expansion in valuation multiples as investment sentiment turned from despair to hope.

We will be the first to admit that a strong equity market was not our base case as we entered 2023 in the midst of one of the most restrictive interest rate hiking cycles in history. There were several factors that contributed to a more resilient economic environment and provided a supportive backdrop for risk assets, offsetting some of the effects from higher interest rates. However, many of these positive contributors are expected to fade in the coming year and, as such we would not expect the strong momentum to persist.

Consumer spending has been supported by buoyant jobs/ labour markets and excess savings that came about from excessive government support packages during COVID-19, however most of those savings have now been spent. In addition, fiscal support packages announced during the year were significantly larger than expected, and the regional banking crisis in the US resulted in a material injection of liquidity by authorities in their efforts to support the banking sector, its investors, and depositors. This fiscal spend has increased the US government’s budget deficit which has largely been dismissed by markets although the rating agency Fitch recently downgraded the US sovereign credit rating to AA-. This greater indebtedness is of concern if it is not brought under control as it will likely result in investors requiring a greater margin of safety before committing further funds to US assets.

We have previously written about the lack of market breadth in equity returns during 2023. The strong market performance was carried by a small number of large cap information technology (AI beneficiaries), luxury and weightloss stocks. Meanwhile, returns from the broader equity market (Russel 2000 for instance) have been much more moderate and not that different from cash yields, which has not been surprising given that corporate earnings for the year were largely unchanged from 2022.

While the medium-term outlook has improved and the probability of a recession has receded on the back of lower interest rate expectations and more favourable financial conditions, we believe that much of the good news has already been discounted in valuations and investors will have to be more selective in their approach for 2024. We do however acknowledge that the direction of travel for this asset class has become more positive and we will be cautiously increasing our exposure in global equities to Neutral across multi asset portfolios.

Conclusion

Developed world central banks now look set on a path of lowering interest rates commencing in the first half of this year as long as price pressures do not reignite. It is perhaps still far too early to hear the death knell bells of inflation, but there is no doubt that developed world central banks have exceeded expectations by raising interest rates significantly without triggering a global recession or having a meaningful impact on employment. Markets tend to overemphasise monetary policy expectations when they change direction, and this time has been no different, with a significant rally in global asset prices towards the end of last year. We view the very recent rally in bond and equity markets as excessive as inflation is not yet at target levels whilst the last leg of lowering core inflation is not likely to be without its challenges, particularly with consumer demand remaining resilient due to favourable employment markets.

The excess savings and the benefits of the widespread refinancing, both at the corporate and personal levels, that took place in the aftermath of the pandemic are no longer an economic tailwind and we expect much more subdued growth in the year ahead. However, the very real wealth effect from higher asset prices and a solid jobs market provides a cushion against a material slowdown. This is in addition to central banks which have now amassed anti-recession armouries by way of higher interest rates that can and will be cut if necessary.

We have been cautiously positioned in portfolios over the past year but have recently changed the recommended asset allocation by increasing the exposure to global equities and fixed income to benefit from the change of direction in monetary policy. We wouldn’t be surprised if global financial markets consolidate somewhat in the very short term after the year-end-rally and will be using the volatility as an opportunity to implement the proposed changes while keeping a close eye on valuations.

Investment performance

Despite a challenging macroeconomic and geopolitical environment, both equities and fixed income securities delivered strong returns in the final quarter of 2023 leading to favourable portfolio outcomes for the year. Recent inflation data across developed economies has surprised to the downside, paving the way for asset prices to adjust favourably to expectations of earlier than previously forecast cuts in interest rates and the increased chances of a soft economic landing globally. At the asset allocation level, our tactical underweight equity allocation proved to be a headwind for the period and for the year, however, despite being positioned cautiously our portfolios have delivered favourable absolute returns that are ahead of peers.

Our ongoing philosophy of investing in truly great global companies that are price setters rather than price takers (think Oil & Gas, materials etc) and have a proven history of compounding their sales, earnings and cash flows over long periods of time has added value. Our neutral fixed income weighting in multi-asset portfolios coupled with our strategy to extend duration to lock into higher yields delivered value, with fixed income also delivering favourable returns for the year. Looking ahead, we remain cautiously optimistic about the market environment and believe that 2024, an election year for a huge portion of the democratic world, will be a positive year. While uncertainties persist, our ongoing commitment to thorough research, disciplined execution, and continuous monitoring will contribute to the sustained success of our investment portfolios.

Asset classes

| Equities | Neutral |

| Fixed Income | Overweight |

| Cash Plus | Underweight |

Asset allocation

Global Equity – Neutral

The medium-term outlook for global growth has incrementally improved and a US soft landing appears more likely. Interest rates have peaked and the expected interest rate easing cycle has been pulled forward, after one of the most aggressive interest rate hiking cycles in history. At the same time financial conditions have eased materially over the past few months as credit spreads have narrowed and bond yields declined. A favourable backdrop for global equities, especially given that corporate earnings have bottomed.

While we have increased the recommended weight in multi-asset portfolios to a more balanced neutral position to take advantage from a change in the interest rate and growth outlook, we are reluctant to add aggressively to the exposure in the near term given that certain headwinds persist.

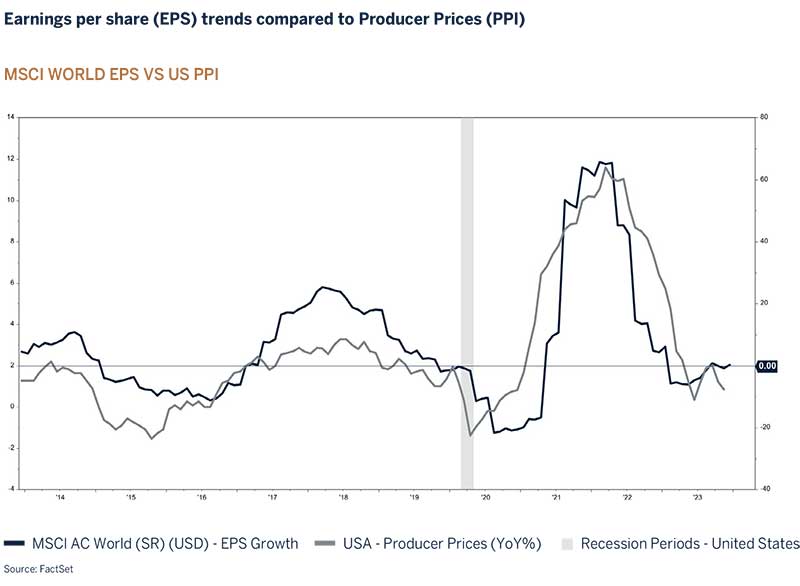

We believe that risks to the corporate earnings outlook are tilted to the downside for several reasons. Consensus forecasts expect top line growth to accelerate after a period of disappointing growth in 2023 while profit margins (excluding Financials) are expected to continue to expand from record high levels. However, weakening pricing is likely to be a constraint on earnings growth as we enter 2024. Since 2020, considerably higher levels of inflation allowed companies to pass through higher costs to the end consumer during a period of strong underlying consumer demand bolstered by loose monetary and fiscal policies. Inflation has since moderated materially as supply chains normalised and productivity improved. Economic growth has also slowed and will most likely result in weaker corporate sales growth than what is currently discounted. At the same time labour costs are likely to be sticky on their way down and rising interest/funding costs will become a headwind for companies as they refinance outstanding debt.

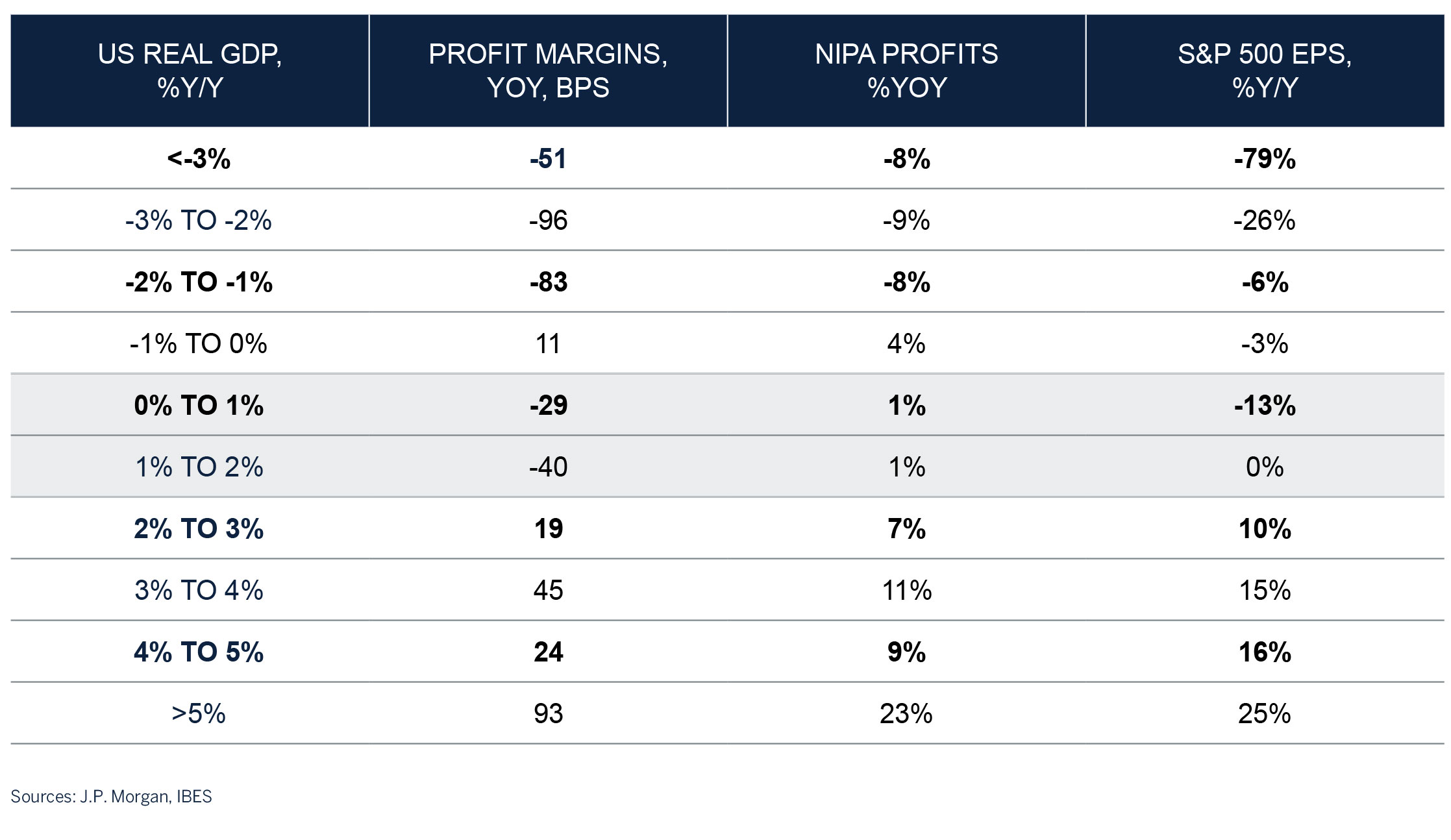

With global and US GDP growth expected to moderate further this year, it is worth considering the fact that corporate profit margins have historically always declined when the US economy grows at a rate of less than 2%, which is currently the base case.

While several factors could result in the outcome being different this time, the odds are firmly stacked to the downside, at least in the near term. Equity valuations are at best fairly priced and short-term sentiment appears to be overly optimistic; a very different environment compared to a year ago, and one of the main reasons why we will cautiously be adding to the asset class when investment opportunities arise.

| Consumer Discretionary | Overweight |

| Consumer Staples | Underweight |

| Energy | Underweight |

| Financials | Overweight |

| Healthcare | Overweight |

| Industrials | Neutral |

| Information Technology | Underweight |

| Materials | Neutral |

| Communications Services | Overweight |

| Utilities | Neutral |

| Real Estate | Underweight |

Global Fixed Income – Neutral

| G7 Government | Underweight |

| Investment Grade - Supranational | Overweight |

| Investment Grade - Corporate | Neutral |

| High Yield - Corporate | Overweight |

Global bond markets staged an impressive rally in the final quarter of 2023 driven by optimism that the Fed, along with other major developed world central banks, have not only reached the end of their respective tightening cycles but will begin cutting rates in 2024. This performance marks a welcome reprieve from the deep sell-off in world bond markets which began in mid-2020, triggered by a sharp rise in global inflation and the subsequent realisation that it would only be brought under control by an equally sharp rise in interest rates. Inflation rates are still above central bank target levels, but markets appear optimistic that price pressures will continue to trend lower in the coming quarters, predominantly due to the lagged effects of rate hikes bearing down on growth conditions, which in the US have proved to be much more resilient than forecast, but also due to the supply of goods now recovering from the Covid led restrictions. Looking to the year ahead, we have our reservations that the strong performance of the fourth quarter will be sustained at a similar pace. We are positive on the outlook for fixed income markets over the medium term, however this is predominantly due to bonds offering more attractive starting yields rather than expecting sharp price rises (falls in yields). Bond markets are barometers, pricing today for tomorrows outcomes (monetary policy, inflation, growth etc.), and whilst not always accurate, we are reminded that the strong performance in the last quarter has ‘priced in’ much of the potential monetary easing in the year ahead. However, we are also cognisant that yields at current levels clearly appear attractive when compared to recent years and the prospect of global monetary easing in 2024 should, by default, prompt flows out of cash and into fixed income. This could potentially push yields lower than our current forecasts, but a return to ten-year yields (in the US and UK) of 2% appears both optimistic and a long way off.

Cash – Underweight

We have reduced our exposure in favour of equity and fixed income which should be better positioned than cash in a declining interest rate environment.