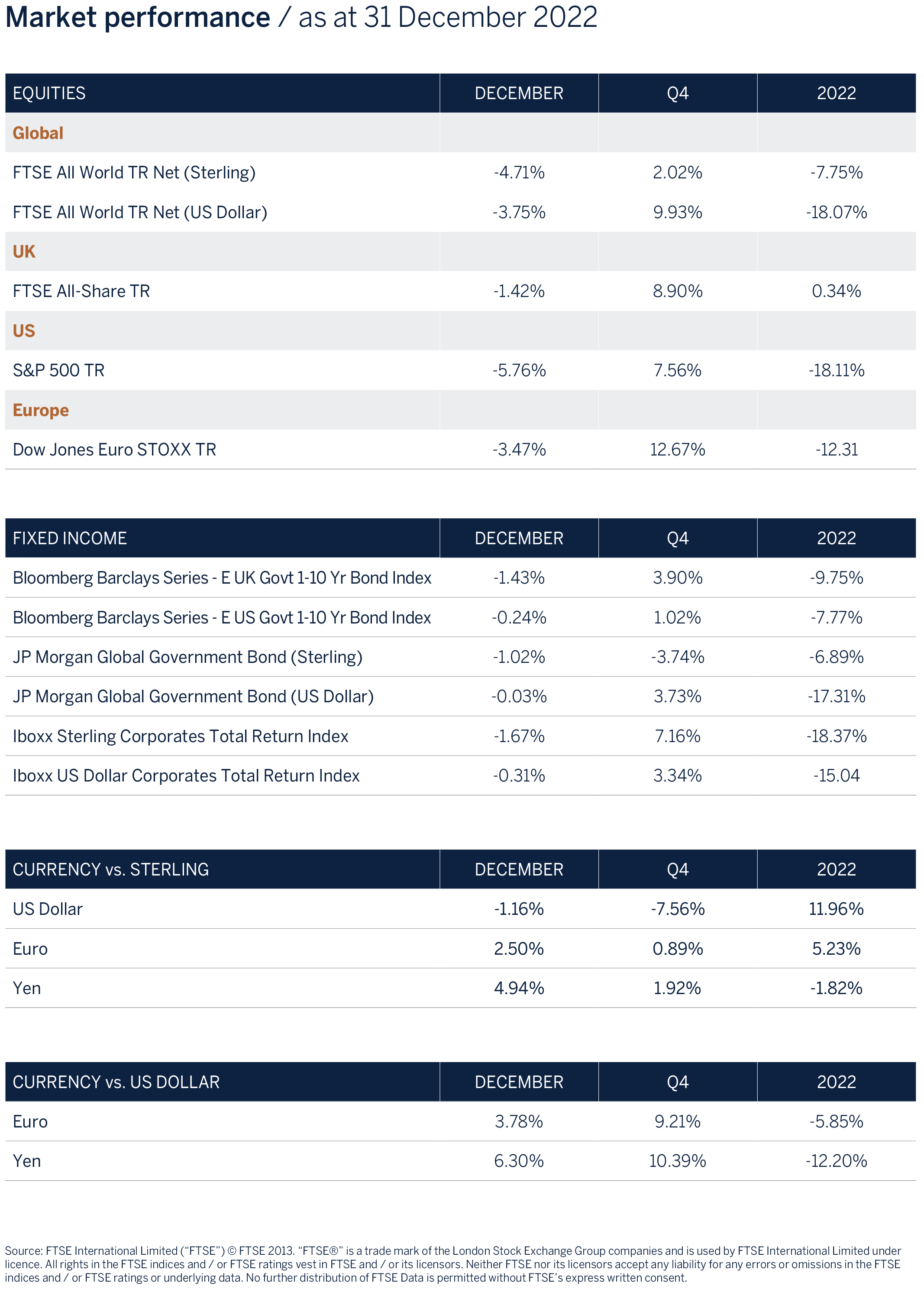

Worst year since 2008 but some optimism returns to global investment markets

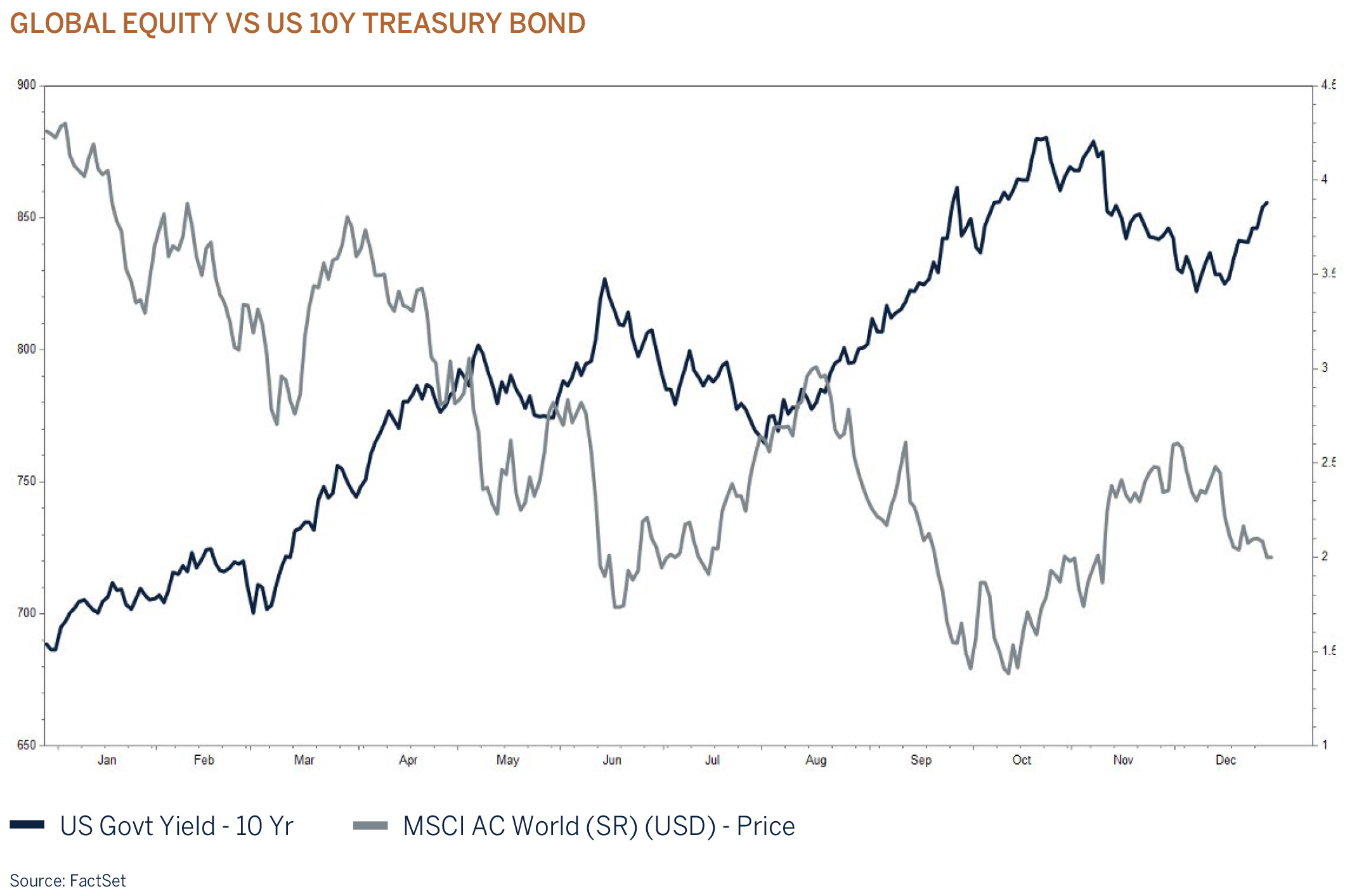

Despite global central banks best efforts to rein in inflation by way of slowing demand growth with much tighter monetary policy, risk assets made a comeback during the fourth quarter of 2022 whilst the US greenback lost its shine, giving back some of its significant outperformance over the past year. Several factors contributed to the bounce from the October lows with investors focusing on the improved outlook for inflation as consumer goods, food and energy prices all eased leading to predictions that inflation has peaked. An important development, as high and stubborn inflation coupled with a vibrant labour market, has resulted in one of the most aggressive interest rate hiking cycles in recent history. With the disinflationary trend intact as supply constraints ease, central banks have indicated their preference to slowdown the pace of monetary tightening and to follow a “wait and see approach”, meaning that interest rates will probably peak towards the end of the first quarter in 2023. Additional factors that contributed to the bounce in equity markets are the prospect of less restrictive COVID-19 measures in China and a significant decline in the price of natural gas in Europe. Gas storage levels have been adequately increased to cater for the colder winter months in the Northern hemisphere as users switched to liquid natural gas. As a result, and not for the first time this year, we have seen that a lower than expected inflation print in the US has resulted in lower bond yields and a rerating in equity markets, an indication of just how sensitive equity valuations and risk appetite have become to changes in the outlook for the cost of funding (bond yields).

Interest rates have increased significantly over a short period and are not expected to come down from the current restrictive level any time soon, given that inflation by any standard remains much too high. The outlook for macroeconomic conditions, monetary policy and the geopolitical backdrop remains highly uncertain given the warning from US Federal Reserve Chair Powell that “monetary policy affects the economy and inflation with uncertain lags, and the full effects of our rapid tightening so far are yet to be felt” and as such investors should expect volatility to remain elevated and very much data dependent as the global economy enters a period of below-trend growth or, even worse, a recession. We have reduced risk in portfolios further by cutting the equity exposure to underweight and have used the proceeds to increase the allocation to fixed income to neutral, thereby locking into higher yields. Although equity valuations are much more reasonably priced than a year ago when interest rates were exceptionally low, the recent rally leaves investors with a limited margin of safety should corporate profit margins and/or earnings decline, as we expect.

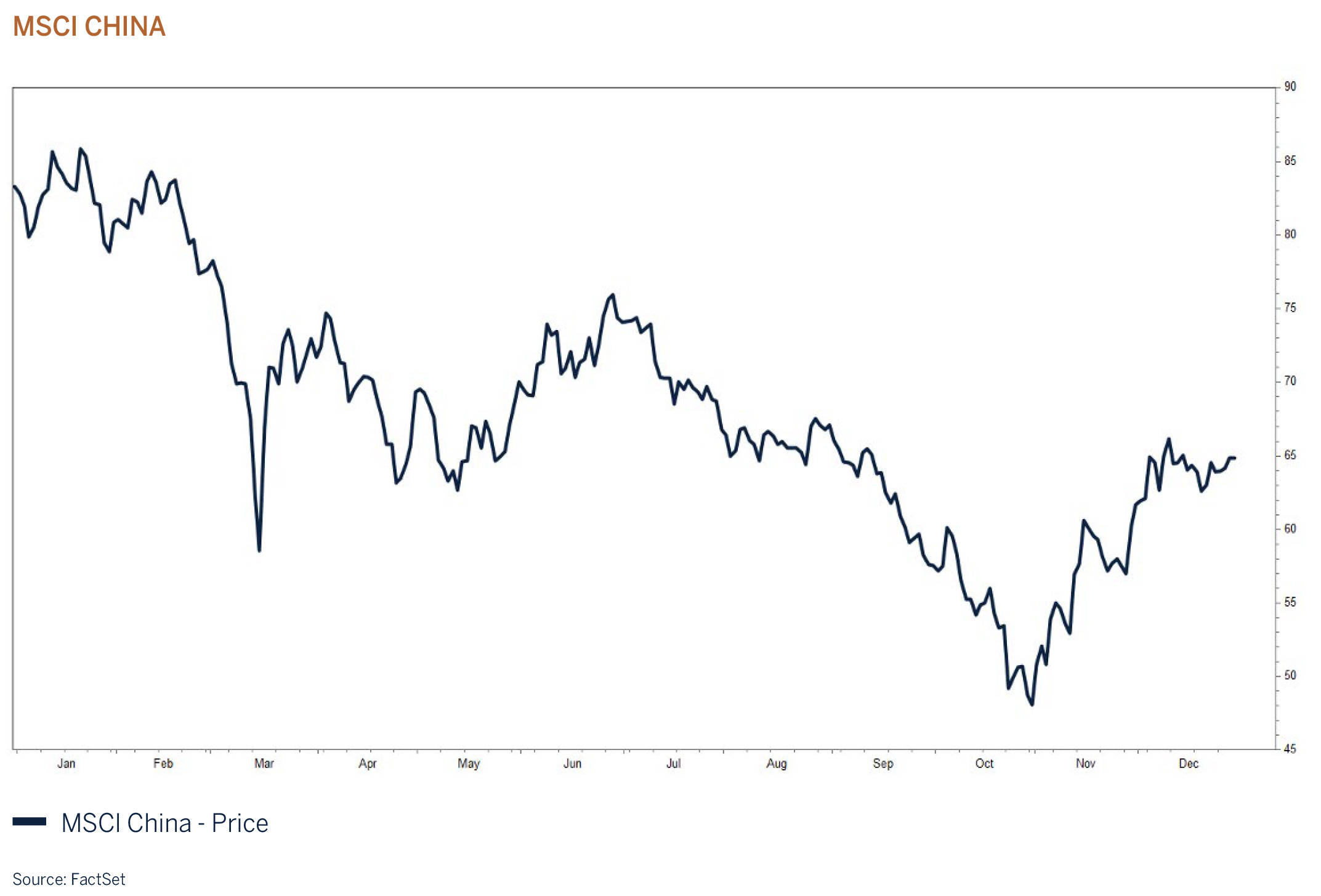

China – awakening from the COVID-19 restrictions

While COVID-19 cases have been increasing at an alarming rate in mainland China and Hong Kong, authorities have indicated their willingness to start relaxing some of the draconian restriction measures in place. The stock market has rebounded strongly from its lows on this news and globally, sectors such as resources and mining stocks have benefitted the most on hopes of a recovery in final demand as China’s economy awakens once more.

MSCI CHINA

The Chinese economy undershot expectations in 2022 due to the enforcement of COVID-19 related lockdowns coupled with a slowdown in the property market as many real estate developers encountered liquidity and solvency difficulties as funding became challenging. Lower property prices, a weakening economy and large-scale layoffs resulted in investors and banks taking a more cautious approach towards injecting more capital into the real estate sector. A weakening real estate sector poses significant risks to local governments that have previously relied on proceeds from the selling and letting of land. The Chinese authorities are aware of the negative spillover effects to the rest of the economy as the housing/property market and related industries contribute almost 50% to the economy. The initial softening in the property market was expected as the Chinese government implemented measures to cool-off rapidly rising property prices, which became a major concern for households looking to enter the market for the first time. In addition, Chinese authorities became progressively concerned about the increasing levels of speculation and size of the industry. Their challenge at present is to prevent the housing market from collapsing further and they are injecting liquidity and reducing some of the restrictions on individuals/households looking to enter the market. The Japanese experience of a “lost decade” and persistent deflation due to the collapse of the property bubble is something that the Chinese government will be hoping to avoid. The path of economic recovery will likely be bumpy and the timing of the lifting of COVID-19 restrictions may be questionable before the Chinese New Year celebrations over January/February, given the already increasing levels of infection rates. However, with the assistance of lower interest rates and a liquidity injection, 2023 should be a year of recovery for one of the largest economies in the world, with positive implications for countries and regions dependent on China’s fortunes.

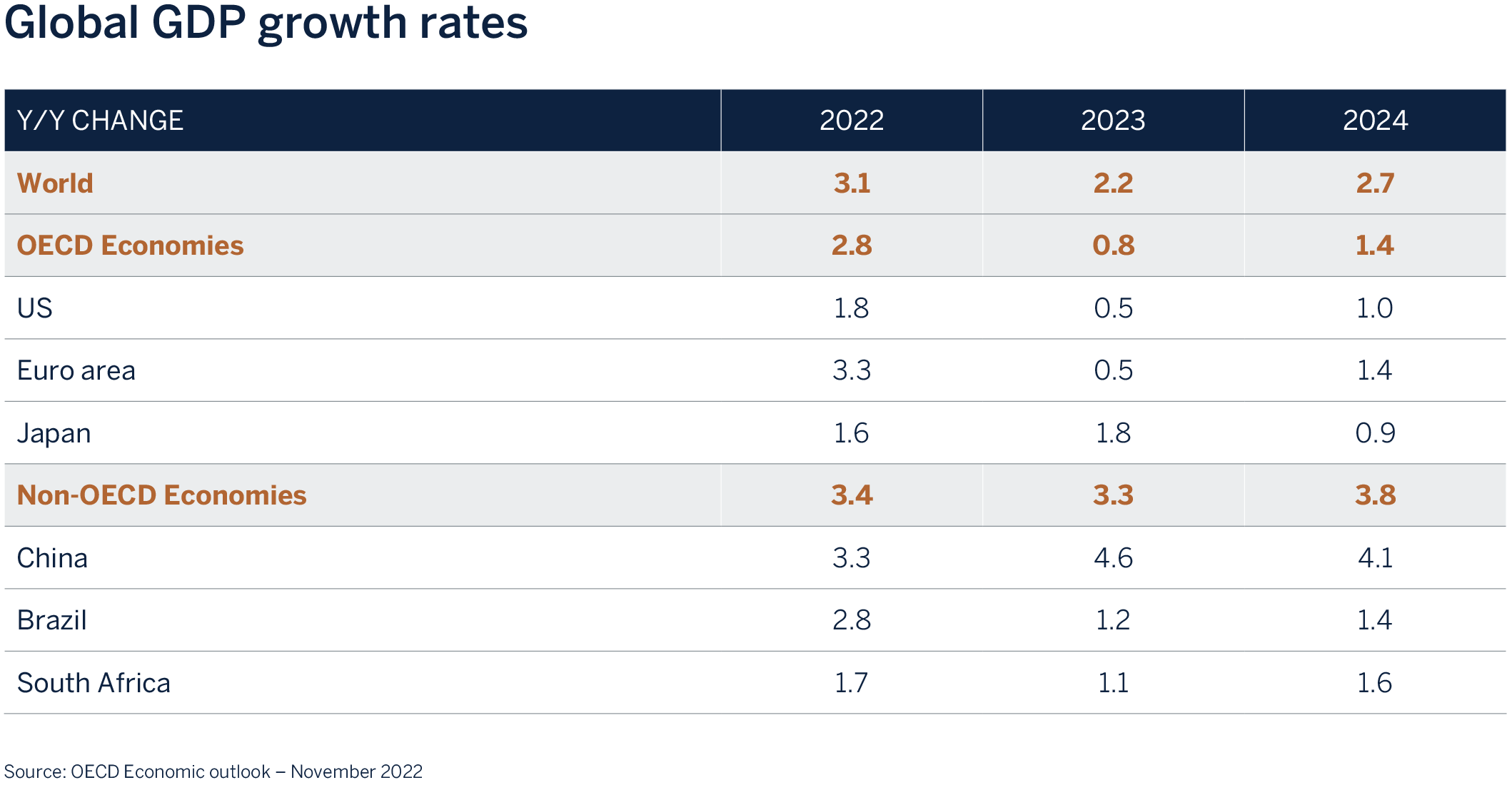

Equity markets – ongoing volatility in H1 2023 likely

The impact of higher interest rates coupled with lower real disposable household income on the global economy can be seen in the table below as the world enters a phase of below trend growth driven by an expected sharp roll-over in the US and the Euro area’s credit cycle and a slowdown in private sector fixed investment. The full effects of the aggressive monetary tightening seen in 2022 are still to be felt. It just takes time!

Equity valuations have already meaningfully responded to the weaker economic and higher interest rate outlook with valuation multiples declining sharply during 2022 as share prices fell. Indeed, fixed income assets also performed very poorly as interest rates have been raised to fight inflation which is seen as a worse evil than short term lower economic growth. The upshot is that for the first time in many years, non-equity (cash and fixed income) assets have once again become a viable investment option (given higher yields) to consider from a diversification perspective. Equity valuations are much more reasonable today than what they were a year ago and are trading in line with long term averages. But the economic and geopolitical outlook remains uncertain and equities are not yet priced for a worse than expected economic and/or earnings growth outlook. Consensus expects positive earnings growth for this year, but that would appear to be too optimistic in an environment of subpar economic growth.

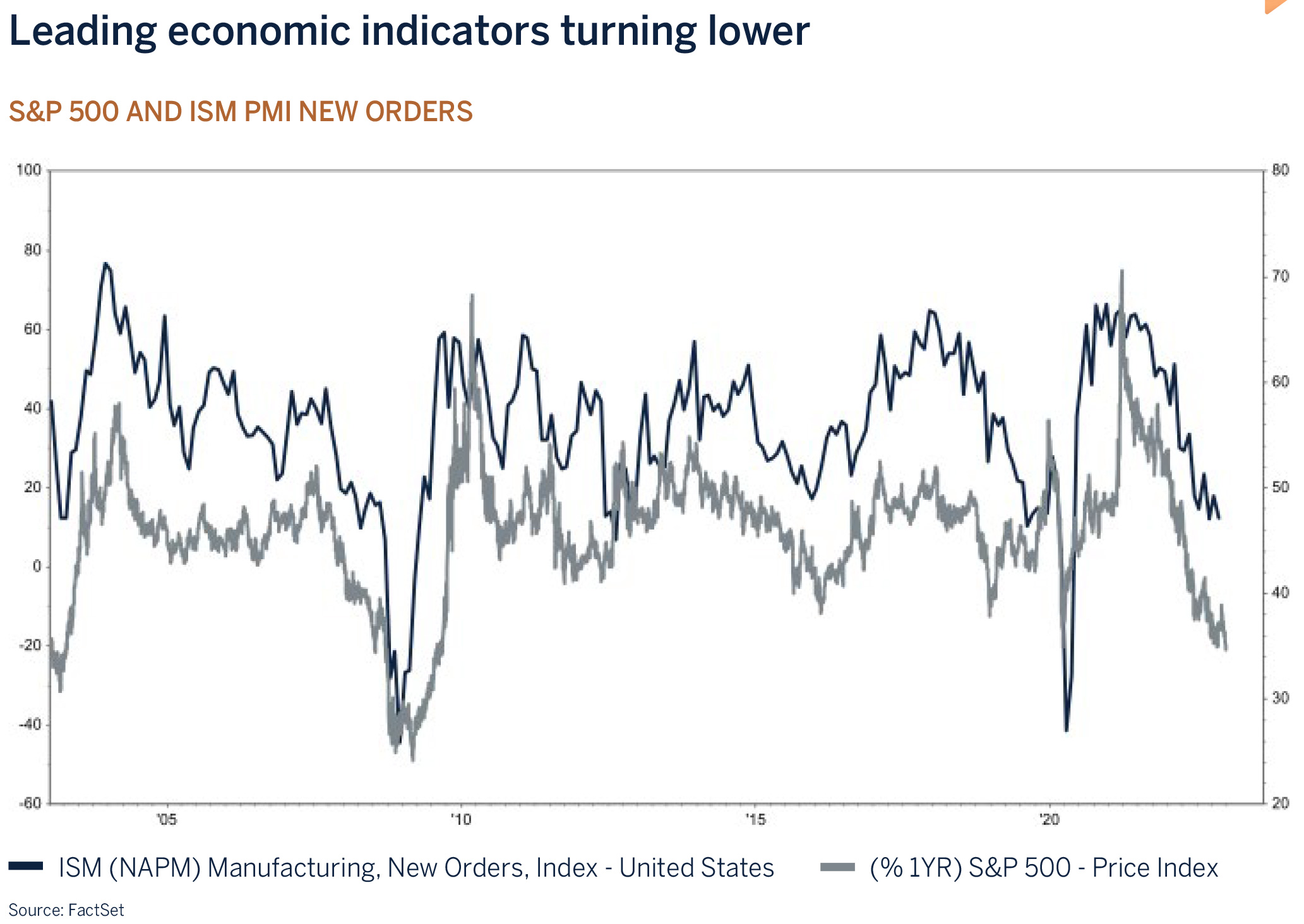

In the near term, risks are tilted to the downside as corporates, investors and households adapt to an environment of higher interest rates and costs, and leading indicators are pointing to a cyclical slowdown and recessions in several western world economies. Given the ongoing challenging near-term outlook we have taken a more cautious (tactical) stance in the short term and will continue to actively monitor the key drivers of equity returns, which include valuations, the outlook for inflation and interest rates, the change in direction of leading economic indicators and developments in employment. We stand ready to change tack as the environment dictates.

Conclusion

2022 was a year that most investors would like to forget. Prices of equity and fixed income assets declined sharply after global central banks changed course to combat inflation. The war in Ukraine was supposed to be short lived and so too were the COVID-19 restrictions in China. Valuations across asset classes have adjusted to the reality that both inflation and interest rates will remain stickier than what was expected a year ago. Volatility and cheaper valuations do however provide new opportunities that should be welcomed by patient investors that focus on long term fundamentals. Many high-quality stocks with structural growth tailwinds and strong balance sheets have become attractive once again and provide the necessary margin of safety for us to consider in client portfolios. Cash and fixed income yields have also adjusted significantly higher and for the first time since the 2008 Global Financial Crisis are providing returns that exceed longer term inflation forecasts, which allows investors to take less risk (lower equity and credit risk) than before to generate positive risk-adjusted returns in balanced portfolios. We believe that volatility will remain elevated in the near term as the global economy resets to a period of sub trend growth. However, lower starting valuations coupled with declining inflation, a peaking interest rate cycle and defensive positioning by market participants do provide the necessary backdrop for investors to look forward to a year of improved investment returns.

Investment performance

As we entered 2022, we were optimistic that the world would emerge from the pandemic leading to strong consumer demand and capital investment which would drive corporate earnings and global stock markets higher. We also believed that interest rates would continue their steady normalisation resulting in lower fixed income prices. Russia’s unexpected invasion of Ukraine swiftly changed that outlook and led to an extremely challenging year for both equity and fixed income investors as energy and food price inflation soared and central banks raised interest rates very aggressively. Despite being underweight fixed income and reducing equity weightings throughout the year, equity and multi-asset portfolios have struggled on both an absolute and relative basis. The underperformance can be largely attributed to our growth style, and this has been communicated regularly with the quarterly valuations. However, with tighter monetary policy leading to the prospect of western world recessions in the year ahead, investors are once again showing signs of rotating back to the world’s largest and best managed global companies that have well-run balance sheets, pricing power, competitive advantages and attractive future growth projections that will see them emerge in an even stronger competitive position when the current disruptions abate. As such we expect this shortterm underperformance to be recouped in the year ahead. Pleasingly, fixed income portfolios outperformed on a relative basis due to our defensive shorter duration policy.

Asset Classes

| Equities | Underweight |

| Fixed Income | Neutral |

| Cash Plus | Overweight |

Asset Allocation

During the quarter we increased the exposure to fixed income by one notch to neutral whilst reducing the equity exposure to one notch underweight. The global economy is expected to decelerate sharply this year on the back of higher interest rates and further tightening in monetary policy. The risk is that central banks overtighten in their efforts to rein in inflation which has become their major concern. Higher interest rates will slow demand and banks willingness to extend credit as delinquencies increase. Many asset prices have already declined sharply, and the housing market has rolled over. Consumer and business confidence has deteriorated and as growth slows and consumers pull back on spending, unemployment is expected to deteriorate with knock on effects to the rest of the economy, as well as corporate profits. We have previously mentioned that fixed income assets have once again become a viable investment option and are for the first time in over a decade providing attractive longer-term inflation adjusted returns. By increasing the exposure to fixed income assets (particularly government bonds), multi asset portfolios will benefit from higherfor- longer yields and a degree of “protection” during this year’s expected slowdown in economic activity.

Global Equity – Underweight

| Consumer Discretionary | Overweight |

| Consumer Staples | Neutral |

| Energy | Underweight |

| Financials | Neutral |

| Healthcare | Overweight |

| Industrials | Neutral |

| Information Technology | Neutral |

| Materials | Neutral |

| Communications Services | Overweight |

| Utilities | Neutral |

| Real Estate | Underweight |

Hoarding of labour likely to dampen corporate profit margins

The fortunes of risk asset prices such as equities are very much linked to the outlook for economic growth and, by implication, profit/earnings growth, which in turn is dependent on the trend of global liquidity and/or monetary policy. Central banks are quite correctly, on a mission to reduce inflation and inflation expectations which have remained stubbornly high despite recent declines in goods inflation. The concern for monetary authorities is that the longer inflation stays above target, the greater the risk that higher inflation becomes entrenched. The US Federal Reserve’s current assessment is that inflation risks are skewed to the upside, as non-housing related services inflation (55% of the US inflation basket) remains uncomfortably elevated. Part of the problem is that nominal wages have been increasing significantly on the back of an unusually robust and unbalanced employment market in which job openings substantially exceed supply of available workers leading to companies being forced to pay up for new hires and award material pay rises to existing employees in order to retain them.

There appears to be a structural labour shortage. The participation rate (the percentage of the population that is either working or actively looking for work) is much lower than expected due to numerous factors, which include an accelerated retirement rate, increase in mortality rates due to COVID-19 and migration policies. In the US alone, it is estimated that the shortage in the labour market amounts to some 3.5 million employees, which means that it is unlikely that the unemployment rate will increase significantly, given that corporates (outside of the Information Technology sector) are hesitant to fire workers for fear that they will not be able to re-hire the necessary talent required in better times. In other words, corporates might be willing to sacrifice profit margins in the short term as demand slows to ensure that they are well positioned for the next upturn in the economic cycle. This poses a risk to the outlook for corporate profit growth (and in turn valuations of equities and corporate credit) as the global economy weakens, hence our lowering of equity risk in client portfolios.

Fixed Income – Neutral

| G7 Government | Underweight |

| Investment Grade - Supranational | Overweight |

| Investment Grade - Corporate | Neutral |

| High Yield | Overweight |

We enter 2023 with markedly higher yields and whilst the global interest rate cycle is yet to reach its finale, bond markets will anticipate the peak well in advance and we see increasing evidence that this ‘topping out’ process for yields is already underway. We do not expect yields to fall sharply just yet, however, at current levels they look increasingly attractive on a medium to long-term horizon. With this in mind, we are poised to increase durations throughout our fixed income strategies although remain mindful that the mixed backdrop of slower growth yet persistently high inflation is likely to result in ongoing volatility in global bond markets.

The Federal Reserve currently expect US interest rates to peak at just over 5% this year but this forecast may prove to be a little low based on the strength in the labour market and inflation. Whilst the lagged effects of tighter monetary policy are a clear headwind to the growth outlook, so far, the fully employed consumer has remained more resilient than expected. The US economy posted negative growth in the first half of the year, however, third quarter GDP rebounded to an above forecast +3.2% and indications suggest this positive momentum continued in the fourth quarter. We do expect economic growth to slow in the period ahead, but current evidence suggests that a deep and prolonged recession could be avoided, particularly if the interest rate cycle does stall at or around 5%.

Inflation does appear to have passed its peak ensuring the bulk of monetary tightening is in the rear-view mirror, however, it still remains uncomfortably high necessitating additional interest rate hikes in the months ahead. Ongoing strength in the employment market and associated wage growth are complicating the outlook for inflation and whilst we do expect price pressures to continue to ease as we go through 2023, a rapid deceleration to central bank target levels in the 2% to 2.5% range is uncertain, at best.

The Bank of England (BOE) have embarked on nine consecutive interest rate hikes since December 2021 taking base rates to 3.5% and further monetary tightening is to be expected in the coming months with the market discounting rates to peak at circa 4.5%. UK bonds across the entire maturity spectrum sold off aggressively last year but most acutely at the longer end of the curve where 10-year issues suffered losses of almost -20%.

GDP has recently contracted and with a slowdown in consumer services and manufacturing output, it is likely that the UK economy is already in recession, with further contraction expected through 2023 as the squeeze on household real (after inflation) income intensifies. There can be no doubt that 2023 (and beyond) is going to be extremely challenging for the UK economy and inflation at approximately five times the BOE’s target means interest rate cuts cannot afford to come to the rescue yet.

US Dollar

Expectations that inflation has peaked and therefore, the US tightening cycle is closing in on terminal rates weighed on the US Dollar in the fourth quarter. The currency’s significant rally over previous quarters, which defied even our bullish expectations, left it vulnerable to a retracement which doesn’t surprise us. Despite this sell off, the currency as measured by the DXY Index was still the standout winner of 2022 appreciating +8.21%, adding to a strong gain of +6.37% the previous year.</p

Recent weakness has prompted many to reassess their outlooks to negative for the year ahead and whilst we are cognisant that the US Dollar’s peak may be behind us, given the mixed outlook for global growth, it is perhaps premature to expect the currency to continue to weaken at the same pace as recorded in the past quarter. Many factors that have supported the currency throughout its rally remain in situ. Namely, the US economy maintains a distinct economic growth advantage over counterparts such as Europe (including the UK) which should ensure an ongoing interest rate and yield advantage. Reserve currency status has been beneficial throughout recent quarters of ‘risk-off’ volatility and this theme remains in play as global central banks continue to tighten policy and therefore, recession risks rise.