Growth headwinds unnerve investment markets

2021 was a favourable year for risk assets despite some loss of momentum towards the latter part of the year as economic growth concerns resurfaced and the outlook for inflation became far less “transitory”. Several factors including the US Federal Reserve (Fed) bringing forward the end of its quantitative easing (QE) program, is a sign that it wishes to start addressing stickier inflation, and the discovery of the new Omicron variant made investors nervous.

Central Banks are recognising that commencing the path to policy normalisation is needed to stabilise inflation and promote a sustained, rather than boom/bust, economic expansion. In other words, excess liquidity (an important driver for risk asset valuations) will gradually be drained from the economy and financial markets in the year ahead, an important development.

The sooner central banks act to lower inflation expectations and rein in excess demand, the lower the chances of a policy mistake (acting too aggressively) as the global economic cycle matures. Yet while this transition in monetary (and fiscal) support plays out, investors should tread carefully. Prices of speculative assets such as cryptocurrencies and high profile but unprofitable businesses have increased hugely from their lows last year, and have no doubt benefited from an environment of growing speculation during a period where the cost of money has effectively become all but free.

This will no longer be the case and as investors start to unwind their leveraged positions, the consequences for these asset prices and the potential impact on the rest of the market remains to be seen. As we enter the next phase of the economic cycle, investment returns are expected to moderate as the ‘punchbowl’ of ultra-loose monetary conditions is withdrawn and economic growth momentum moderates back to trend levels.

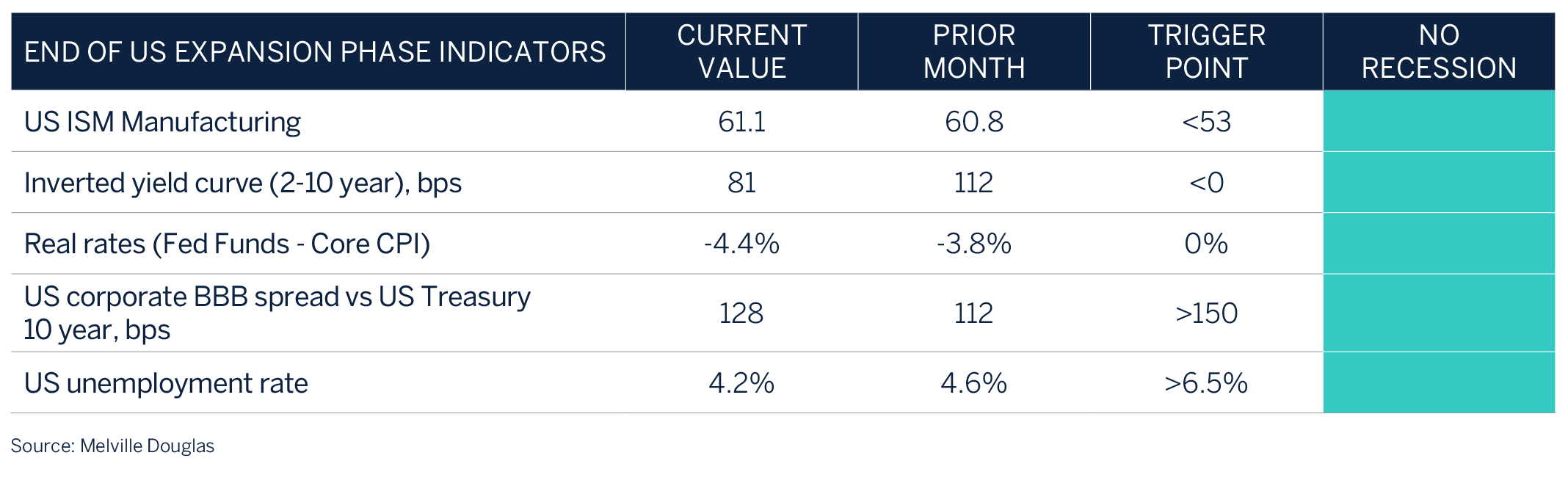

As we write this end year review none of our early recession indicators are pointing to any stress in financial markets, and as such we remain optimistic that global equities will continue to outperform in the year ahead, albeit with more volatility along the way. Fixed income assets will face significant headwinds as monetary support unwinds, and as such we end 2021 with an overweight position to equities.

The outlook for growth remains positive, but headwinds remain

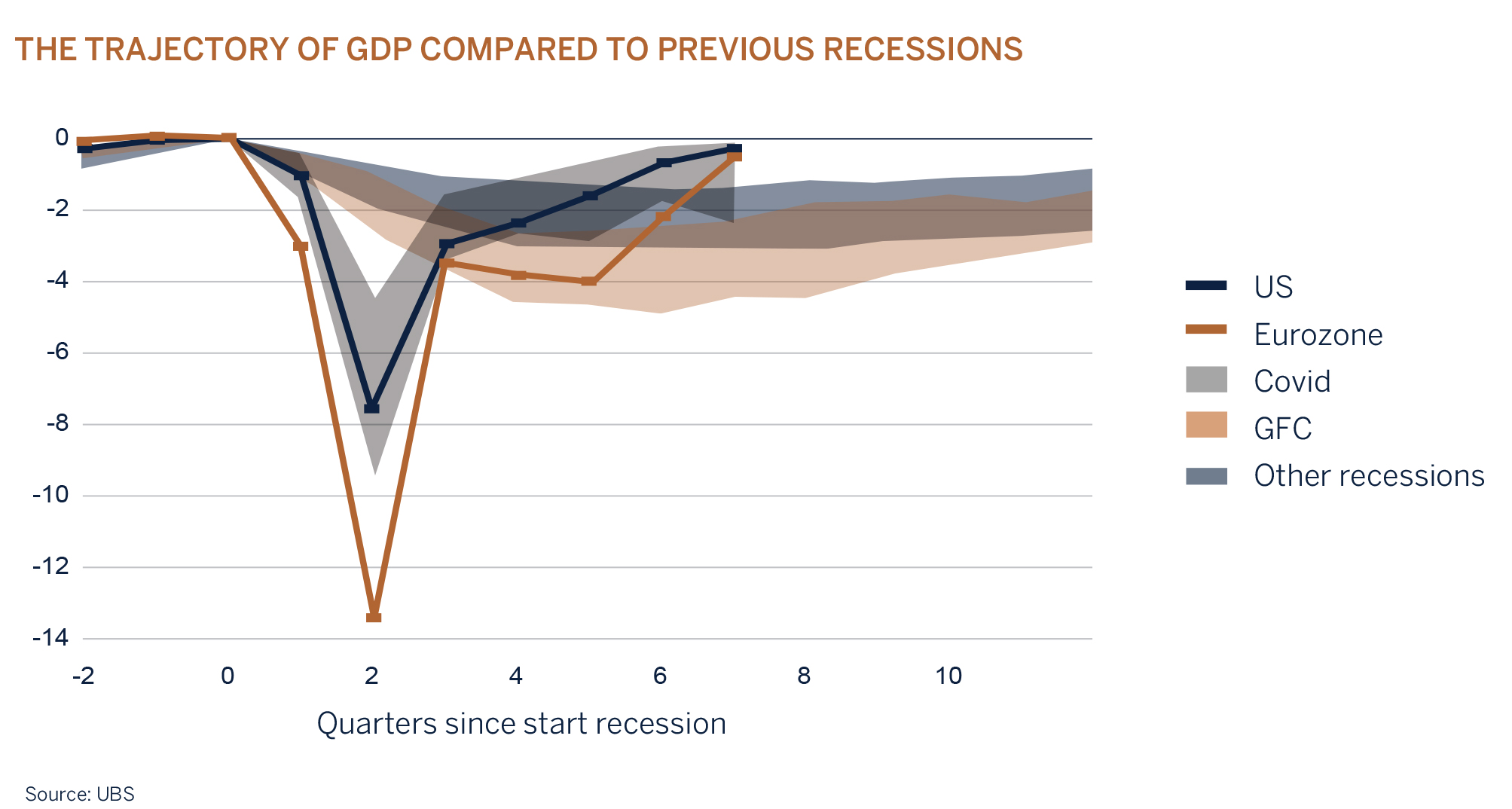

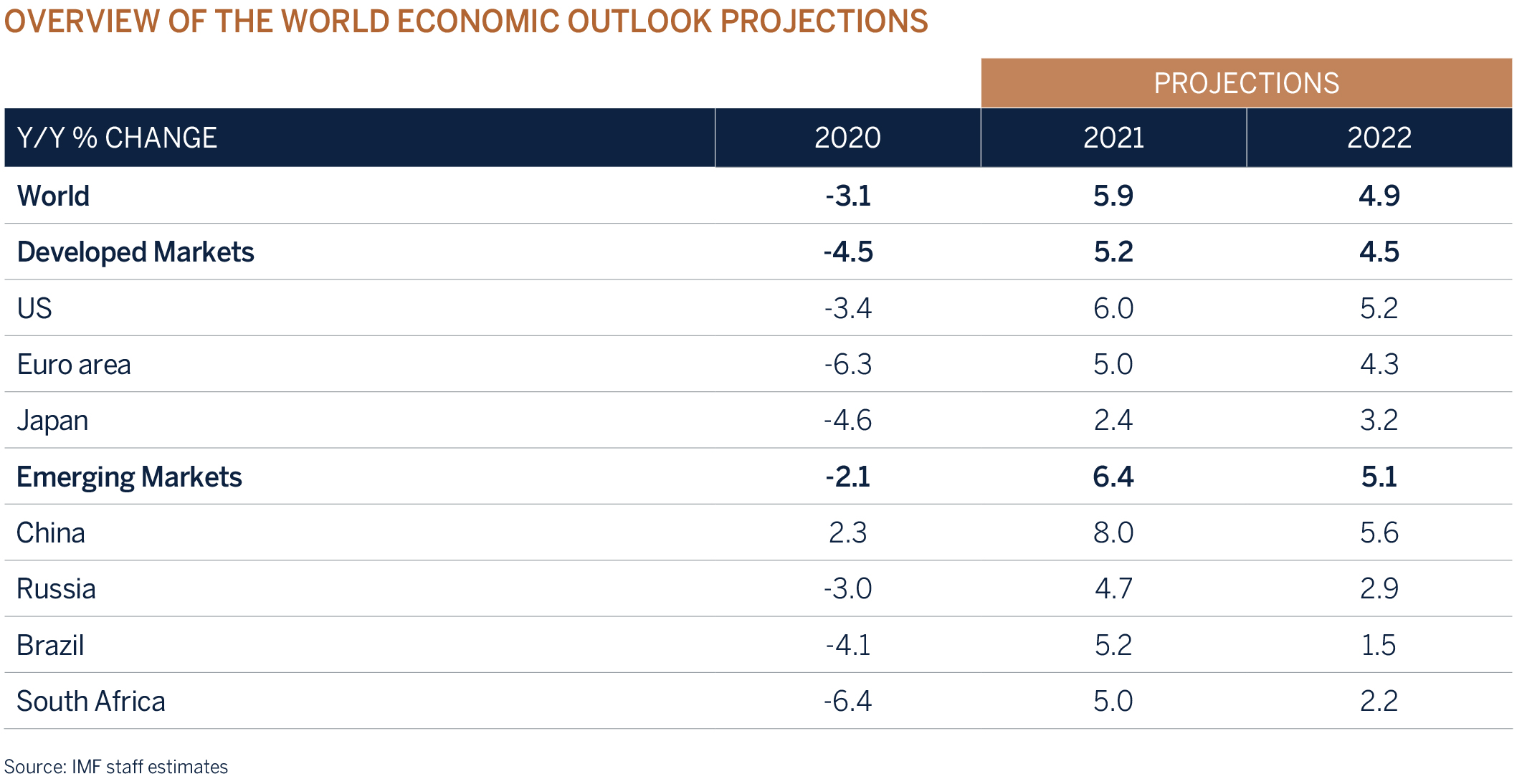

The pace of the global economic recovery has been extraordinary, underpinned by aggressive monetary and fiscal stimulus programs as well as the large-scale rollout of successful inoculation programs in many developed economies. Consumer demand was supported by income transfers and very low interest rates, which also led to an increase in asset prices in real estate and equity markets. Combined, these events have resulted in an improvement in confidence and a sharp increase in the requirement for goods/products, as consumers diverted their spending away from services (travel, hotels, tourism, restaurants, cafes etc.), which unfortunately could not all be met as manufacturing activity struggled to get back to the levels achieved pre-Covid. The services sector has not yet made a full recovery and the current fourth/fifth wave of infections across Europe and other parts of the world will once again hamper the recovery trajectory as governments impose renewed restrictions and households stay/work from home and isolate.

Supply Bottlenecks Are Slowly But Surely Easing

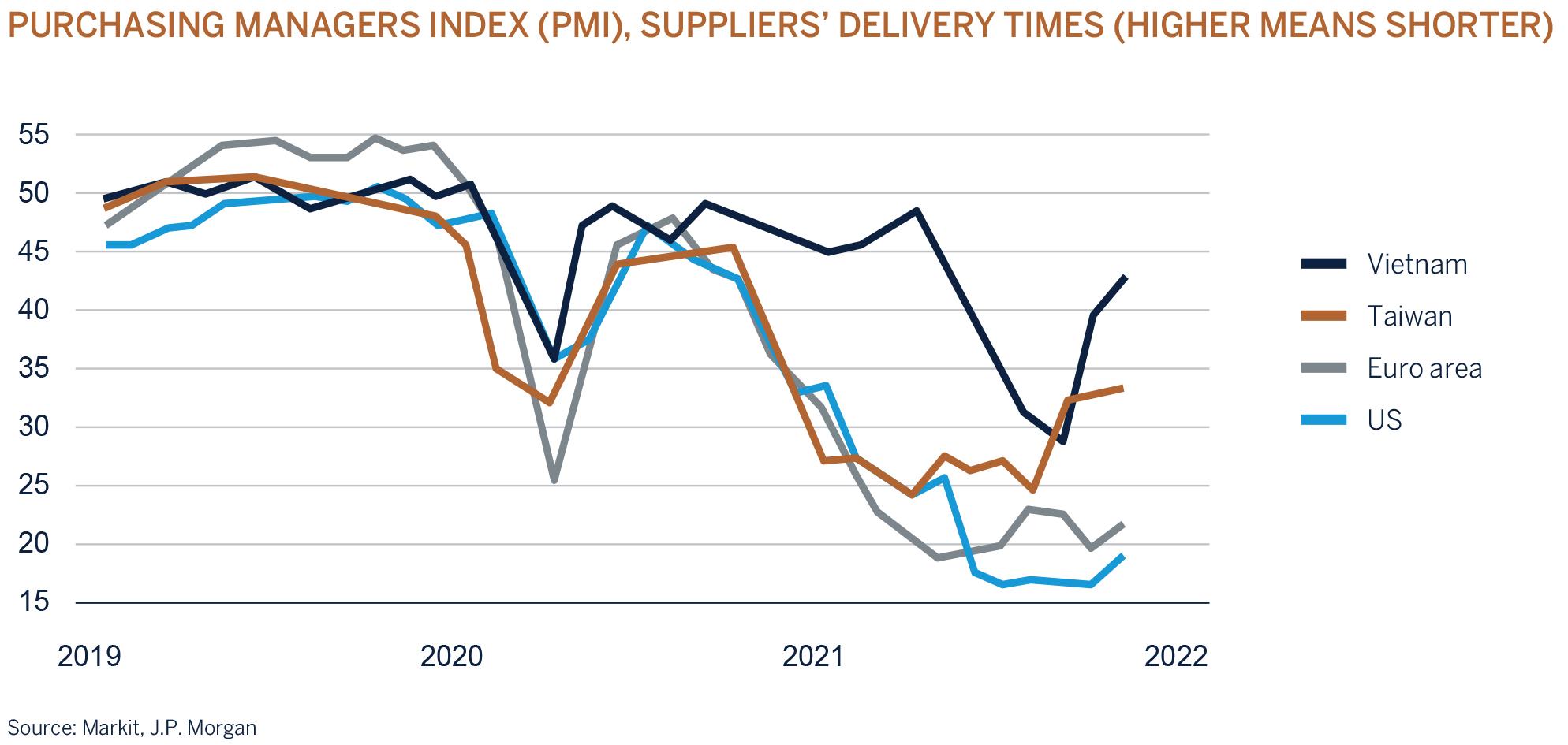

Disruption in the supply of goods, due to Covid led manufacturing closures, coupled with strong demand have resulted in a significant pick up in global inflation and a slowdown in industrial production. Furthermore, many companies have indicated that the disruptions are having an impact on their ability to source enough goods whilst input costs have increased significantly. In the near term this will be a headwind to profit margins and earnings growth for companies that cannot pass these costs on via pricing power.

The good news is that some of the leading indicators such as delivery times, inventory accumulation and global shipping costs are pointing to some easing in these supply bottlenecks which is sure to underpin an uptick in manufacturing activity and industrial production (growth). In addition, metal commodity prices and freight costs have been trending lower and auto production in Germany, Japan and the US has accelerated on the back of some renewed supply of semiconductors from Asia. These improvements will assist in cooling elements of inflationary pressures that currently exist and will pave the way to lower inflation as 2022 progresses. Realistically it is unlikely that supply chain disruptions can be fixed overnight with more pandemic waves looming and will likely continue to be a drag on growth in the year ahead. In the near term, companies will have to adapt and adjust their stock management programs. Certain measures such as double ordering and/or alternating suppliers will be required to offset the supply chain disruption, but this will likely come at a cost to working capital (cashflow) and profit margins. In the long term, should these disruptions persist, it could result in an acceleration of investment and capital expenditure (capex) spend. Reshoring, away from China, of supply chains might become an attractive longterm solution for companies, with greenfield and brownfield investments (manufacturing), accelerating automation, and digitalisation. These changes are sure to provide opportunities for investors and those companies that can adapt fast enough.

Could Inflation Upset The Apple Cart?

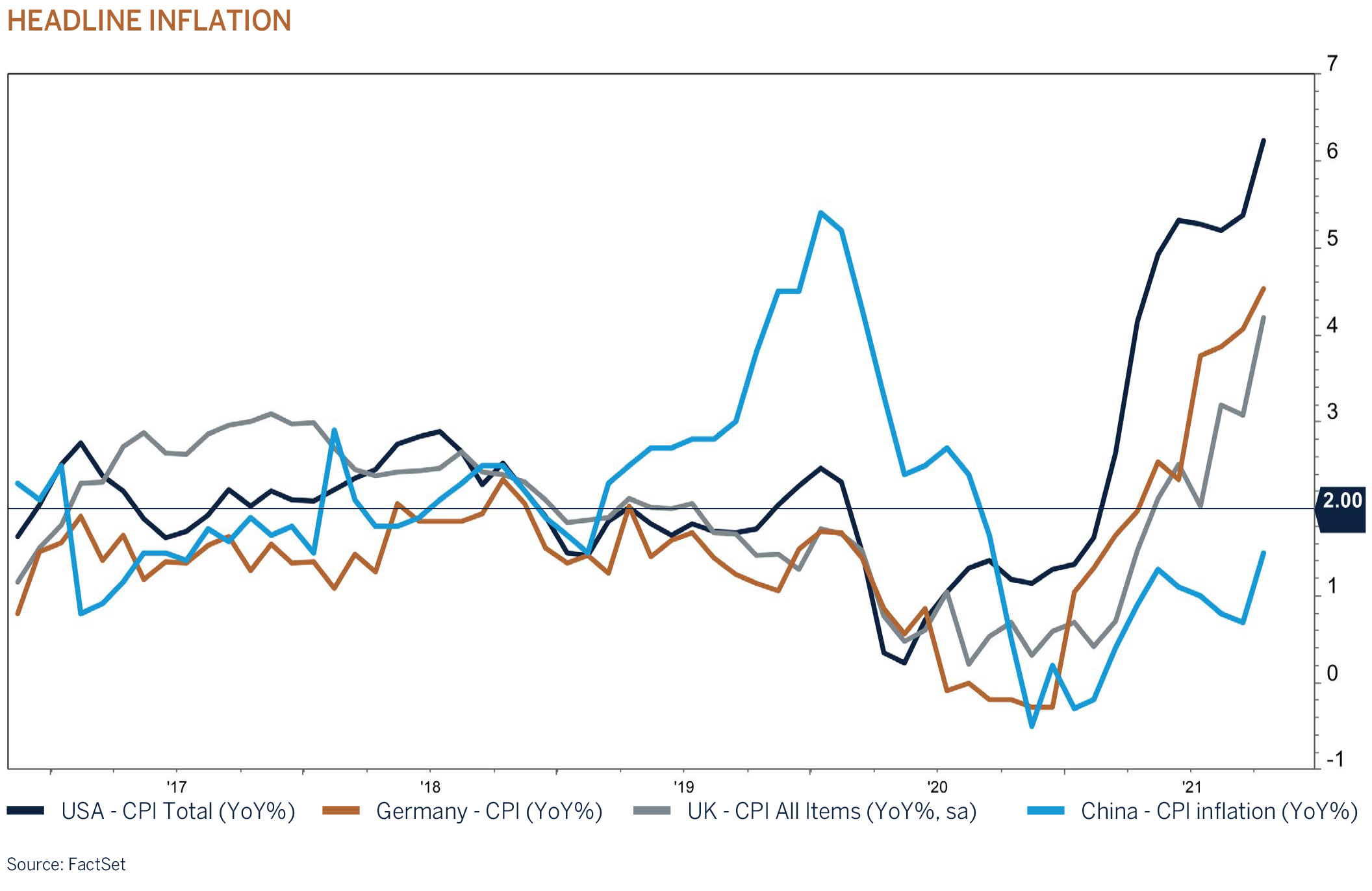

The US Federal Reserve (Fed) doesn’t always get it right and its recent retirement of the buzzword ‘transitory’ when referencing inflation is a case in point. With US headline inflation recently jumping to its highest level since 1982 there seemed little merit in continuing to spout misleading messages to the market on a subject that clearly has major ramifications for the future pace of monetary tightening. Thus far, the liquidity-fueled ‘rally in everything’ has appeared to (mostly) brush aside concerns of a more hawkish policy response given that economic conditions remain strong, or put another way, inflation hasn’t bitten yet and financial conditions remain ‘very easy’ and accommodative relative to the economic backdrop – but is that all about to change? Global central banks (not just the Fed) will be feverishly hoping that inflationary pressures begin to slow in the coming year as they do not want to ‘fall behind the curve’ i.e. be forced to raise interest rates quickly in an attempt to bring down inflation whilst at the same time creating a headwind for growth. It is difficult to envisage a ‘soft landing’ under this scenario as there would be meaningful negative consequences for asset prices and the global economy with an economic recession almost guaranteed.

Evidence so far is that ‘the return of inflation’ has been seriously underestimated and whilst this clearly has ramifications for central bank credibility, the more pressing and unfortunate by-product is that more vulnerable segments of the population have the most to lose as their already pressured incomes face ongoing strains from sharply higher living costs. Despite mounting evidence, it is still too early to cast an escalation of this more negative outlook in stone. There are tentative signs that some of the key measures in ongoing supply chain issues (commodity related) are easing as consumers continue to rotate away from consumer goods to ‘services’ and China experiences slower growth conditions. In addition, rolling base effects in the underlying inflation components should also provide an element of downforce in 2022. Does this mean inflation is falling back to central bank targets (+/- 2%) next year – certainly not. However, signs of a change in direction would be greatly welcomed by all, including financial markets, as it should indicate a gradual return to more agreeable price conditions, even if that is a story for late 2022 and beyond. Experience tells us that markets can usually stomach shocks in the here and now, provided the future appears more assured and they seem to be holding on to that play for now. COVID-19 aside, inflation and the varying degrees of measures required to combat it remain key to the outlook in the year ahead – we continue to watch these events closely and will act accordingly if, or when, required.

Central Banks & Monetary Policy

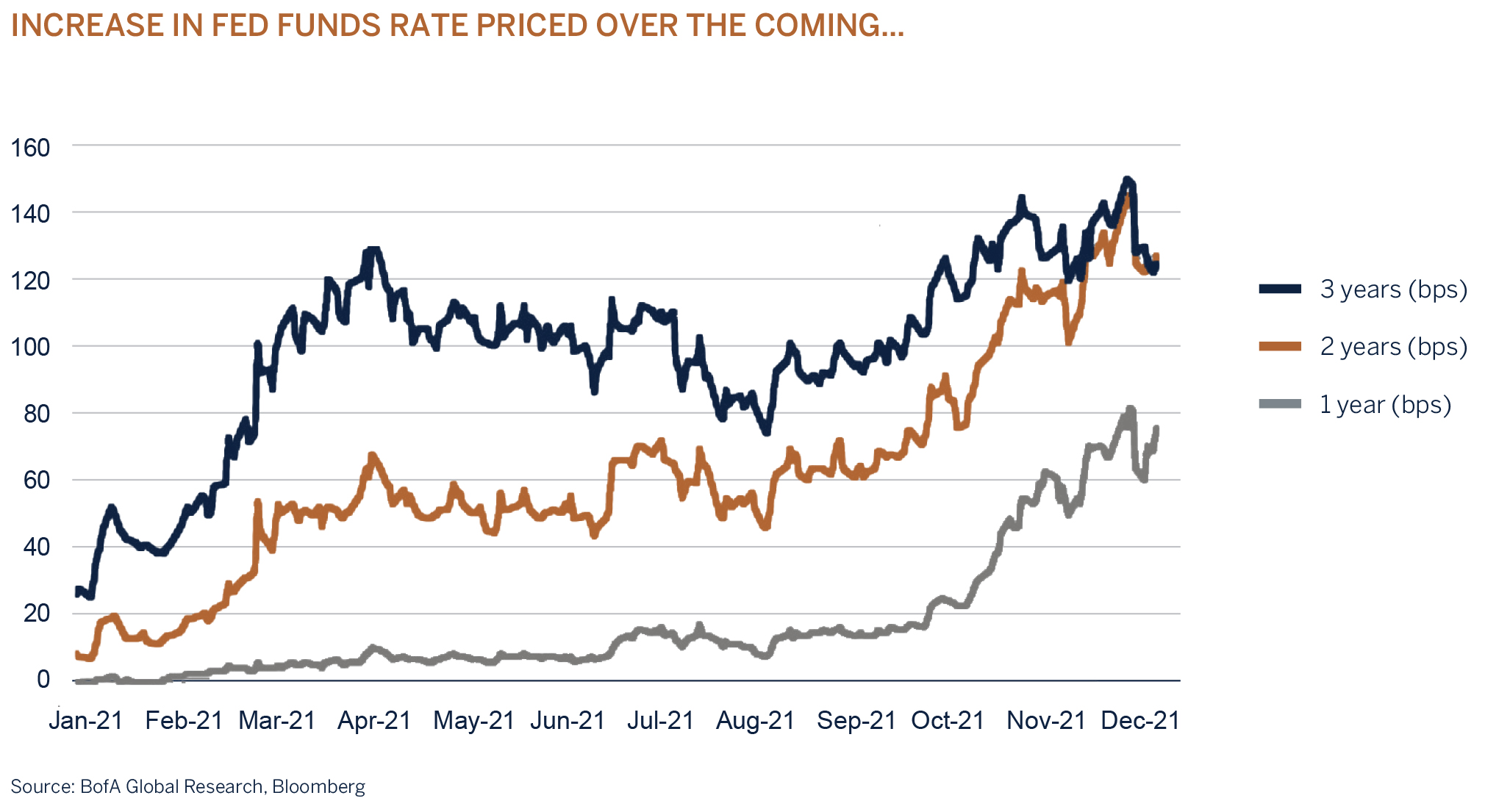

Since the 2008/09 Global Financial Crisis (GFC) global markets have become accustomed to ultra-easy monetary policy by way of ultra-low interest rates and quantitative easing. It is no secret that low (sometimes negative) risk free rates have been a boon for risk assets and when this ‘cheap money’ environment is challenged, as in late 2018, equity markets vote with their feet until calm is restored via improved economic data or a further loosening in monetary policy. The pandemic has further drained the interest rate armories of developed market central banks and they now face the unenviable challenge of tightening monetary policy whilst attempting to placate markets and maintain the positive and sustainable economic growth trajectory. Memories of 2013’s ‘taper tantrum’ are relatively fresh and the US Federal Reserve (Fed) thought it best to warn about a reduction in quantitative easing (QE) well in advance to avoid any shocks. As a result, their well telegraphed announcement in November confirming a reduction in monthly purchases stirred limited volatility. However, subsequent economic data (predominantly inflation) complicated matters and within a mere six weeks the Fed concluded to accelerate the monthly reduction pace from $15bn to $30bn.

Therefore, US interest rates may rise sooner and potentially quicker than markets had previously anticipated given the reduced timeline for the QE drawdown. Interest rates in the US now look set to be raised in Q2 2022, with three 25bps hikes anticipated for the year. It is too soon to speculate on the ‘terminal’ or ‘neutral rate’ as much hinges on the stickiness of inflation, but currently both the Fed’s ‘dot plot’ and markets alike are speculating a number of around 2.5% (not a coincidence but the same level rates peaked at in 2018/2019). If history is a guide, markets should be able to withstand a rise to this level as long as the pace of interest rate hikes is not aggressive (i.e. behind the curve) and of course, the economic backdrop is resilient enough to withstand tighter policy. There is of course an element of having some faith in the Fed and whilst their ‘transitory’ inflation mishap has dampened credibility, there is little doubt that their immediate policy responses to the GFC and coronavirus pandemic should be applauded and by default, likely reduces the odds of a serious policy error.

Ultimately, the trend is towards higher rates globally as inflation is now acknowledged as a clear threat to the economic expansion that needs addressing. So far, the markets appear to have faith that central banks can engineer a ‘soft landing’ but that appears predicated on current rate hike forecasts and subsequent timelines – a deviation from either (i.e. a surprise) would create uncertainty and asset price volatility. Looking at the quarters ahead, central banks will move at different speeds relative to the strength of their respective economies, levels of inflation and of course, the degrees of impact from ongoing COVID-19 infections, in particular the Omicron variant. Ultimately, in the absence of any unforeseen shocks, indications are that markets can accommodate tighter monetary policy as it unfolds in the year ahead. There remain many pillars of support for growth, perhaps the most obvious is that monetary conditions remain very easy and relative to growth conditions, should remain so even when interest rates begin to rise. With regards the timing of the next economic downturn, based on data going back over 65 years, it takes on average 3 to 3.5 years from the start of the hiking cycle before a recession occurs, with the shortest being just 11 months. Assuming the first US rate hike is sanctioned in the second quarter, the year ahead should retain a positive growth bias and remain supportive for equity markets.

Investment Performance

With risk assets benefitting from strong global growth and very robust corporate earnings all our client global equity and multi-asset portfolios enjoyed positive absolute returns during the year. Our asset allocation positioning to remain overweight global equity at the expense of fixed income assets, which struggled, added value. However, on a relative basis USD mandates largely failed to match their benchmarks due to the underperformance of our equity allocation, but we expect the easy gains from lower quality economic recovery/value stocks will subside in the year ahead as investors shift their focus back to long-term secular growth companies with proven business models and pricing power, a backdrop that is more conducive for our style. GBP mandates fared better due to the weakness of Sterling versus the US Dollar and our overweight position to US companies. Our long held defensive underweight and short dated fixed income positioning continued to add relative value for our fixed income and multi asset portfolios.

Asset Classes

| Equities | Maximum Overweight |

| Fixed Income | Maximum Underweight |

| Cash Plus | Neutral |

Asset Allocation

Apart from the risks involved with COVID-19, policy error by monetary authorities remains the key risk for asset prices. During the lockdowns of early 2020, central banks and governments threw in the kitchen sink through huge and expensive bond buying programs and furlough schemes to ensure people made it through a self-imposed recession. A lot of the monetary stimulus found its way into asset markets (such as equities and real estate) as well as the real economy. With world economic growth set to remain above trend and inflation broadening and tracking above target levels, central banks are now looking to withdraw some of the monetary punchbowl.

The fear is that less monetary support equates to lower markets, but this has rarely been the case in the past, except for periods when there was an interest rate “shock” (2006 and 2018) which resulted in a significant slowdown in economic activity. It tends not to be the firstrate hike, but rather the fourth or more, that marks the market top. The same phenomenon was also apparent with the tapering of quantitative easing. When seeking to normalise policy after the Global Financial Crisis (GFC) of 2007-09, the Federal Reserve announced tapering in late 2013 and then started it in early 2014.

Although financial markets experienced some volatility around those events, the MSCI All Country World Index was comfortably up over 2013 and 2014 as the economy, and corporate earnings growth, had enough strength to offset the policy change. On balance, we expect the same today and despite some headwinds in the near term, we are comfortable with an overweight position to global equities on better than expected earnings growth, at the expense of low yielding assets such as cash and government bonds. However, as always, we stand ready to make changes to our positioning should threats to our 2022 prediction of ongoing global economic expansion and corporate profit growth materialise more meaningfully.

Equities

| Consumer Discretionary | Overweight |

| Consumer Staples | Neutral |

| Energy | Underweight |

| Financials | Neutral |

| Healthcare | Overweight |

| Industrials | Neutral |

| Information Technology | Overweight |

| Materials | Neutral |

| Consumer services | Neutral |

| Utilities | Neutral |

| Real Estate | Underweight |

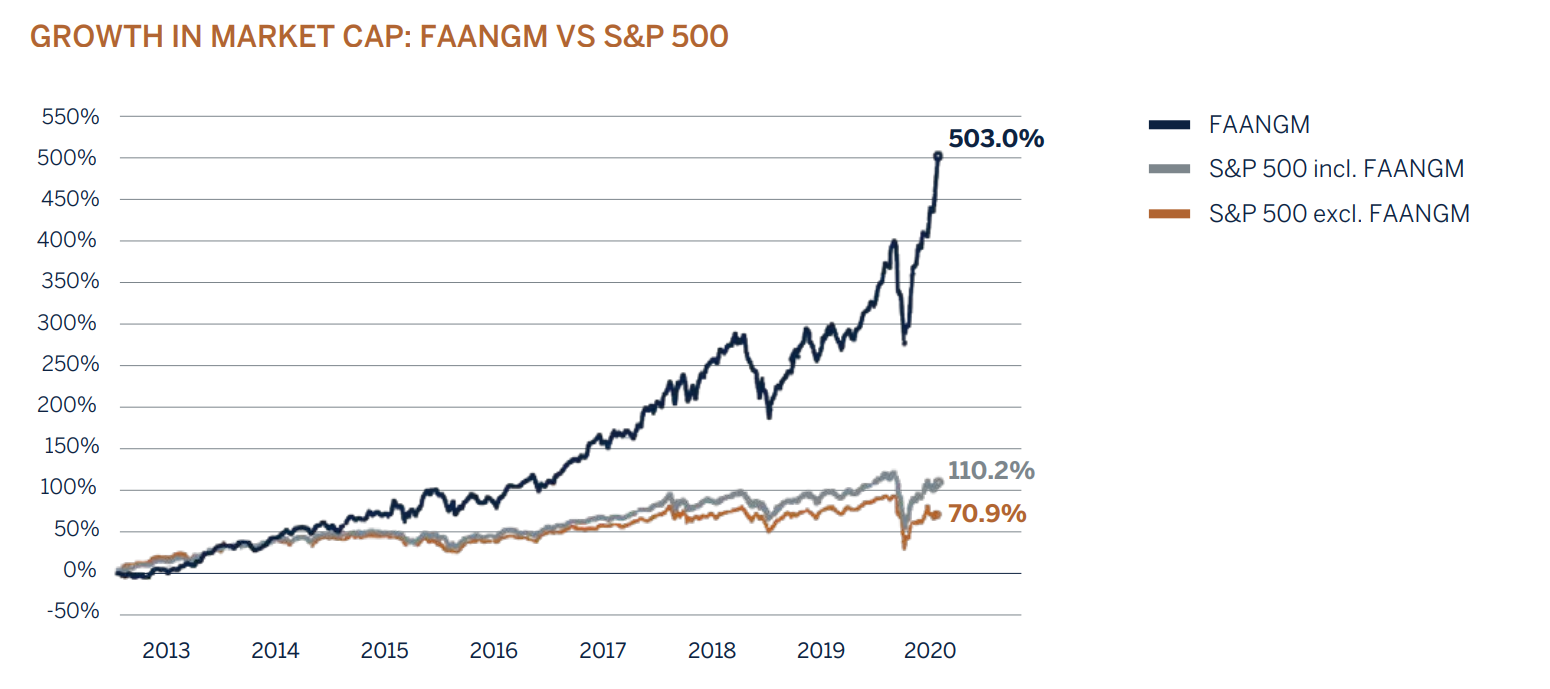

The sheer pace and magnitude of the recovery in most global equity indices from the March lows has surprised. However, as alluded to in previous updates, the rally has been far from broad-based with ‘stay at home’ and ‘growth’ stocks leading the rebound ahead of their more cyclical and value counterparts. Given the COVID led changes in consumer behaviour and the search for stable and repeatable earnings growth under a low interest rate environment this trend is understood and may have further to run but the relative performance gap is extreme and could close if vaccines are administered swiftly and successfully thereby allowing economies to re-open and mobility to again return. With cash and sovereign bonds looking set to continue to offer only negative real (after inflation) returns for some time to come quality global equites remain a preferred asset class. However, there is no escaping the simple fact that equity markets have rallied strongly and at current prices they should not be viewed as being cheap; many share prices are anticipating better times ahead and therefore without meaningful improvements in the permanent containment of COVID in the coming 3-6 months then equity prices could be set for some short term volatility. Having said this there is no escaping the predominantly risk-friendly backdrop. Namely, central banks are going to keep their feet on the stimulus pedals (both fiscal and monetary), economies should begin to open up and should be met with strong pent-up consumer demand and the general direction of travel for economic data should be positive, albeit from low bases. Ultimately, a favourable climate for risk assets that sadly will not stop some two-way volatility, but should ensure that downside periods are not lasting, rather viewed as buying opportunities – we remain cautiously optimistic.

Fixed Income

| G7 Government | Underweight |

| Index-Linked (US Government) | Overweight |

| Investment Grade - Supranational | Overweight |

| Investment Grade - Corporate | Overweight |

| High Yield | Overweight |

Longer-dated US government bond yields have been steadily rising since early August but relative to the outlook for a sustained recovery in economic growth conditions next year and for inflation to trend higher, we believe the market remains expensive, particularly based on historic ‘real return’ levels. It appears likely that the 10-year benchmark will breach 1% but we are mindful that the Federal Reserve will only tolerate yields rising sharply if coupled with signs that the economy is on a sustainable path to pre-pandemic levels. If not, further manipulation of the yield curve via quantitative easing measures (i.e. buying longer dated US treasuries) is probable. With interest rates near zero and destined to stay there for some time, the yield curve has steepened in recent months but the difference between two- and ten-year issues still remains some 50 basis points below its ten year average and therefore, not yet close to levels that we would deem sufficiently attractive to consider extending durations. Ultimately, market yields remain extremely low which in turn raises the duration risk exponentially and this is not a favourable mix for longer[1]dated bonds when taking a medium to long-term view – we remain cautiously defensive.

UK sovereign bond yields fell sharply throughout 2020 with all Gilts maturing in six years or less now trading on negative yields. The continued ‘will they, won’t they’ delays on a final Brexit deal together with the spread of a new “mutated” coronavirus strain understandably led to demand for safe[1]haven government bonds. The market is pricing in a bleak picture for the UK economy, suggesting rates will remain lower for longer, something we fully subscribe to. However, whilst UK PLC has clear headwinds, after a circa 11% contraction in 2020 we expect the economy to expand in the year ahead although the timing and pace will be at the mercy of the pandemic and, more importantly, the vaccine deployment. With yields either negative or close to historic lows, our defensive ‘underweight duration’ bias remains – the yield advantage on longer-dated bonds is negligible and vastly outweighed by potential capital downside risk. We expect a more attractive buying opportunity, although this may not present itself until the second half of the year.

Our strategies have retained a moderately overweight allocation to investment grade and high yield corporate credit. However, we are cognisant that these markets have rallied strongly since late March to the extent that spreads on both are now either at or close to pre-pandemic levels. The level of forward-looking optimism, aided by an ongoing search for yield and central bank support justifies these moves. Whilst we do anticipate ongoing demand for these higher yielding markets, further significant upside may be limited from current levels if markets begin to price in diminishing central bank support via quantitative easing. As with all ‘risk’ markets the direction of travel will not be ‘one way’ and whilst we are happy to maintain our current allocations, we will aim to increase at more attractive levels.

Currencies / Interest Rates

| Current | Direction | ||

|---|---|---|---|

| US Dollar | Overweight | 0.25% | → |

| Sterling | Neutral | 0.10% | → |

| Euro | Underweight | 0.00% | → |

The US Dollar weakened in the second half of the year, more than we had anticipated and to the detriment of our overweight strategy. In particular, the currency’s slide against the Euro during this period has been meaningful however it should be noted that the US government bond market has significantly outperformed its German counterpart year-to-date so the relative cost to performance has not been material. Looking ahead, further downside in the US Dollar is very much the ‘consensus’ opinion which, in itself should be a slight concern, particularly given the weakness already experienced this year. Ultimately, we may be forced to reduce the long held overweight strategy but we remain very mindful that the US bond market still enjoys a considerable yield pick-up over virtually all counterparts (circa 1.5% in the case of German ten-year bonds for example) and therefore, allocating to Euro or Yen assets forces our strategies to invest in zero, and more often deeply negative yielding assets.

Sterling had a strong run into year-end thanks to a mix of broad US dollar weakness and positive news on the Brexit trade deal. At current levels it appears much of the good news may be priced-in but we are not discounting further short-terms gains. Years of wrangling over Brexit and the COVID-19 pandemic have taken their toll on the UK economy and whilst we are more optimistic for the year ahead, there is a big mountain to climb to recoup much of the lost output. Interest rates are certainly staying put and, though this is not our base case, speculation remains that the Bank of England may consider taking them negative. Our Sterling International strategies have remained moderately overweight base currency and we will continue with this strategy unless it becomes apparent that the currency has run ahead of economic fundamentals.

Market Performance % / as at 31 December 2020

| EQUITIES | DECEMBER | Q4 | 2020 |

|---|---|---|---|

| Global | |||

| FTSE All World TR Net (Sterling) | 2.20% | 8.44% | 12.43% |

| FTSE All World TR Net (US Dollar) | 4.64% | 14.66% | 16.01$% |

| UK | |||

| FTSE All-Share TR | 3.86% | 12.62% | -9.82% |

| US | |||

| S&P 500 TR | 3.84% | 12.15% | 18.40% |

| Europe | |||

| Dow Jones Euro STOXX TR | 2.09% | 12.57% | 0.25% |

| FIXED INCOME | DECEMBER | Q4 | 2020 |

| Bloomberg Barclays Series - E UK Govt 1-10 Yr Bond Index | 0.53% | 0.16% | 3.17% |

| Bloomberg Barclays Series - E US Govt 1-10 Yr Bond Index | 0.03% | -0.23% | 5.49% |

| JP Morgan Global Government Bond (Sterling) | 1.17% | -3.29% | 6.29% |

| JP Morgan Global Government Bond (US Dollar) | 1.19% | 2.26%% | 9.68% |

| Iboxx Sterling Corporates Total Return Index | 1.68% | 3.96% | 8.63% |

| Iboxx US Dollar Corporates Total Return Index | 0.47% | 2.89% | 9.62% |

| CURRENCY vs. STERLING | DECEMBER | Q4 | 2020 |

| US Dollar | -2.20% | 2.68% | -2.84% |

| Euro | -0.03% | 7.32% | 5.78% |

| Yen | -1.25% | -3.39% | 2.15% |

| CURRENCY vs. US DOLLAR | DECEMBER | Q4 | 2020 |

| Rand | 2.27% | 4.29% | 8.87% |

| Euro | 0.97% | 2.15% | 5.13% |

Source: FTSE International Limited (“FTSE”) © FTSE 2013. “FTSE®” is a trade mark of the London Stock Exchange Group companies and is used by FTSE International Limited under licence. All rights in the FTSE indices and / or FTSE ratings vest in FTSE and / or its licensors. Neither FTSE nor its licensors accept any liability for any errors or omissions in the FTSE indices and / or FTSE ratings or underlying data. No further distribution of FTSE Data is permitted without FTSE’s express written consent.