Higher for longer interest rates cause concerns

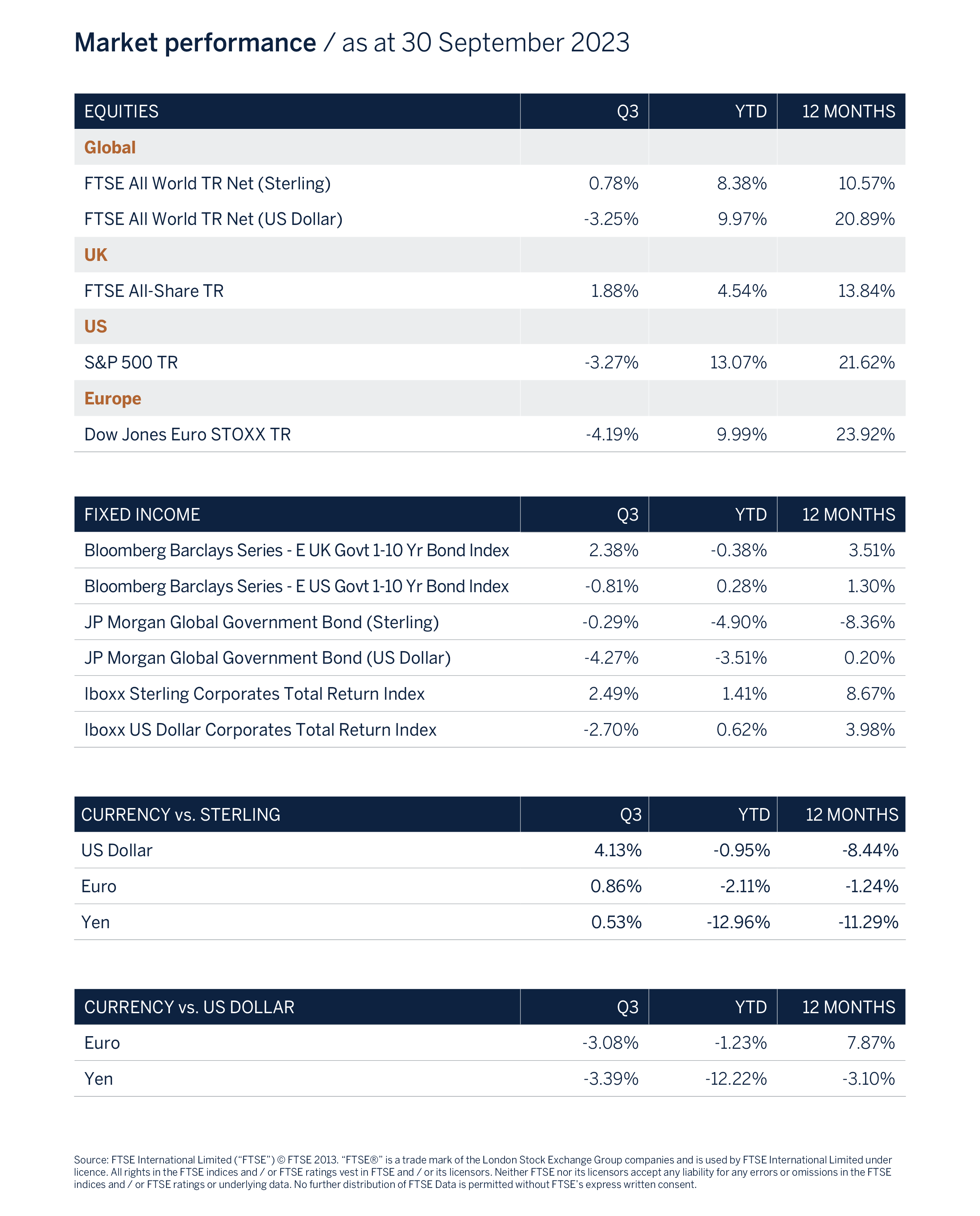

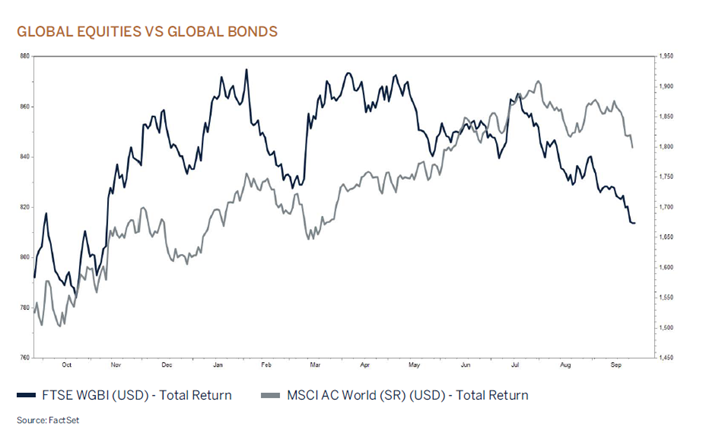

After a positive first six months of the year both global equity and fixed income markets declined during the third quarter. There were several factors that unnerved investors during the quarter, with the main headwind being confirmation from central banks that interest rates are set to remain higher for longer as they continue to fight inflation. Bond prices fell, pushing yields to their highest level for this cycle, leading equity prices to naturally adjust lower as a result of a higher discount rate.

The adjustment of interest rates and interest rate expectations has been significant with the recent credit downgrade of US sovereign debt and a sharp pick up in US Treasury issuance (to fund budgeted spending deficits) adding impetus to the upward trend in yields. In the midst of the COVID-19 pandemic, the 10-year US Treasury yield hit an all-time intraday low of 0.3%. Since then, we have experienced an astonishing turnaround with 10 year yields now standing at 4.6%, and it’s worth remembering that the annual rise of c. 2.3% over 2022 was already the biggest yearly increase since 1788.

Long duration growth assets such as technology shares, which had been the driver of returns earlier in the year, felt the brunt of the pain. Conversely, higher crude oil and energy prices resulted in the energy sector outperforming the rest of the market by 15%. While the US economy appears resilient, softening economic data elsewhere, particularly in Europe and China, has led to growing concerns about the near-term global growth outlook and negative revisions to corporate earnings.

The rise in crude oil prices and higher bond yields raises particular concerns for investors as these factors will weigh negatively on the growth outlook, while at the same time, fueling stubbornly high inflation in the near term. Central banks have little option other than to keep interest rates higher for longer, increasing the risk of some form of financial/ asset dislocation as credit conditions continue to tighten and cheap debt is refinanced at even more costly levels.

"We believe that risks remain tilted to the downside given the extent of monetary tightening."

What to expect from equities once interest rates have peaked?

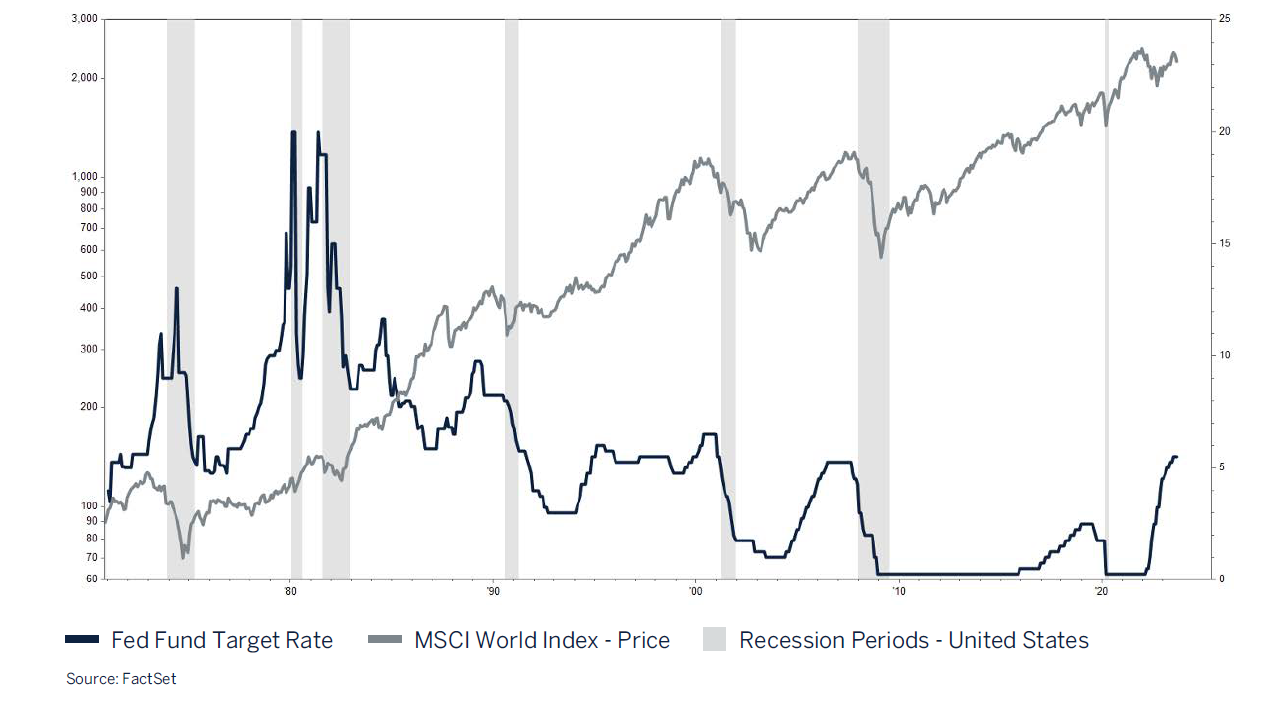

Over the past 30 years, there have been nine cycles of increasing interest rates, and the current cycle marks the 10th, being the sharpest and most aggressive since 1972.

As shown above, over the past 50 years equities tended to rise when the interest rate hiking cycle was not followed by a recession. This only occurred three times; 1984, 1995 and 2018. For every other cycle, where higher interest rates resulted in a recession, equity markets experienced a correction of at least 20%. In addition, it is also interesting that the global economy experienced a sharp downturn whenever interest rates increased by 300 basis points or more over a rolling 12-month period.

Every economic and business cycle is however unique, and the sharp downturns experienced in the global economy since 2000 were accompanied by either an asset bubble (2000 dot.com) and/or periods of extreme risk taking (2008 global financial crisis). Our baseline view is that the global economy is unlikely to enter a period of recession given healthy balance sheets across households and corporates, significant increase in households net assets and a tight job market which has for the first time in many years supported real income growth for employees. However, we believe risks remain tilted to the downside given the extent of monetary tightening (higher interest rates) since 2022, with the lagged effects to the global economy still to play out, reduced fiscal support, tightening credit standards, high oil price (sticky inflation) and unfavourable geo-political developments between China and the Western economies. The current economic cycle would appear to be quite mature in nature and unlikely to reaccelerate until monetary authorities decide to ease interest rates again, an event that has been pushed back until next year.

Conclusion

Growth in the global economy has been surprisingly more resilient this year than what the forward leading economic indicators had been signaling and what economists had expected. The developments surrounding Artificial Intelligence, automation and reshoring of manufacturing facilities have played an important role in supporting gross fixed capital formation and economic growth. The benefits from these investments will also support economic growth over the medium to long term.

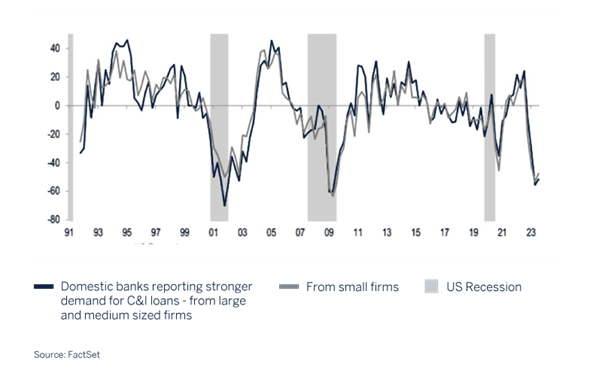

The knock-on effects from higher interest rates have thus far largely been contained. But as with most aggressive interest rate hiking cycles, investors should expect some moderation in economic activity, especially now that fiscal (government spending) support measures are starting to fade. While household income remains healthy, there are signs of employment growth slowing, albeit from a high base. Credit conditions have tightened with both demand and supply for new credit declining as affordability wanes and delinquencies across various credit lines increase at an alarming rate. The housing markets in developed economies have also started to show some weakness with new and existing home sales under pressure. Some consolidation in the property market should be expected and welcomed after a period of significant increases in house prices and interest rates and will assist in reducing core inflation over the coming year

DEMAND FOR CREDIT IS COMING DOWN AGGRESSIVELY, THE MOST SINCE THE GFC

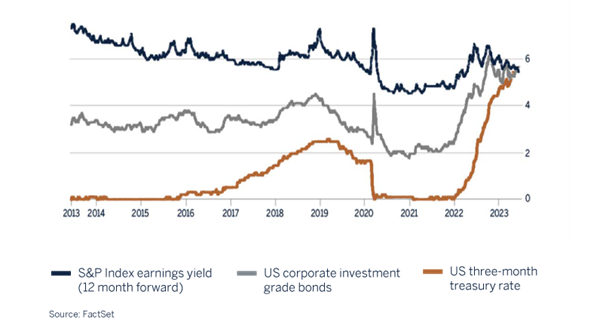

The global equity market has lost some of its shine from earlier this year as earnings revisions have turned negative and the outlook for interest rates has become even more restrictive. The increase in energy prices is concerning and poses an additional headwind to the direction of both inflation and companies’ profit margins. Equity valuations have adjusted somewhat to higher real yields and are no longer that extreme but remain far from cheap when compared to the income yields on offer in cash and fixed income (15 year high) when adjusted for risk.

We are cautiously positioned in client portfolios with an underweight allocation to global equity at a time when cash and fixed income assets are providing more attractive forward-looking risk adjusted returns, while realising that interest rates are close to reaching their peaks in the current business cycle.

Global Equity – Underweight

| Consumer Discretionary | Overweight |

| Consumer Staples | Neutral |

| Energy | Underweight |

| Financials | Neutral |

| Healthcare | Overweight |

| Industrials | Neutral |

| Information Technology | Neutral |

| Materials | Neutral |

| Communications Services | Overweight |

| Utilities | Neutral |

| Real Estate | Underweight |

After an initial surge in equity prices during the first half of the year, underpinned by China’s reopening, downwardly trending headline inflation and resilient macroeconomic data, equity market valuations adjusted to the reality that interest rates will continue to be a headwind for the global economy, and that monetary relief has been pushed out to the second half of next year increasing the risk of a financial dislocation as the global economy loses momentum. The sell off in global bond yields means that the discount rate used to value equities has increased materially, which requires an adjustment to prices and most likely earnings growth over the next 12 months as corporates adjust to higher for longer interest rates.

Outside of the technology and energy sector, equity markets have largely been trading rangebound this year, given that certain leading economic indicators are pointing to some softness ahead. Banks have been tightening their lending standards which has resulted in both credit extension and credit demand slowing materially. In addition, corporate bankruptcies this year have reached the levels last seen during the global financial crisis. Outside of the US and Japan, global equity markets have in fact been trending sideways and down (in USD) since reaching their peaks in February as the outlook for earnings growth has been adjusted lower. Consensus expects earnings for 2023 to be marginally down on last year.

We remain underweight the asset class due to the following reasons:

- The full effect of higher interest rates still needs to play out. It can take up to 2 years before the economy fully responds to tightening monetary policy. Higher interest rates combined with tightening credit standards, and a decline in money supply have in the past always resulted in a recession (not our base case).

- Interest rates are not expected to decline in the near term. Core inflation remains elevated given a buoyant labour market and is not expected to decline to levels that will allow central banks to cut interest rates until next year.

- Equity markets have historically not reached a bottom prior to the end of the interest rate tightening cycle and have tended to only bottom after the first interest rate cut. The risk is that monetary authorities overtighten in their effort to curb inflation.

- From a valuation perspective, equities are not overly attractive on a risk adjusted basis, and even less so when compared to the interest rates on offer for cash and government bonds. Expected returns over the next 12 months are in line with that of cash and fixed income.

- An environment of higher for longer interest rates and elevated inflation is unlikely to result in higher valuation multiples from current levels.

- The outlook for company earnings remains uncertain and given peak profit margins and an expectation that inflation and volumes will slow earnings growth could provide a challenge for many companies to sustain in the short run.

- Equity valuations are not extreme, but a soft landing is arguably already priced in which provides little to no cushion for any disappointment.

Global Fixed Income – Neutral

| G7 Government | Underweight |

| Investment Grade - Supranational | Overweight |

| Investment Grade - Corporate | Neutral |

| High Yield | Overweight |

been another tough quarter for global bond markets with the Bloomberg Global Aggregate Index lower by -3.59%. A combination of falling, but still elevated inflation together with strong employment markets in developed economies has forced central banks to remain focused on the necessary action required to bring inflation back down to target levels, with warnings that restrictive monetary policy will remain in place for longer than originally anticipated, something we have communicated in previous updates. Bond markets have adjusted for this outlook in the quarter with yields on 10-year sovereign US and UK bonds re-testing levels last seen prior to the global financial crisis (GFC) in 2008. Whilst concerns continue to be raised over the negative implications of higher interest rates, we must be mindful that current monetary policies have only returned to more ‘normalised’ levels from what we have experienced post the GFC, a period where central banks manipulated markets with the sheer volume of bond purchases under their quantitative easing programs.

As widely expected, the US Federal Reserve (Fed) kept interest rates on hold in September, but the accompanying ‘hawkish’ undertone was clearly noted by the bond market which sold off further despite no move in rates. Monetary policy concerns have shifted from ‘how high’ to ‘how long’ and news that the Fed’s interest rate projections out to 2026 had shifted higher asserted the growing view that interest rates are going to remain in restrictive territory for longer than originally anticipated. One more hike this year certainly can’t be ruled out but that is no longer the determining factor for bond market direction. The latest ‘dot plot’ now assumes only two rate cuts next year which fits with the ‘soft landing’ narrative. Indeed, the Fed’s conviction for this outcome appears to be climbing with more positive revisions to both growth and employment next year. The determining factor for this monetary policy outlook remains inflation and we believe it should continue to trend lower in the coming months/quarters but a return to central bank target levels will likely take longer than originally forecast as factors such as resilient growth, demographics and de-globalisation continue to play a part in keeping price pressures elevated.

Resilient economic growth, above target inflation and higher for longer interest rates are likely to keep US government bond yields elevated, at least over the shortterm. However, bond markets are discounting mechanisms and many of these factors have already been priced in and should ensure that longer-dated yields are close to their peak, allowing a good opportunity to extend durations and lock into these attractive yields for the longer-term. This is a process we have been implementing over recent months and one that we believe will reward investors over the medium to long-term as inflation continues to trend closer to target levels. With valuations now also looking attractive on a relative basis and increasingly looking set to outperform cash over the next year we are closer to upping the allocation to this asset class to overweight.

The Bank of England (BOE) left rates on hold at 5.25% in September following 14 successive hikes since December 2021. A total of 515 basis points of tightening have been sanctioned to date, the most aggressive hiking cycle in more than three decades. Central bank governor Andrew Bailey signalled that this was a pause, leaving the door open to further hikes should inflation not fall as expected. It was a tough call on whether they would or would not raise rates following the release of August’s inflation report the previous day which confirmed an unexpected slowdown to the lowest level in 18 months, driven by a fall in hospitality and food prices. In addition, lacklustre growth in the economy, contracting business activity together with a slight softening in the employment market provided additional ammunition to pause the hiking cycle as it becomes increasingly evident that higher interest rates are starting to take effect.

However, as with many other central banks, the focus now is shifting from the peak in rates to the length of time rates are held at restrictive levels. On this subject, Andrew Bailey commented that interest rates will be “sufficiently restrictive for sufficiently long”, therefore the mantra for now remains one of ‘higher rates for longer’. There is no doubt that the BOE remains in a difficult predicament, economic growth is uninspiring and being revised lower at a time when inflation, currently 6.7%, is running at three times the central bank’s target rate. This stubborn inflation is the BOE’s priority even if the cost is a period of negative growth and as such, we would not be surprised if one more rate hike is sanctioned in the months ahead and do not expect any rate hikes until the second half of next year.

The US dollar remains our preferred currency and has appreciated sharply in the quarter, hitting new highs for the year in September (DXY Index). The relentless upward march in US government bond yields continues to support the currency, particularly now given the prospect of both interest rates and yields remaining higher for longer.

The currency continues to benefit from positive growth divergences and an enhanced yield against counterparts such as the Euro and Yen and is now also deemed to be a ‘safe haven’, a very supportive combination which we believe will be tough to break, at least over the medium term.

Cash Plus – Overweight

Short-term money-market instruments are providing attractive yields at present in an environment where the outlook for the global economy and geopolitical environment remains uncertain. These funds will naturally be deployed across the other asset classes when investment opportunities arise.

Asset Classes

| Equities | Underweight |

| Fixed Income | Neutral |

| Cash Plus | Overweight |

We continue to actively monitor the key drivers of asset class returns, which include valuations, the outlook for inflation and interest rates, the change in the direction of leading economic indicators and developments in employment. We stand ready to change tack as the environment dictates and although we believe investors should look forward to a year of improved investment returns in response to lower starting valuations, declining inflation, a peaking interest rate cycle and defensive positioning by market participants, for now, we remain underweight to equities, neutral to fixed income and overweight cash plus.

Investment performance

At the asset allocation level, our tactical underweight equity allocation assisted US dollar and euro-based portfolios in Q3 2023, but was a slight detractor for sterling mandates, whilst our overweight cash-plus added value. Within equity, our quality growth style underperformed the market having no exposure to energy and as the Artificial Intelligence (AI) hype petered out. September and October are typical months for corrections before Q4 optimism takes hold. It may be different this year, but those with a “glass half empty” perspective would latch onto weaker macro data points as a positive development for potential rate cuts. Pessimists would view this as negative for corporate profits. Either way, our clients’ portfolios are populated with quality businesses through prudent sector allocation which enables them to ride out whichever narrative the market chooses over the short-term on the way to generating attractive longer term compound returns. Our neutral fixed income weighting in multi-asset portfolios coupled with our strategy to gradually extend duration to lock into higher yields, has delivered value and returns were broadly in-line with benchmarks.