Navigating Through an Environment of Increased Uncertainty

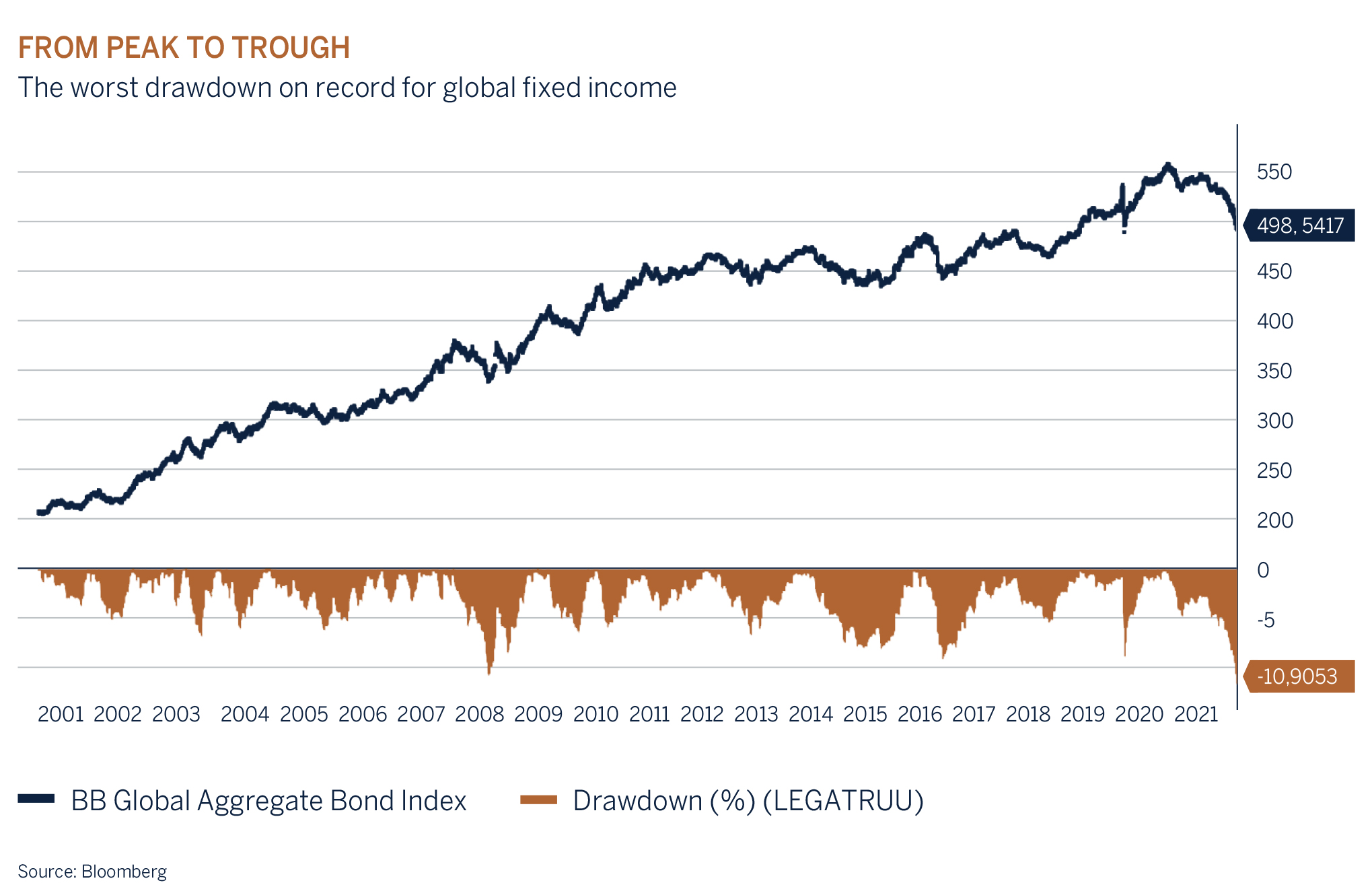

Following two years of strong returns from equity markets volatility set in during the first quarter of 2022 as the outlook for inflation, interest rates and global growth has deteriorated. The war in Ukraine coupled with widespread sanctions imposed on Russia has only added to inflationary and economic growth fears as the price of natural gas and crude oil soared on supply disruption concerns. As expected, global bond yields adjusted higher, as prices fell, with investors starting to price in the reality of higher for longer inflation and a more rapid interest rate tightening cycle. At the same time corporate credit and emerging market sovereign spreads have widened to more ‘realistic’ levels on growth concerns, leaving yield hungry bond investors with significant losses. Global bonds have experienced their worst drawdown since 2002, falling -12% (peak to trough). That is significant given how low the starting income yields have been over the same period.

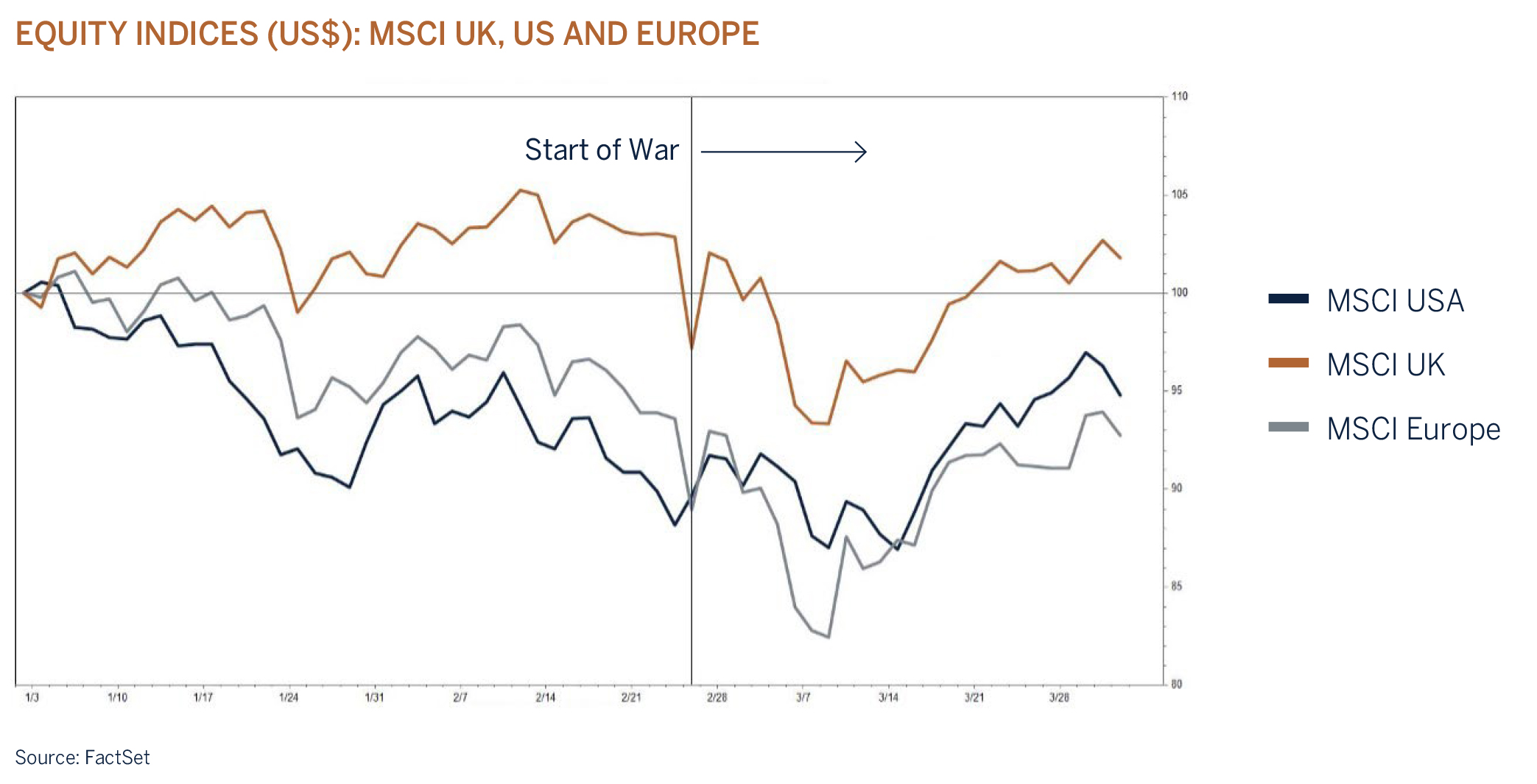

After a turbulent start to the year global equity markets gathered some composure to finish the quarter down -5% in USD terms and -2.5% in GBP, with energy the only sector to close the period in positive territory, surging over +20% as oil prices broke through $120 per barrel. Initially, equity market valuations adjusted to the change in the outlook for interest rates, but this was soon followed by fears of a possible invasion of Ukraine by Russian forces, which sadly became a reality and has resulted in one of the worst humanitarian crises in recent history.

Equity markets did however behave exactly in line with previous episodes of heightened geopolitical tension and have rebounded strongly from their lows after the initial shock and further angst around the potential long-term implications of such an event on world stability and world commodity prices. Although still very early days, history has taught us that increased volatility from geopolitical events tends to be short lived.

Although it is impossible to predict how long the military conflict and associated sanctions will continue for, a prolonged war would likely inflict significant harm to the global economy through higher inflation, reduced real disposable income for consumers/households and lower profit margins for many companies. This of course is in addition to the dreadful human suffering and loss of life. Europe’s economy, which is heavily reliant on global trade and manufacturing, will be directly exposed to the significant increases in energy costs and will be particularly vulnerable if Putin decides to retaliate by reducing or cutting off energy supply to the region. The latest fall in the German IFO Business Climate Index points to a challenging period ahead in Europe.

As markets rebounded at the end of March, we have taken some risk off the table by reducing equity weightings in client portfolios, but we are cognisant that the global economy is fundamentally strong and still recovering from the loss of output caused by COVID-19. Employment is growing, households and corporate balance sheets are healthy, interest rates, although rising, are historically low, and significant ‘re-opening’ pent-up demand exists as the world learns to live with COVID-19. In Europe, new fiscal support initiatives have been announced to offset some of the inflationary costs associated with the war and more is likely to follow, which will provide an element of underpin to economic activity when Europe needs it most.

Investors should however brace themselves for ongoing volatility and lower returns as the valuations of asset classes adjust to an environment of ongoing geopolitical uncertainty, higher interest rates and slower growth given the messaging from central banks, which is “they will do what it takes” to fight inflation.

Central Banks Dilemma

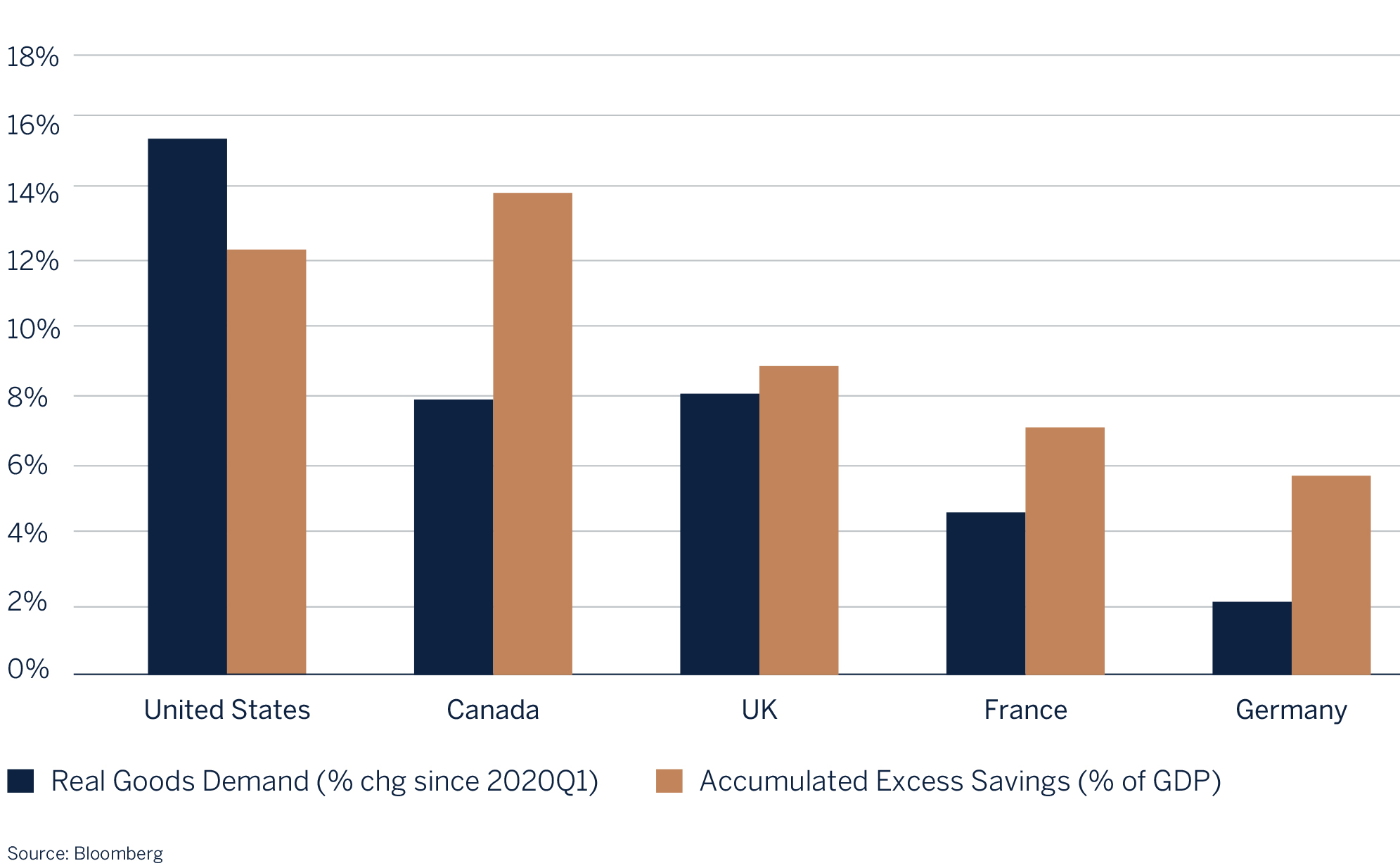

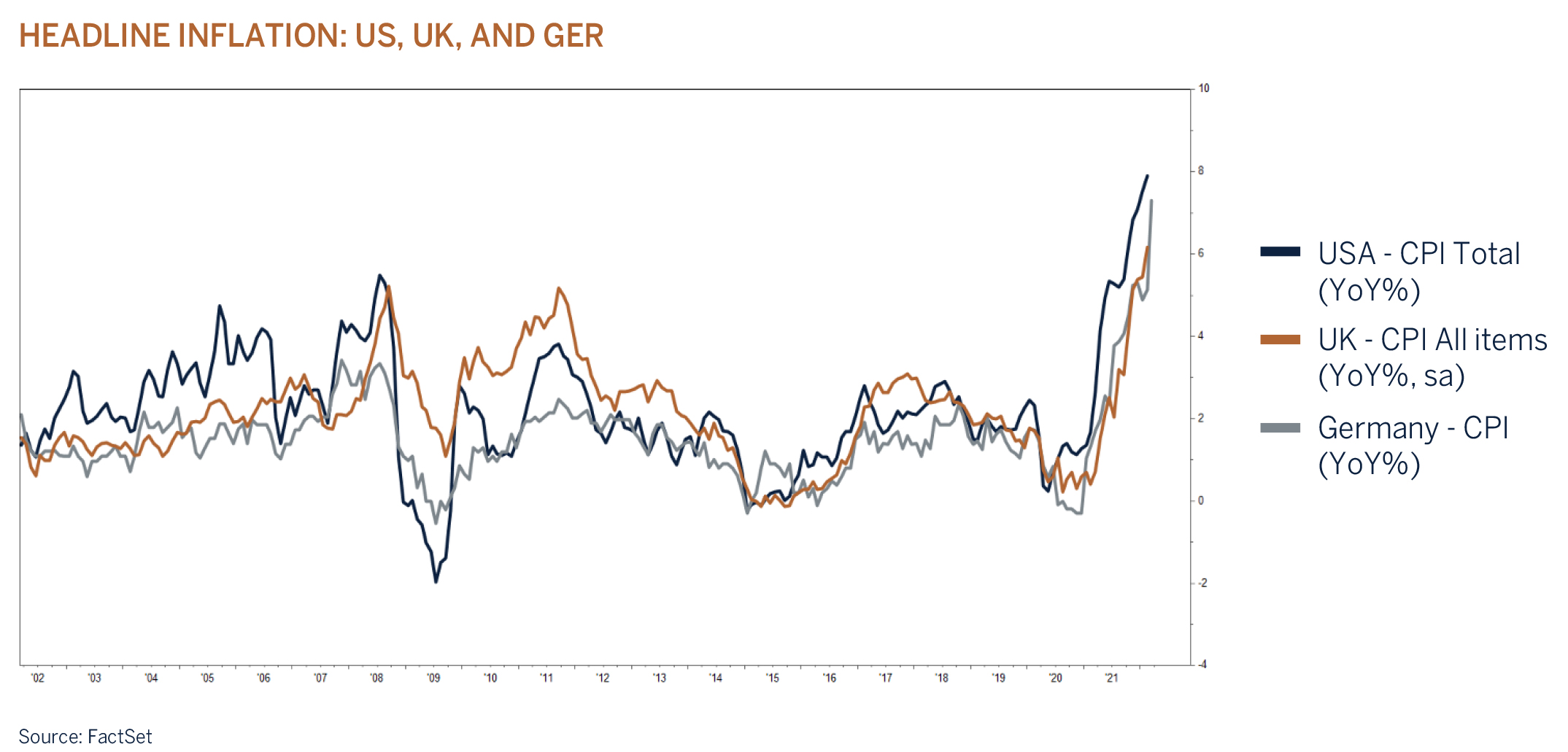

The combination of strong underlying demand, in part due to highly accommodative monetary policy (low interest rates) and reduced supply, which has been amplified by Russia’s invasion of Ukraine, has resulted in inflation reaching multi-decade highs in the developed world. Until recently, western world central banks have been patient in the face of an inflation spike that was viewed to be transitory. However, this has changed as the broadening of price pressures and labour shortages have increased inflation concerns. During the past three decades the global economy was regularly buffeted from geopolitical events that limited commodity supply and caused price spikes, but the current cycle is different as prolonged and broad based COVID-19 led supply disruptions, and now the Russia/Ukraine conflict, have created more widespread core price pressures in labour and basic food stuffs.

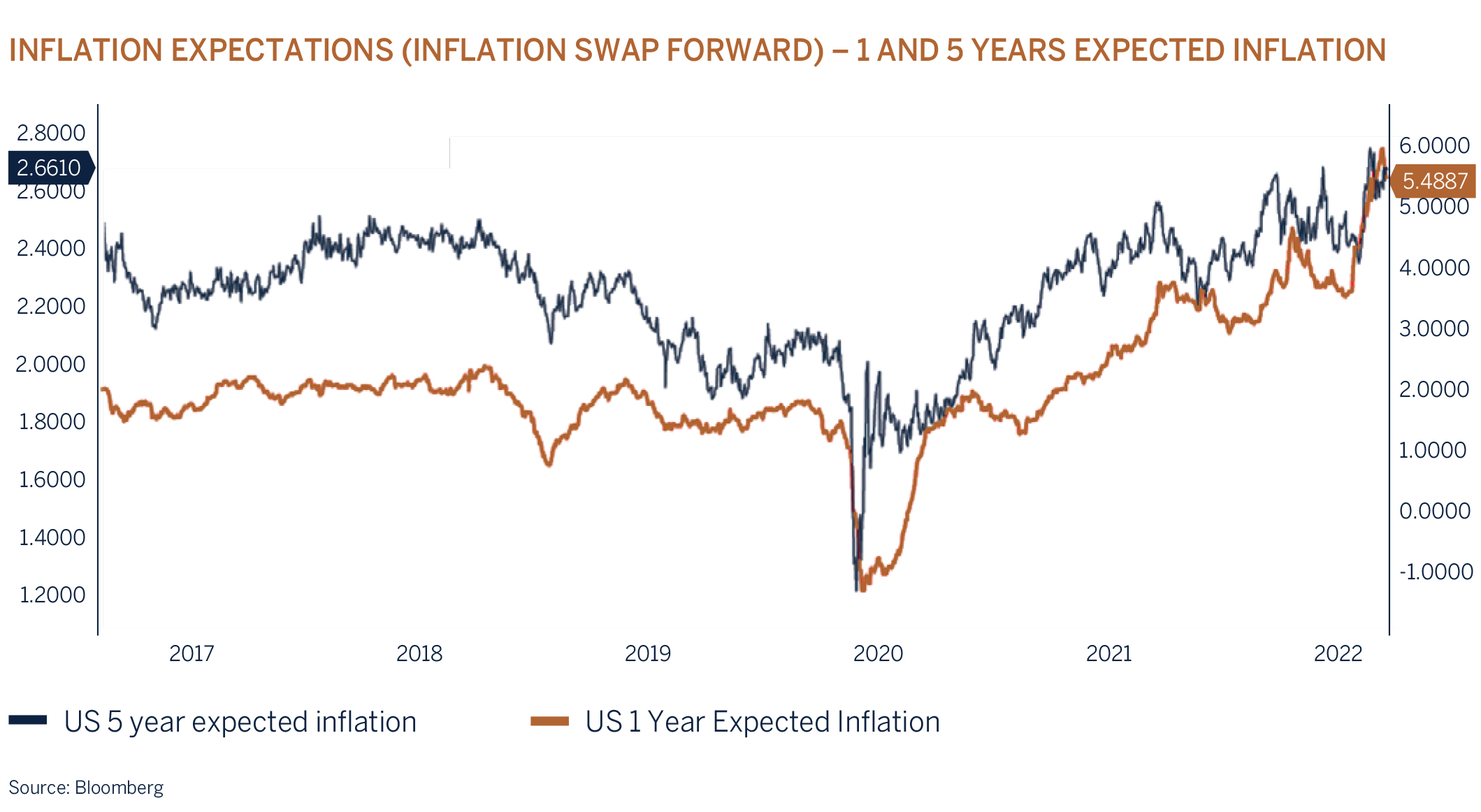

Understandably central banks have become markedly more hawkish and are raising interest rates to counter inflation. Inflation targeting (price stability) remains one of the key objectives for central banks as it is inflation that destroys wealth and real incomes. It is therefore vitally important for central banks to signal that they will do whatever it takes to ensure that high inflation is not sustained and to keep inflation expectations in check.

High and sustained inflation results in reduced disposable incomes, elevated interest rates, lower asset prices, and in turn decreased economic growth. As a result, both the US Federal Reserve and the Bank of England are guiding the market to sharper and quicker interest rate increases and at the same time quantitative tightening, which involves the shrinking of central banks’ balance sheets as they dispose of government and corporate bonds. Some of the effects of the withdrawal of easy monetary conditions are already evident in the US housing market where a significant (31%) increase in the cost of servicing mortgages has been a major contributor to moving the property affordability index back to levels last seen during 2007. In other words, a period of subpar growth might be required to contain inflation if it continues to overshoot.

Conclusion

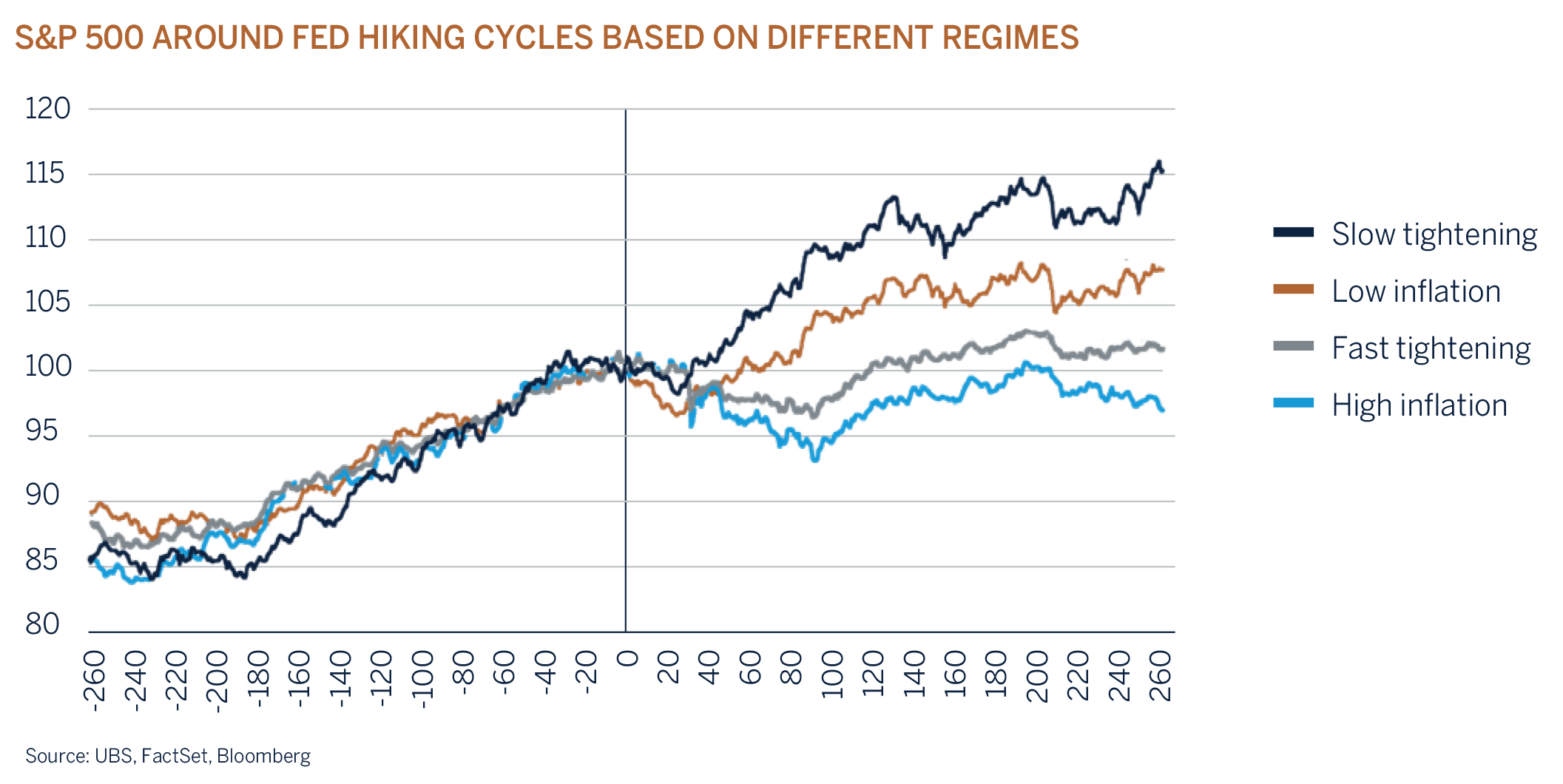

The pace of monetary tightening and the path for inflation will play an important role in determining returns from risk assets. If history is to be repeated investors should expect lower returns in the immediate future as valuations adjust to an environment of reduced liquidity and higher discount rates (used for valuing cash flows).

The expected growth resilience is very much dependant on households drawing down excess savings to offset the squeeze in after inflation disposable income and firms’ willingness to continue filling vacancies in the face of rising uncertainty. But while risks to slower growth are mounting and should be closely monitored, global manufacturing and services leading economic indicators remain robust and are consistent with above trend growth momentum as the effects from Omicron fade.

Investment Performance

It was a challenging quarter in both absolute and relative terms as client portfolios were impacted by the broad sell-off in both global equity and fixed income markets as investors reassessed valuations amidst a higher interest outlook, global growth uncertainties and a war in Europe. Our overweight allocation to risk assets (equities) and sector allocation (no energy) and style bias (quality growth) counted against the benchmark relative-performance. Portfolios remain populated with a blend of some of the world’s largest and best managed global companies, with minimal direct exposure to Russia or Ukraine. These companies are likely to emerge in an even stronger competitive position when the current disruptions abate.

Our long held defensive underweight and shorter dated fixed income positioning continued to add relative value for our fixed income and multi asset portfolios.

Asset Classes

| Equities | Overweight |

| Fixed Income | Maximum Underweight |

| Cash Plus | Overweight |

Asset Allocation

Although we remain fundamentally constructive on equities, allocations in portfolios have been right sized to reflect a more uncertain environment. The Melville Douglas tried and tested investment approach of investing in quality companies with strong balance sheets and unique offerings that ultimately drive growth and pricing power, alongside adequate diversification across asset classes will continue to safeguard portfolios as we navigate our way through a more challenging period for the global economy. With the rising interest rate cycle having just commenced it remains too early to increase the weighting to fixed income assets and therefore we maintain our maximum underweight positioning and are holding an overweight to cash/cash plus, awaiting a better entry point and opportunity to lock into higher yields. We stand ready to make changes to our positioning during these uncertain times.

Global Equity – Overweight

Global equity markets have de-rated considerably this year and are trading at levels not too different from their long-term averages; returns are expected to be positive for the remainder of the year. Even so, as interest rates increase and with them the discount rate (risk free rate) for long duration growth assets, valuations will remain under pressure and should de-rate further. Sustained high inflation poses an additional headwind to valuations. Earnings growth of 6%-8% over the next year is achievable and will be in line with long term averages, but operating cost pressures do pose a risk for lower profit margins in the future.

Strong underlying demand has allowed companies to pass on the costs and maintain gross margins, which has more than offset the increase in operating costs, but this will become more of a challenge for companies to overcome as growth reverts to trend over the next year or two. We have used the March rebound in equity markets as an opportunity to lower the exposure to global equities and will reduce risk in portfolios further should the medium-term outlook for economic growth and/or expected returns weaken materially and necessitate action. Allocations, where appropriate, to the MD Global Impact Fund have commenced as communicated in the year-end review.

Equities

| Consumer Discretionary | Overweight |

| Consumer Staples | Neutral |

| Energy | Underweight |

| Financials | Neutral |

| Healthcare | Overweight |

| Industrials | Neutral |

| Information Technology | Neutral |

| Materials | Neutral |

| Communications Services | Overweight |

| Utilities | Neutral |

| Real Estate | Underweight |

Fixed Income & Currency

| G7 Government | Underweight |

| Investment Grade - Supranational | Overweight |

| Investment Grade - Corporate | Overweight |

| High Yield | Overweight |

Global bonds sold off aggressively in the first quarter with the US Treasury market suffering declines of over 5% and US Investment Grade (IG) lower by 7.5%. The previously held view of central banks that inflation would be “transitory” was clearly far from the mark, with pressures from COVID-19 induced supply chain disruptions now magnified by a marked rise in energy and food costs following the Russian invasion of Ukraine in February. The US Fed commenced the tightening cycle in the quarter, sanctioning a 0.25% hike to 0.50% almost immediately after ending their quantitative easing program. This marks the beginning of a raft of rate rises this year, set to be one of the most aggressive tightening cycles since the mid-2000s. We can expect another five or six hikes before year-end with moves of 50 basis points at one or more meetings a distinct possibility. In addition, the Fed currently expects a further 100 basis points of tightening in 2023 although much can change between now and then.

The Fed’s dual mandate of full employment, which one could argue has been achieved with high vacancy rates helping to push the unemployment rate down to 3.9%, and an inflation target “averaging 2% over the cycle”, currently running at a headline rate of 7.9% (a forty-year high), is clearly an issue for the committee. The onset of the Eastern European war has provided more “fuel to the inflationary fire” and in response Jerome Powell and his committee have a tough job in balancing tighter monetary policy against a slowdown in economic growth. However, for now the underlying health of the US economy remains robust on a number of measures. The consumer remains healthy, but the effect of higher food and energy prices together with higher borrowing costs will no-doubt have an impact on disposable incomes, which in turn will lead to lower growth. Whilst growth will slow in the months ahead, we do not forecast a recession over the next twelve months as sufficient pillars of support remain in place to underpin growth at, or likely above, long-term averages.

Major ‘negative’ geo-political events would ordinarily favour government bonds for their ‘safe-haven’ status, but other than a brief and temporary retracement in yields when Russia first invaded, this has not stopped ten-year US Treasury yields from rising sharply to the current 2.35% level. Currently, it is expected that the long-term neutral/ terminal US interest rate will surpass 2.5% which should, by default, put yields on a path to 3% plus (barring the onset of a recession and rapid decline in inflation). In the UK, the Monetary Policy Committee (MPC) led the way in the global tightening cycle, raising interest rates for a third successive meeting in March, taking the Base Rate back to the pre-pandemic level of 0.75%. Similarly, toother economies, the central bank is struggling to contain inflationary pressures with headline inflation currently at 6.2% and expected to rise to over 8% in the coming months, a level not seen since 1982, leading to a squeeze on household incomes.

The government has responded with some fiscal support, including a reduction in fuel duty, however the measures are unlikely to be sufficient to support many consumers and the MPC is fully aware of the resultant implications for economic growth. The MPC has recently softened its rhetoric on tighter monetary policy, suggesting it may pause on further rate hikes after the next meeting in May as they try to finely balance lowering inflation whilst maintaining positive economic growth levels. Gilt yields have risen across the curve in the quarter, with the ten-year benchmark yield currently trading at 1.65%, a considerable move higher from the record low of just 0.08% in September 2020. However, with inflation now forecast to be higher for longer, yields at current levels, whilst offering better value, are still expensive in the context of the underlying dynamics in the economy, and looking ahead we expect them to continue to drift higher. In the Investment Grade (IG) and High Yield (HY) markets, credit spreads have widened over the quarter, although in line with the recent rally in risk assets, recently contracted to close the gap in March. Whilst maintaining a neutral to small overweight in IG bonds, we have been reluctant to increase exposure as rising ‘risk free’ rates are a headwind for this area of the market.

The majority of our exposure in the IG space is targeted at the shorter end of the maturity spectrum which has been comfortably outperforming the broader benchmark index year-to-date. The US dollar has gained a further 2.75% year-to-date and we have maintained an overweight position to the currency in global mandates. Rising interest rate expectations and reserve currency status continue to underpin the currency, particularly against lower yielding counterparts such as the Euro and Yen, and we expect the currency to remain supported in the short-term. Ultimately, economic growth and therefore interest rate expectations have to increase in the Eurozone and Japan before their respective currencies benefit; we continue to watch for early warning signs and will reduce the overweight exposure on such evidence.

Market Performance % / as at 31 March 2022

| EQUITIES | DECEMBER | Q4 | 2020 |

|---|---|---|---|

| Global | |||

| FTSE All World TR Net (Sterling) | 2.20% | 8.44% | 12.43% |

| FTSE All World TR Net (US Dollar) | 4.64% | 14.66% | 16.01$% |

| UK | |||

| FTSE All-Share TR | 3.86% | 12.62% | -9.82% |

| US | |||

| S&P 500 TR | 3.84% | 12.15% | 18.40% |

| Europe | |||

| Dow Jones Euro STOXX TR | 2.09% | 12.57% | 0.25% |

| FIXED INCOME | DECEMBER | Q4 | 2020 |

| Bloomberg Barclays Series - E UK Govt 1-10 Yr Bond Index | 0.53% | 0.16% | 3.17% |

| Bloomberg Barclays Series - E US Govt 1-10 Yr Bond Index | 0.03% | -0.23% | 5.49% |

| JP Morgan Global Government Bond (Sterling) | 1.17% | -3.29% | 6.29% |

| JP Morgan Global Government Bond (US Dollar) | 1.19% | 2.26%% | 9.68% |

| Iboxx Sterling Corporates Total Return Index | 1.68% | 3.96% | 8.63% |

| Iboxx US Dollar Corporates Total Return Index | 0.47% | 2.89% | 9.62% |

| CURRENCY vs. STERLING | DECEMBER | Q4 | 2020 |

| US Dollar | -2.20% | 2.68% | -2.84% |

| Euro | -0.03% | 7.32% | 5.78% |

| Yen | -1.25% | -3.39% | 2.15% |

| CURRENCY vs. US DOLLAR | DECEMBER | Q4 | 2020 |

| Rand | 2.27% | 4.29% | 8.87% |

| Euro | 0.97% | 2.15% | 5.13% |

Source: FTSE International Limited (“FTSE”) © FTSE 2013. “FTSE®” is a trade mark of the London Stock Exchange Group companies and is used by FTSE International Limited under licence. All rights in the FTSE indices and / or FTSE ratings vest in FTSE and / or its licensors. Neither FTSE nor its licensors accept any liability for any errors or omissions in the FTSE indices and / or FTSE ratings or underlying data. No further distribution of FTSE Data is permitted without FTSE’s express written consent.