Hopes of economic soft landings increase as inflation ebbs

Financial markets bounced back extremely strongly during the final quarter resulting in favourable returns for the year as a whole, despite the initial concerns of a potential hard landing in the first quarter. Global equities were one of the best performing asset classes during 2023 returning 22% in USD terms, an astonishing result given the fragile geopolitical and macro-economic backdrop the world found itself in.

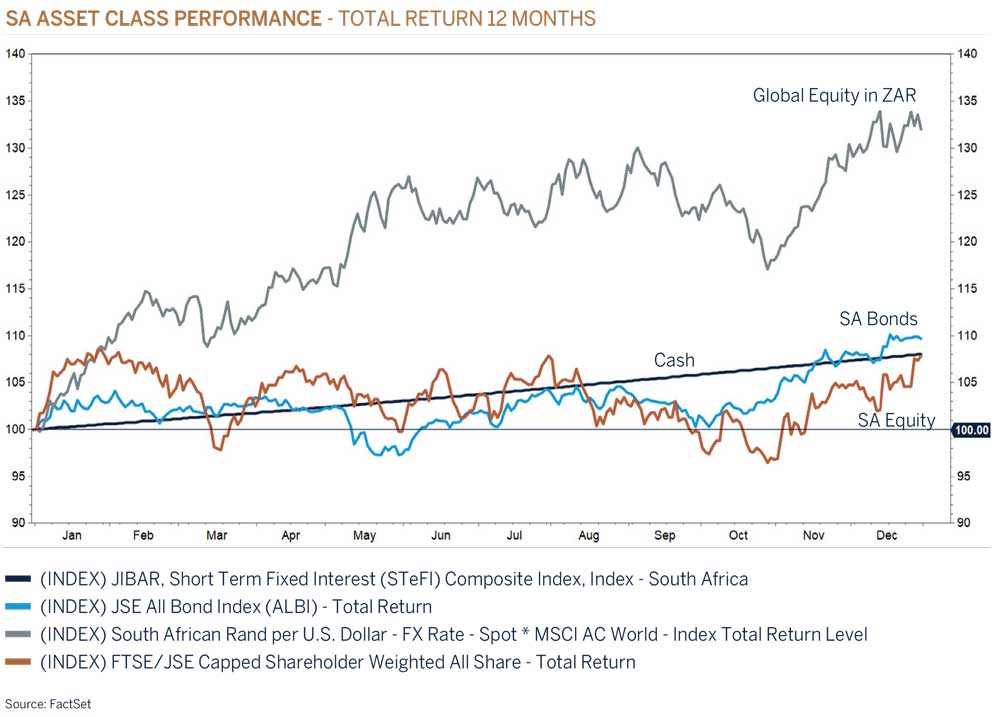

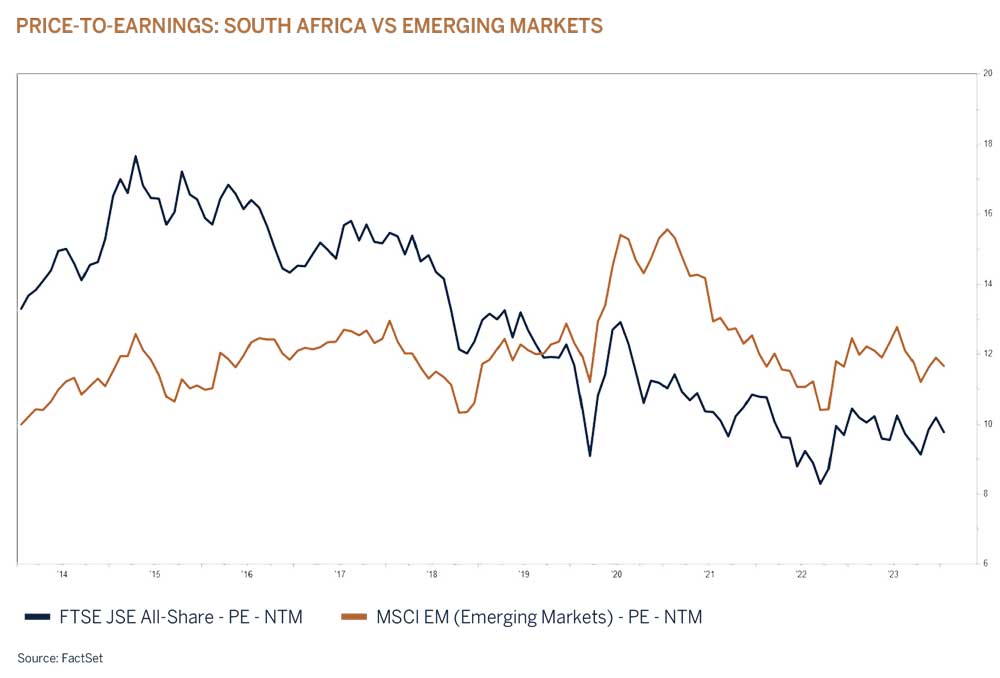

While the South African Equity market benefited from improved risk appetite towards the end of the year, government bonds once again outperformed the local bourse as Resources sold off sharply on growth concerns out of China. The SA Equity market was one of the worst performing regions and significantly underperformed the MSCI Emerging Market Equity Index which lagged Developed Markets by more than 10% over the past twelve months.

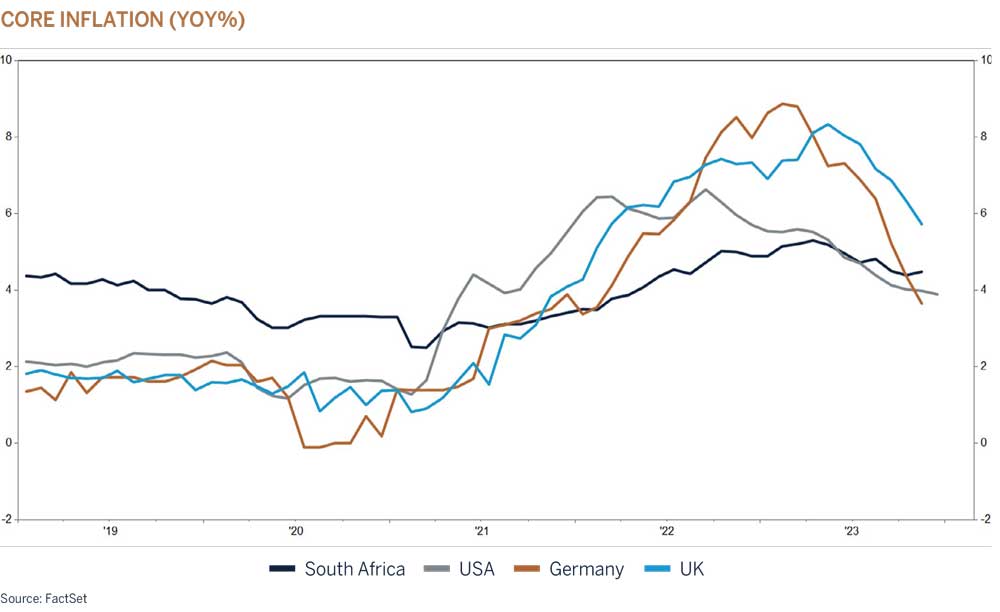

The key driver behind the recent positive movement in asset prices is the belief that economic soft landings are increasingly possible now that the US Federal Reserve (Fed) and other central banks, including the South African Reserve Bank, look set to lower interest rates to a more accommodative stance earlier than previously forecast, as inflation data and trends across the developed economies surprise to the downside.

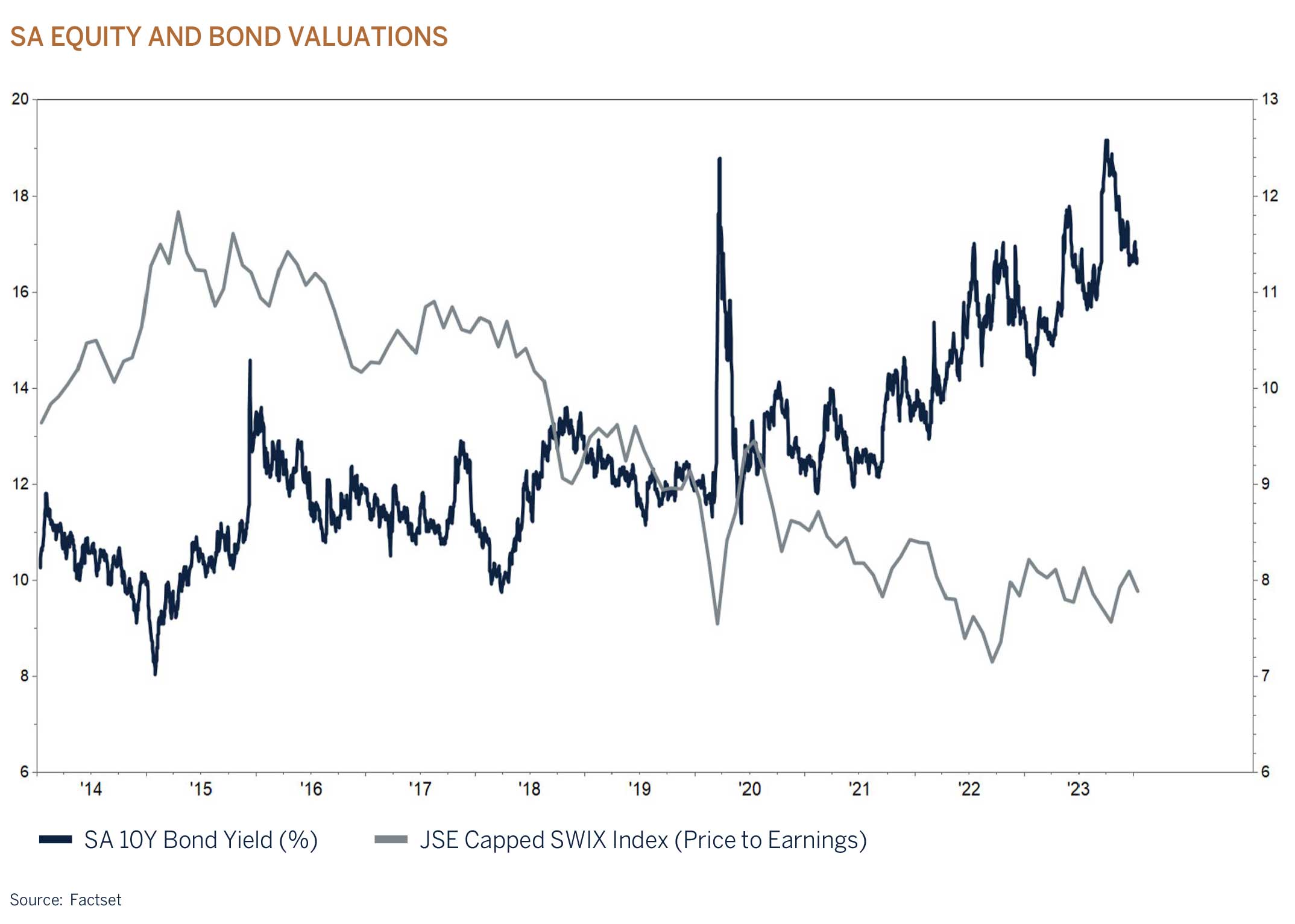

Asset prices are now pricing in significantly lower interest rates over the next two years on the back of these softer than expected inflation prints, as energy and food prices have cooled off from their zenith in 2022. Bond prices climbed and yields declined sharply as investors scrambled to lock into high income yields which in turn supported equity valuations - a timely reminder that “Interest rates are to asset prices what gravity is to the apple” – Warren Buffet.

Whether the strong performance from equity markets in developed economies can continue remains to be seen, with the lagged effects from tighter financial and credit conditions still to play out, while at the same time valuations (margin of safety) have become less supportive and earnings growth expectations appear to be on the optimistic side. Nevertheless, the more accommodative stance from central banks, combined with the bottoming in the corporate earnings cycle, will go a long way in reducing the tail risk of a potential hard landing and/or a dislocation in global financial markets as economic growth moderates globally.

International Equity markets are discounting a good outcome and seem slightly complacent despite the tail risks

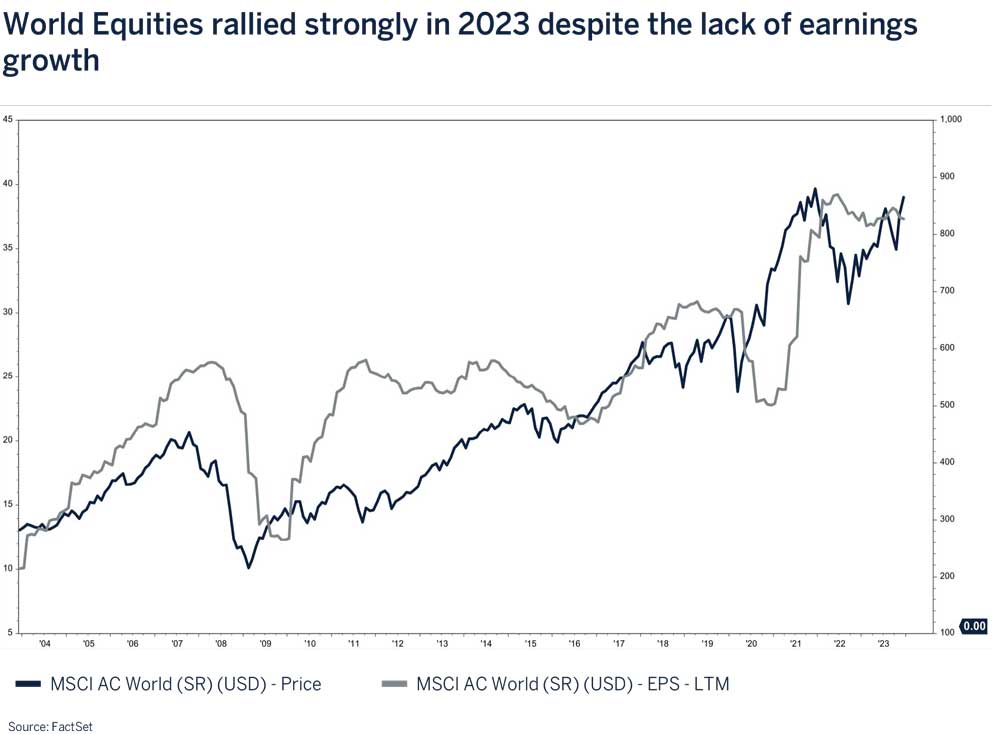

International equity markets delivered very strong performance during 2023, initially spurred on by the re-opening of China’s economy, but mainly driven by a handful of tech stocks (‘Magnificent 7’) that rallied largely thanks to their exposure to Artificial Intelligence (AI), before broadening out towards the end of the year as interest rate expectations were lowered. Returns were not necessarily driven by strong growth in underlying earnings, but rather an expansion in valuation multiples as investment sentiment turned from despair to hope.

We will be the first to admit that a strong equity market was not our base case as we entered 2023 in the midst of one of the most restrictive interest rate hiking cycles in history. There were several factors that contributed to a more resilient economic environment and provided a supportive backdrop for risk assets, offsetting some of the effects from higher interest rates. However, many of these positive contributors are expected to fade in the coming year and, as such, we would not expect the strong momentum to persist.

Consumer spending has been supported by buoyant jobs/labour markets and excess savings that came about from government support packages during COVID-19, however most of those savings have now been spent. In addition, fiscal support packages announced during the year were significantly larger than expected, and the regional banking crisis in the US resulted in a material injection of liquidity by authorities in their efforts to support the banking sector, its investors, and depositors. This fiscal spend has increased the US government’s budget deficit which has largely been dismissed by markets although the rating agency Fitch recently downgraded the US sovereign credit rating to AA-.

This greater indebtedness is of concern if it is not brought under control as it will likely result in investors requiring a greater margin of safety before committing further funds to US assets. We have previously written about the narrowness in offshore equity returns during 2023. Outside of the strong performance from a small number of large cap information technology (AI beneficiaries), luxury and weight-loss stocks, returns from the broader equity market has been much more moderate and not that different from cash yields, not surprising given that corporate earnings for the year were largely unchanged from 2022. While the medium-term outlook has improved and the probability of a recession has receded on the back of lower interest rate expectations and more favourable financial conditions, we believe that much of the good news has already been discounted in valuations and investors will have to be more selective in their approach for 2024.

We do however acknowledge that the direction of travel for this asset class has become more positive and we will be cautiously increasing our exposure in global equities to Neutral across multi asset portfolios.

An improving macro-outlook in 2024 may prove favourable for South African assets given the base effects and attractive valuations relative to global peers

2023 was a test of resilience, as it was yet another tough and turbulent year for all facets of the country’s economy. South African households and companies had to endure many challenges once again, most notably the pain inflicted by higher interest rates. If it wasn’t the Lady R event which triggered significant Rand weakness or a deteriorating fiscal balance on the back of a struggling economy and declining commodity prices, loadshedding reached new highs.

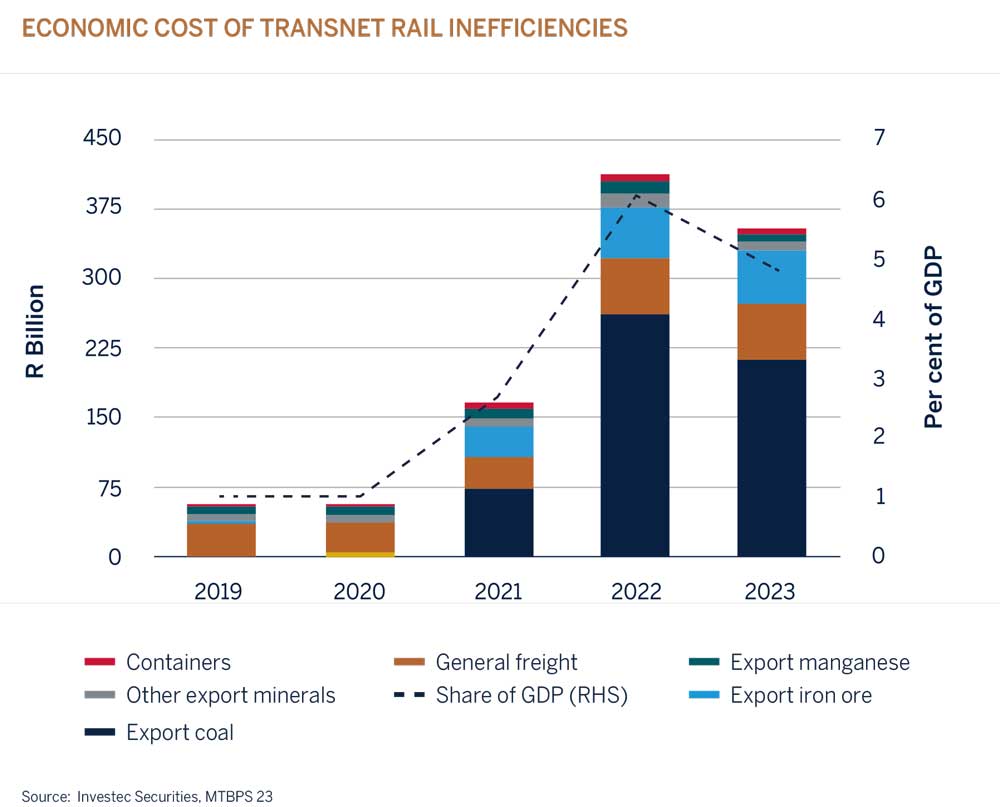

To add fuel to the fire, the country’s logistical infrastructure collapsed as Transnet’s rail network and goods/container handling at the major ports “operated” in complete disarray as depicted below. These own goals cost the economy billions in lost revenue and production, leading to continued investment outflows with investor confidence falling by the wayside.

In addition, Emerging Markets and SA have been starved of foreign capital during the past year. This has been attributed to higher US interest rates, weak commodity prices, disappointing growth out of China relative to expectations and reduced risk appetite which has consequently resulted in Rand weakness. Meanwhile deteriorating terms of trade from weaker export commodity prices, a trade deficit due to delayed exports and large outflows from institutional fund managers to increase their offshore holdings on the back of the change in regulation, further impacted the vulnerability of the Rand and the underperformance of South African assets during 2023.

Many of the above drivers may well improve this year, which could trigger the long-awaited value unlock in domestic assets, which appear cheap across most metrics. Using the Buffett indicator (stock market capitalisation/GDP), SA screens cheap as it sits at 81% vs 181% for the US.

Operating in South Africa has never been plain sailing, but the direction of change in the form of interest rates may be on the horizon. This positive impulse should provide a helping hand to the country’s growth outlook and the perceived riskiness of our assets relative to Emerging Markets. With regards to idiosyncratic risks within our SOE’s, it remains a “show me” story and hopefully this election year will bring forward meaningful reform that will help make up for lost time.

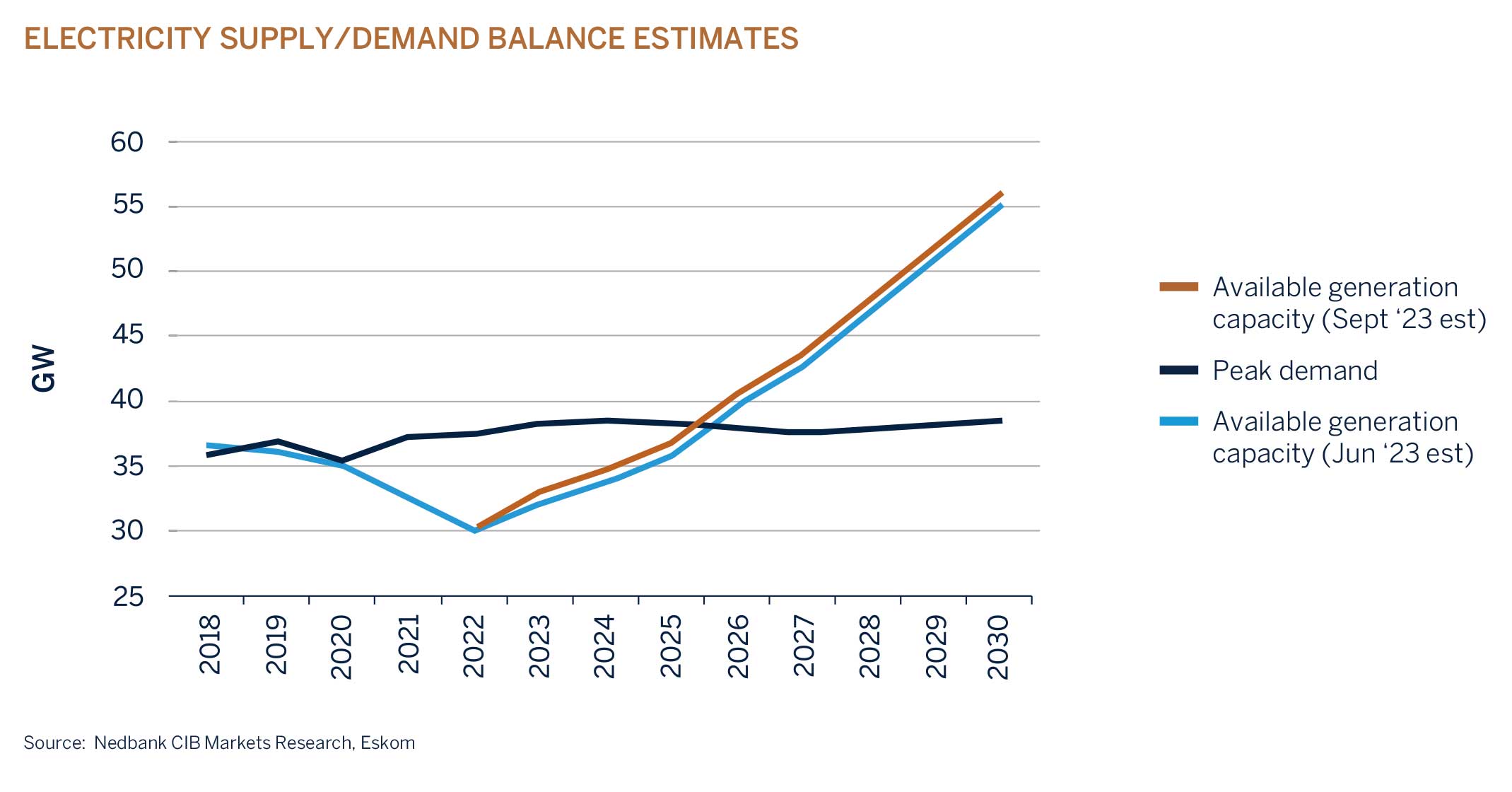

Over and above the potential change in global financial market dynamics which bode well for Emerging Markets (South Africa included), evidence of tangible progress (governance and operational) albeit painstakingly slow, at Eskom and Transnet will support the domestic economy. The government has recently established the National Logistics Committee to improve operational performance at Transnet. There have been interventions, which include rehabilitating the rail network to improve service delivery by reforming the local supply chain, deploying digital solutions to enhance efficiencies and responsiveness, improving security, and reviewing cost allocations to boost returns. Despite these positive changes, it is imperative that the private sector is invited and encouraged to meaningfully participate in progressing the management and daily operations of the country’s infrastructure and logistics. Transnet has shown that individually it will not be able to develop crucial transport infrastructure fast enough to support the economy. While significant investment is required to improve Transnet’s port infrastructure and service delivery, their January announcement was encouraging as it highlighted that significant headway had been made in reducing the vessel backlog at the Port of Durban. The State-Owned Entity mentioned that this has been achieved through improved operational management - “since the beginning of December, employees have been scheduled to work through long weekends with 100% attendance to date and through the new year across all the terminals”. While much work and capital will be required to elevate the efficiencies at the ports and ensure that SA can once again compete with the rest of the world, the update from Transnet does signal that with improved leadership, management, focus and dedication, productivity is set to improve from its very low base. This will be a welcome relief for many companies with commodity driven revenue streams, as well as for the broader domestic economy. Eskom’s investments in renewable energy and the redeployment of some of its large, damaged power generation units may result in an improved electricity backdrop, hopefully helping SA experience sustainably lower loadshedding levels. Execution, financing, and grid capacity constraints remain the largest stumbling blocks which magnifies the urgency to unbundle Eskom into three separate units, namely transmission, generation, and distribution for improved operational efficiency and access to financing.

Many companies and households’ hands have been forced into being proactive and adaptive by investing large amounts into renewable energy to combat the energy crisis facing the country. The point being is that this cost has been incurred and, is now in the base, meaning that companies are better equipped and have become less reliant on Eskom to do business. A sea change from a year earlier when the economy was literally brought to a standstill, brings reason to be more optimistic for the year ahead.

Conclusion

Central banks now look set on a path of lowering interest rates commencing in the first half of this year as long as price pressures do not reignite. It is perhaps still far too early to hear the death knell bells of inflation, but there is no doubt that central banks have exceeded expectations by raising interest rates significantly without triggering a global recession or a meaningful impact on employment. Markets tend to overemphasise monetary policy expectations when they change direction, and this time has been no different, with a significant rally in global asset prices towards the end of last year. We view the very recent rally in bond and equity markets as excessive as inflation is not yet at target levels whilst the last leg of lowering core inflation is not likely to be without its challenges, particularly with consumer demand remaining resilient due to favourable employment markets.

The excess savings and the benefits of the widespread refinancing, both at the corporate and personal levels, that took place in the aftermath of the pandemic are no longer an economic tailwind in developed economies and we expect much more subdued growth in the year ahead. However, the very real wealth effect from higher asset prices and a solid jobs market provides a cushion against a material slowdown. This is in addition to central banks, which have now amassed anti-recession armouries by way of higher interest rates that can and will be cut if necessary.

South Africa’s economic fortunes are very much dependent on the successful implementation of structural growth reforms and developments in the global economy and geopolitical environment. Over the short term, South Africa’s economic outlook appears subdued, as it continues to grapple with a considerable number of headwinds ranging from a lack of service delivery, infrastructure constraints and loadshedding (albeit at lower levels).

An oversold currency clearly reflects SA’s idiosyncratic risks, political risks and a deteriorating fiscal outlook. Interest rates in South Africa have peaked and will provide support to an economy that is suffering from a confidence crisis. Favourable base effects will however result in improved growth for the year ahead. China, one of SA’s major trading partners, appears to be on the mend from an economic perspective after a disappointing recovery in the aftermath of the COVID-19 pandemic, and Eskom and Transnet’s turnaround plans are expected to gather pace, albeit from a low base. As a result, we expect earnings growth for companies listed on the domestic bourse to turn positive after a disappointing performance last year.

An improvement in earnings momentum and favourable valuations coupled with lower interest rates globally and perhaps a weaker US dollar should be supportive for SA assets. We are cognisant that the period leading up to the general elections may cause some volatility, but volatility presents investment opportunities which we will be closely monitoring. We remain cautiously optimistic about the market environment and believe that 2024, an election year for a huge portion of the democratic world, will be a positive year. While uncertainties persist, our ongoing commitment to thorough research, disciplined execution, and continuous monitoring will contribute to the sustained success of our investment portfolios.

Asset classes

| Domestic Equity | Neutral |

| Global Equity | Neutral |

| Domestic Fixed Income | Overweight |

| Global Fixed Income | Neutral |

| Domestic Cash | Underweight |

Post the recent changes to Regulation 28 around asset allocation limits (in particular the increase of offshore assets to 45%) and our access to a much larger investment universe and opportunity set globally, we are in the process of widening the range of our allocation to offshore assets within South African portfolios. Please view the below asset allocation in this context, while we transition portfolios to align to the new asset allocation ranges as and when we see value.

Asset allocation

Domestic Equity - Neutral

2023 has been a challenging year for many domestic-facing companies and for the South African listed bourse. The re-opening in China and an improved outlook in Europe bolstered SA assets at the beginning of the year but the slower than expected Chinese rebound (that reduced the demand for commodities) impacted an already challenged domestic macro environment. The Lady R event also triggered significant Rand weakness. The JSE Capped Swix Index ended the year up +7.9% (and an uninspiring +0.4% in USD terms), supported by a strong performance from the Financial sector +22% with insurance counters and banks continuing to show relative strength in the market. The Resource sector was a drag on the local bourse and generated a negative return of -12% as metal prices eased and loadshedding curtailed production.

Domestic-facing companies were confronted with several challenges and higher costs associated with the electricity crisis, poor infrastructure and service delivery, as well as inflated interest rates. The Resource sector faces the headwind of lower metal prices, while loadshedding and high interest rates remain problematic for consumerfacing stocks. Earnings have been consistently revised lower during the year and for 2023 EPS is expected to be down 11%. That said, we believe that much of the negative news is already discounted by share prices, even after adjusting for a higher cost of equity. Favourable base effects are expected to support earnings growth this year and we estimate EPS growth in excess of 10%. Dividends are attractive and should underpin valuations over the medium term. Sectors such as banks will continue to benefit from the endowment effect caused by higher interest rates and the strong underlying credit demand from corporates that are investing in renewable energy projects. Although not necessarily our base case, many industrial companies are well positioned to benefit from the expected infrastructure upgrading spend associated with water, railway lines, ports and electricity. We are monitoring these facets of the economy closely for new investment opportunities. In addition, we believe that interest rates have peaked and will support valuations as investors position themselves for an improvement in the outlook for South Africa’s economy and corporate earnings growth.

A lack of structural reforms and government’s inability to implement change have been costly to South Africa and this needs to be addressed in order to unlock value. Despite this, we remain firm in our belief that valuations for the domestic equity market remain attractive.

Our strategy remains to be invested in high-quality businesses with strong balance sheets and robust cash flow streams. With valuations at multi-year lows, we intend to stay the course by patiently staying at weight in the asset class while receiving attractive dividend cash flows that reduce the effects of inflation in the meantime.

Global Equity – Neutral

The medium-term outlook for global growth has incrementally improved and a US soft landing appears more likely. Interest rates have peaked and the expected interest rate easing cycle has been pulled forward, after one of the most aggressive interest rate hiking cycles in history. At the same time financial conditions have eased materially over the past few months as credit spreads have narrowed and bond yields declined. A favourable backdrop for global equities, especially given that corporate earnings have bottomed.

While we have increased the recommended weight in multi-asset portfolios to a more balanced neutral position to take advantage from a change in the interest rate and growth outlook, we are reluctant to add aggressively to the exposure in the near term given that certain headwinds persist.

We believe that risks to the corporate earnings outlook are tilted to the downside for several reasons. Consensus forecasts expect top line growth to accelerate after a period of disappointing growth in 2023 while profit margins (excluding Financials) are expected to continue to expand from record high levels. However, weakening pricing is likely to be a constraint on earnings growth as we enter 2024. Since 2020, considerably higher levels of inflation allowed companies to pass through higher costs to the end consumer during a period of strong underlying consumer demand bolstered by loose monetary and fiscal policies. Inflation has since moderated materially as supply chains normalised and productivity improved. Economic growth has also slowed and will most likely result in weaker corporate sales growth than what is currently discounted. At the same time labour costs are likely to be sticky on their way down and rising interest/funding costs will become a headwind for companies as they refinance outstanding debt.

With global and US GDP growth expected to moderate further this year, it is worth considering the fact that corporate profit margins have historically always declined when the US economy grows at a rate of less than 2%, which is currently the base case.

While several factors could result in the outcome being different this time, the odds are firmly stacked to the downside, at least in the near term. Equity valuations are at best fairly priced and short-term sentiment appears to be overly optimistic; a very different environment compared to a year ago, and one of the main reasons why we will cautiously be adding to the asset class when investment opportunities arise.

Domestic Fixed Income - Overweight

Despite government’s fiscal challenges, South African government bonds yields have declined significantly towards the end of 2023. This is in line with developments in global fixed income markets where prices have adjusted to lower inflation and interest rate expectations. Although execution risks remain and tax revenue is trending lower as the economy slows and capital flight transpires, the government remains committed to prudent fiscal management.

We believe that inflation and interest rates have peaked, but do not anticipate lower interest rates until the second quarter of the year. Furthermore, we expect a gradual decline in interest rates until the Reserve Bank is comfortable that inflation and inflation expectations are comfortably within its 3-6% target band. Given attractive starting income yields in both nominal and inflation adjusted terms, we would expect returns to be well above cash over the medium term as interest rates decline, hence our constructive position to the asset class.

Global Fixed Income – Neutral

Global bond markets staged an impressive rally in the final quarter of 2023 driven by optimism that the Fed, along with other major developed world central banks, have not only reached the end of their respective tightening cycles but will begin cutting rates in 2024.

Looking to the year ahead, we have our reservations that the strong performance of the fourth quarter will be sustained at a similar pace. We are positive on the outlook for fixed income markets over the medium term, however this is predominantly due to bonds offering more attractive starting yields rather than expecting sharp price rises (falls in yields). Bond markets are barometers, pricing today for tomorrows outcomes (monetary policy, inflation, growth etc.), and whilst not always accurate, we are reminded that the strong performance in the last quarter has ‘priced in’ much of the potential monetary easing in the year ahead. However, we are also cognisant that yields at current levels clearly appear attractive when compared to recent years and the prospect of global monetary easing in 2024 should, by default, prompt flows out of cash and into fixed income. This could potentially push yields lower than our current forecasts, but a return to ten-year yields (in the US and UK) of 2% appears both optimistic and a long way off.

Domestic Cash – Underweight

We favour long duration fixed income assets at present.