Quarterly Commentary: Q4 2020

View PDF versionThe End Of A Challenging Year

by Bernard Drotschie / Chief Investment Officer

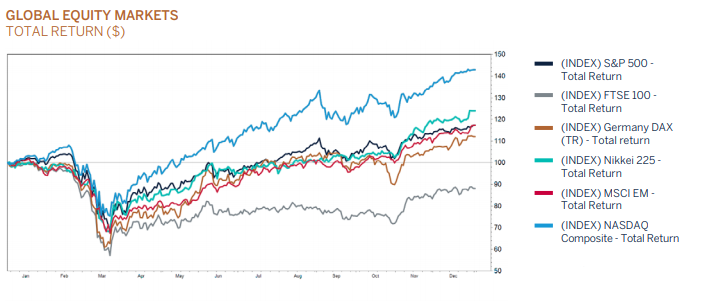

It is often said that ‘fact is stranger than fiction’ and indeed it is difficult to fully comprehend some of the events of 2020. The initial reaction to the pandemic, which has sadly claimed over 1.85 million lives so far, was for risk assets to drop sharply, with global equity markets falling some -35%, but the bear market proved to be the shortest in history and the ensuing global economic recession also proved to be extremely short-lived. We saw futures prices for oil contracts fall to an astonishing negative -$37.63 in April highlighting the extreme volatility and stress experienced in global assets in the earlier part of the year, which have since eased and allowed global equity markets to finish higher as a result of the truly colossal central bank and government monetary and fiscal stimulus together with hopes of a return to some sort of normality during the year ahead due to the roll out of effective vaccines.

The year also delivered a very divisive US election and a long-awaited Brexit deal, but for many 2020 will be considered a very challenging year that they might wish to forget. Attention now turns to what may unfold in 2021. As we remain in the middle of a global pandemic which continues to have the ability to materially change the direction of travel in each and every asset class, dealing with COVID-19 via a successful vaccination program clearly remains the determining factor for how 2021 will turn out both economically and socially. The simple truth is that we do not know exactly when this awful saga will run its course but we do know that it is transitory in nature and some of the best medical minds on the planet have worked tirelessly to get us closer to the light at the end of the tunnel with the development of vaccines that have surprisingly high efficacy rates.

Melville Douglas’ debates on market forecasting usually centre around global growth conditions, the generosity of central banks, interest rate forecasts and company earnings, and whilst all of these of course remain highly relevant, there is no doubt that these key factors remain hostage to the success of the worldwide vaccination program. We are optimistic on this front and as such increased risk during the final months of 2020 and are positioned overweight equity within client portfolios as we enter 2021. It would be remiss not to expect some road bumps along the way with regards to the implementation of successful vaccine distribution strategies, which hopefully will not only be deployed swiftly but also in the fairest way possible, not just to those with the deepest pockets. Maybe one positive side effect of this terrible episode will be that it brings nations, families and individuals closer together in a common humanitarian goal.

In the following paragraphs we attempt to briefly summarise our thoughts on some of the key factors and markets in the year ahead:

Global Economic Growth Outlook

We are likely to continue to experience an economic rollercoaster as the revolving door of COVID-19 led lockdowns perseveres well into 2021. Much output has been lost and whilst it will be recouped in time, do not expect it to be immediate. Government and central bank support measures have been lifelines but nevertheless, the post[1]pandemic world will be one with many industries, businesses and individuals struggling. It is both expected and paramount therefore that stimulus measures and ultra-easy monetary conditions remain in situ for some-time to come; policymakers were too quick to enact tightening headwinds in the aftermath of the Global Financial Crisis and they are unlikely to make that mistake again. So ‘easy’ conditions look set to be with us for a while – at least until it becomes very clear economies can withstand diminishing stimulus - and that monetary and fiscal support will be an important tailwind for growth conditions in the quarters ahead whilst vaccines are being distributed. The side effect of this of course is worsening government deficits – but that is likely to be a story for another year. Most economies experienced deep ‘services led’ recessions in 2020 as lockdown measures were enforced and whilst much of this lost output will not return, it is natural to assume that when they re-open (at or near full capacity) consumers, with pent up demand, will spend – in fact, we already have evidence of this with the robust economic activity evident in the third quarter of 2020. However, growth doesn’t have to be robust, indeed it wasn’t before the pandemic, it just needs to be travelling broadly in the right direction and at a pace strong enough to chip away at the economic wounds of COVID-19. Boom economic times may be reserved for the history books in favour of ‘new norm’ growth levels and without doubt hurdles remain (protectionism, de-globalisation, trade disputes etc.), but support measures remain overwhelming and therefore we are optimistic that global economic growth will once again prevail in 2021, although it is likely to be patchy and uneven as many industries and economies will remain suppressed due to ongoing COVID-19 disruptions.

World Economic Outlook

| PROJECTIONS | DIFFERENCE FROM JUNE 2020 WEO UPDATE | DIFFERENCE FROM APRIL 2020 WEO | |||||

|---|---|---|---|---|---|---|---|

| 2019 | 2020 | 2021 | 2020 | 2021 | 2020 | 2021 | |

| WORLD OUTPUT | 2.4 | -4.7 | 4.8 | 1.4 | -0.5 | -0.5 | -0.6 |

| aDVANCED ECONOMIES | 1.7 | -5.8 | 3.8 | 2.3 | -1.0 | 0.4 | -0.7 |

| eMERGING MARKET AND DEVEOLPING ECONOMIES | 3.6 | -3.0 | 6.2 | -.1 | 0.1 | -1.7 | -0.6 |

| Emerging and Developing Asia | 5.7 | -0.7 | 8.0 | -0.4 | 0.4 | -1.7 | -0.6 |

| Emerging and Developing Europe | 2.1 | -4.5 | 3.8 | 1.3 | -0.5 | 0.7 | -0.3 |

| Latin America and the Caribbean | -0.5 | -8.1 | 3.6 | 1.3 | -0.1 | -2.8 | 0.2 |

| Middle East and Central Asia | 1.0 | -5.7 | 3.2 | 0.3 | -0.4 | -2.1 | -1.1 |

| Sub-Saharan Africa | 2.8 | -3.5 | 3.1 | 0.2 | -0.3 | -1.5 | -0.9 |

| Memorandum | |||||||

| Low-Income Developing Countries | 5.1 | -1.4 | 4.7 | -0.1 | -0.3 | -1.6 | -0.7 |

Source: IMF staff estimates. Note: The aggregate growth rates are calculated as a weighted average, where a moving average of nominal GDP in US dollars for the preceding three years is used as the weight, WEO = World economic Outlook. 1 Difference based on rounded figures for the current, June 2020 WEO Update, and April 2020 WEO forecasts.

Bond Markets

When assessing bond markets, it is important to make the distinction between government (safest) and corporate/high yield (riskier). As their opposing risk characteristics suggest, one should be cheap, the other shouldn’t, but in the current abnormal environment that isn’t the case – they both appear expensive. The reason for this is fairly simple; risk free interest rates are as good as zero or indeed increasingly turning negative and if central banks keep manipulating yields lower surely that’s an almost riskless trade investors want to be part of? Well, the answer was a firm yes in 2020 but looking forward we have our reservations concerning the sustainability of both government yields and corporate credit spreads to remain at such low and outright expensive levels. It would be fair to say we are more concerned with the very low level of perceived safe-haven government yields than we are with narrow corporate spreads, although even the latter now seems somewhat out of sync with economic reality. Central banks have become the biggest buyers of their own bonds, by far, thanks to quantitative easing and this has been a key factor in driving yields to abnormally low levels.

The result is that we now have many bond markets trading as pure ‘capital’ plays with little, and quite often negative, yield protection. Consequently, the smallest move in yields can equate to large capital swings and the danger here is that it has (almost) been a one-way street in recent years and the onset of the pandemic has only served to drive yields even lower. Sure, in a low growth and inflation environment this can continue for a while longer, but if either surprise on the upside there could be a rush for the exit door. Investment grade and high yield corporate debt is perhaps a little easier to understand as the ongoing global ‘search for yield’ has found itself with increasingly fewer places to look and these markets tap into that desire. However, participation in crowded trades can often blind investors to the fundamentals and therefore one should never forget to ask ‘am I being paid for the risk?’. We don’t believe corporate bond markets are yet pushing the risk/return boundaries but there is no doubt that the asset class is on the expensive side and as such dissuading us from aggressively adding to current weightings.

Brexit – Historic Trade Agreement Signed

Since the United Kingdom (UK) formally left the European Union (EU) on 31 January 2020, investors have long been focused on the state of negotiations over a new trading arrangement to follow the transition period that ended on 31 December 2020. Typically, and with just a week left the parties finally agreed a deal which has been politically ‘spun’ to impose the impression of a ‘win-win’ situation for both sides.

The final major sticking point in the agreement was EU fishing boat access to UK waters given the political sensitivities for the UK and EU coastal states including France, Belgium and the Netherlands. However, economic pragmatism has won the day with the fishing industry valued at $730m, or less than 1% of annual trade between the nations. It seems without full disclosure (yet) that a transition period stretching to five years along with an agreed EU catch reduction has been enough to achieve acceptance. The other tough issue that has been overcome was the EU demanding that the UK ensures fair competition in future by not slashing its state-aid, labour or environmental rules, but the finer points on this and how to ‘police’ such issues is included somewhere within the full 2000 plus page trade document! However, in some quarters there will be disappointment that there is nothing in the agreement about UK financial services which remains to be agreed and is hugely important to the UK economy and its future.

Undoubtedly, a trade agreement is very good news for the broad world economy. It comes at a time when new strains of the COVID-19 virus may impact the effectiveness of worldwide mass vaccinations later this year along with the prospective 2021 global economic recovery. It is a key comfort for those businesses that contribute to the annual $900bn EU/UK trade as well as satisfying Joe Biden, the incoming US President, who is looking to his European allies to increase political cooperation in his quest to deal more effectively with perceived Chinese ‘threats’.

Financial markets have proved an accurate discounter of events as shown by the recent recovery in Sterling against the US dollar and to a lesser extent that of the Euro. Quite noticeably, the UK stock market has been a weak relative performer against other major bourses as overseas investors have shied away from UK exposure given the underlying difficulties that will arise as a result of a post Brexit economy. Nonetheless, with an agreement now signed, it may signal a moderate resurgence of overseas interest in the UK and Sterling which could provide some economic crumbs of comfort for Boris Johnson and his government. Domestically, UK companies will breathe a big sigh of relief that they can continue to trade with ‘zero-tariff’, ‘zero quota’ access to EU markets. The supply chains appear now to be safe so that business can conduct activities without the hindrance or inertia that Brexit has produced. Domestically orientated companies have recently fared well in share price terms with UK Banks, some Retail and Housebuilders all capturing extra investor attention. Elsewhere, our preferred multi-national companies have proved quiet given the dampening translation impact of a recovering pound, though historically these periods have proved short lived.

US Election

It is now official - Joe Biden will be inaugurated as the 46th president of the United States on January the 20th with the Democrats controlling both the White House and Congress for the first time since the first half of President Obama’s first term. This will open the door for additional fiscal stimulus and provide an underpin to the growth outlook in the US. President Trump’s desperate attempt to upset the voting process turned out in absolute mayhem in Washington DC as some of his most staunch supporters stormed and broke into the Capitol building - indeed a very unfortunate event that will surely one day be recorded in the history journals.

In Biden’s latest speech, he said it’s “time to turn the page” after his election victory was confirmed. A clear affirmation that despite the domestic political turmoil and divisions inside the US, Biden is first and foremost a pragmatist. After 48 years in government, since he was first elected to the US Senate for the state of Delaware, his campaign and administration will expectedly focus on themes of unification, bipartisanship and his ability to collaborate with moderate Republicans; moderates form most of the Republican representation in the Senate.

Biden is expected to focus on key legislation, such as infrastructure, environment, green energy, and improvements to the Affordable Healthcare Act (Obamacare).

What we as investors will concentrate our minds upon is the Biden initiative to rejoin the Paris Climate Agreement, thus committing to cut US greenhouse gases by up to 25% by 2025. This is highly positive for investment and companies embracing environmental, social and governance initiatives so our Melville Douglas philosophy of allocating only to companies that can display strong corporate and social disciplines look well positioned. Additionally, appointing Pete Buttigieg to transport secretary is a clear indication of the want for a sweeping infrastructure bill that will increase the potential for cyclical companies to progress as the 2021 economic recovery takes hold. Biden’s values of multilateralism and engagement on the world’s stage has not changed so a reversal of Trump’s isolationist view is very much on the cards. Reaching out to NATO allies to repair divisions will allow the formation of international coalitions centered around democracy to fight China’s trade practices, instead of the current combative unilateral trade tariffs. One should also not disregard the enthusiasm that the new President will bring to healthcare and cancer research given that Biden’s son Bo died of cancer in 2015.

Finally, many of us have grown accustomed to hearing the President’s thoughts and feelings broadcast to his 60 million Twitter followers; an insight into a President’s mind we have not previously been privileged to. Biden’s decisions will be behind closed doors for the most part. On a positive note – we no longer need worry about Presidential ‘tweets’ that can alarmingly move financial markets on a whim!

Conclusion

The discovery of vaccines with very high efficacy rates in such a short period has brought hope as widespread vaccination programs are expected to break the link between mobility measures and the number of infections. Risks in the near term remain, such as the supply and usage rates of the vaccines, whilst new strains of the virus are a concern, but there is no doubt that the recent breakthrough in medical technology has improved the medium-term outlook significantly. In addition a combination of other factors such as pent up demand, high savings ratios, inventory rebuilding and policy support in the form of low interest rates and fiscal initiatives, which include income payment transfers and infrastructure projects, and perhaps a more predictable geo-political environment will all contribute to an improved growth outlook for 2021 and beyond.

Investors should however remain selective and vigilant in their approach given elevated debt levels and less favourable valuations. We will continue to invest in quality securities with strong balance sheets, proven business models and secular growth drivers which will ultimately result in sustainable and predictable uplifts in profitability.

South Africa – Hope On The Horizon!

Market Returns

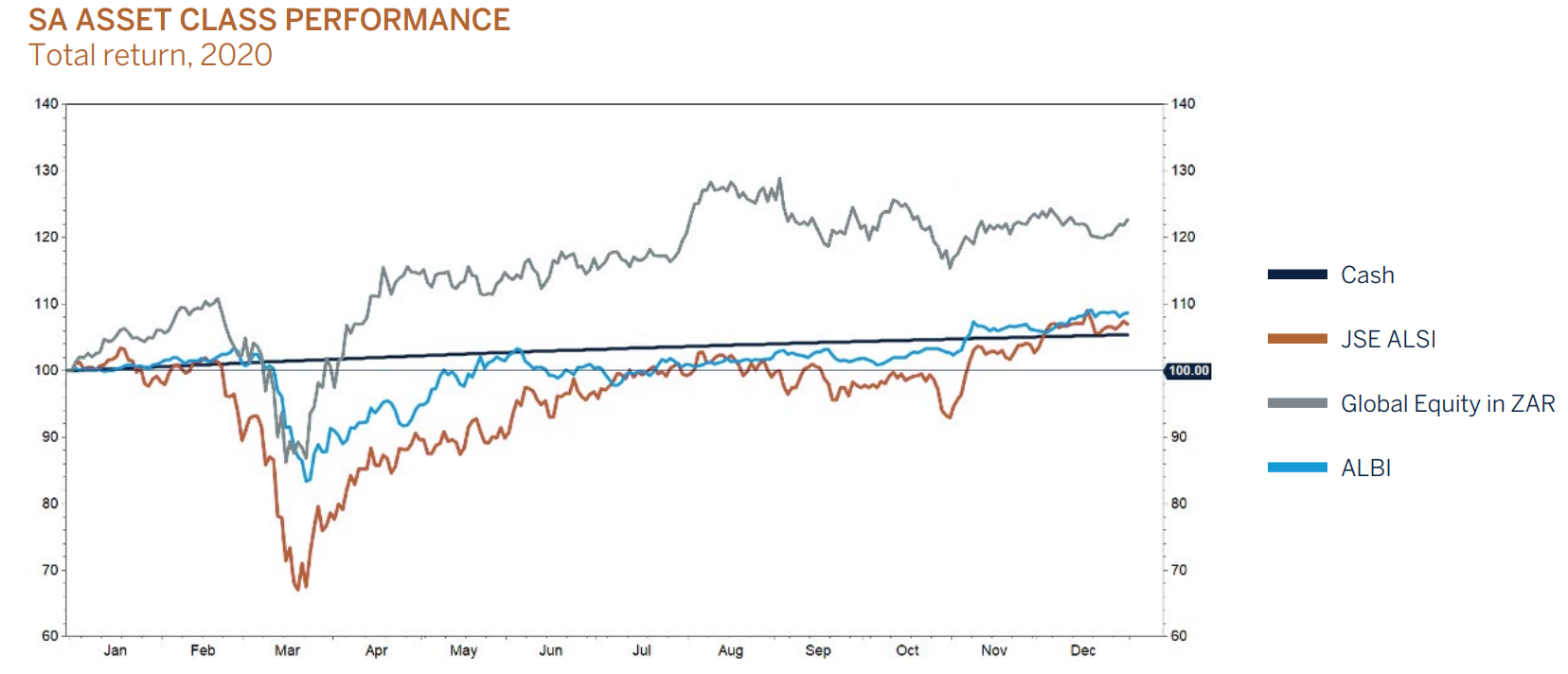

Notwithstanding the negative effects of COVID-19 on the global and South African economies, domestic investment markets rewarded patient investors who remained invested during one of the most challenging years in history. After a sharp sell[1]off in equities, government bonds, and the domestic currency during the peak of the lockdown period in March and April, domestic asset prices recovered to such an extent that investors would be forgiven for asking what all the fuss was about.

Towards the end of last year domestic asset prices benefited from an improvement in risk appetite, similar to global markets, as news on the vaccine front improved and the outcome of the US presidential election was viewed favourably, in general. Foreign investors returned to our shores in December which marked the first month of net inflows into the JSE All Share Index since May 2019. These inflows coupled with a record current account surplus buoyed the rand towards the end of the year. On further reflection, equity returns during the year were very narrowly based with only Naspers/Prosus, Richemont and the resources sector (which has benefitted from much higher commodity prices), driving the local bourse higher. Domestically focused shares such as financials, retailers and other South Africa only industrial shares ended the year in negative territory as earnings and dividend payments were severely impacted by a weak South African economy

South Africa’s Economic Recovery Surprises

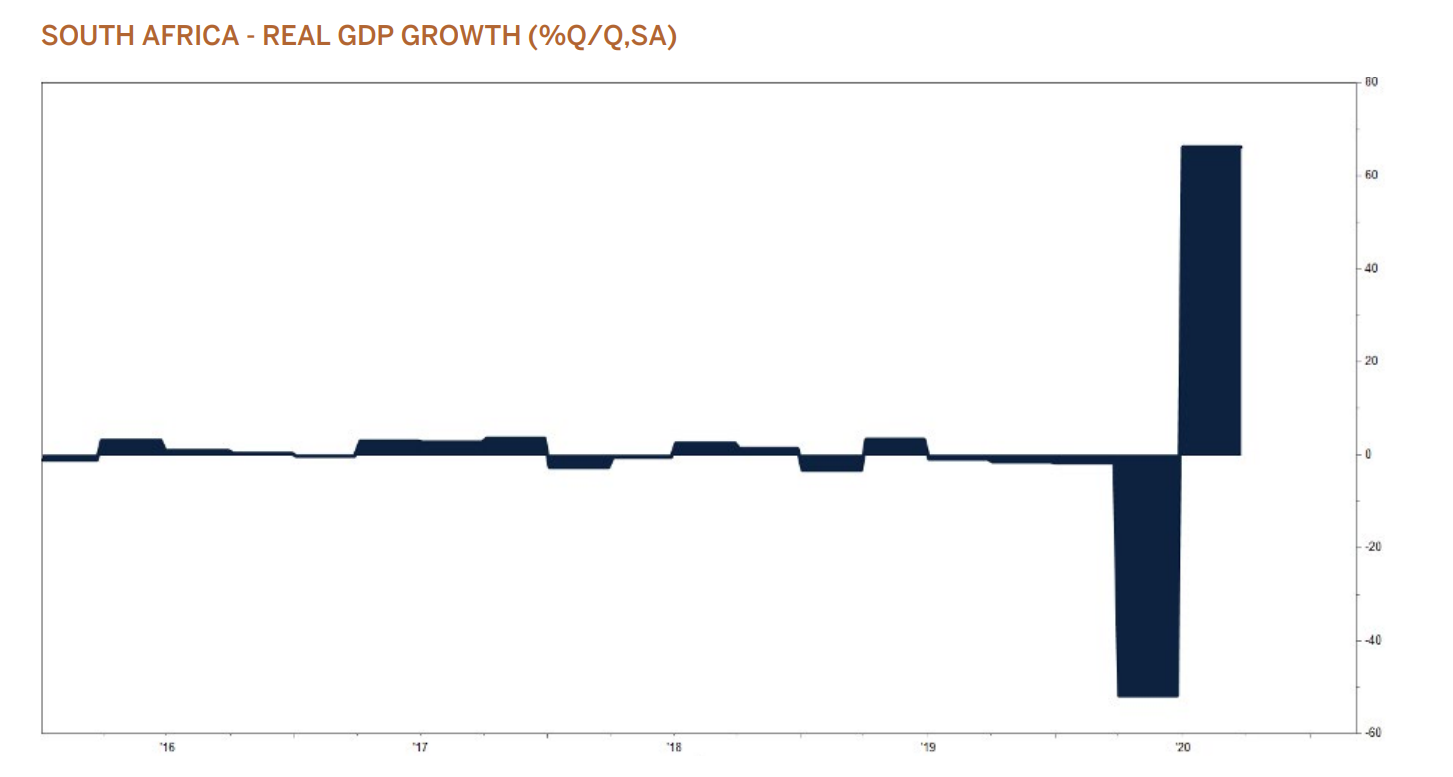

Even though the domestic economy had to contend with numerous headwinds during 2020, the economic recovery thus far has proven stronger than what has been expected, as the global economy gathered momentum and severe lockdown restrictions were relaxed. In addition, low interest rates and social income grants (disposable income) also contributed to the improvement in momentum. The economy is now expected to decline by only 6 to 8%.

While the pandemic has played havoc with the hospitality and leisure industries, other sectors in the economy have fared better. Agriculture benefited from good rainfall and healthy crop yields during the year and mining companies and export industries profited from a weaker currency and strong commodity prices.

Source: FactSet Research Systems

Third quarter GDP surged 66.1% q/q annualised and on an annual basis the economy was 6% weaker. Such numbers are unheard of and reflect just how severely lockdown restrictions impacted the economy in the second quarter when it shrunk by 51.7% q/q. Tax revenue, employment, and confidence took a significant hit from these developments and the full effects from the crisis will only be revealed in time once the support measures from government and the Reserve Bank are removed. The good news is that economic momentum continued to improve into the fourth quarter with vehicle sales, manufacturing activity, and confidence surveys pointing to better times ahead, but perhaps more importantly, illustrating how much companies and individuals have already adapted to the changing environment. Unfortunately, the alarming increase in COVID-19 cases across the country, which has resulted in the re-introduction of level-3 lockdown measures, coupled with Eskom’s load shedding announcement and a temporary slowdown in global economic activity will once again result in a slowdown of growth momentum in the near term. Importantly however, this does not spell the end of the recovery in the current economic cycle.

Signs That Reforms Are Gathering Momentum.

Structural reforms are slowly being implemented. More companies can generate electricity for own consumption, significant capital has been invested in alternative and more environmentally friendly sources of electricity such as solar and wind, while high profile arrests within the public sector provide hope that government is serious about eradicating the corruption which has become so ingrained in the system and plagued the economy for years.

The misallocation of taxpayers’ money has been very costly and an improvement on this front will hopefully pave the way for improved service delivery and ultimately economic prosperity for all, something that is desperately needed in an economy that has not been able to grow GDP per capita over the last 5 to 6 years. Government’s recent victory over public sector wage increases for 2020/2021 also provides hope that there exists enough political will within government ranks to follow through on fiscal consolidation. This will please ratings agencies and bond investors alike, especially after the recent downgrades to the country’s credit rating. Of course, much more change is still required to sustainably lift South Africa’s growth trajectory and deal with the country’s massive unemployment and social challenges. The reality is that it will take time and a concerted effort from all stakeholders in the economy, as well as a much closer working relationship between government departments and the private sector.

Conclusion

The near-term outlook for the South African economy remains challenging given the impact of the fast-spreading COVID-19 virus and the risk of stricter lockdown measures. The deployment and inoculation rate of the vaccines will play an important role in establishing some form of normality in economic activity.

In the meantime, low interest rates, pent-up demand, a more promising global economic backdrop, and government’s growth initiatives, which are predominantly infrastructure led, will underpin this year’s economic recovery. Fiscal consolidation will however act as a headwind to growth as government repairs its balance sheet. In the longer-term South Africa’s growth rate will be determined by how successfully government implements growth enhancing reforms and if Eskom’s turnaround plans have been achieved. An improving economic environment will go a long way in healing some of South Africa’s social and political challenges.

South African assets are by no means expensive and investors should therefore continue to focus on achieving their long-term investment objectives through adequate diversification across geographies and asset classes, careful selection of investment opportunities, and by looking through the near-term risks emanating from the current wave of COVID-19 infections. The economy is in an upward trajectory albeit from a low base and with President Cyril Ramaphosa’s reform wheel slowly starting to gather pace, investors should expect a reasonable outcome for the year ahead.

Domestic Asset Allocation

by Bernard Drotschie / Chief Investment Officer

|

Domestic Equity |

Overweight |

|

Domestic Cash |

Underweight |

|

Domestic Bonds |

Neutral |

|

Global Equities |

Underweight |

Please note that changes were made to the equity benchmarks for global mandates which became effective on 1 January 2021. We have reduced the benchmark’s equity allocation to domestic listed companies in favour of their offshore counterparts which will now contribute approximately 40% of the equity benchmark. The primary reasons for these changes were the much larger opportunity set that is available for investors offshore and the diversification benefits of allocating a greater component of one’s investments to companies and sectors that domestic investors do not have access to on the local bourse, which has also reduced in size. The asset allocation discussion below is in relation to the new benchmarks.

Domestic Equities – Overweight. Expected returns from both a bottom up and a top down perspective remain attractive with double digit returns expected this year. This is a function of attractive valuations and a rebound in earnings from depressed levels which will further be supported by an improving global backdrop. Any tangible signs of reforms in South Africa or an improvement in the domestic growth outlook will unlock significant value for investors. A return to dividend payments by many domestic companies will also be welcomed as cash earnings improve.

Offshore Equities – Underweight. Although we expect positive returns from offshore equities over the next 12 months, we find domestic equities at current valuations more attractive. Elevated absolute valuations in offshore listed equities are however expected to be supported by very low interest rates in developed markets. Strong and positive earnings growth will continue to underpin returns but this should to some extent be hampered by the fairly rich starting valuations. In other words, a de-rating in valuations is our base case.

Domestic Fixed Income – Neutral. Income yields are attractive relative to cash and long term expected inflation, but we expect that returns from current levels will predominantly be derived from income (coupon). A deteriorating fiscus does pose some upside risk to yields (lower prices) in the medium term and the recent credit downgrades by Moody’s and Fitch have brought South Africa’s sovereign rating only one downgrade away from being rated speculative. While developed market bonds continue to trade at historically low yields, we would expect South African bonds to be well supported by an improving global backdrop, which could result in foreigners returning to our bond markets in search for yield.

Cash – Underweight. Current interest rates are unattractive.

Offshore Fixed Income – Underweight. With more than a third of global bonds trading at negative income yields, we find the asset class very unattractive in both absolute and inflation adjusted terms.

Domestic Equity

by Paolo Senatore / Head: Domestic Equity Strategy

|

Basic material |

Underweight |

|

Technology |

Neutral |

|

Financials |

Overweight |

|

Healthcare |

Underweight |

|

Telcos |

Underweight |

|

Consumer goods |

Underweight |

|

Industrials |

Neutral |

|

Consumer services |

Overweight |

South African equity had a strong fourth quarter driven by candidate vaccine optimism early in the quarter and ending the quarter with roll outs of the vaccines in some countries. The outcome of the US election also provided reasons for risk assets to advance strongly.

The Capped Swix delivered a return of 11.5% in Rand terms for the last quarter of 2020, bringing the calendar year performance of South African equities measured by the Capped Swix to 0.6%. As an indication of the volatility, the low point on a year-to-date basis was on the 23rd March, where the Capped Swix was down 37%.

The sector returns for the quarter were strong across the board, with South African facing sectors such as financials, real estate and industrials benefitting the most off cheap valuations. Their returns were 20%, 22% and 19% respectively. Basic materials continued to perform strongly delivering a return of 8%, with mixed returns in the subsectors as gold sold off into the risk on trade. Consumer services had a strong quarter driven by an anticipated economic recovery in 2021, delivering a return of 14%.

Despite the second wave of COVID-19 cases, equity markets globally and domestically appear to be looking through the case numbers and focusing on the economic recovery post the pandemic induced lockdowns as the vaccine rollout commences. We remain cautious domestically as South Africa does not have any headroom for severe lockdowns and news flow on the vaccine rollout has been slow.

The US election outcome, although turbulent has been viewed as positive for emerging markets, which outperformed most developed markets in the final quarter of 2020 as the risk on trade began. The MSCI All Country World index returned 15% in USD for the fourth quarter against the MSCI Emerging Index return of 20% on a comparable basis.

If we compare South African equities to their emerging market peers, there could be some catch up moving into 2021 should the risk on trade continue given their underperformance in 2020. For the calendar year, the MSCI Emerging Index returned 18% in USD against the JSE Capped Swix Index return of -4.3% for the comparable period. The unwind has already started with the JSE Capped Swix delivering a return of 27% for the final quarter of 2020 in USD against the MSCI Emerging Index return of 20% for the last quarter measured in USD.

Should the risk on trade continue, we could expect to see domestic stocks continue their rally in the near term. We do however need to see the recovery in domestic earnings to make the rally sustainable given current valuations post the rebound in the last quarter of 2020. As we continue through company updates, we are finding that many of the high-quality businesses continue to print results that are better than forecast and show balance sheet resilience. Post the rally in domestic stocks in the last quarter of 2020, the focus turns to the earnings recovery to justify the rerating.

Moving into 2021, we expect more volatility. With the second wave growing at an alarming rate, we will need to use some lessons learnt in 2020 to navigate the year. The vaccine rollout is key to any domestic economic recovery. Large asset price movements do present opportunities and we are alert to these. Now, more than ever, stock selection and diversification are paramount.

Domestic Fixed Income

by Mzimasi Mabece / Head of Fixed Income

|

Government |

Overweight |

|

Inflation Linked |

Underweight |

|

State Owned Enterprise |

Underweight |

What a year 2020 has been! South Africa being part of this global universe was not spared the rout that befell global financial markets and economic decimation brought about by the onset of the corona virus pandemic. As a consequence of the pandemic, authorities had to respond with the South African Reserve Bank (SARB) being first off the blocks and in the course of 2020 reduced interest rates by a cumulative 300 basis points. The government, in its response to the pandemic, placed the country in a lock down under the strictest restrictions that confined citizens to their homes and virtually ground the economy to a halt in the first half of the year.

Given the SARB’s aggressive cuts in interest rates during the year, we believe that the interest rate cutting cycle has bottomed. However, given the sluggish economy, we believe that price pressures will remain subdued and as such inflation is likely to remain below the 4.5% long term target that the central bank would like to anchor inflation at and as such the SARB is under no pressure to tighten monetary policy.

The Medium-Term Budget Policy Statement (MTBPS) is always the focus in the fourth quarter and last year was no different. In the afternoon of Wednesday 28 October 2020, the Minister of Finance Mr. Tito Mboweni stood in parliament and delivered to the nation his much[1]anticipated Medium-Term Budget Policy Statement. The Minister in his address laid bare the extent of the deterioration in the country’s fiscal position. The South African Government borrows R2.2 billion per day with the national debt exceeding R4 trillion. To put this into perspective, public debt is four times bigger than the national budget and this debt trajectory is unsustainable and cannot continue unabated. What became evident from the MTBPS are the following:

/ The expected cost containment and expenditure reduction is hinged on a public wage freeze and therein lies the greatest implementation risk as public sector unions will fight tooth and nail against this proposal.

/ Debt is expected to stabilise both higher and later than previously envisaged. However, the market expected disappointment in this area as the active scenario, which predicted a peak of 87%, was viewed skeptically from the beginning. The debt stabilisation path proposed in this statement may be viewed as more realistic and achievable and this should anchor the domestic bonds and currency markets.

/ The MTBPS did not go far enough to please left leaning interests who are arguing for the government to spend its way out of trouble nor was it pleasing to conservative economists whose counter argument is for an austerity path out of our problems. In our view the Minister of Finance danced dangerously close to the cliff but managed to chart a realistic path out of our problems with political boldness required to achieve that recovery path.

We believe that as yields on developed market bonds begin to normalise to higher levels and South Africa’s fiscal position deteriorates, the domestic bond yield curve will continue to steepen. Given the above and our view that funding risks will continue to be expressed at the long end of the curve (higher yields), we prefer to be positioned along the shorter end of the yield curve where capital risk is more contained.

Domestic Market Performance % / as at December 2020

|

EQUITY |

DECEMBER |

Q4 |

12 MONTHS |

|

All Share Index |

4.2 |

9.8 |

7.0 |

|

Capped SWIX Index |

5.5 |

11.5 |

0.6 |

|

Resources |

9.5 |

8.3 |

21.2 |

|

Financials |

8.8 |

19.4 |

-21.1 |

|

Industrials |

-1.0 |

7.4 |

12.0 |

|

All Bond Index |

2.4 |

6.7 |

8.7 |

|

MSCI US |

-1.2 |

0.5 |

26.8 |

|

MSCI UK |

0.9 |

4.7 |

-3.9 |

|

MSCI Emerging |

1.9 |

5.4 |

24.3 |

|

MSCI AC World |

-0.7 |

1.0 |

22.1 |

|

US DOLLAR RETURNS |

DECEMBER |

Q4 |

12 MONTHS |

|

MSCI US |

4.1 |

13.0 |

20.7 |

|

MSCI UK |

6.3 |

18.9 |

-8.5 |

|

MSCI Japan |

4.1 |

15.3 |

14.5 |

|

MSCI Emerging |

7.4 |

19.7 |

18.3 |

|

MSCI AC World |

4.6 |

14.7 |

16.3 |

|

Citigroup WGB Index |

1.4 |

2.8 |

10.1 |

|

CURRENCY VS. US DOLLAR |

DECEMBER |

Q4 |

12 MONTHS |

|

Rand |

5.3 |

14.0 |

-4.7 |

|

Euro |

2.4 |

4.2 |

8.9 |

|

Yen |

1.0 |

2.1 |

5.1 |

|

Sterling |

2.6 |

5.8 |

3.1 |