Delayed effects of higher interest rates start to bite

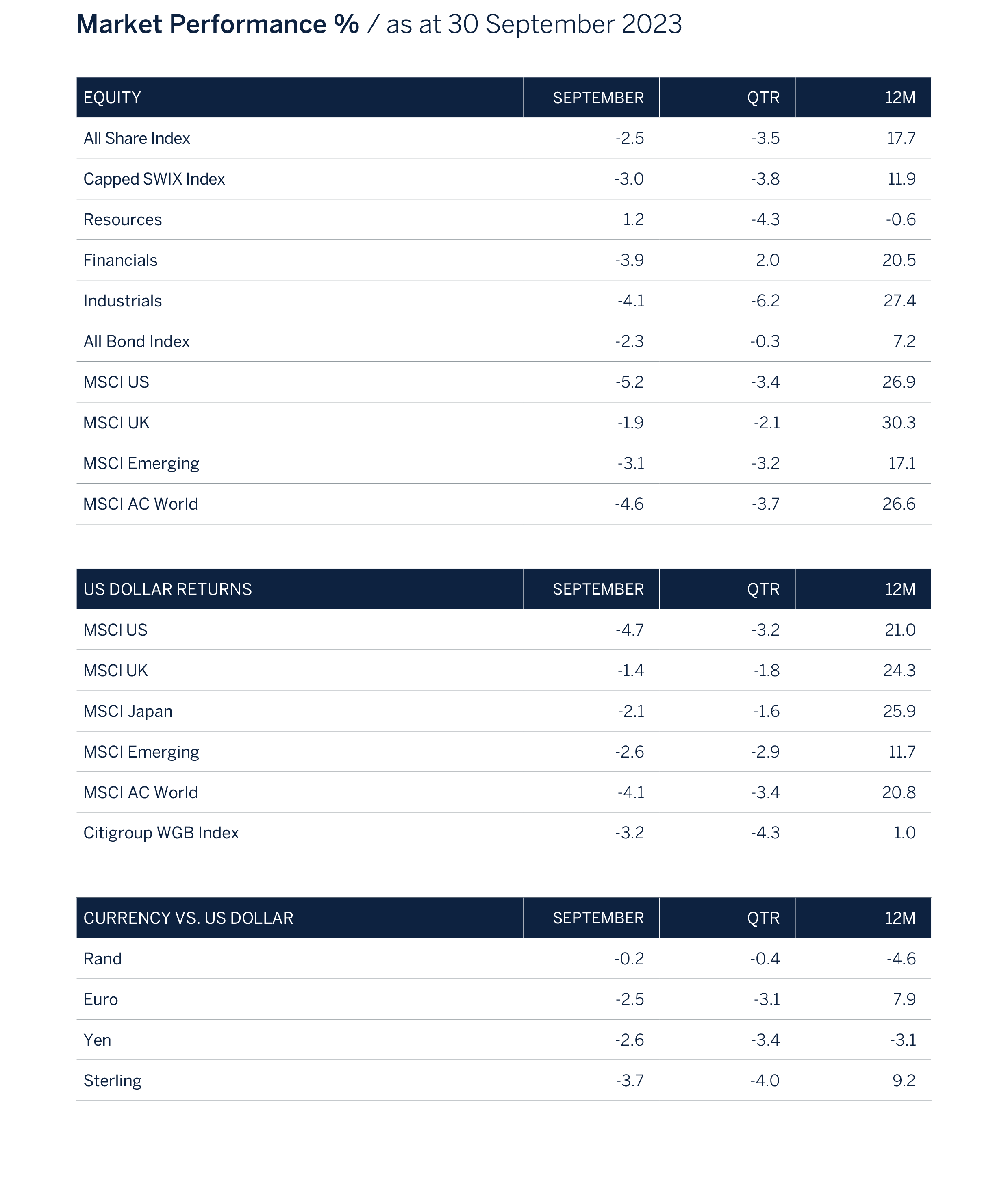

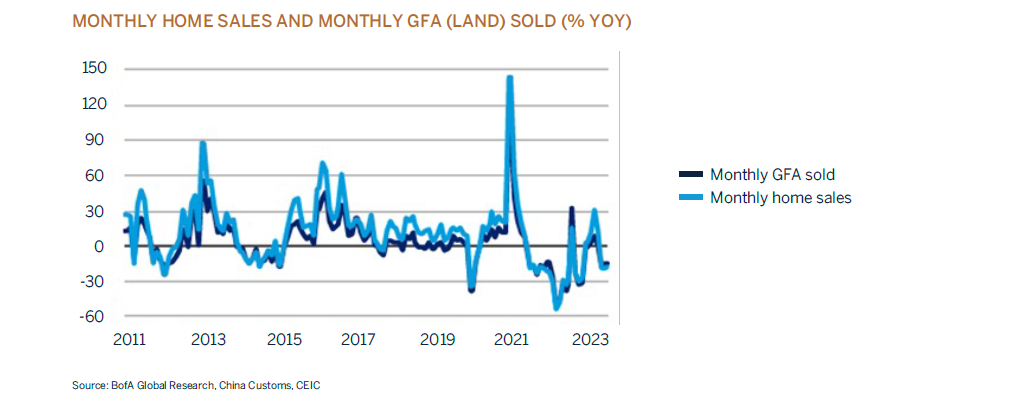

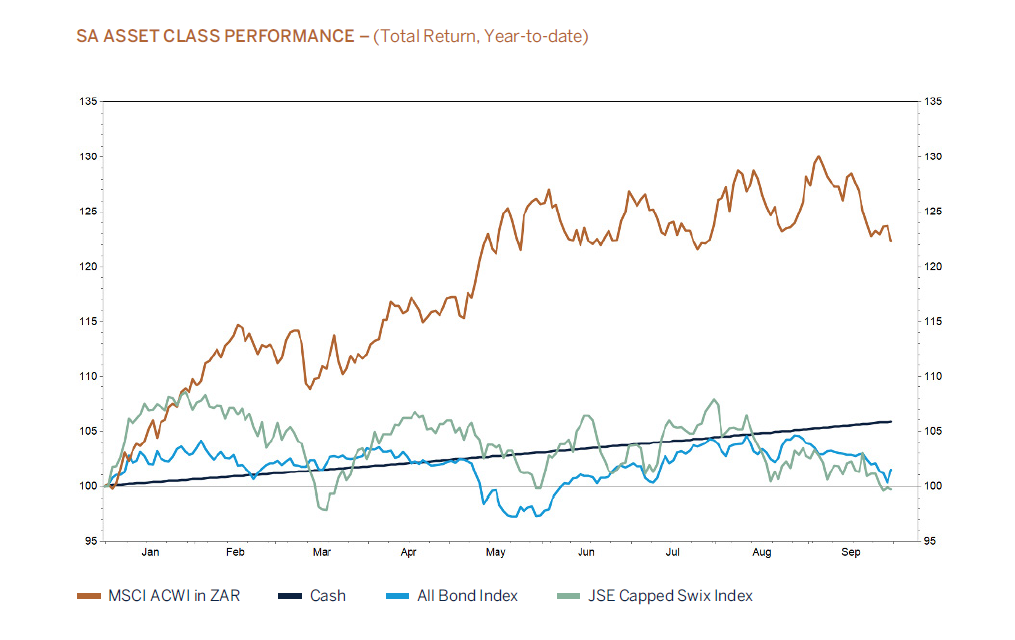

After a positive first six months of the year, both global equity and fixed income markets declined during the third quarter. The South African financial markets could not escape the volatility in global markets and ended the quarter in negative territory. SA cash was one of the best performing asset classes during this period, albeit off a low base, after the rand depreciated earlier in the year. There were several factors that unnerved investors during the quarter, with the main headwind being confirmation from central banks that interest rates are set to remain higher for longer as they continue to fight inflation. Bond prices fell, pushing yields to their highest level for this cycle, leading equity prices to naturally adjust lower as a result of a higher discount rate.

The adjustment of interest rates and interest rate expectations has been significant, with the recent credit downgrade of US sovereign debt and a sharp pick-up in US Treasury issuance (to fund budgeted spending deficits), adding impetus to the upward trend in yields. In the midst of the Covid-19 pandemic, the 10-year US Treasury yield hit an all-time intraday low of 0.3%. Since then, we have experienced an astonishing turnaround, with 10-year yields now standing at 4.6%, and it is worth remembering that the annual rise of c. 2.3% over 2022 was already the biggest yearly increase since 1788.

Long duration growth assets such as technology shares, which had been the driver of returns earlier in the year, felt the brunt of the pain. Conversely, higher crude oil and energy prices resulted in the energy sector outperforming the rest of the market by 15%. While the US economy appears resilient, softening economic data elsewhere, particularly in Europe and China, has led to growing concerns about the near-term global growth outlook and negative revisions to corporate earnings.

The rise in crude oil prices and higher bond yields raises particular concerns for investors as these factors will weigh negatively on the growth outlook, while at the same time fueling stubbornly high inflation in the near term. Central banks have little option other than to keep interest rates higher for longer, increasing the risk of some form of financial/ asset dislocation as credit conditions continue to tighten and cheap debt is refinanced at even more costly levels.

What to expect from equities once interest rates have peaked?

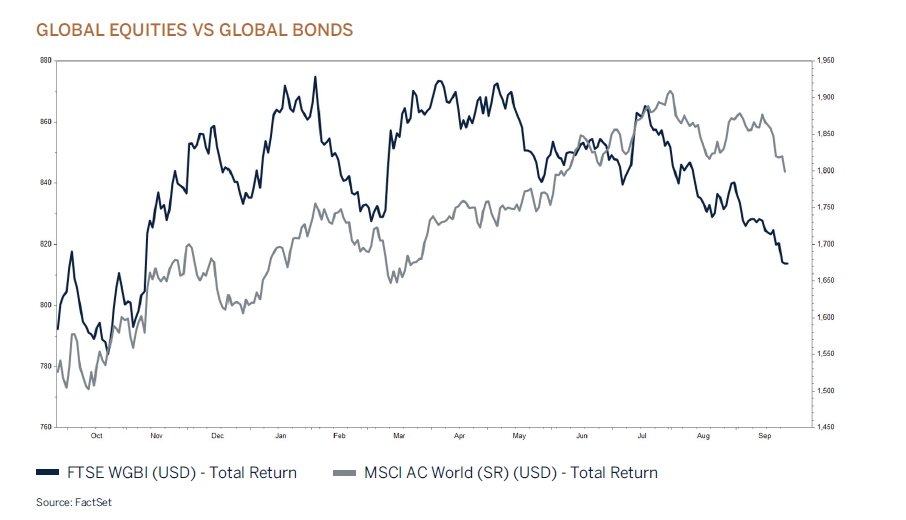

Over the past 30 years, there have been nine cycles of increasing interest rates, and the current cycle marks the 10th, being the sharpest and most aggressive since 1972.

As shown above, over the past 50 years equities tended to rise when the interest rate hiking cycle was not followed by a recession. This only occurred three times: 1984, 1995 and 2018. For every other cycle, where higher interest rates resulted in a recession, equity markets experienced a correction of at least 20%. In addition, it is also interesting that the global economy experienced a sharp downturn whenever interest rates increased by 300 basis points or more over a rolling 12-month period.

Every economic and business cycle is however unique, and the sharp downturns experienced in the global economy since 2000 were accompanied by either an asset bubble (2000 dot.com) and/or periods of extreme risk taking (2008 global financial crisis). Our baseline view is that the global economy is unlikely to enter a period of recession given healthy balance sheets across households and corporates, a significant increase in households’ net assets, and a tight job market, which has for the first time in many years supported real income growth for employees. However, we believe risks remain tilted to the downside given the extent of monetary tightening (higher interest rates) since 2022, with the lagged effects on the global economy still to play out, reduced fiscal support, tightening credit standards, high oil prices (sticky inflation), and unfavourable geopolitical developments between China and the Western economies. The current economic cycle would appear to be quite mature in nature and unlikely to reaccelerate until monetary authorities decide to ease interest rates again, an event that has been pushed back until next year.

China’s recovery loses momentum

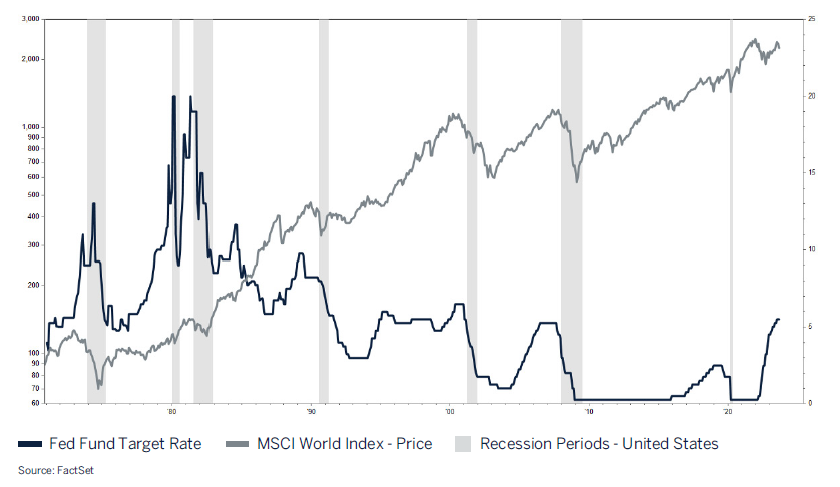

With China being the largest consumer of commodities, the market envisaged that its reopening would be met with a nationwide reflation trade. However, the lack of demand has been attributed to low consumer confidence, which has adversely been affected by lower property prices and a soggy labour market. Unlike other developed markets, such as the US that injected significant stimulus post-pandemic, Chinese consumers are having to rely more on their savings. This is due to the timid stimulus measures implemented by the Chinese government to provide stabilisation to the property market. The health of the Chinese economy is largely dictated by the activity in the property market, a segment of the economy that has been extremely weak thus far. Despite a cut in corporate lending, reserve requirements and reduced deposit requirements for homes, the property market remains soft while economic activity remains lacklustre. Growth in land sales, which acts as a leading indicator for housing demand, has been negative year-on-year (yoy), while the number of completed buildings shows no growth and is down considerably. The property market seems to be facing a structural issue of oversupply, weak demand, unaffordability, and speculation risk. China’s largest state-owned property developer, Evergrande Group, declared Chapter 15 bankruptcy, echoing the uncertainty over the country’s potential property market bubble.

Over the longer term, China faces an issue of three Ds: deflation, demographics, and debt. Unlike most developed markets where inflation continues to be the topic of discussion, China faces deflation risk. Deflation is a potential headwind for the economy as this may result in consumers postponing consumption, which would in turn reduce economic growth. With their demographics diametrically opposed to that of India (now the largest population), one must consider who the marginal buyer of Chinese property will be. Lastly, China’s debt-to-GDP of 250% is more than double that of the US, which remains a systemic risk in an environment where investors are tilting towards risk aversion.

The duration of the current relative weakness of China remains unknown. However, Chinese GDP growth is still forecast to be circa 5% for this year, albeit partially due to base effects since the reopening. As China remains the second-largest economy in the world, and the most influential global trade partner, the strength of its economy is bound to have a domino effect on Asia and Europe.

Meanwhile, the deteriorating relationship with the US and uncertainty over the placement and magnitude of stimulus have further increased market uncertainty. The current distortion between market expectations and the reality within China has been made evident, as China remains focused on their long-term strategy of stabilisation to reduce speculation risk. Given the above, investors may require patience and a rebalancing of market expectations before we see a material improvement out of China.

South Africa

If it wasn’t for Resources…

It has been another difficult year for South Africa’s financial markets. The rand has lost 11% against the US dollar, and SA cash has outperformed the domestic equity and fixed income market. Investors with an exposure to global assets have benefitted from a weaker rand, once again illustrating the importance of diversification across regions. If it wasn’t for the Resource sector’s -14.4%, the returns from the domestic equity bourse would have been much more acceptable, with Financials +8.8% and Industrials +10.1% generating positive returns. In line with global trends, corporate earnings for SA-listed stocks have been revised lower this year, dragged down by Resources on the back of lower metal prices. The SA fixed income market couldn’t uncouple itself from the developments in global bond markets, which resulted in bond yields trending higher on inflationary and fiscal concerns.

"The country’s deteriorating fiscal position has resulted in higher bond yields as investors require a higher rate of return for taking on more risk."

South Africa’s precarious and deteriorating fiscal position

South Africa finds itself grappling with a deteriorating fiscal position. The country’s financial woes are well understood and have been a function of mismanagement, corruption, and the impact of the Covid-19 pandemic, coupled with a decline in consumer and business confidence. Economic growth this year has however been much more disappointing than what was expected, due to a myriad of factors. These include a deteriorating global economic backdrop, a sharp fall in metal prices, which has impacted the profitability of the mining sector, and the continued poor service delivery from the country’s largest state-owned institutions, including Eskom and Transnet, which has resulted in a drag on growth and an increase in the costs of doing business for many South African companies. All of these factors are expected to result in a significant tax revenue shortfall for the current fiscal year.

In addition, wage negotiations have not quite gone to plan and have resulted in an unbudgeted increase in government spending. Some of these costs could be offset by pulling back on certain expenditures to balance the fiscus books, but that could be challenging given that next year’s national election is upon us. The National Treasury will have their work cut out for them to ensure that the fiscal consolidation that the government has committed itself to is realised.

South Africa’s deteriorating fiscal position has also eroded investor confidence. As debt levels rise and economic growth stagnates, foreign investors become increasingly cautious about investing in the country. This lack of investor confidence limits the government’s access to foreign capital, making it difficult to finance its debt and implement growth-oriented policies. The deteriorating fiscal position carries serious consequences for the nation’s economy over the medium to long term and may include a potential downgrade of the country’s credit rating, which would raise borrowing costs and further hinder economic recovery. Additionally, the government may face difficulties in providing essential public services, exacerbating social inequality and unemployment.

To address these challenges, South Africa must adopt several measures. Firstly, there must be a renewed commitment to fiscal discipline, including reducing unnecessary government spending and improving revenue collection. Secondly, tackling corruption and improving governance are crucial to restoring public trust and attracting investment. Furthermore, structural reforms are required, and South Africa should focus on diversifying its economy to reduce dependency on sectors such as mining and agriculture. Investing in infrastructure development, increasing access to education, and fostering innovation can stimulate economic growth and create employment opportunities for its citizens.

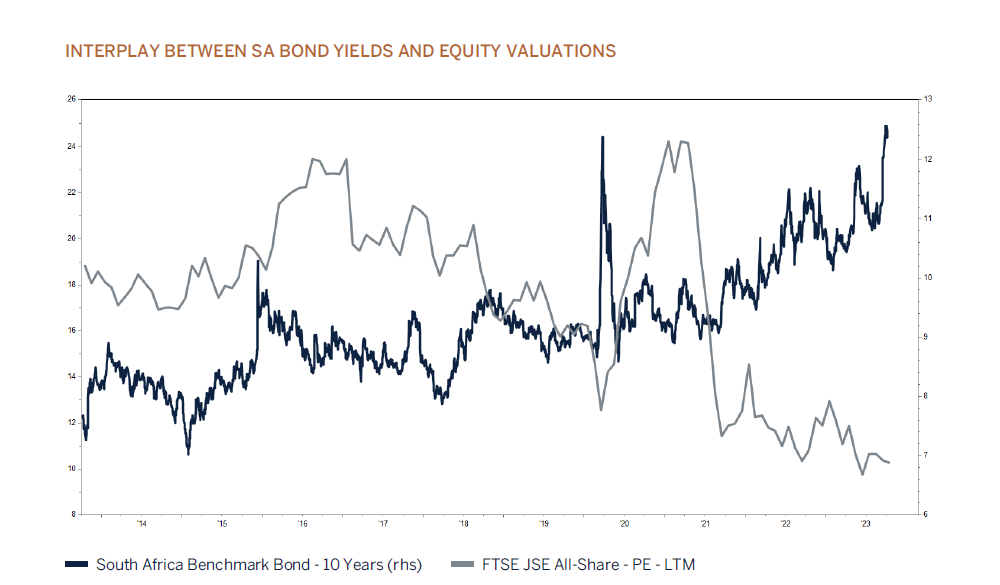

The country’s deteriorating fiscal position is a pressing concern that demands immediate attention from policymakers. South Africa’s high debt levels, economic contractions, corruption, and declining investor confidence pose significant challenges to its economic stability and growth, and it is why we have seen a deterioration in SA asset valuations over the last decade. Higher debt levels have resulted in higher bond yields (interest rates) as investors require a higher rate of return for taking on more risk, and have pulled equity valuations lower as the discount rate increased and economic growth suffered.

By implementing the necessary reforms and restoring fiscal discipline, South Africa can mitigate the crisis and pave the way for a more prosperous future. However, concerted efforts from both the government and the private sector are essential to reverse the current trajectory and rebuild the economy. None of this is news to the presidency, and the government knows what is required to turn things around for South Africa’s ailing economy. The establishment of Operation Vulindlela has been a positive development as it seeks to expedite the growth reforms. Unfortunately, as we have learned, without the political will and required skill set and experience, implementation will continue to be frustratingly slow.

Conclusion

Growth in the global economy has been surprisingly more resilient this year than what the forward leading economic indicators had been signalling and what economists had expected. The developments surrounding artificial intelligence, automation and the reshoring of manufacturing facilities have played an important role in supporting gross fixed capital formation and economic growth. The benefits from these investments will also support economic growth over the medium to long term.

The knock-on effect of higher interest rates has thus far largely been contained. But as with most aggressive interest rate hiking cycles, investors should expect some moderation in economic activity, especially now that fiscal (government spending) support measures are starting to fade. While household income remains healthy, there are signs of employment growth slowing, albeit from a high base. Credit conditions have tightened with both demand and supply for new credit declining as affordability wanes, and delinquencies across various credit lines increase at an alarming rate. The housing markets in developed economies have also started to show some weakness with new and existing home sales under pressure. Some consolidation in the property market should be expected and welcomed after a period of significant increases in house prices and interest rates, and will assist in reducing core inflation over the coming year.

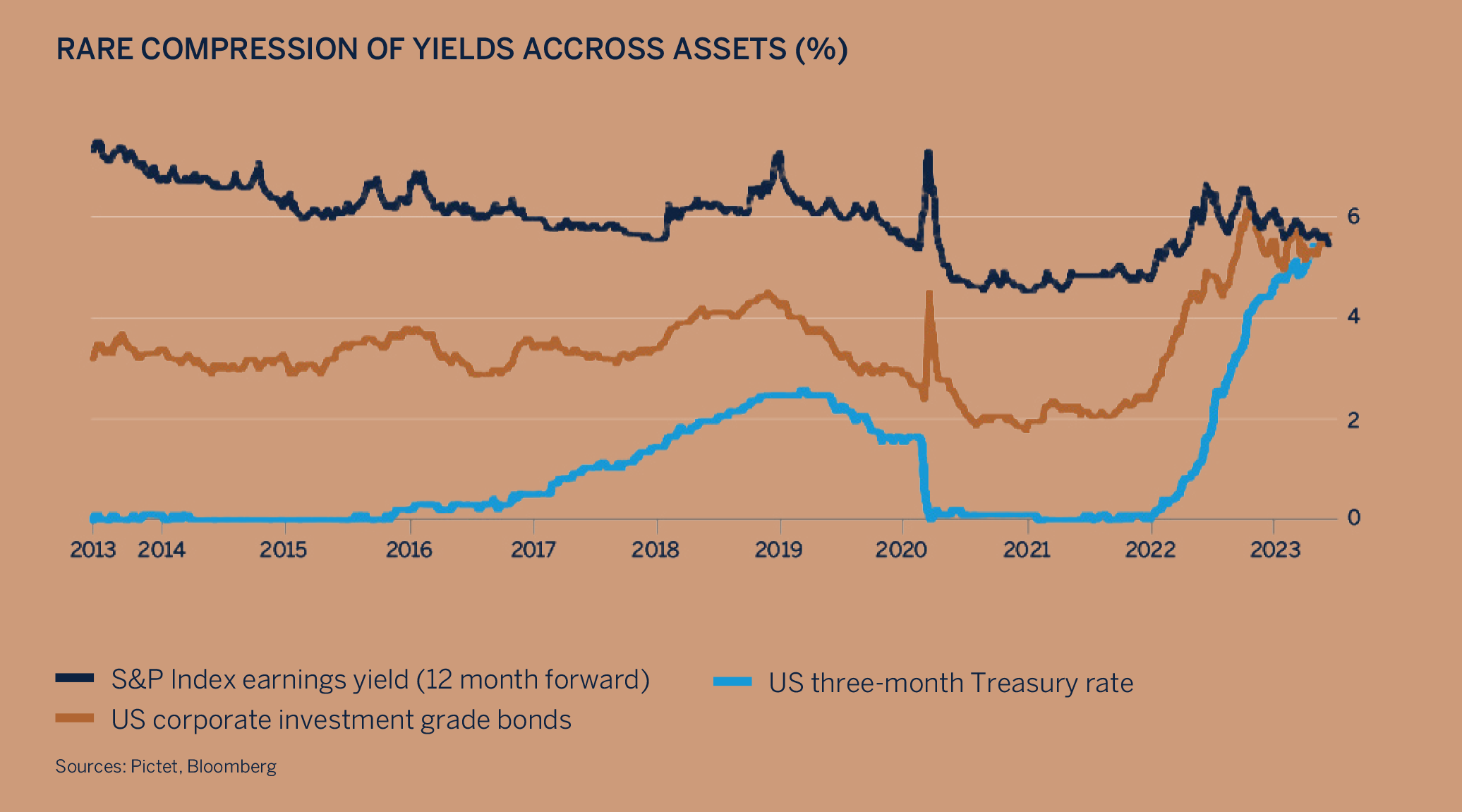

The global equity market has lost some of its shine from earlier this year as earnings revisions have turned negative, and the outlook for interest rates has become even more restrictive. The increase in energy prices is concerning and poses an additional headwind to the direction of both inflation and companies’ profit margins. Global equity valuations have adjusted somewhat to higher real yields and are no longer that extreme, but remain far from cheap when compared to the income yields on offer by developed market cash and fixed income when adjusted for risk.

South Africa’s growth outlook is very much dependent on the fortunes of the global economic cycle. High interest rates and poor service delivery by SOE’s will continue to restrain economic growth in the near term. An improvement in electricity supply over the next year as more renewable projects come on stream, combined with an expected improvement in performance from Kusile and Medupi Power Stations, will ensure that economic activity improves next year, albeit from a low base. South African companies and households have been actively investing in their own sources of energy generation and although this has come at a cost, many companies are better positioned than what they were a year ago to deal with the effects of heightened load shedding events.

South African asset prices have already discounted much of the bad news, offering attractive valuations, especially for fixed income assets. Government bond yields above 12% provide good long-term value in real terms, even accounting for the worsening fiscal outlook. The Reserve Bank is a credible institution with a mandate to achieve long-term price stability, and the National Treasury remains committed to fiscal consolidation. The allure of South Africa’s fixed income assets, combined with an oversold rand, is likely to attract foreign investors back to the country once the global economic outlook improves and/or commodity prices stabilise.

Equity prices are also attractive, with many shares trading on dividend yields that exceed their price-toearnings ratio. This valuation level has not been seen since the global financial crisis. Economic cycles are important to consider when investing, and interest rates are expected to peak globally this year and trend lower next year as inflation falls. This will initiate the next upswing in the global and South African economic cycles, an environment that is typically supportive of risk assets.

Asset allocation

Domestic Equity – Neutral

The near-term outlook for earnings growth has deteriorated for many domestic-facing companies in South Africa. The main ongoing causes are the significant costs associated with the electricity crisis, poor infrastructure and service delivery, and inflated interest rates. The Resources sector faces the headwind of lower metal prices, while load shedding and high interest rates remain problematic for consumer-facing stocks.

That said, we believe that much of the negative news is already discounted by the share prices, even after adjusting for a higher cost of equity. Dividends are attractive and should underpin valuations over the short to medium term.

Sectors such as banks will continue to benefit from the endowment effect caused by higher interest rates and the strong underlying credit demand from corporates that are investing in renewable energy projects. Although not necessarily our base case, many industrial companies are well positioned to benefit from the expected infrastructure upgrading spend associated with water, railway lines, ports and electricity. We are monitoring these facets of the economy closely for new investment opportunities.

In this structurally challenging environment, we expect volatility to persist in the near term, until interest rates have peaked and/or global growth concerns have stabilised. This investment landscape calls for steadfastness. Our strategy remains to be invested in high-quality businesses with strong balance sheets and robust cash flow streams. With valuations at multi-year lows, we intend to stay the course by patiently staying at weight in the asset class while receiving attractive dividend cash flows that reduce the effects of inflation in the meantime.

Domestic Bonds – Overweight

South African government bonds have derated sharply during the course of this year. This can in part be explained by the sell-off in global bonds, but investors have also become increasingly concerned about the risk of fiscal slippage given the current state of the economy, coupled with the deteriorating terms of trade. The risk premium in South Africa has risen to account for the higher-thanexpected inflationary environment due to the rand’s weakness and inefficiencies in service delivery. Although execution risks remain and tax revenue is trending lower as the economy slows and capital flight transpires, the government remains committed to prudent fiscal management.

We believe that inflation has peaked in the near term, and the monetary policy tightening cycle is near its end. The domestic fixed income market is not immune to developments in global bond markets, but given the attractive starting income yields in both nominal and inflation adjusted terms, we would expect returns to be well above cash over the medium term, hence our overweight position to the asset class.

Global Equity – Neutral

After an initial surge in equity prices during the first half of the year, underpinned by China’s reopening, downwardly trending headline inflation and resilient macroeconomic data, equity market valuations adjusted to the reality that interest rates will continue to be a headwind for the global economy and that monetary relief has been pushed out to the second half of next year, increasing the risk of a financial dislocation as the global economy loses momentum. The sell-off in global bond yields means that the discount rate used to value equities has increased materially, which requires an adjustment to prices and most likely earnings growth over the next 12 months as corporates adjust to higher-for-longer interest rates.

Outside of the technology and energy sectors, equity markets have largely been trading range-bound this year, given that certain leading economic indicators are pointing to some softness ahead. Banks have been tightening their lending standards, which has resulted in both credit extension and credit demand slowing materially. In addition, corporate bankruptcies this year have reached levels last seen during the global financial crisis. Outside of the US and Japan, global equity markets have in fact been trending sideways and down (in USD) since reaching their peaks in February as the outlook for earnings growth has been adjusted lower. Consensus expects earnings for 2023 to be marginally down on last year.

Tactically, we remain cautious in this asset class due to the following reasons:

- The full effect of higher interest rates still needs to play out. It can take up to two years before the economy fully responds to the tightening monetary policy.

- Interest rates are not expected to decline in the near term. Core inflation remains elevated given a buoyant labour market and is not expected to decline to levels that will allow central banks to cut interest rates until next year. The risk is that monetary authorities overtighten in their effort to curb inflation.

- From a valuation perspective, global equities are not overly attractive on a risk-adjusted basis, and even less so when compared to the interest rates on offer for USD cash and developed market government bonds.

- An environment of higher-for-longer interest rates and elevated inflation is unlikely to result in much higher valuation multiples from current levels.

- The outlook for company earnings remains uncertain and given peak profit margins and an expectation that inflation and volumes will slow, earnings growth could prove a challenge for many companies to sustain in the short run.

Global Fixed Income – Neutral

It has been another tough quarter for global bond markets. The Bloomberg Global Aggregate Index is down -3.59% in US dollar terms. A combination of falling, but still elevated inflation, together with strong employment markets in developed economies has forced central banks to remain focused on curtailing inflation, with warnings that the restrictive monetary policy will remain in place for longer than originally anticipated.

Bond markets have adjusted for this outlook during the quarter with yields on 10-year sovereign US and UK bonds retesting levels last seen prior to the global financial crisis in 2008. While concerns continue to be raised over the negative implications of higher interest rates, we must be mindful that current monetary policies have only returned to more ‘normalised’ levels from what we experienced post the GFC – a period when central banks manipulated markets with an unprecedented volume of bond purchases under quantitative easing programmes.

Resilient economic growth, stubborn inflation and higherfor- longer interest rates are likely to keep US government bond yields elevated, at least over the short term. However, bond markets are highly efficient discounting mechanisms, and many of these factors have already been priced in. This ought to ensure that longer-dated yields are close to their peak, allowing a good opportunity to extend durations and lock into these attractive yields for the longer term. This is a process we have been implementing over recent months and one that we believe will reward investors over the medium to long term as inflation continues to trend closer to target levels. With valuations now also looking attractive on a relative basis and increasingly looking set to outperform cash over the next year, we have been increasing the allocation to this asset class.

SA Cash – Underweight

We favour long duration fixed income assets at present.