Few places to shelter

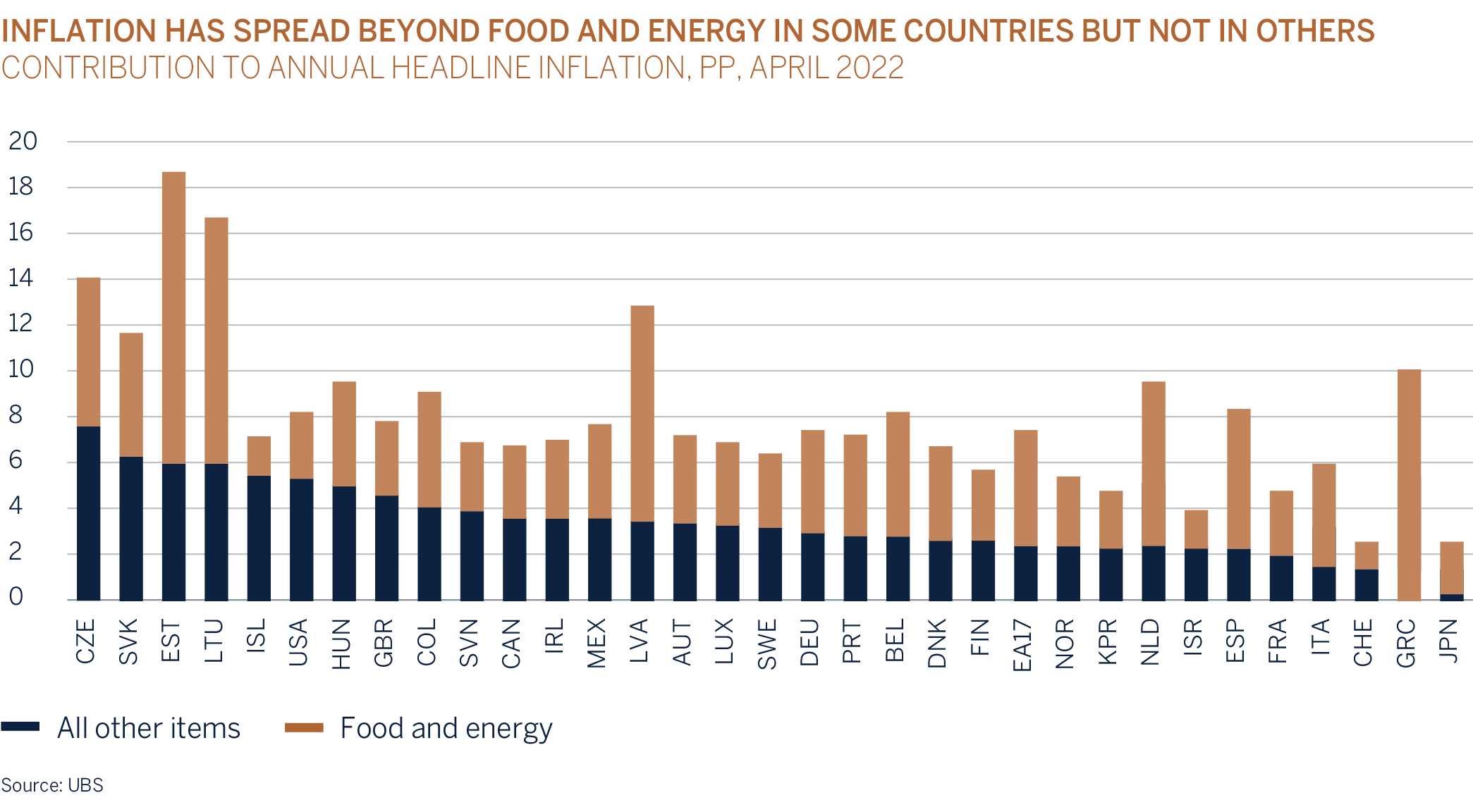

Liquidity is the lifeline for global economies and investment markets. Aggressive monetary easing from global central banks alongside unprecedented fiscal expansion played an important role in stimulating economic growth since the onset of COVID-19 and post the Global Financial Crisis of 2008. But this liquidity combined with consumer pentup demand, supply chain bottlenecks, rapidly increasing energy and food prices (linked to the ongoing war in Ukraine) and tight labour markets have coincided to release the inflation genie for the first time since the early 1980’s. Central banks have recently made their intentions clear and will do “whatever it takes” to bring inflation under control and regain credibility by implementing synchronised hikes in interest rates (monetary tightening) to slow demand. Investors have reacted to this reality and are positioning themselves for the increased risk that central banks, who correctly deem inflation to be more of a long-term evil than a short-term detraction, will cause a widespread economic contraction by hiking interest rates too aggressively. Outside of the US Dollar, which has appreciated by some 17% on a general value basis, there have been few places to shelter this year with both global equity and bond markets down significantly, having reached new lows at the end of the third quarter.

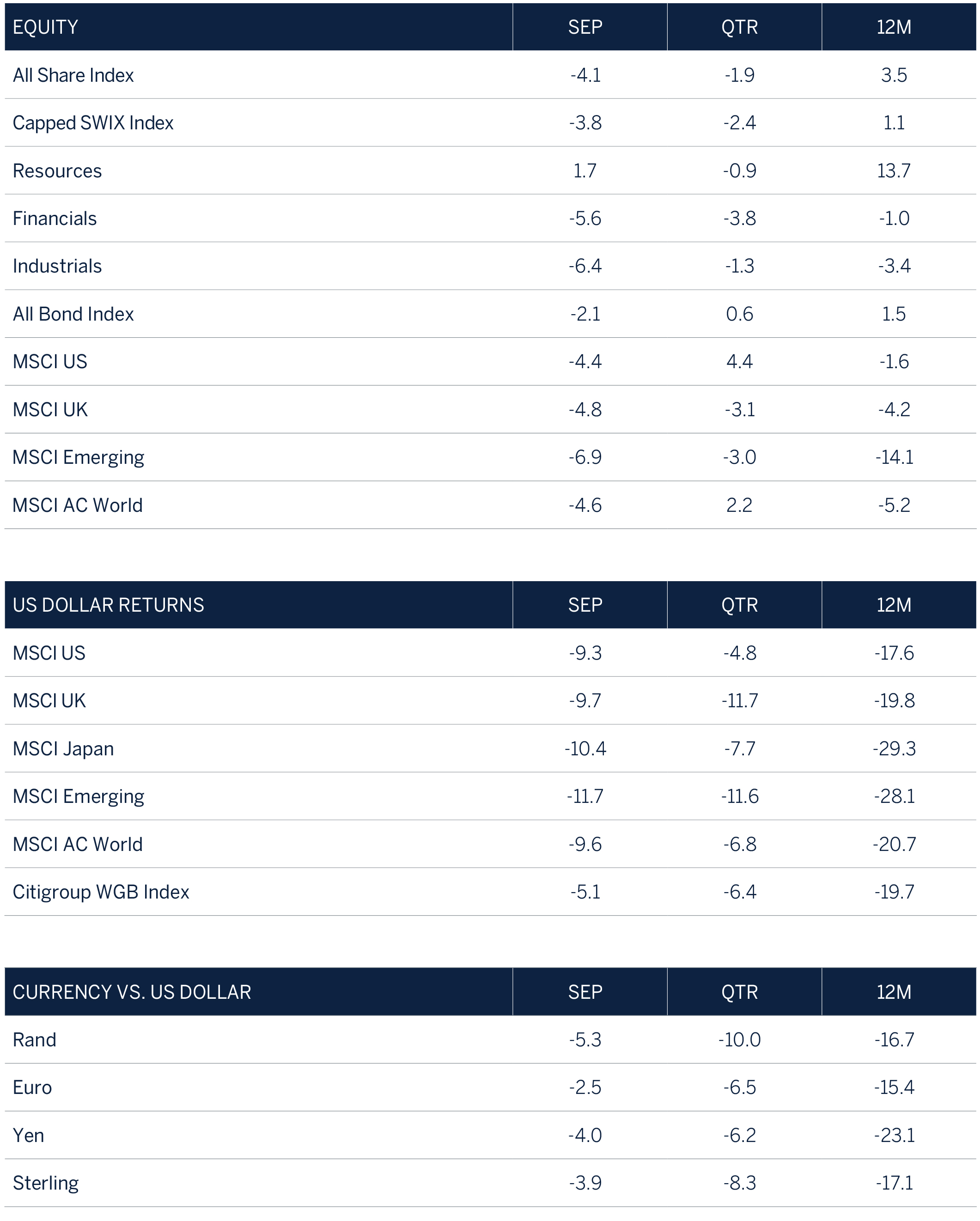

South African investment markets were dragged along by the volatility in global markets. At the end of September cash was the only asset class that managed to squeeze out a positive return, while the FTSE JSE All Share Index returned -10%, and domestic bonds produced a negative return of -1.3% as yields increased in sympathy with global bonds. Favourable valuations have resulted in South African assets outperforming global markets and we would expect this trend to continue in the near term. On a forward price to earnings multiple of 8 times, the South African Equity market is trading on its lowest valuation since the Global Financial Crisis, i.e. a lot of bad news is already discounted in share prices given the weakening global economic backdrop and the country’s inability to produce economic growth that is high enough to make a dent in SA’s unemployment challenge and to make it attractive for foreigners to commit long term capital to investment opportunities. The increasing bout of load shedding coupled with higher interest rates will unfortunately have a dampening effect on growth, will result in an increase in the cost of doing business and in turn, lower confidence in the near to medium term. Over the longer term it is crucial that President Ramaphosa pushes through with his structural reforms. The successful implementation of the “energy action plan” is of paramount importance to the economy. These types of initiatives and an improvement in basic service delivery can make a significant difference to the outlook of economic activity through the immediate benefit and spin-offs across various sectors from fixed investment projects backed by the private sector. In addition and perhaps more importantly, it also clears the way for a higher and more sustainable growth in future.

Cabinet in a scramble to avoid grey listing

South Africa needs to urgently tackle systemic rot in law enforcement institutions if it wants to avoid being put on the global financial crimes watchdog’s so-called “grey list”. South Africa has until the end of this month to show the Paris-based Financial Action Task Force (FATF) that it is overcoming what the body flagged as insufficient money laundering and anti-terrorism financing controls. If South Africa fails to convince the body, of the progress made, at its October 2022 meeting, the country could be added to the watchlist of what FATF calls “jurisdictions under increased monitoring”. The FATF warned the South African government in October 2021 that slow progress in investigating and prosecuting state capture allegations and recovering looted assets, counted against it, and noted that “significant gaps in financial intelligence existed”. The watchdog is due to make its final decision in February 2023.

In response and in an effort to avert this eventuality, the South African government led by the National Treasury has sent a litany of legislative bills to Parliament to address gaps and concerns raised by FATF. Some of the bills that the cabinet has approved, and the responsible ministers tabled before Parliament are the following:

- The General Laws (Anti-Money Laundering and Combating Terrorism Financing) Amendment Bill. This bill seeks to address deficiencies in at least fourteen of the twenty recommendations, including an appropriate enhancement of powers and procedures for regulatory authorities

The Protection of Constitutional Democracy against Terrorist and Related Activities Amendment Bill

The Minister of Justice and Correctional Services, speaking in an investor forum recently said his department had taken a number of steps to address FATF concerns. Some of these steps were the following:

The creation of the Anti-Money Laundering (AML) Desk within the National Prosecuting Authority (NPA). The desk has formulated an Anti-Money Laundering Desk Strategy, which covers the investigation and prosecution of money laundering and terrorist financing

The NPA’s International Cooperation Unit’s processes have been improved in respect of referrals relating to foreign predicate offences. Staff capacity has been increased at head office

Mutual Legal Assistance (MLA) requests on state capture investigations were made to several countries in 2018. These countries include the USA, the UAE, India, Canada, the Netherlands, and China

The Asset Forfeiture Unit has, since 19 November 2019, pursued cases of foreign predicate offending relating to charges of fraud, which is one of the focus areas in terms of South Africa’s risk assessment.

How do we expect this to play out?

Government in its haste to avert being included in the grey list, may trip over some of the suggested recommendations and find itself being included in the list, come February 2023. Of course this will have negative consequences for the country and some of these may include:

Raising government’s borrowing costs with bond yields remaining elevated despite the expected deceleration in inflation due to tighter monetary policy and the easing of supply bottlenecks

Being included in the list could weaken the country’s reputation and bring into question the country’s commitment to governance reforms. This could eventually place SA's sovereign rating, which stands at 'BB-' foreign currency and 'BB' local currency, at risk. We however do not think the country’s sovereign ratings are at risk at this stage

We concur with S&P’s view that the adoption of international best practises by the South African Reserve Bank (SARB) should translate into sound governance at South African banks and therefore the impact should be muted in this sector

We expect the impact on portfolio capital flows because of the listing to be low. South Africa has deep domestic capital markets with most debt issued in local currency and held by local investors. The negative foreign sentiment brought on by the listing should be offset by liquidity stemming from the domestic market

However, the impact on State Owned Entities (SOE’s) could be negative as some of these companies rely on international banks and capital markets for parts of their large funding requirements.

Should South Africa be grey listed in February 2023 as it is most likely to be, we believe the listing, just like Mauritius’, will be short lived. Mauritius was grey listed in February 2020 and exited the watch list in October 2021 after having addressed the concerns FATF had pertaining to Anti Money Laundering and Combating of Terrorism Financing regimes. South Africa to its credit has demonstrated, albeit late, its commitment to addressing the concerns FATF has raised with the Pretoria administration and it is for this reason that we believe that the country will likely follow the Mauritian trajectory as far as grey listing is concerned.

Dealing with the global inflation dilemma

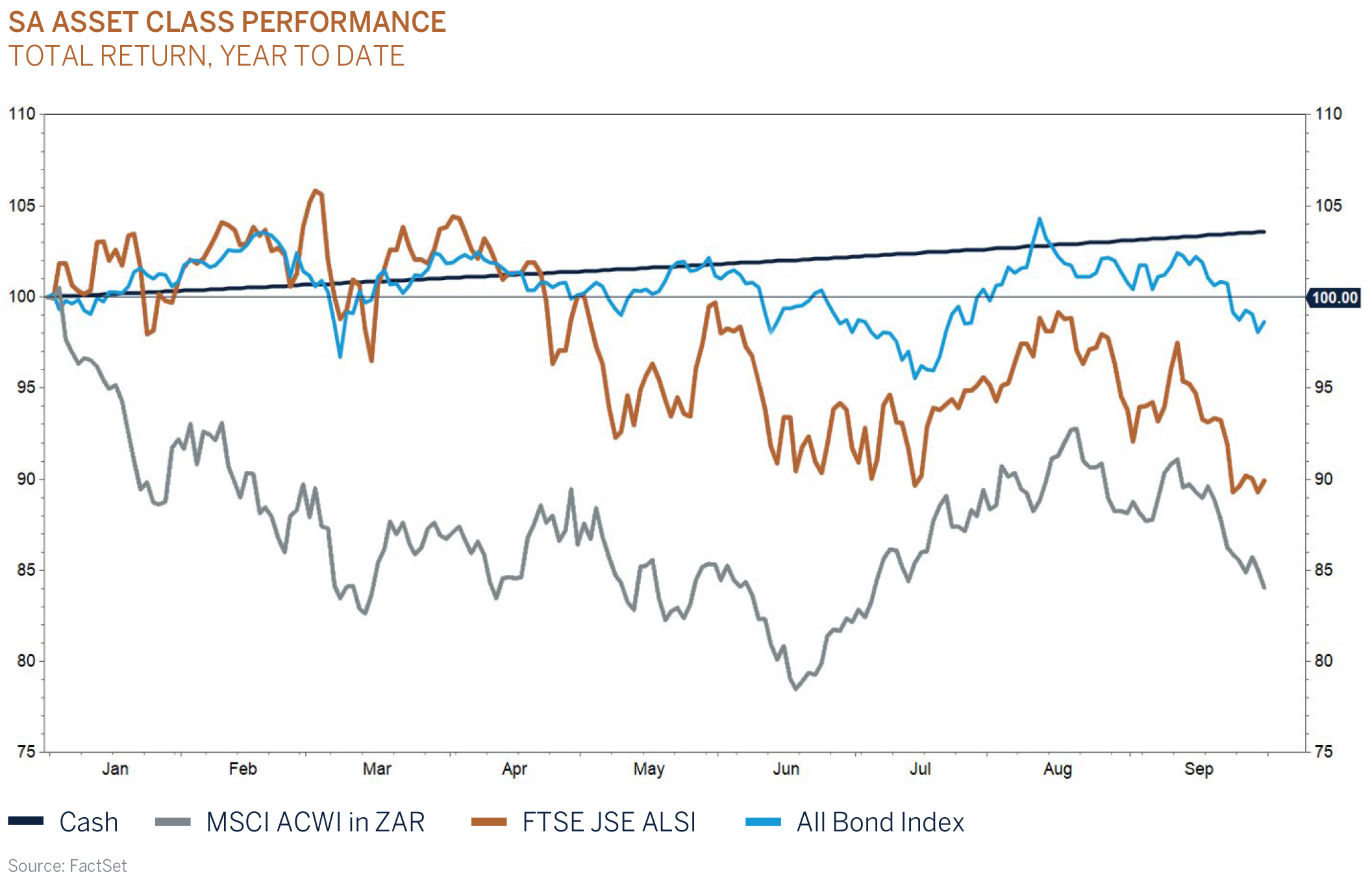

The prospect of high (or above central bank target level) inflation has had many false dawns over recent years but has been kept in check by global trends, such as, the price competition side-effects of globalisation and productivity led technology efficiencies. Numerous warnings about the perils of ‘letting the inflation genie out of the bottle’ due to excessive liquidity/monetary supply (think historically low interest rates and quantitative easing), remained unfounded, until now that is. Perhaps the inflationary storm was already circling before COVID-19, but the actions by central banks to safeguard economies throughout the pandemic certainly threw fuel on the fire. Cautions about rampant money supply exceeding GDP by almost unimaginable multiples went largely unheard as markets continued to dismiss inflation fears as something resigned to the 1980’s. Of course, not all blame can be imparted on central banks, if they hadn’t acted so forcefully and generously the public uproar would have been unprecedented and global growth would have struggled to rebound from the confines of lockdowns. Other factors played their part in creating the perfect storm for inflation to return with a vengeance. Firstly, lockdowns in Asian export economies, especially China, severely impacted global supply chains. Whilst in Europe, BREXIT has also hampered supply chains and increased costs at a time when there was significant appetite to spend, and the centuries old ‘supply versus demand’ equation went full tilt. Secondly, Europe’s dependence on Russian energy supplies quickly became a serious issue in the wake of the war in Ukraine. In conclusion, a multitude of factors combined to create the current inflationary headache and easing the pain will not be without its challenges.

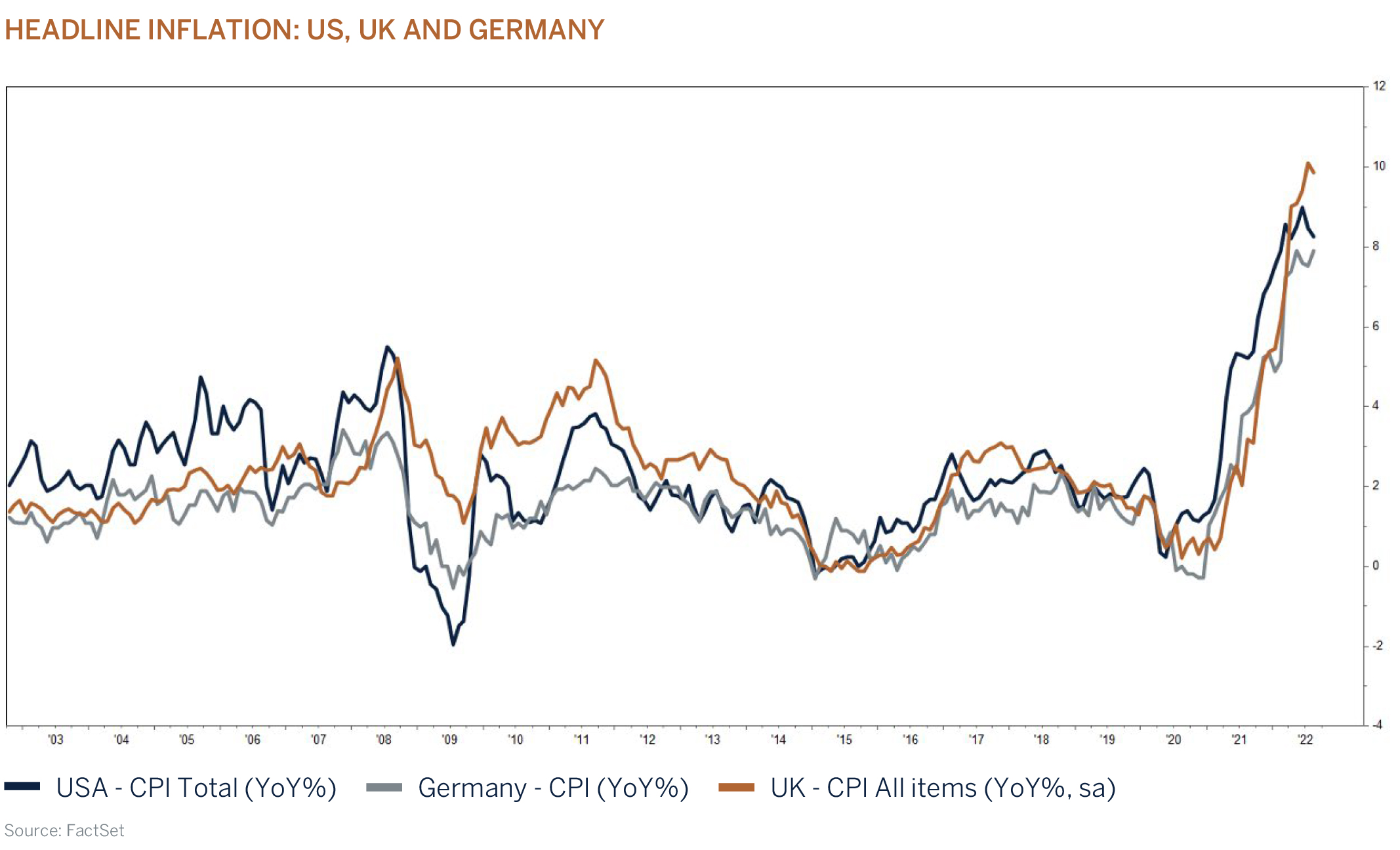

HEADLINE INFLATION: US, UK AND GERMANY

Global central banks are now faced with an unenviable balancing act of rapidly withdrawing liquidity whilst imparting the least amount of economic damage, an extremely challenging process with a questionable past. Virtually all have made it very clear that lowering inflation is ‘priority no.1’ and if the price to pay is slower growth or a recession, so be it. Global interest rates are rising quickly and ‘hawkishness’ only seems to be intensifying as each central bank meeting passes. Tighter monetary policy has scant effect on supply chain issues or Putin, but it can combine with the ‘pinch’ of higher inflation to lower demand, thereby interrupting the cycle. The only issue here is that it remains unknown by how much demand will have to be destroyed before inflation slips. Will central banks over-tighten monetary policy, engineering a lasting bout of stagflation? Currently, whilst there are signs of annualised headline (inc. food and energy) inflation easing, core inflation is exhibiting no signs of abating as services remain strong. As long as this persists, central banks will continue to spout hawkish rhetoric in an effort to rein in consumer spending.

Only time will tell if there is a favourable outcome to this inflationary saga. It is clear that global bond markets continue to price-in even higher interest rates and are currently turning a blind eye to the economically damaging after-effects. To be clear, we do not believe interest rates are returning to the lofty levels of the 1980’s but there is still more to go. Until inflation readings begin to exhibit evidence of a sustained turnaround, central banks have little choice but to remain hostile after many years of over generosity. Some of this hostility is likely to come in the form of ‘verbal’ communications warning of higher terminal rates that in fact may or may not come to fruition. We remain optimistic that a combination of restrictive monetary policy, the negative feedback loop of higher inflation itself (reduction in affordability) and rolling base effects will have ‘an effect’ in the coming months. Is inflation on a rapid path back to central bank target levels (circa 2%)? We think not but history has taught us markets will undoubtedly breathe a sigh of relief when we are out of the eye of the storm and inflation numbers are again simply heading lower, something we expect to see within the next 3-6 months.

Conclusion

The scale of the recent sell-off indicates that a recession is increasingly being priced in, but investors should expect the current bout of volatility to continue until inflation is seen to be moderating. Fiscal stimulus may assist households and companies to deal with worryingly higher energy prices in the short term, but the associated increase in interest rates that are sure to follow may turn out to be more costly as the world economy enters the next cyclical downturn with implications for South Africa’s growth outlook.

The correction in investment markets is starting to provide opportunities for patient investors. Bond yields are back to the levels last experienced in 2008 and are offering attractive long-term inflation adjusted returns and equity market valuations are starting to discount a worse than expected outlook for company profits over the next year. In addition, investors have already adjusted their equity and cash allocations to 2020 levels, i.e. positioning for the worst. An improvement in the outlook for inflation is sure to provide an underpin to risk assets from the current levels and could result in investment markets reaching the next inflection point as we move from the current phase of “despair” to “hope” - a period which has historically generated the greatest returns for equity investors and over a relatively short period of time. And, while the world economy is entering a more challenging period and geopolitical risks remain heightened, it is important to note the strength of corporate, financial sector and household balance sheets during this cycle, which will help to weather the storm.

At Melville Douglas we believe that our proven investment philosophy of investing in quality businesses with strong balance sheets and secular growth drivers will once again provide the necessary underpin in portfolios.

Asset Allocation

The very strong US Dollar and rapidly increasing interest rates have resulted in cyclical and long dated growth assets, such as information technology, emerging markets and mining shares experiencing the brunt of the pain during the third quarter of 2022. Europe also remains one of the worst performing equity markets this year, given the challenges associated with the war in Ukraine. Gas and oil supply into the region remains a risk and the significant increase in the cost of energy will be a substantial headwind to household balance sheets and company profit margins. However, fiscal support measures (lower taxes and energy subsidies) introduced by governments to combat the higher cost of living and doing business will alleviate some of the nearterm pain, while at the same time drive sustainable longterm growth through investment initiatives such as the renewed focus on expanding renewable energy generation capacity. The question of course is, will these fiscal stimulus measures announced in countries such as the UK result in even stickier inflation which will most likely be accompanied by even higher interest rates and an increased risk of a recession down the line? In our opinion increased central bank policy error risks continue to translate into a need for balance in portfolios.

As we navigate through these trying times, we will continue to invest in quality companies with strong balance sheets and structural growth drivers that are less sensitive to the economic cycle. From an asset allocation perspective, we remain overweight SA Equity and domestic bonds given the attractive valuations/yields on offer. For clients with global mandates, we are neutral global equities and underweight developed market bonds but will be looking to increase the exposure to neutral should yields tick up from current levels.

Global Equity – Neutral

After a strong start to the third quarter, global equity markets sold off aggressively as the outlook for interest rates became increasingly hawkish and as geopolitical risks in Europe increased. Policy error (monetary, fiscal and political) has perhaps become the largest risk for investors, with recent examples including the “leaking” of the Nord Stream gas pipeline and fiscal developments in the UK. Higher interest rates impact equity valuations in two ways. The first being its impact on valuations as the discount rate adjusts higher and the second, what the change in interest rates means for global growth. A slowdown in global growth tends to tighten financial conditions and result in higher volatility as the outcome for company earnings becomes less certain. In addition, a worsening global economic backdrop affects the likelihood of shocks as well as the vulnerability to negative spillovers and explains why risk assets have sold off so extensively this year.

We do not expect volatility to ease much in the near term. Earnings revisions have turned negative, and the full impact of higher interest rates will only be felt next year. Equity markets are forward looking and have already adjusted, while positioning by asset managers has turned decisively negative with cash and equity holdings back to 2020’s pandemic crisis levels, i.e. a lot of bad news has already been discounted. Investors will do well to focus on the long-term fundamental drivers of companies and not be influenced by the daily vagaries of the stock market. We view risk as the permanent loss of capital, not volatility. Over the long term, share prices do revert to their intrinsic value and at current valuations many shares are once again offering good value – be greedy when everyone else is fearful. While we cannot profess to know exactly when equity markets will turn, history has proven time and time again that the initial phase of a cyclical recovery generates the highest returns for investors, and to try and “time the market” from the current depressed levels can be both risky and expensive. We prefer to hold our nerve and exercise patience during periods of extreme volatility. At Melville Douglas we believe that our proven investment philosophy of investing in quality businesses with strong balance sheets and secular growth drivers will once again provide the necessary underpin in portfolios and remain neutral the asset class.

South African Equity – Overweight

The South African stock market couldn’t escape the vagaries in global markets this year. A combination of higher interest rates, inflation and growth concerns resulted in the domestic equity market (All Share Index) falling by another 2% during the third quarter. Interestingly enough, it wasn’t Resources that dragged the local bourse lower, but the Financial and Industrial sector. Resources tend to underperform when global growth concerns surface and/ or during periods of USD strength. Load shedding in South Africa intensified during the quarter and together with a hawkish Reserve Bank resulted in a derating of domestic shares that are exposed to the fortunes of South Africa, such as Banks, Insurance companies and Retailers.

The South African equity market is trading on depressed valuation multiples. Understandably given the global backdrop and that the world has entered the next downtrend in the global business and economic cycle. Although the South African economy will not be completely insulated from global economic and geopolitical developments, the country doesn’t face the same inflation challenges, which means that that while higher interest rates will put the brakes on economic growth, the domestic economy is not expected to enter a (deep) recession as the interest rate “shock” to the economy will be less significant than developed economies where interest rates are increasing at a very fast rate and from unprecedented low levels. Debt levels across households and corporates are still very much contained in South Africa and there are no signs of excesses and/or inflated valuations across asset classes in the economy. The medium-term outlook for earnings growth remains reasonable at around 10% as the economy and companies recover from the lows during the pandemic. In line with our commentary on global equities, we would expect volatility to continue in the near term until interest rates have peaked and/or global growth has stabilised. But given how attractive the local market is (cheapest since the Global Financial Crisis), we intend to stay the course by patiently staying slightly overweight the asset class while receiving attractive dividend cash flows in the meantime. Valuations do matter and we believe that patience will be rewarded, as it always does in the end.

Global Fixed Income – Underweight

The rout in global government bond markets continued unabated in the third quarter with yields rising sharply in reaction to ongoing extreme inflationary pressures and therefore, increasingly ‘hawkish’ central banks. Earlier hopes that weakening economic data would convince central banks to adopt less aggressive tightening cycles had cold water thrown on it in July when the US Federal Reserve committed to ‘do whatever it takes’ to bring inflation back in line. This monetary policy mantra has been quickly adopted on a global scale and interest rate expectations continue to climb despite the clear negative ramifications for future economic growth conditions as lowering inflation has become overwhelmingly more important than achieving a ‘soft landing’. Having become accustomed to the luxury of predictable central bank ‘forward guidance’ and the absence of inflationary pressures for many years, global bond markets are now contending with heightened uncertainty on both fronts and their reaction has been distinctly negative.

US government bonds suffered further losses in the quarter with 10-year yields rising over 80 basis points to 3.83%. The US Federal Reserve (Fed) is battling the highest inflation in nearly forty years and has acknowledged that a slowdown in economic growth conditions and a rise in unemployment are prices worth paying to ease rampant price pressures. Five interest rate hikes have now been sanctioned this year with the last three being 75 basis point moves and the tightening phase is not over yet. At the end of the quarter global bonds yields are back and, in some instances, higher to the levels reached in June. Despite an improvement in expected returns, bond yields are expected to continue to rise in sympathy with higher policy interest rates. At current prices, cash and short dated bonds are preferred over longer dated bonds, but we would be looking to increase the allocation to the asset class should yields rise further.

Domestic Fixed Income - Overweight

South African bond yields have been following global bond yields higher this year. Given attractive starting yields, domestic bonds have sold off much less than their developed market peers. Government’s debt profile has surprised positively this year as government remained committed to prudent fiscal management and tax revenues have been much stronger than expected. International credit rating agencies have given SA the thumbs up by revising government’s sovereign credit rating outlook higher by one notch. Although it is too early to celebrate, it does signal an improvement in confidence towards SA and perhaps a lower risk premium in future. The domestic fixed income market is not immune to developments in global bond markets but given the attractive starting income yields in both nominal and inflation adjusted terms, we would expect returns to be well above cash over the medium term.

Cash - Underweight

Domestic Equity

| Basic Materials | Underweight |

| Industrials | Overweight |

| Consumer Staples | Overweight |

| Healthcare | Overweight |

| Consumer Discretionary | Underweight |

| Telecommunication | Overweight |

| Technology | Overweight |

| Financial Services | Underweight |

South African Equity declined 2.4% in the third quarter of 2022, as measured by the FTSE/JSE Capped Swix Index. The index is now down 7% for the first 9 months of this year. South African Equity has held up well in 2022 relative to Global Equity. When measured in USD, SA Equity is down 17.4% against Emerging Market Equity and Developed Market Equity which is down 27.2% and 25.6% for the year to September respectively. This is most likely driven by the fact that SA Equity was far better value than Global Equity at the start of the year.

Throughout the quarter, persistent high inflation globally took front and centre stage. Central banks in the most part became very hawkish and communicated the urgent need to address the issue. The Fed made very clear comments around the urgent need to bring inflation under control. They hiked rates as anticipated by 0.75% in September 2022, but the negative sentiment and reaction in capital markets was driven by the forward-looking comments on growth and the fact that growth will take a back seat while dealing with the current state of inflation. This took the wind out the sails of any prospects of a Fed pivot and an economic soft landing, despite the strong employment numbers that the US currently enjoys.

Europe too have had to act against inflation caused by energy bills which are hampering the cost of living for citizens. The interest rate hikes in Europe come with a backdrop of weak growth and will therefore cause far deeper and serious consequences for the region. The United Kingdom is in a similar position to the rest of Europe. They however have made some politically driven fiscal statements that are in stark contrast to interest rate tightening which caused a crisis in the Sterling currency and bond markets which forced the BoE to step in and be a buyer of last resort to limit the damage at a time when markets were already concerned about the economy.

Central banks and policy aimed at curbing inflation are now more important than ever and any missteps could lead to severe consequences in global economies and capital markets. The outcome has been extreme volatility in capital markets driven by macroeconomic news flow and Fed commentary.

South Africa continued to raise interest rates in line with the world during the quarter. Inflation appears to be more manageable in South Africa than the rest of the world as core inflation is sitting in the middle of the Reserve Bank’s range. Energy remains a strong contributor to inflation, and this will hopefully normalise as the oil price pulls back off the high base that was driven by the Eastern European conflict which began in February 2022.

Of more concern domestically was the record load shedding the economy experienced during the quarter with the coal fired power stations showing their age and poor design. This will have a severe impact on GDP and the consumer which will no doubt feed through into the country’s fiscal position and company earnings.

Consequently, domestic growth in South Africa will remain below the required level to meaningfully reduce unemployment and drive sustainable growth that domestic companies require to generate optimal returns on capital for the foreseeable future. South African Equity is trading on valuations that appear to be attractive in the global context despite the structural economic headwinds. Achieving a risk adjusted return may require a patient investor as equity generally struggles to rerate in rising interest rate environments. Starting to position portfolios to benefit over the long term at current prices looks attractive.

As we move through 2022 and into 2023, the base effects for earnings will become tougher. We have a positive outlook on South African Equities based on their valuations on an absolute and relative basis, but we will most likely not benefit from the valuations until the market becomes clear on the peak of interest rates, which could be another six months away.

Domestic Fixed Income

South Africa’s potential grey listing by the Financial Action Task Force (FATF), added to the volatility during the quarter.

In the second quarter the economy as measured by GDP, contracted by 0,7%, with the manufacturing sector being the largest detractor. This sector was negatively impacted by the floods experienced in KwaZulu Natal during this period. Furthermore, loadshedding also weighed heavily on economic activity during the quarter. Annual inflation rose to 7,6% y/y in August, a 0,2% decline from the previous month. Economists expect inflation to soften from these levels, given the recent decline in global energy and food prices. In an expected move, the South African Reserve Bank increased the repo rate by a further 75 basis points to 6,25% in its meeting in September 2022. The split in the voting by members of the monetary policy committee was however unexpected. Two members of the committee would have preferred a 100 basis points rise in interest rates. The SARB still considers risks to inflation to be tilted to the upside and emphasised the data dependence of future interest rate decisions. The central bank is still of the view that it is not ahead of the curve in its interest rate decisions. This is even though since November 2021, the bank has upwardly adjusted rates by a cumulative 275 basis points.

We believe that around current levels, inflation is peaking, and the monetary policy tightening cycle is near its peak. Given the hawkish rhetoric emanating from the central bank we are of the view that the bank will hike rates by a further 50 basis points in its last meeting of the year in November 2022. This should take the repo rate to 6,75% by year end and a further 50 basis points in 2023 before pausing. We expect volatility to persist, given the risks that are still on the table (geopolitical and fiscal) and believe it is best to be defensively positioned in such circumstances. We remain defensively positioned and are short duration relative to the All Bond Index and we will reassess our position as risk unwinds and some level of certainty returns.

Domestic Market Performance % / as at 30 Sept 2022