Quarterly Commentary: Q1 2022

View PDF versionNavigating through an environment of increased uncertainty

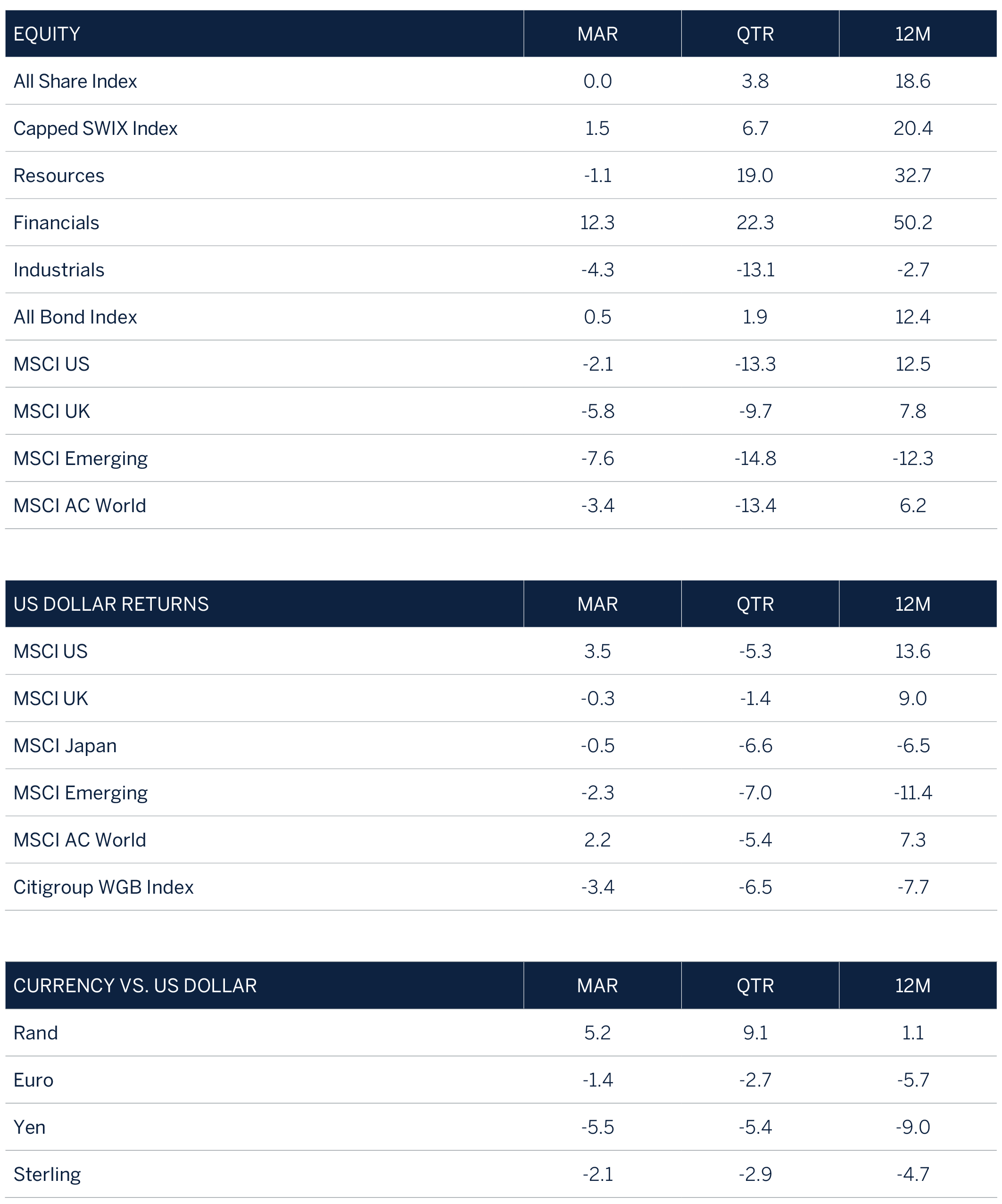

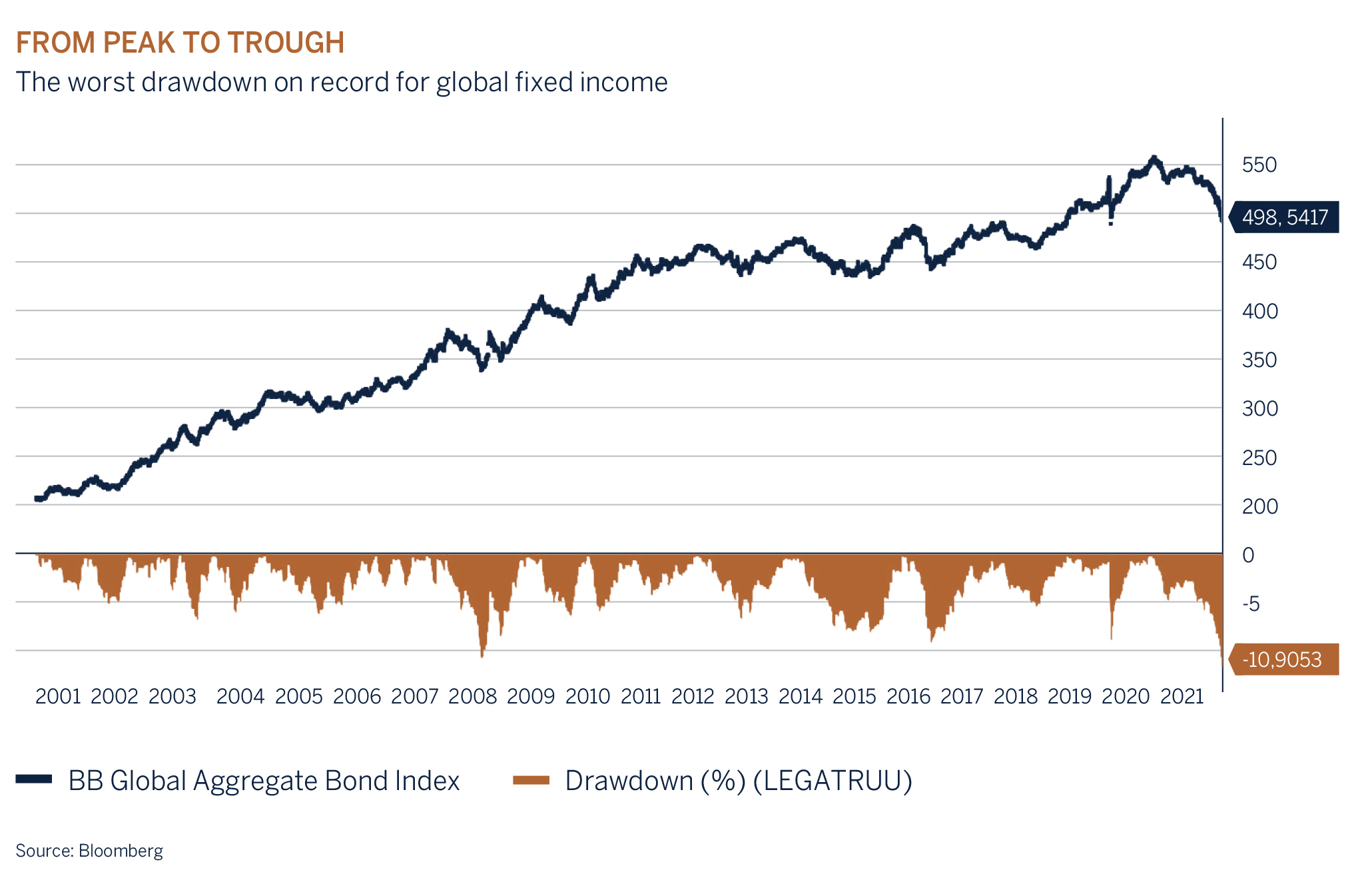

Following two years of strong returns from equity markets volatility set in during the first quarter of 2022 as the outlook for inflation, interest rates and global growth has deteriorated. The war in Ukraine coupled with the widespread sanctions imposed on Russia has only added to inflationary and economic growth fears as the prices of natural gas and crude oil soared on supply disruption concerns. As expected, global bond yields adjusted higher as prices fell, with investors starting to price in the reality of higher for longer inflation and a more rapid interest rate tightening cycle. At the same time corporate credit and emerging market sovereign spreads have widened to more ‘realistic’ levels on growth concerns, leaving yield hungry bond investors with significant losses. Global bonds have experienced their worst drawdown since 2002, falling -12% (peak to trough). That is significant given how low the starting income yields have been over the same period.

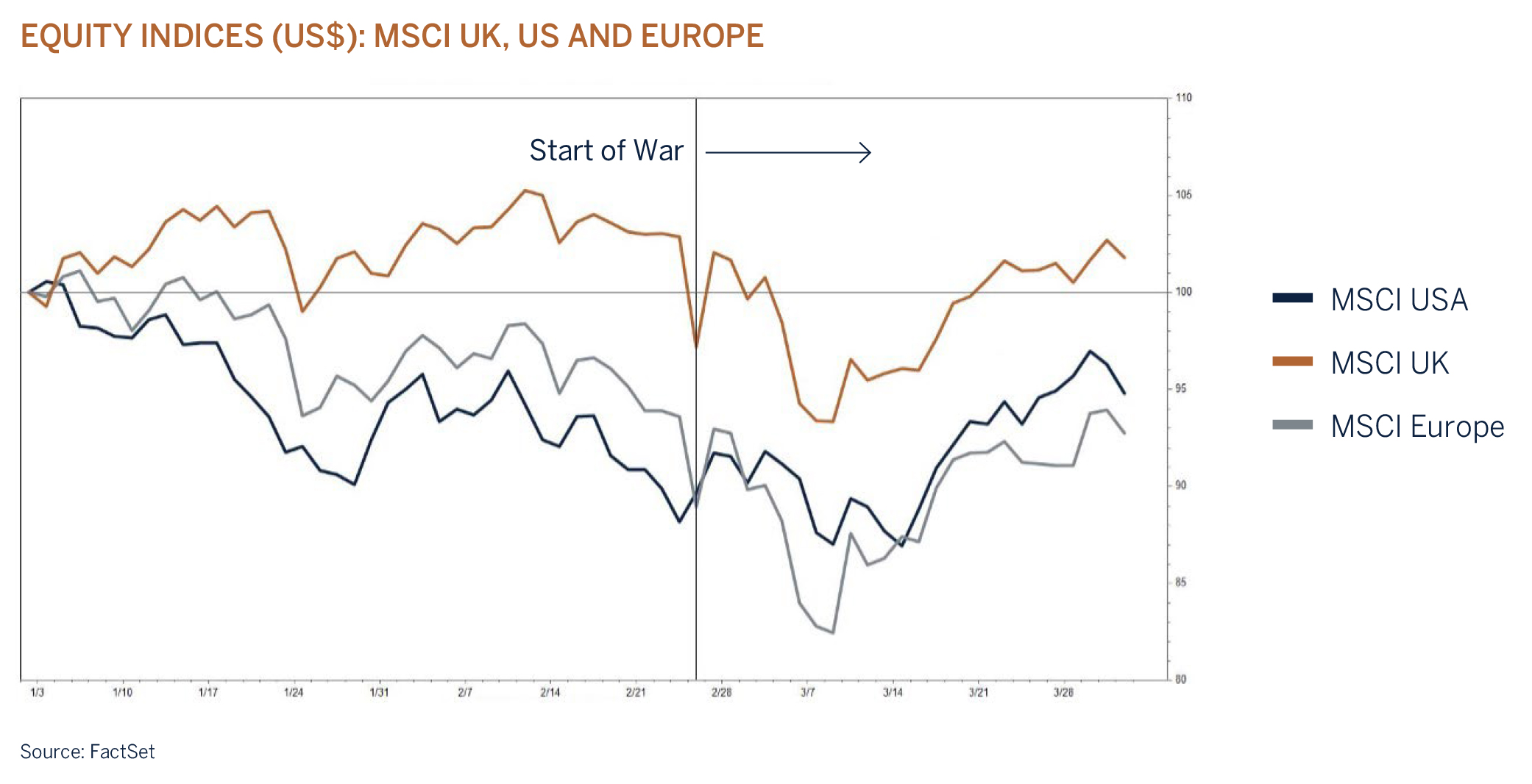

After a turbulent start to the year global equity markets gathered some composure to finish the quarter down -5% in USD terms and -2.5% in GBP, with energy the only sector to close the period in positive territory, surging over +20% as oil prices broke through $120 per barrel. Initially, equity market valuations adjusted to the change in the outlook for interest rates, but this was soon followed by fears of a possible invasion of Ukraine by Russian forces, which sadly became a reality and has resulted in one of the worst humanitarian crises in recent history. Equity markets did however behave exactly in line with previous episodes of heightened geopolitical tension and have rebounded strongly from their lows after the initial shock and further angst around the potential long-term implications of such an event on world stability and commodity prices. Although still very early days, history has taught us that the increase in volatility from geopolitical events tends to be short lived.

Although it is impossible to predict how long the military conflict and associated sanctions will continue for, a prolonged war would likely inflict significant harm to the global economy through higher inflation, reduced real disposable income for consumers/households and lower profit margins for many companies. This of course is in addition to the dreadful human suffering and loss of life. Europe’s economy which is heavily reliant on global trade and manufacturing will be directly exposed to the significant increases in energy costs and will be particularly vulnerable if Putin decides to retaliate by reducing or cutting off energy supply to the region. The latest fall in the German IFO Business Climate Index points to meaningful weakness ahead in Europe. As markets rebounded at the end of March, we have taken some risk off the table by reducing equity weightings in client portfolios, but we are cognisant that the global economy is fundamentally strong and still recovering from the loss of output caused by COVID-19. Employment is growing, households and corporate balance sheets are healthy, interest rates, although rising, are historically low and significant ‘re-opening’ pent-up demand exists as the world learns to live with COVID-19. In Europe, new fiscal support initiatives have been announced to offset some of the inflationary costs associated with the war and more is likely to follow, which will provide an element of underpin to economic activity when Europe needs it most.

Investors should however brace themselves for a period of increased volatility and lower returns as the valuation of asset classes adjusts to an environment of ongoing geopolitical uncertainty, higher interest rates and slower growth as central banks “will do what it takes” to fight inflation.

Central Banks Dilemma

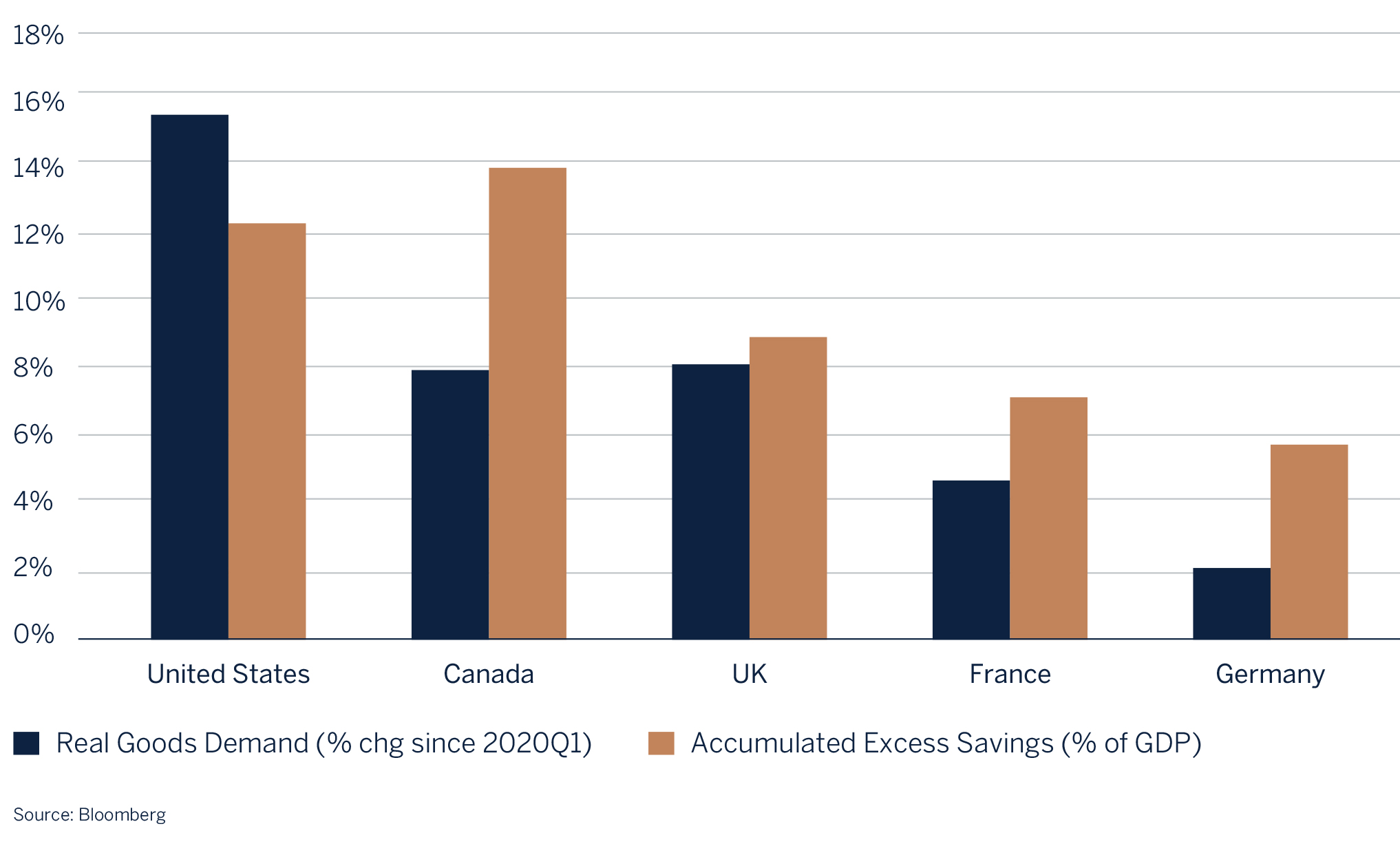

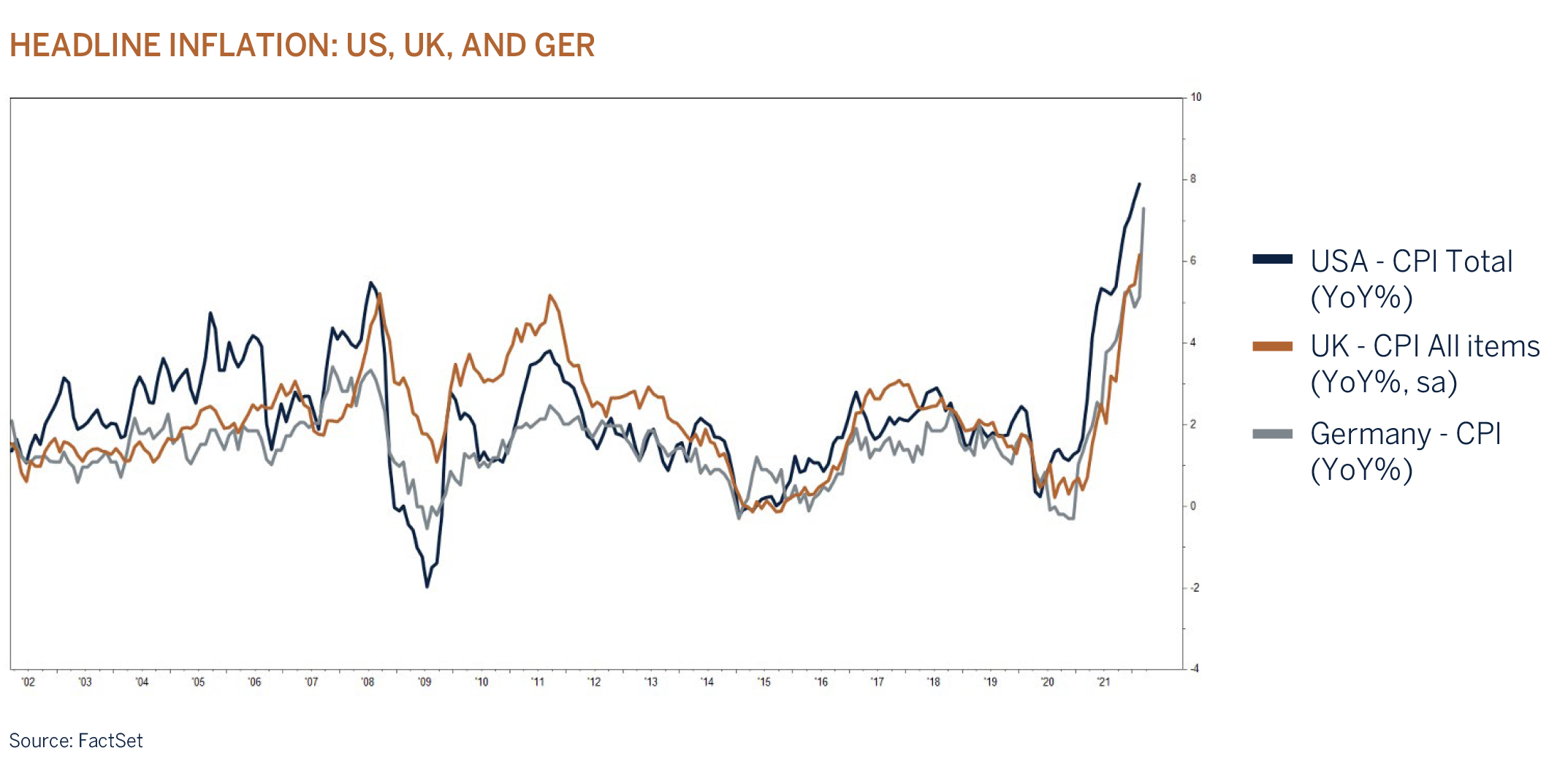

The combination of strong underlying demand, in part due to highly accommodative monetary policy (low interest rates) and reduced supply, which has been amplified by Russia’s invasion of Ukraine, has resulted in inflation reaching multi-decade highs in the developed world. Until recently, western world central banks have been patient in the face of an inflation spike that was viewed to be transitory. However, this has changed as the broadening of price pressures and labour shortages have increased inflation concerns. During the past three decades the global economy was regularly buffeted from geopolitical events that limited commodity supply and caused price spikes, but the current cycle is different as prolonged and broad based COVID-19 led supply disruptions, and now the Russia/Ukraine conflict, have also created more widespread core price pressures in labour and basic food stuffs.

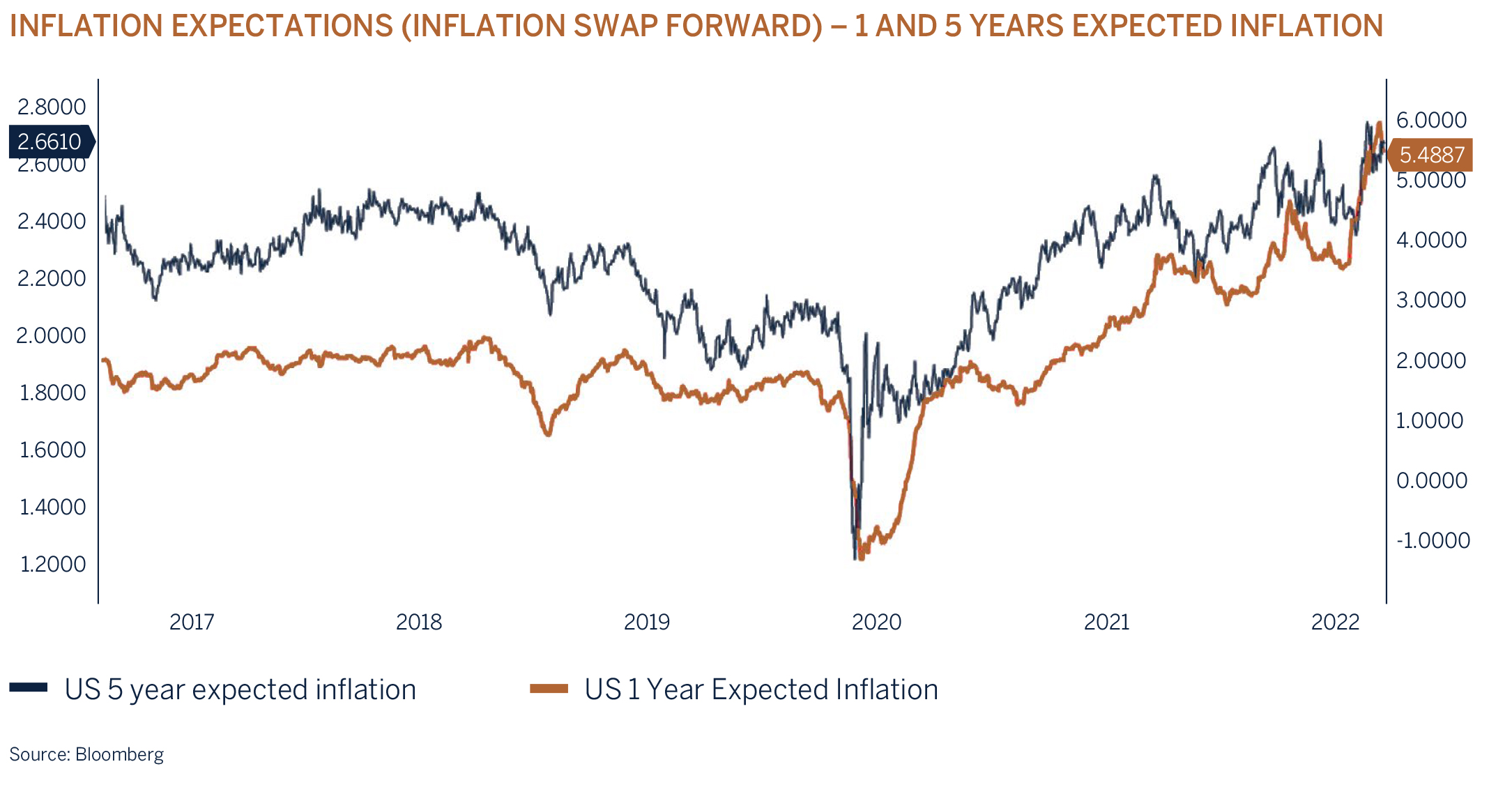

Understandably central banks have become markedly more hawkish and are raising interest rates to counter inflation. Inflation targeting (price stability) remains one of the key objectives for central banks as it is inflation that destroys wealth and real incomes. It is therefore vitally important for central banks to signal that they will do whatever it takes to ensure that high inflation is not sustained and to keep inflation expectations in check.

High and sustained inflation results in reduced disposable incomes, elevated interest rates, lower asset prices, and in turn decreased economic growth. As a result, both the US Federal Reserve and the Bank of England are guiding the market to sharper and quicker interest rate increases and at the same time quantitative tightening, which involves the shrinking of central banks’ balance sheets as they dispose of government and corporate bonds. Some of the effects of the withdrawal of easy monetary conditions are already evident in the US housing market where a significant (31%) increase in the cost of servicing mortgages has been a major contributor to moving the property affordability index back to levels last seen during 2007. In other words, a period of subpar growth might be required to contain inflation if it continues to overshoot.

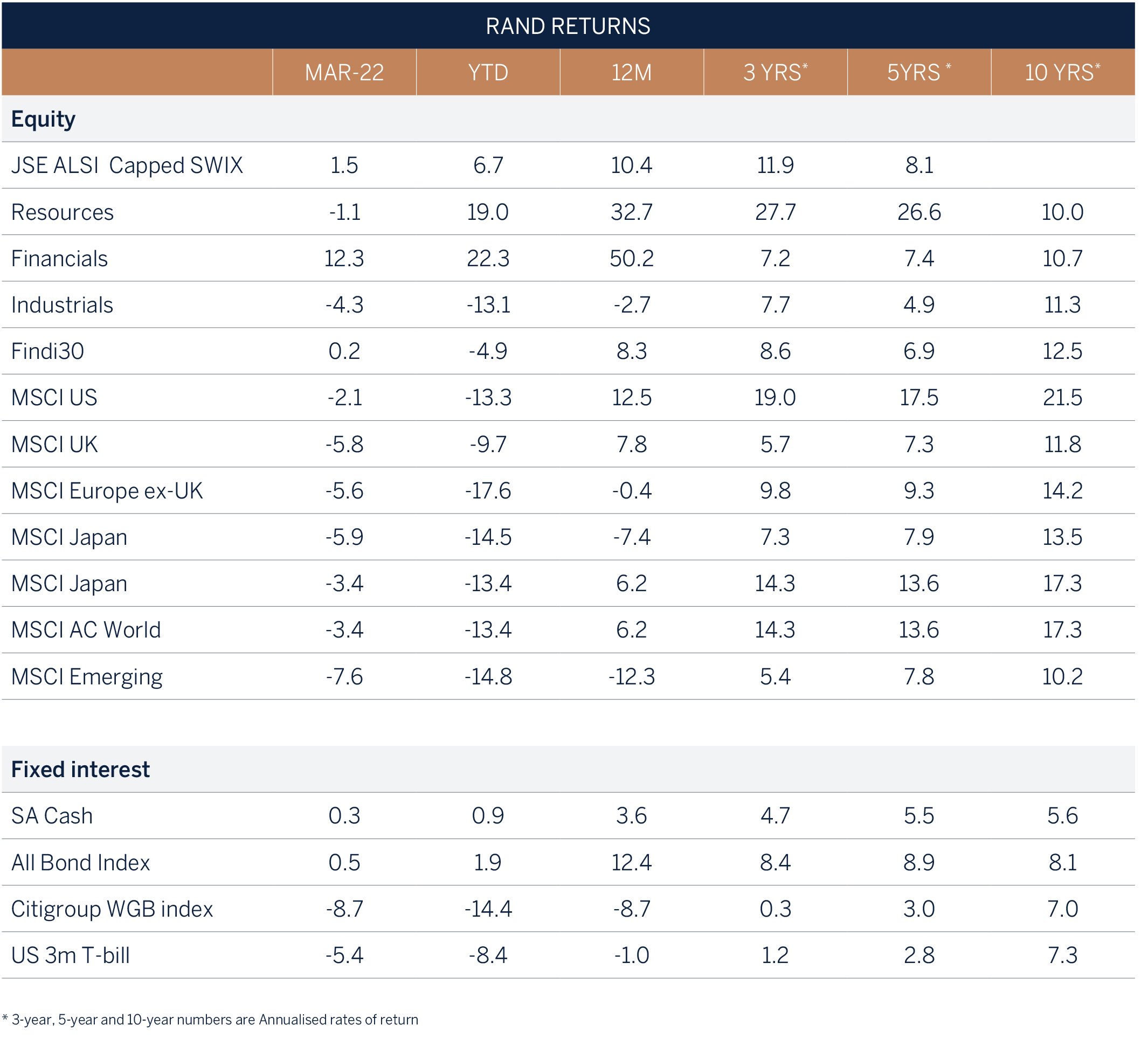

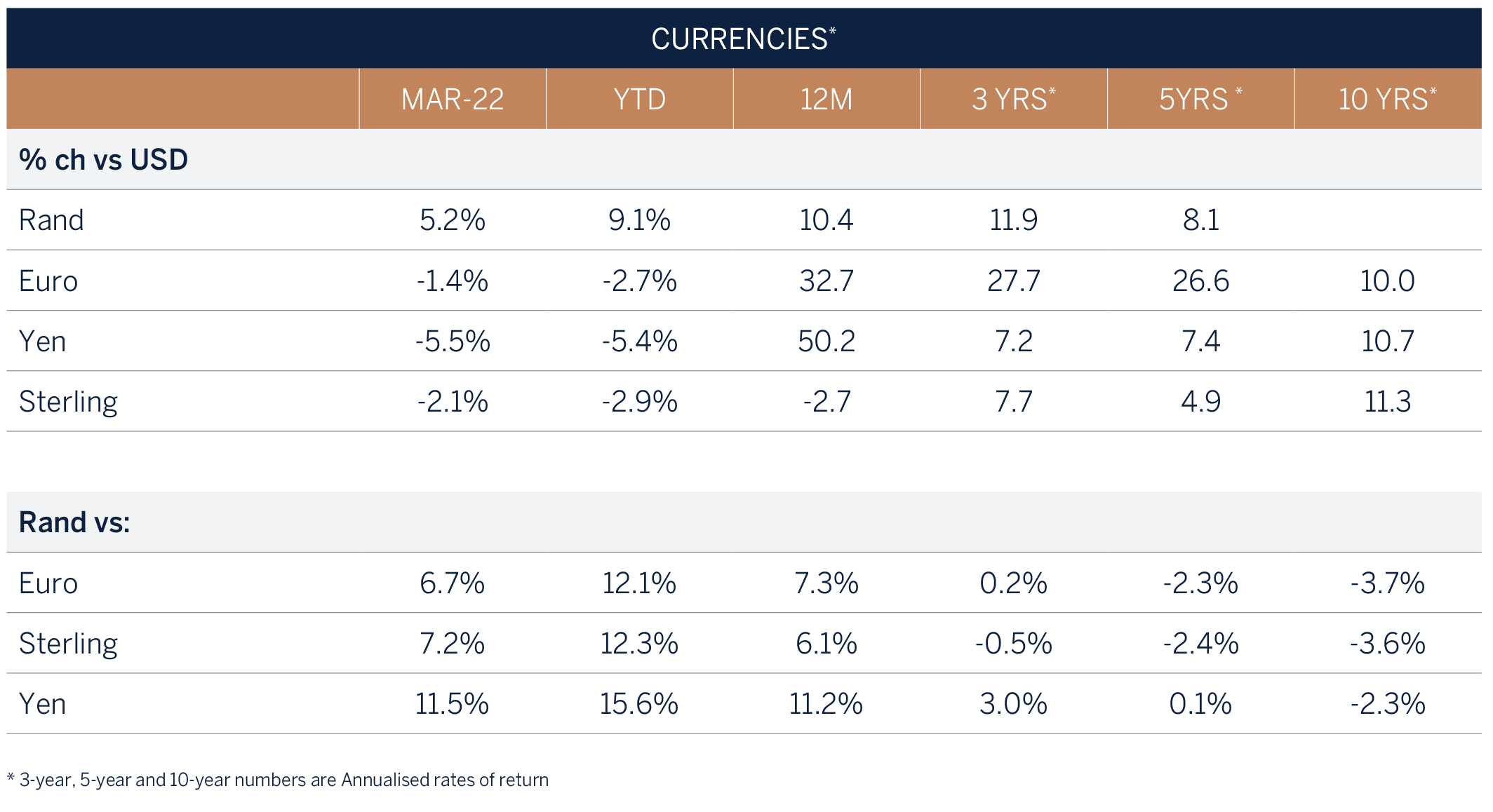

‘One man’s misery is another man’s fortune’

South African investors will be pleased with the returns of their domestic investments this year. In an environment filled with uncertainty local assets outperformed global assets significantly. To such an extent that during the first quarter the JSE ALSI Capped Swix Index has outperformed the MSCI ACWI by 20%, leaving SA equity returns 14% higher over a one-year period. The same is true for domestic cash and bonds, both of which have outperformed international bonds and the US greenback over every reporting period going back 10 years.

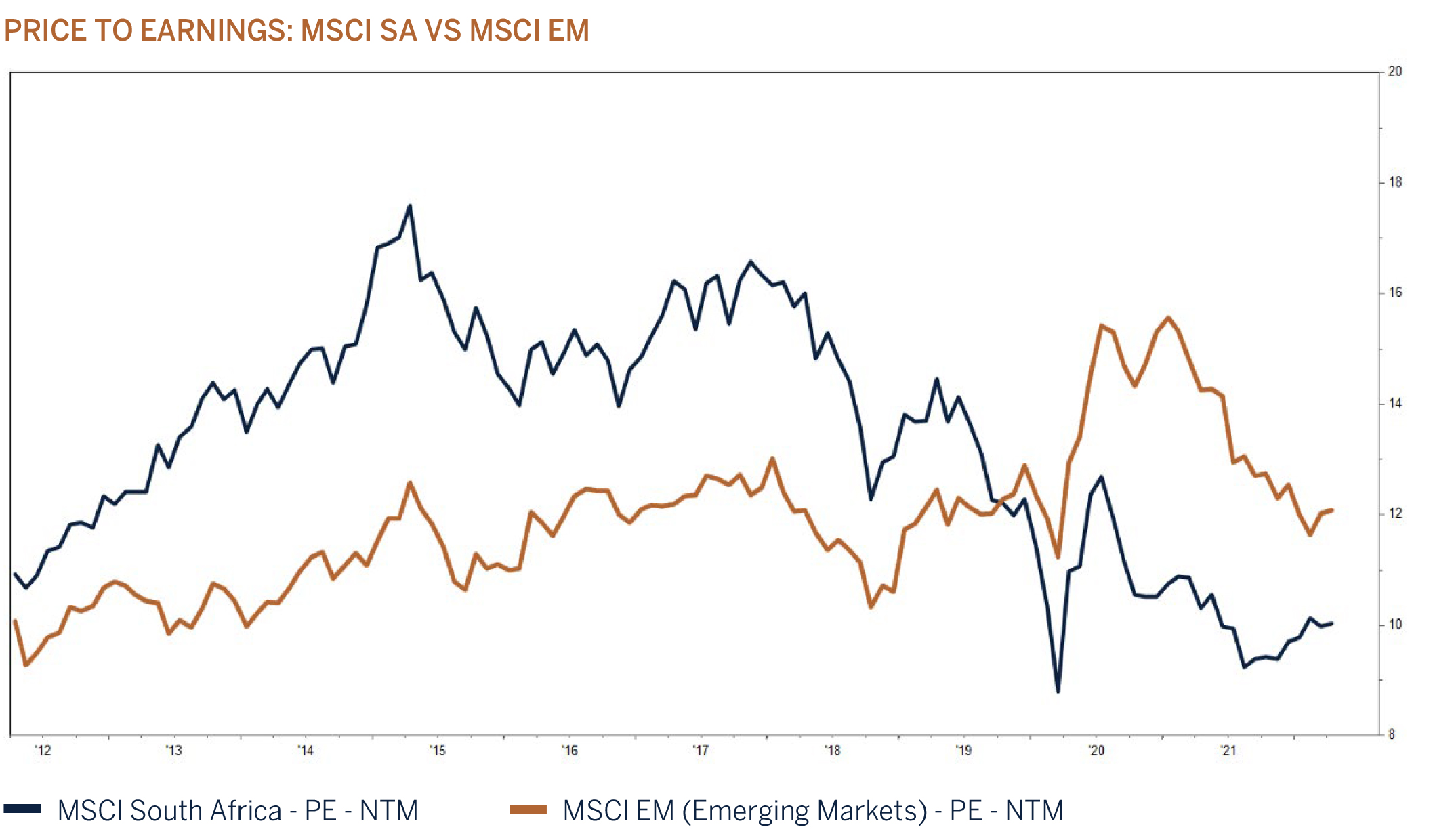

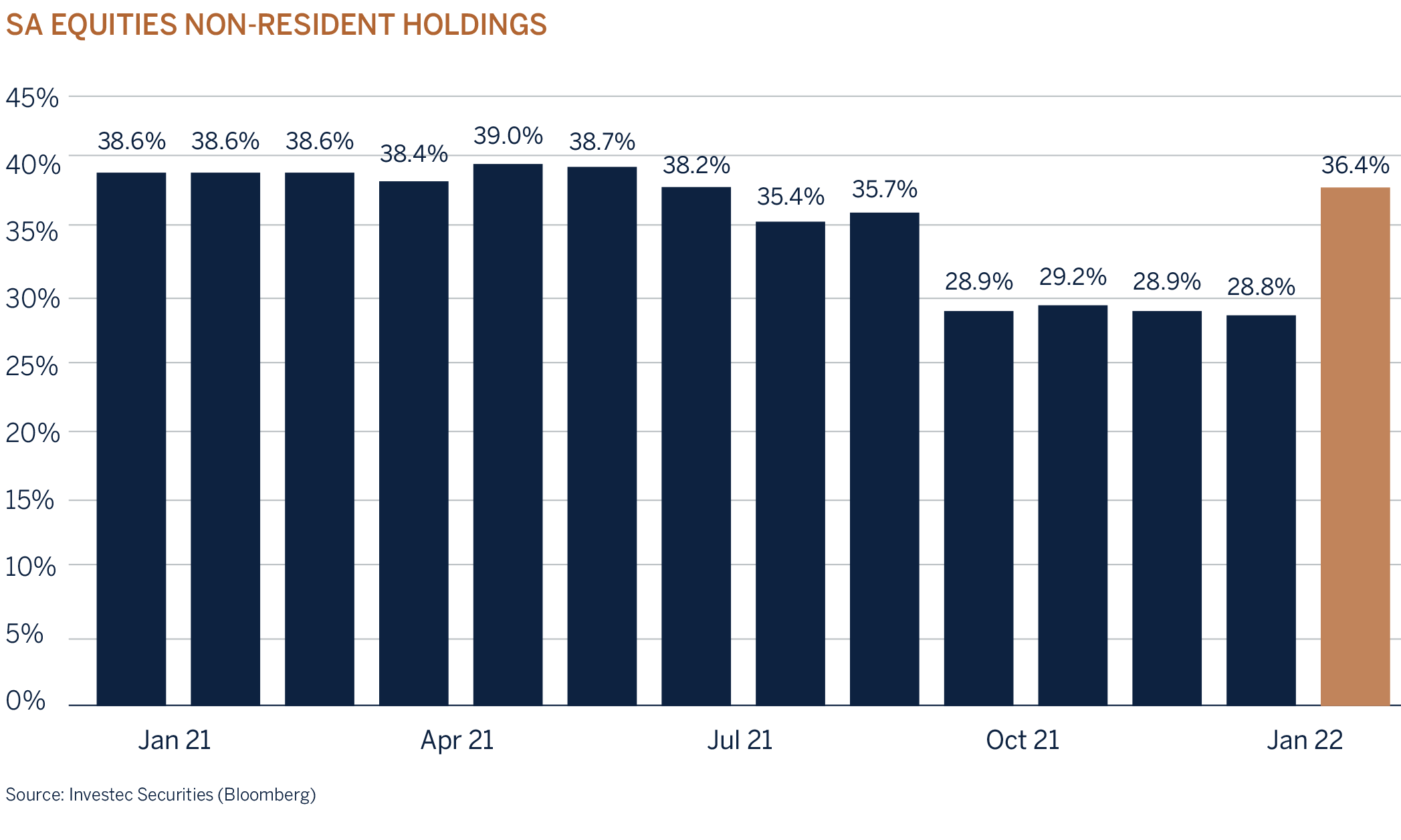

One should of course not ignore the positive contribution from the strong Rand this year, which has benefited from a very supportive terms of trade on the back of high export commodity prices. But for the first time in a while, South African listed shares have benefited from significant inflows by foreigners which has resulted in foreign ownership returning to pre-crisis levels. Favourable valuations (see chart below) and improving fundamentals relative to the Emerging Market (EM) peer group, combined with the unfortunate developments in countries such as Russia which has been removed from the all-important MSCI EM Equity Index and China’s misfortunes with Omicron, in addition to the Chinese government perceived ‘support’ for Russia has benefited the local bourse. South Africa’s economic recovery has been playing catch up with the rest of the world, but now that the news flow surrounding growth reforms and an improving fiscal outlook are gaining momentum, investors have been diverting equity flows to SA which historically has been viewed as a relatively stable investment destination with sound corporate governance.

The mining sector and companies supplying into the industry have benefited hugely from high commodity prices, which has been a function of supply chain disruptions during the crisis and more recently the war in Ukraine. Although the current profitability levels may not be sustained as commodity prices normalise and cost pressures intensify, the decline in aggregate earnings (and tax revenue) should be offset by the recovery in other sectors as company profits return to levels achieved prior to COVID-19. In general, financial results for listed companies have been surprisingly positive this year and have played an important role in underpinning share prices of undervalued South African stocks. Whether the positive momentum (relative to our peers) is going to be sustainable remains to be seen, but while the sun is shining on SA, policy makers have a golden opportunity to make hay, by distinguishing ourselves from the rest of the EM universe by implementing sound and credible growth and fiscal reforms.

Monetary Policy – It’s time to take some medicine

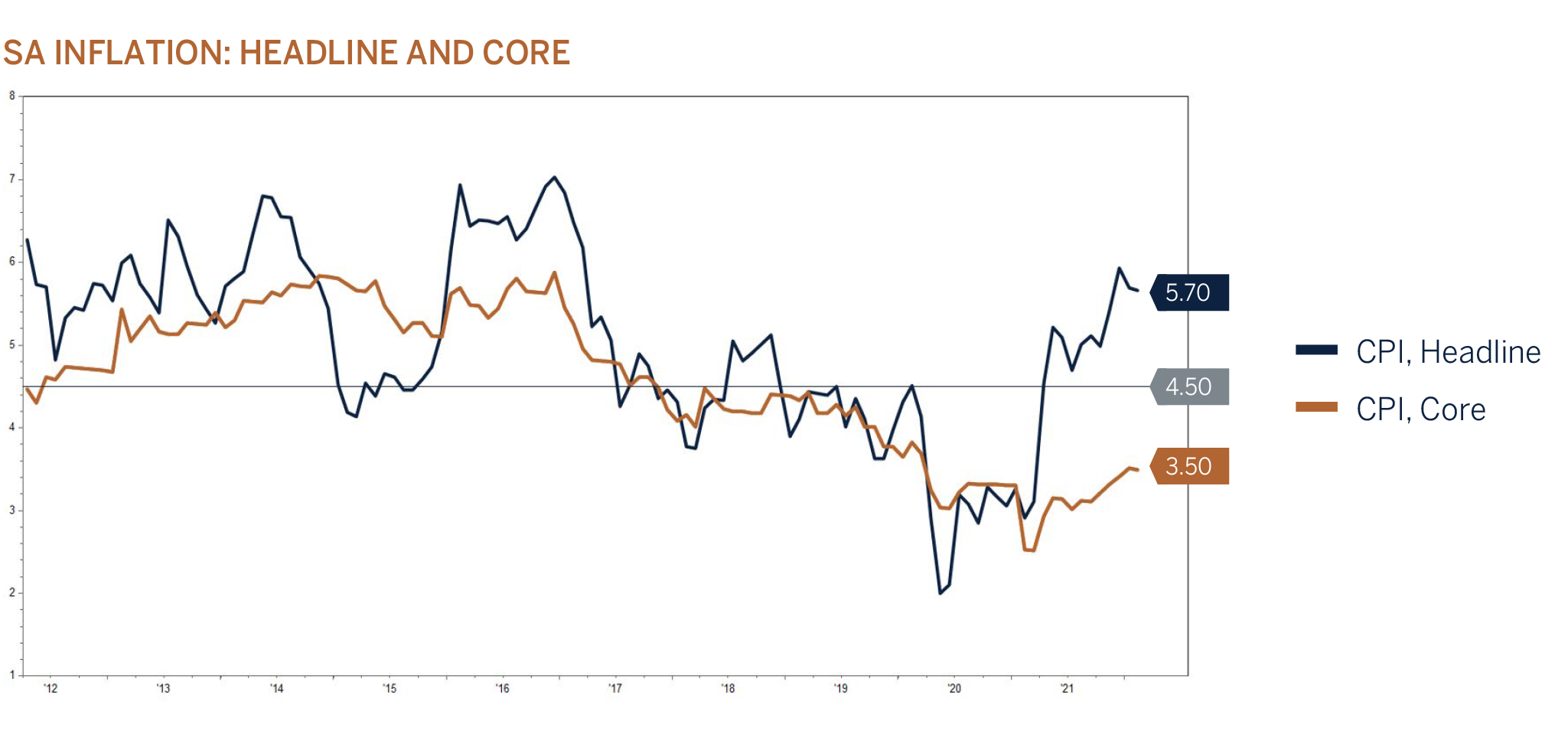

South Africa’s inflation outlook has deteriorated in line with global developments. The significant increases in the price of fuel and food prices are primarily responsible for the change in headline inflation. Core inflation, which excludes volatile items such as fuel and food, has remained reasonably well behaved thus far, and reflects an environment of weak underlying demand. Not surprisingly, given the country’s high and increasing unemployment rate. The backdrop in SA is, therefore, very different to what is experienced in developed economies where employment markets are robust and wage inflation at levels well above long-term trends as employers are finding it challenging to fill vacancies fast enough. Demand in developed markets had been bolstered by fiscal transfers to households and small-andmedium enterprises during the crisis, something which was not possible or affordable to South Africa, given the government’s precarious debt situation. In other words, the broadening of inflation in developed economies has been a function strong underlying demand.

While the inflation rate in SA has been trending higher, an appreciating local currency and high fuel levies have shielded the economy from the same magnitude of price increases experienced in many developed economies. This does, however, make us vulnerable to any Rand weakness. Food inflation has been increasing in line with the increase of global agriculture prices, but there are a few factors that could prevent it from going much higher in the short term, barring a sustained increase in the fuel price. The war between Russia and Ukraine will likely result in downward price pressures on fruits in the coming months due to an increase in supply in the harvest period of citrus and the temporary limits of key exports in the Black Sea region. In addition, the recent outbreak of foot-and-mouth disease will likely lead to the temporary closure of some key export markets for the red meat industry, thus adding downward pressure on prices. And finally, an increase in sunflower seed production will help boost domestic supplies and lessen the reliance on imports.

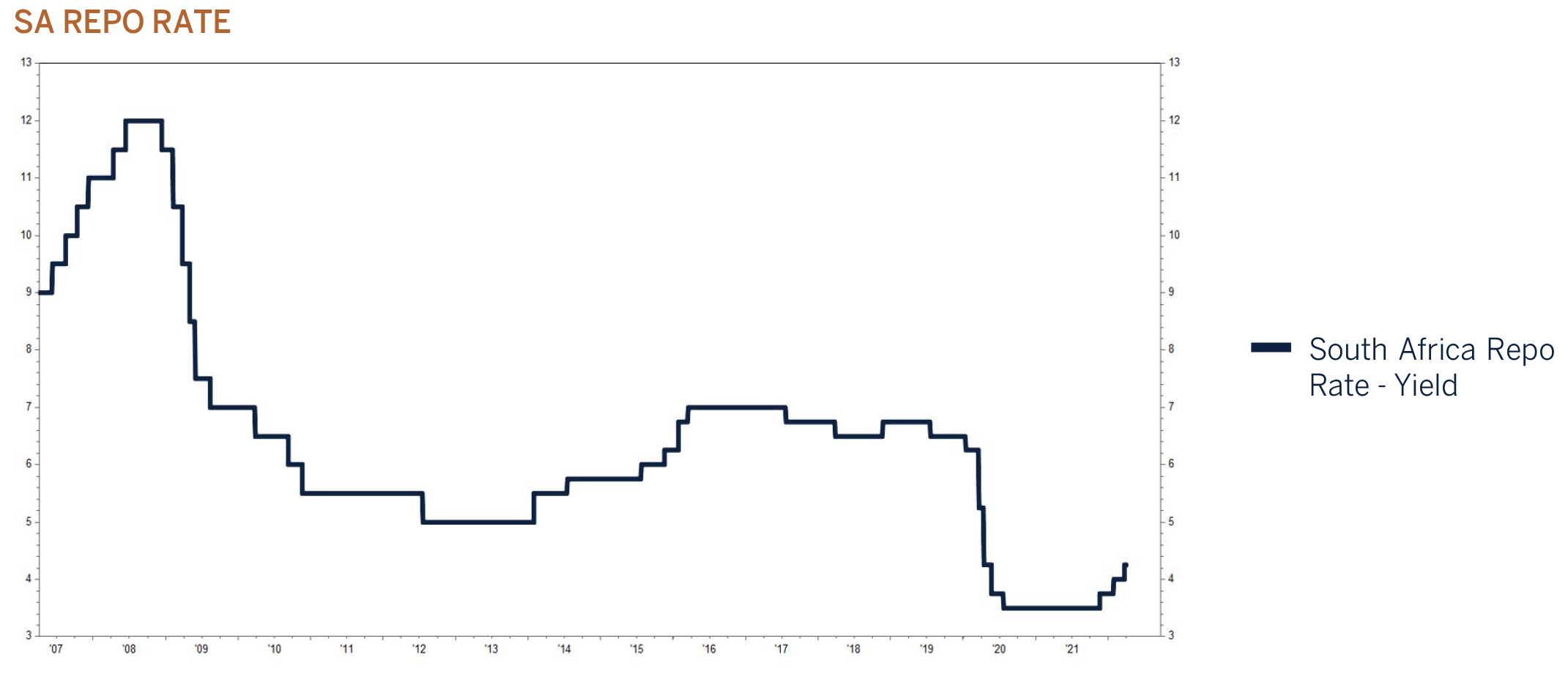

The South African Reserve Bank has unsurprisingly become more concerned about the outlook for inflation since the outbreak of the war and has revised its forecasts higher. Headline inflation for 2022 is now expected to reach 5.8% (4.9%), before reverting to 4.6% on average for the subsequent two years. Core inflation is expected to gradually increase this year and to remain above the targeted midpoint of 4.5% by the end of 2024, with risks firmly tilted to the upside. The rhetoric from the MPC (Monetary Policy Committee) has turned decisively hawkish with two of the five members opting for a 50 basis point increase during their meeting in March. The majority vote resulted in a 25-basis point hike in the repo rate. The MPC is serious about anchoring inflation expectations at the midpoint of the 3-6% range and has sent a strong message to market participants and consumers - interest rate increases will likely be frontloaded in this cycle should inflationary pressures not subside. Not the greatest news (in the near term) for an economy trying to get off its knees, but the sooner the MPC reacts to contain inflation (expectations), the greater the chance of preventing interest rates from becoming too restrictive over the medium term. Anchored inflation expectations, together with prudent fiscal discipline and the successful implementation of growth reforms will in the future open the door to lower sustainable interest rates and ultimately higher trend growth which is desperately needed to alleviate some of the country’s socio-economic challenges such as unemployment and poverty.

Progress on reforms

South Africa’s growth has been held back by structural constraints which included poor basic services delivery in the form of energy and water supply, healthcare, education, logistics, competition, and prolonged load shedding. An inflexible labour market and high levels of unemployment have added to the socio-economic pressures which resulted in government having to spend an exorbitant amount of taxpayers’ funds on social and income grants (in addition to a high interest cost bill), instead of investing enough on productive assets which can make a marked difference to the county’s sustained growth outlook.

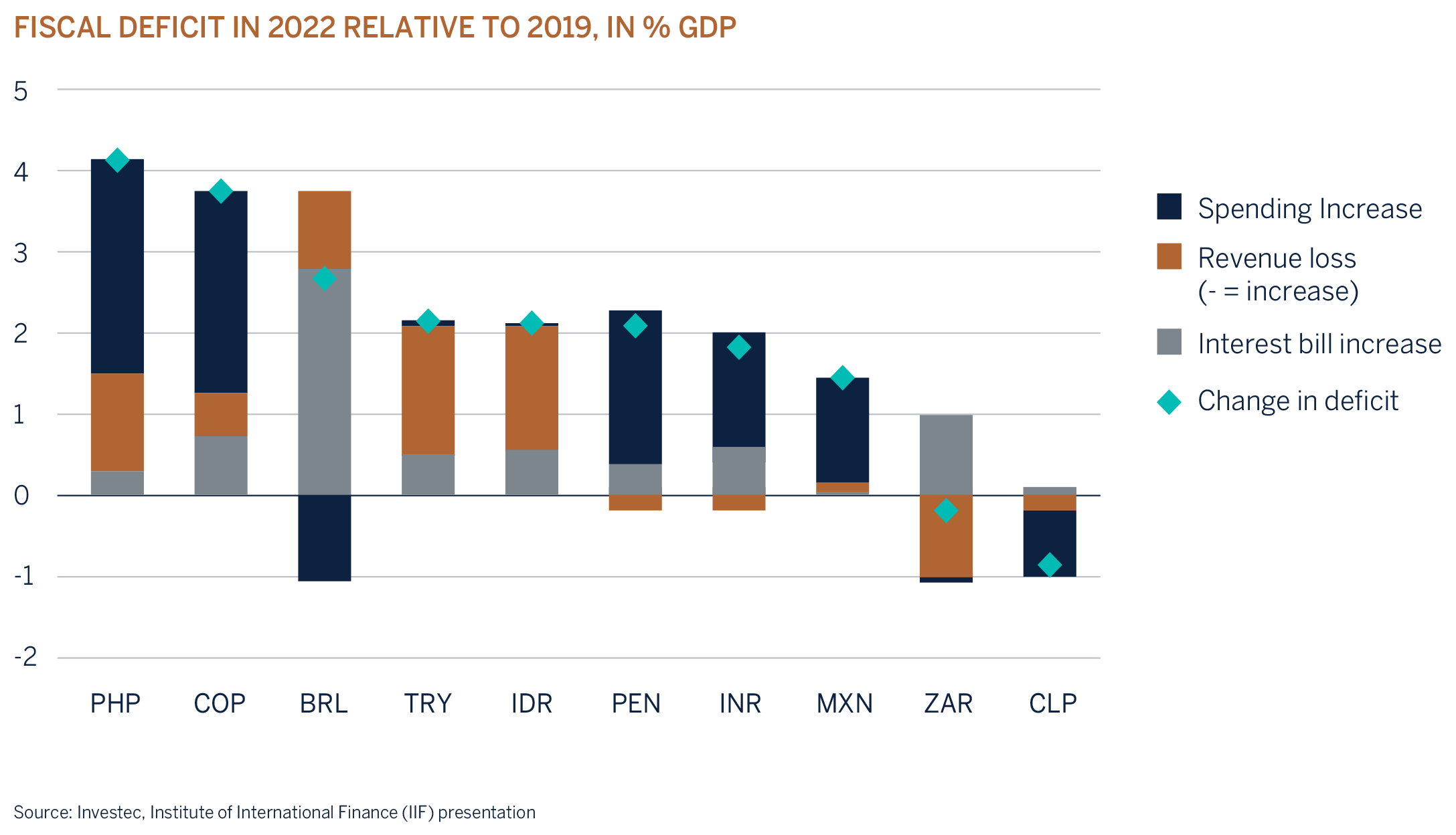

But to implement ‘real’ change, government requires a healthy balance sheet to fund the growth initiatives. The overrun in tax revenue and improved cost control measures over the past year have certainly assisted in National Treasury’s optimism that debt consolidation and a primary budget surplus are both attainable in the not-too-distant future, assuming economic growth estimates (which on the face of it look conservative) and tax collections by SARS materialise as expected. Moody’s was the first credit rating agency to assess SA’s sovereign rating after National Treasury’s presentation of the main budget in February. The decision was to leave the rating unchanged at Ba2, but they have adjusted the outlook from negative to stable, an endorsement of government’s consolidation efforts and commitment which has resulted in an improvement in South Africa’s fiscal deficit (% of GDP) both in absolute terms and relative to the peer group since 2019.

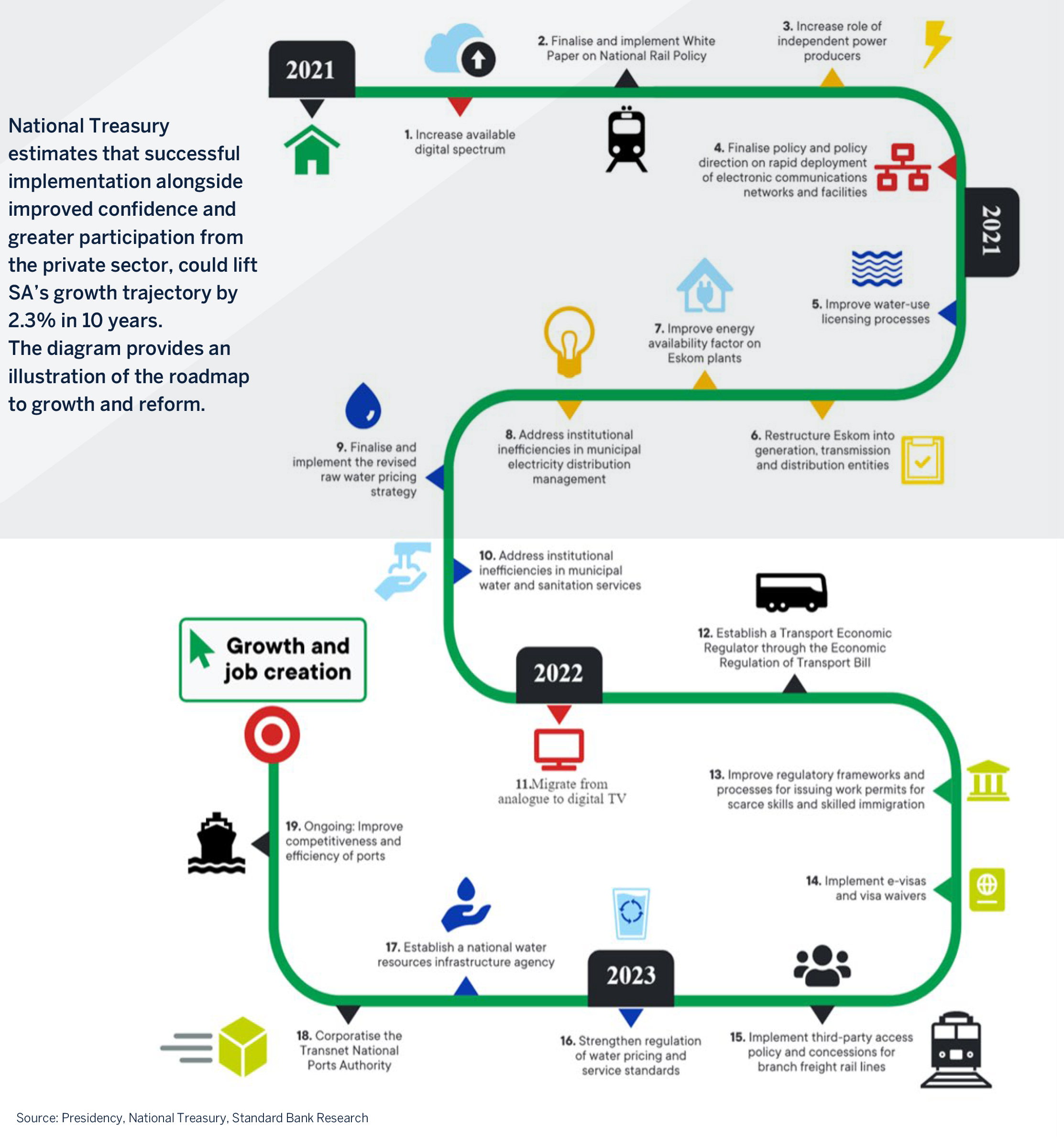

In the State of the Nation Address earlier this year, President Ramaphosa provided an update on the progress made in achieving the milestones laid out for the successful implementation of operation Vulindlela. As a reminder, “Operation Vulindlela is a joint initiative of the Presidency and National Treasury to accelerate the implementation of structural reforms and support economic recovery. Operation Vulindlela aims to modernise and transform network industries, including electricity, water, transport and digital communications”, with the aim of achieving National Treasury’s growth reform building blocks that are centered around meeting the following five objectives:

- Modernise network industries

- Increased competition and small business growth

- Prioritise labour-intensive growth (incl. agriculture and tourism)

- Focused and flexible industrial and trade policy

- Promote export competitiveness

The update from the presidency showed progress, especially within the electricity and the telecommunication sectors with the recent spectrum auction. Bureaucratic hurdles still need to be overcome and challenges remain, but the upshot is that the foundations are slowly being put in place for a more sustained and improved growth outlook in the economy.

Standard Bank Research department has in a recent note to clients provided a useful summary of the key reforms that have been implemented thus far.

|

AREA |

REFORM |

|

Electricity |

The amendment of Schedule 2 of the Electricity Regulation Act (2006), raising the licensing threshold from 1 to 100 megawatts (MW), has made it possible for private power generators to sell directly to customers. Amended regulations also enable municipalities to self-generate or procure power directly from independent power producers. The pace and scale of private generation will largely depend on the ease of the National Energy Regulator of South Africa’s (Nersa) registration process, which needs to be streamlined Preferred bidders have been announced for the fifth bid window (2, 600MW) of the Renewable Energy Independent Power Producer Procurement Programme (REIPPP); financial close is expected by 2Q22 and commercial close within the next three years. Around 800MW of capacity from the previous bid window should become commercially operational soon; see the Appendix for more detail). Eskom’s unbundling is progressing. |

|

Transport |

Transnet Freight Rail will allow third-party access to the freight rail network by end-2022; this should improve system capacity. Government has announced the corporatisation of the Transnet National Ports Authority as an independent subsidiary of Transnet and appointed an interim board. It is hoped that the separation of port infrastructure and operations will create incentives for efficiency and competitiveness between port service providers. |

|

Tourism |

The new eVisa system has been rolled out to select countries. |

|

Telecommunication |

The long-awaited spectrum auction has been conducted. Work is under way to standardise and improve processes for applications to use property in rolling out towers and fibre to expand digital communications infrastructure. This work will be finalised by October 2022. |

|

Infrastructure |

A review of the public-private partnership regulations was completed in May 2021 and the recommendations will be implemented from early 2022. This includes simplifying the regulations, eliminating delays in approval and implementation, standardising project preparation and building capacity at all levels of government. |

Conclusion

The cocktail of rising interest rates, elevated inflation and geopolitical uncertainty pose risks to consumer and business confidence, and ultimately the outlook for global growth. The expected growth resilience is very much dependant on households drawing down excess savings to offset the squeeze in after inflation disposable income and firms’ willingness to continue filling vacancies in the face of rising uncertainty. But while risks to slower growth are mounting and should be closely monitored, global manufacturing and services leading economic indicators remain robust and are consistent with above trend growth momentum as the effects from Omicron fade.

The pace of monetary tightening and the path for inflation will play an important role in determining returns from risk assets. If history is to be repeated investors should expect lower returns in the immediate future as valuations adjust to an environment of reduced liquidity and higher discount rates (used for valuing cash flows).

The war in Ukraine is having damaging effects on the world economy through supply chain disruptions and inflationary pressures. Even though South Africa has been relatively shielded given the strength in commodity prices, consumers and businesses are starting to feel the pain from increasing costs. The South African Reserve Bank is on a mission to contain inflation and government is serious about reducing the debt burden of the country. In other words, limited scope exists from either fiscal or monetary authorities to support the economy through another challenging period, only two years after one of the deepest recessions in history caused by the COVID-19 pandemic.

Investors globally, have benefitted from the unprecedented support measures implemented during the pandemic, but that is about to change as economies have recovered and inflation has become a major headache for global central banks. Inflation was supposed to trend lower during the second quarter of this year, but Russia’s invasion of Ukraine has resulted in inflation not only being stickier but also higher than previously thought. In other words, globally (ex-China) excess liquidity will be drained from the economy and financial markets in an effort to manage demand and inflation lower. The effects from this sea change in support from policy makers globally will only be revealed in time, but as economic growth starts to moderate globally, South Africa will also feel the pinch. The longer the war continues, the greater the impact on the global economy and for Europe in particular, which remains one of SA’s largest trading partners.

While we are cognisant of the risks associated with the war, inflation and tightening monetary policy, valuations remain supportive for domestic assets and supports our tactical overweight position in portfolios.

Asset Allocation

Domestic Equity – Overweight

Economic momentum has surprised positively this year in South Africa as the recovery takes hold. The same holds true for earnings growth, which for the MSCI SA Index is now expected to increase by 19% in 2022 (from a depressed base), against an expectation of 9% at the start of the year. The positive revisions have been broad based across sectors and has resulted in a derating in equity valuations as the positive revisions to earnings growth outpaced price returns this year. We remain constructive on domestic equity given that valuations are attractive compared to history and earnings growth momentum remains supportive. Although this is not factored into our expected returns, any improvement in sentiment towards SA or an improved growth outlook on the back of growth reforms could drive valuations higher. Higher interest rates globally and in South Africa, do however pose a headwind to growth in the medium term and will likely result in more moderate returns. It is therefore important for investors to be selective in their approach. We remain committed to investing in good quality companies with strong balance sheets, unique offerings, and pricing power.

Global Equity – Neutral

Global equity markets have de-rated considerably this year and are trading at levels not too different from their long-term averages with returns expected to be positive for the remainder of the year. Even so, as interest rates increase and with them the discount rate (risk free rate) for long duration growth assets, valuations will remain under pressure and should de-rate further. Sustained high inflation poses an additional headwind to valuations. Earnings growth of 6%-8% over the next year is achievable and will be in line with long term averages, but operating cost pressures do pose a risk for lower profit margins in the future. Strong underlying demand has allowed companies to pass on the costs and maintain gross margins, which has more than offset the increase in operating costs, but this will become more of a challenge for companies to overcome as growth reverts to trend over the next year or two. We are monitoring the effects of the war and sanctions imposed on Russia closely and will reduce risk in portfolios should the medium-term outlook for economic growth and/or expected returns weaken materially and necessitate action.

Domestic Fixed Income – Overweight

Government’s commitment to fiscal consolidation and attractive valuations have underpinned returns from government bonds this year. Yields remain attractive for long term investors on both an absolute and inflation adjusted basis. Interest rates are expected to be increased over the next two years as monetary policy becomes less supportive, but these expectations are already reflected in prices. We do therefore not expect that bond yields will move significantly higher (lower prices) from current levels. Returns from bonds over the long term are primarily a function of their income yields, and with the 10-year SA government bond yielding almost 10%, we find bonds attractive and remain overweight the asset class.

Global Fixed Income – Underweight

The US Fed commenced the tightening cycle in the quarter, sanctioning a 25 basis point hike to 50 basis point almost immediately after ending their quantitative easing program. This marks the beginning of a raft of rate rises this year, set to be one of the most aggressive tightening cycles since the mid-2000s. We can expect another five or six hikes before year-end with moves of 50 basis points at one or more meetings a distinct possibility. In addition, the Fed currently expects a further 100 basis points of tightening in 2023 although much can change between now and then. The Fed’s dual mandate of full employment, which one could argue has been achieved with high vacancy rates helping to push the unemployment rate down to 3.9%, and an inflation target “averaging 2% over the cycle”, currently running at a headline rate of 7.9% (a forty-year high), is clearly an issue for the committee. The onset of the Eastern European war has provided more “fuel to the inflationary fire” and in response Jerome Powell and his committee have a tough job in balancing tighter monetary policy against a slowdown in economic growth. However, for now the underlying health of the US economy remains robust on a number of measures. The consumer remains healthy, but the effect of higher food and energy prices together with higher borrowing costs will no-doubt have an impact on disposable incomes, which in turn will lead to lower growth. Whilst growth will slow in the months ahead, we do not forecast a recession over the next twelve months as sufficient pillars of support remain in place to underpin growth at, or likely above, long-term averages.

Major ‘negative’ geopolitical events would ordinarily favour government bonds for their ‘safe-haven’ status, but other than a brief and temporary retracement in yields when Russia first invaded, this has not stopped ten-year US Treasury yields from rising sharply to the current 2.35% level. Currently, it is expected that the long-term neutral/terminal US interest rate will surpass 2.5% which should, by default, put yields on a path to 3% plus (barring the onset of a recession and rapid decline in inflation). Central banks credibility is at stake and they will be looking to drive down inflation expectations to regain credibility. We continue to view the asset class as unattractive and expect developed market government bond yields to continue trending higher to more normalised levels.

Domestic Equity

|

Basic Materials |

Underweight |

|

Industrials |

Overweight |

|

Consumer Staples |

Overweight |

|

Healthcare |

Neutral |

|

Consumer Discretionary |

Underweight |

|

Telecommunication |

Overweight |

|

Technology |

Underweight |

|

Financial Services |

Overweight |

South African equity advanced 6.7% in the first quarter of 2022, as measured by the FTSE / JSE Capped Swix Index. The quarter was very volatile with the US Fed starting the interest rate lift off in March caused by inflation which is at a record level in the US and further aggravated by the invasion of the Ukraine by Russia.

Inflation globally has been pushed to record levels through global supply bottlenecks, US real wage increases and higher commodity prices. Capital markets were forced to adjust forward looking growth as the cost of capital changed, albeit against the backdrop of strong growth at present, particularly in the US, something that Jerome Powell referred to in his monetary policy commentary. Nonetheless, real rates in places like the US remain negative which does point to accommodative monetary policy, despite the rising interest rates.

Growth assets over the quarter were the worst affected given the slowing growth outlook whereas counters that reflected very low growth in the valuations fared far better, South African equities are a prime example of this.

Added to the inflation and interest rate risk, the invasion of Ukraine by Russia posed huge uncertainty in terms of world order and fundamentally pushed the risks of higher inflation for longer upwards as supply disruptions in hard and soft commodities were a consequence of sanctions on Russia. Markets do not like uncertainty initially, but as we witnessed late in the quarter, markets do find ways to price uncertainty and we did see a recovery at the back end of the quarter, in line with previous conflicts in history.

Domestic growth in South Africa will remain below the required level to meaningfully reduce unemployment and drive sustainable growth that domestic companies require to generate optimal returns on capital for the foreseeable future. Having said that, South African equity trades on valuations that appear to be attractive in the global context despite the structural economic headwinds. Many of the companies have successfully managed their way through the lockdowns and balance sheets domestically appear to be very healthy. As we move through 2022, the base effects for earnings will become tougher. Much of the “easy money” has been made through the rerating of stocks and earnings delivery will be key. We have a positive outlook on South African equities based on their valuations on an absolute and relative basis. Diversification and risk management do however remain of utmost importance given the uncertainties.

Domestic Fixed Income

The year 2022 began on a high note with abundant expectations. The SARB, in its last meeting of 2021 in November had spooked the markets by raising rates by 25 basis points. The outcome of this meeting influenced market sentiment going into the January 2022 meeting. As was expected the SARB once again increased the repo rate by 25 basis points to 4,0%. However, what came as a surprise was the vote split, with four members voting to raise rates by 25 basis points and one member preferring to leave rates unchanged.

The SARB continued in this policy rates normalisation trajectory by raising rates by a further 25 basis points in its March meeting. The difference between these two meetings is that in the second meeting of the year, the SARB had turned more hawkish with two members of the committee voting to raise rates more aggressively by 50 basis points to counter the higher than expected increase in inflation.

The first quarter of the year is also the time where the Minister of Finance delivers the National Budget to the nation. The minister’s maiden speech had a few positive notes, with tax revenue collection exceeding projections in the 2021 MTBPS for 2021/22. There were no increases in Personal Income Tax whilst tax brackets were inflation adjusted to avoid bracket creep. Importantly, in this budget, fuel and Road Accident Fund levies were left unchanged for the first time in more than 30 years. Lastly, Corporate Income Tax was reduced by 1% to 27%. All these measures were aimed at stimulating the economy and were largely local currency and bond yields positive.

Late in February global financial markets were sent on a tailspin with Russia attacking its southern neighbour Ukraine over what it termed a national security threat. The uncertainty brought about by this ongoing war roiled the markets. Oil prices soared to well above $120 per barrel, the local currency tested R15,50 to the US dollar and local bond yields traded well above 10,50%. The timing of this war, besides the untold human tragedy it brings, is unfortunate. It occurs at a time when financial and economic matrices of the country were on a rebound. The inflation trajectory was expected to remain anchored around the midpoint and the SARB to be gradual in its policy normalisation. The war in Ukraine and the subsequent increase in commodity prices have amplified inflation concerns, and has resulted in global central banks, including the SARB becoming more hawkish in their rhetoric towards monetary policy.

At this stage it is difficult to predict how long the war will last or what its long-term effect on inflation and asset prices will be. In this environment, we expect volatility to persist and believe it is best to be defensively positioned in such circumstances. Even though bonds offer good value over the long term, we have taken a tactical decision to reduce duration, and will reassess our position as risk unwinds, inflation moderates and some level of certainty returns.

Domestic Market Performance % / as at 31 March 2022