Quarterly Commentary: April 2020

View PDF versionInvestment Environment

Recessionary ‘Black Swan’ shock

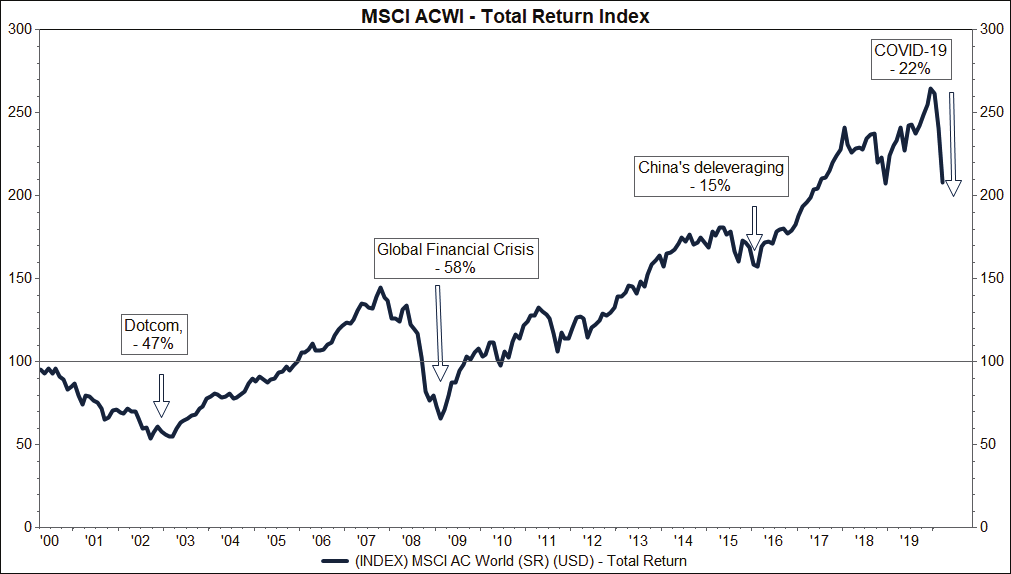

We entered 2020 against a backdrop of a global economy that was expected to show steady improvement as the year progressed and of investment markets set to deliver another year of positive returns - these forecasts have had to be swiftly changed. The outcome is now set to be something radically different as the Black Swan/external shock event in the form of the COVID-19 virus became a global pandemic leading Governments around the world to enforce strict measures to contain the spread of the deadly and highly infectious virus in their attempt to “flatten the curve”. Social distancing and isolation measures enacted across much of the world has, almost overnight, created an external shock to global trade resulting in a swift and sharp negative reaction in investment markets, the likes of which have not been seen since the 1930s with global equities at one stage down 30% in the quarter. Fiscal and monetary authorities have quickly responded with very significant and unprecedented stimulus measures in order to soften the economic shock and calm investment markets. It wasn’t just the sheer size of stimulus measures announced that have for now pacified investors, but also the assurance from authorities that they will do “whatever it takes” to provide a buffer against the economic fall-out from the crisis. Despite these welcomed actions, the global economy has, in just a matter of weeks, entered one of the deepest, most disruptive and perhaps shortest self-imposed recessions in history, and near-term risks remain firmly skewed to the downside as income and output levels adjust to a more challenging and uncertain environment.

Source: FactSet

It’s different this time!

The speed and magnitude of the deteriorating global economic backdrop has taken the world by surprise, largely due to the sudden and global nature of the stringent measures being enforced by governments and healthcare authorities around the world in an effort to limit the contagion of the COVID-19 virus. Around 3 billion of the world’s population is on full or partial lockdown; nearly 40% of the total. Importantly, the cost in human fatalities will be smaller than it otherwise would have been although it will certainly result in many further economic and corporate profit downgrades in the quarters ahead. However, we continue to believe that this painful and disruptive downturn in the global economy will be transitory in nature and that the extent of fiscal and monetary stimulus measures will provide an underpin to an economic recovery in 2021. China, Taiwan and South Korea give us some comfort around what can be achieved to overcome the virus through broad based testing and social distancing/isolation measures. In these regions economic activity is recovering as workers are slowly returning to work and some of the latest forward-looking economic indicators are now already pointing to an improved outlook. Elsewhere, the risk of a more prolonged and profound global pandemic remains a real concern given the inadequate and uneven containment in some countries. The longer the duration of COVID-19, the larger the impact on economies and the slower the expected recovery; therefore, markets are likely to be driven by the associated news flow in the weeks and months ahead.

What makes this recession so unique from other business and economic cycles is that its length will be determined by official and unofficial containment measures rather than monetary or fiscal policy. Furthermore, a wide range of companies’ revenue streams will be completely turned off, rather than just suffering a slowdown, due to the containment measures. This is a significantly worse outcome than previous recessions where activity levels clearly slowed, but never disappeared. Small and Medium sized companies (SMEs) are especially vulnerable to such an economic shock, and many may not have the means to survive or at least participate in the next economic upswing given their stretched and depleted cash balances. But the pain will not be confined only to SMEs, many listed real estate companies by way of example have either slashed or suspended dividend distributions for this year as tenants have found themselves in financial difficulties and stopped paying rent. Growingly, listed companies have also halted issuing financial guidance statements for the current year given the lack of earnings visibility. The extent of the current adjustment to final demand was perhaps best illustrated when the latest release of weekly jobless claims in the US jumped to over 3 million people or five times more than the previous highest level on record. Governments are preparing and standing by to offer loans and bail-outs. Additionally, the potential of companies being nationalised is no longer such a far-fetched outcome in extreme cases, should the crisis continue for longer than what is currently expected to be only one or perhaps two quarters of negative economic growth, while the main source of uncertainty, being COVID-19 is brought under control.

South Africa’s Sovereign downgrade

Moody’s, as widely expected, downgraded SA’s sovereign credit rating to non-investment grade (Ba1) on 27 March 2020. To reflect the downside risk to the country’s growth and fiscal metrics, it preserved the negative outlook. This brings Moody’s credit rating of South Africa in line with Standard & Poor’s and Fitch. Asset prices such as the domestic ZAR currency, government bonds and credit spreads were largely unaffected as this move was already discounted.

The downgrade will not result in any changes to our management of cash within portfolios and the use of liquidity funds as both a yield enhancement and diversifier will continue.

Market Performance %

as at 31st March 2020

|

EQUITIES |

MAR |

Q1 |

12M |

|

Global |

|||

|

FTSE All World TR Net (Sterling) |

-10.92% |

-16.06% |

-6.73% |

|

FTSE All World TR Net (US Dollar) |

-13.52% |

-21.43% |

-11.25% |

|

UK |

|||

|

FTSE All-Share TR |

-15.07% |

-25.13% |

-18.45% |

|

US |

|||

|

S&P 500 TR |

-12.35% |

-19.60% |

-6.98% |

|

Europe |

|||

|

Dow Jones Euro STOXX TR |

-16.90% |

24.75% |

-15.33% |

|

FIXED INCOME |

|||

|

Bloomberg Barclays Series - E UK Govt 1-10 Yr Bond Index |

-0.58% |

2.08% |

3.23% |

|

Bloomberg Barclays Series - E US Govt 1-10 Yr Bond Index |

2.08% |

5.25% |

9.02% |

|

JP Morgan Global Government Bond (Sterling) |

3.10% |

10.15% |

12.81% |

|

JP Morgan Global Government Bond (US Dollar) |

0.09% |

3.10% |

7.35% |

|

Iboxx Sterling Corporates Total Return Index |

-7.52% |

-5.62% |

-0.04% |

|

Iboxx US Dollar Corporates Total Return Index |

-6.77% |

-3.50% |

4.69% |

|

CURRENCY vs. STERLING |

|||

|

US Dollar |

2.92% |

6.99% |

4.81% |

|

Euro |

2.65% |

4.52% |

2.47% |

|

Yen |

3.28% |

7.81% |

7.73% |

|

CURRENCY vs. US DOLLAR |

|||

|

Rand |

-0.27% |

-2.30% |

-2.23% |

|

Euro |

0.36% |

0.75% |

2.77% |

Source: FTSE International Limited (“FTSE”) © FTSE 2013. “FTSE®” is a trade mark of the London Stock Exchange Group companies and is used by FTSE International Limited under licence. All rights in the FTSE indices and / or FTSE ratings vest in FTSE and / or its licensors. Neither FTSE nor its licensors accept any liability for any errors or omissions in the FTSE indices and / or FTSE ratings or underlying data. No further distribution of FTSE Data is permitted without FTSE’s express written consent

Global Asset Allocation

by Bernard Drotschie / Chief Investment Officer

|

Equities |

Underweight |

|

Fixed Income |

Underweight |

|

Cash Plus |

Overweight |

- Although we deploy an element of tactical asset allocation overlay our philosophy of staying largely invested through economic cycles has a much better payoff profile than attempting an all-in or all-out approach and trying to identify the peak or bottom of investment cycles. Our investment approach, irrespective of the environment, is to focus on fundamentals while assessing the risks that we are being presented with, and to not be influenced by daily market movements or momentum. The importance of diversification cannot be emphasised enough during periods of stress.

- The path of this recovery is different to “normal” business and economic cycles and will very much depend on the effectiveness of the COVID-19 virus containment and economic support policies in addition to private sector behaviour. Given the extent of the prevailing uncertainty and impacts of lockdown disruptions on profitability of companies, our approach in the current environment is one of caution and patience. It is too early to know with any level of confidence what exactly the potential fallouts from the current recession will be on final demand.

- We have moved our equity weighting to an underweight position in global equities. This move should be viewed as tactical in nature to reflect the unprecedented level of uncertainty and the fact that equities are still trading at higher multiples than previously experienced during recessionary periods.

- The aggressive monetary stimulus measures announced by the US Federal Reserve and ECB have resulted in much lower government bond yields. We would be surprised to see an immediate sell-off in this asset class given the “anchoring effect” from low levels of policy interest rates but continue to see little value in government bonds. Real yields are negative across developed markets and debt metrics for many countries will reach new highs as budget deficits soar on the back of large-scale fiscal stimulus measures. This is a concern for Fixed Income investors and results in our short duration positioning relative to benchmark. Given the rally in bonds this year, we have cut our exposure in Fixed Income to maximum underweight for all multi-asset strategies.

- The reduction in equities and fixed income have left portfolios with even larger overweight positions in cash, which serves as a risk mitigator in portfolios. In addition, the overweight cash position will provide us with ample capital to deploy when more favourable conditions or valuations present themselves.

Global Equities

by Justin Maloney / Global Equity Fund Manager

|

Consumer Discretionary |

Overweight |

|

Consumer Staples |

Neutral |

|

Energy |

Underweight |

|

Financials |

Underweight |

|

Healthcare |

Overweight |

|

Industrials |

Neutral |

|

Information Technology |

Overweight |

|

Materials |

Underweight |

|

Consumer services |

Neutral |

|

Utilities |

Neutral |

|

Real Estate |

Underweight |

- The speed of events has made the prior month, let alone quarter, seem like another country. Much of the world’s populous are isolated at home, a global recession is a certainty, and last year’s stunning equity market gains have been erased in a flash.

- Policymakers have acted quickly on an unprecedented scale to counteract the hit resulting from government-imposed lockdowns to “flatten the curve”. Unfortunately, it will not be enough to avert a sharp rise in unemployment. The greater the job losses the lower the chances of a “V” shaped snapback in demand once the virus is eventually defeated by a vaccine, effective treatment or herd immunity.

- The overall market is cheap relative to cash and bonds, but not enough of a bargain relative to historical average valuations to warrant upping the exposure at this stage. Amidst all the market chaos the combination of a robust investment process and a strong team of in-house global sector analysts has enabled us to exploit opportunities thrown up by the shakeout. Hence, this month saw us make more changes than usual in client portfolios on a stock-by-stock basis, albeit most of the new ideas have been on our radar for a considerable period.

- Alibaba was reintroduced to client portfolios. Subsequent information eased our prior corporate governance concerns over the restructuring of its fintech business in 2018. The company owns two of China’s largest e-commerce platforms (Taobao and Tmall) which collect fees from merchants for advertising and completing transactions. A virtuous circle whereby more consumers attract more merchants, and more merchants attract more consumers, has enabled Alibaba to establish a market position larger than all other e-commerce players in China put together. As well as benefiting from robust e-commerce growth, the company has broadened its addressable market to include cloud computing, payments and digital media in China.

Global Fixed Income

by Karl Holden / Head of International Fixed Interest and Currency Strategy

|

G7 Government |

Underweight |

|

Index-Linked (US Government) |

Overweight |

|

Investment Grade - Supranational |

Overweight |

|

Investment Grade - Corporate |

Neutral/Overweight |

- Safe-haven US government bonds have rallied sharply with 10-year benchmark yields falling by some 1.25% in the quarter to 0.67%. Interest rates have been slashed rapidly by 1.5% to 0.25%, an initial stimulus package amounting to almost 10% of GDP agreed and a commitment to ‘open-ended’ quantitative easing. The short to medium term direction of the bond market will be determined not by the severity of the weakness in upcoming key economic indicators, rather the shape of the coronavirus contagion and mortality curves, which will ultimately define the timing and subsequent pace of the recovery. Our US dollar strategies hold a duration strategy of around 3.5 years and we are reluctant to extend maturities after such a severe drop in yields to levels which are deeply negative in ‘real’ inflation adjusted terms and offer little to no longterm value.

- In the UK, the Monetary Policy Committee (MPC) deployed two emergency interest rate cuts to a record low of 0.10%. In addition, the MPC also agreed to re-start QE to the tune of a further £200 billion to take the target to £645 billion. This will be predominantly via purchases of Gilts, but will also include a corporate bond purchase facility. UK Gilts have rallied strongly in the quarter, particularly short-dated issues where yields at one stage dipped into negative territory, something usually associated with German Bund yields. With yields now at such extreme levels we see no value in selling existing holdings to extend duration for what amounts to very meagre pick-up in yield returns.

- Investment grade (IG) corporate debt spreads have widened in line with the sell-off in risk assets. Spreads have not deteriorated to levels experienced in the credit crunch and it remains uncertain how high they will climb but we are reminded that early 2009 (peak credit crisis spreads) represented an incredible buying opportunity in this investment space. For now, the sheer scale of uncertainty is preventing us from increasing allocations, but the opportunity may present itself in the coming weeks or months. Our strategies hold either in line or moderately overweight allocations to IG debt which have not been exempt from the recent disturbance, however, most of our exposure is directed at the shorter-end of the maturity spectrum.

Global Currencies

Interest Rates

RECOMMENDATION - INTEREST RATES

|

Current |

Direction |

||

|

US Dollar |

Overweight |

0.25% |

→ |

|

Sterling |

Neutral |

0.10% |

→ |

|

Euro |

Underweight |

0.00% |

→ |

- The US dollar remains the ‘worlds reserve currency’ and the rush for liquidity has seen the currency appreciate, on a trade weighted basis, some 2.76% year-to-date. Whilst favourable yield and interest differentials versus many peers have narrowed, the currency is now exhibiting a very strong positive correlation to ‘risk off’ episodes. Our strategies remain overweight the US dollar and are likely to remain so until we see some light at the end of this socially and economically testing tunnel.

- Sterling fell prey to selling pressure in the quarter, at one-point trading as low as 1.15 against the US Dollar, a level not seen since 1984. The UK entered this crisis in the unenviable position of battling with sub-par growth and a host of uncertainties surrounding the next stage of BREXIT negotiations. This was further compounded by the apparent lack of an initial response from the government to act proactively to prevent the spread of COVID-19. Sterling still appears undervalued and subsequently should offer solid long-term value, but we have retained an element of foreign currency exposure within Sterling International mandates.

Domestic

It “just became real”

What started off as an epidemic in China in January quickly became a global pandemic. In March South Africa joined the rest of the world, first with social distancing, followed by a 21-day national lockdown.

For many South Africans the reality set in when President Ramaphosa made this courageous decision and announced our own lockdown measures to contain the spread of COVID-19.

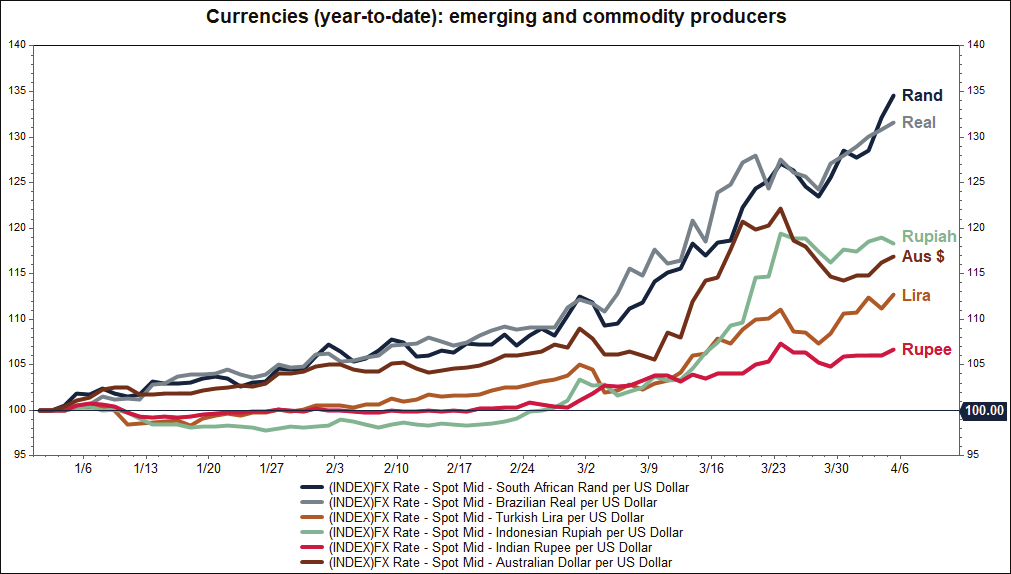

South African assets were particularly hard hit from the last week in February, due to the global outbreak, as investors fled for safety elsewhere and exited Emerging Market assets. The pain was felt across all risk assets, from listed equities to government bonds and the domestic currency, which reached an all time low against the USD

Source: FactSet

The timing of COVID-19 and its impact on the global economy, albeit transitory could not have come at a worse time for South Africa given its vulnerability to external shocks. The country was already experiencing a painful recession after a prolonged period of stagnant economic growth as a combination of loadshedding, lack of structural reforms, large scale layoffs and an overindebted public sector weighed on business and consumer confidence. The domestic economy is now widely expected to contract anywhere between 3 to 6 percent this year with devastating effects on the profitability of domestic businesses.

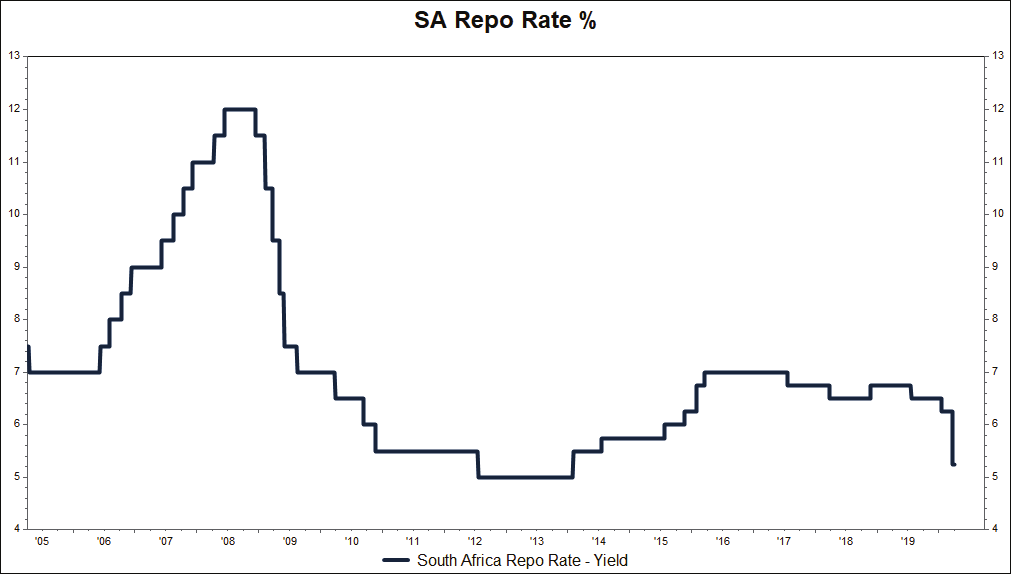

Unprecedented monetary and fiscal stimulus measures announced globally opened the door for the Reserve Bank to cut the repo interest rate to 5.25%, a level last experienced during the European Credit crisis. More interest rate cuts are sure to follow to shore up the faltering economy. However, there is only so much monetary policy can achieve in such an unusual economic environment where the duration of the economic downturn will primarily be determined by how quickly the world and South Africa can overcome the COVID-19 health crisis.

Source: FactSet

Perhaps more surprising was the unusual steps taken by the Reserve Bank to intervene in the domestic bond market when purchasing government bonds, which experienced significant selling from foreign investors while liquidity dried up at the same time as investors started hoarding cash.

Although the Reserve Bank did not call it Quantitative Easing, it made its intensions clear. It would continue buying bonds to ensure a well functioning fixed income market. This is an important step, which, if successful, will assist in keeping Government’s cost of funding under wraps. The Central Bank also encouraged domestic banks to relax regulatory measures to keep credit and funding lines open to households, companies and small and medium sized enterprises that are expected to draw on the facilities to overcome the current cash crunch experienced from the lockdown.

Indeed, an unusual environment that requires extraordinary intervention from policymakers. Banks have obliged to Governments’ call and have announced various payment holidays on the loans for students, households and companies. Investors should note that these measures could very well impact the cash distributions to shareholders in the coming year.

Unfortunately, from a fiscal perspective, Government does not have a lot of room to manoeuvre in order to stimulate the economy, given the poor state of its balance sheet and record high debt levels which, under the current environment, are expected to drastically deteriorate (more on that below).

Innovative initiatives such as the formation of a Solidarity Fund, which has already received significant donations from influential families and companies, will assist with supporting the healthcare system which is expected to come under significant pressure as the pandemic spreads across the population.

The funds will assist in buying much needed ventilators and ICU beds, but much more intervention will be required to provide a safety net to a contracting economy where large-scale job losses are expected.

At a minimum, National Treasury will be forced to reallocate funds which were previously earmarked for growth initiatives, to supporting the poor, faltering companies and SA’s healthcare system. One of the options mentioned by the Governor of the Reserve Bank was to approach the International Monetary Fund (IMF) which has made funding without any conditions and low interest costs available to support countries that need assistance during the COVID-19 pandemic. Time will tell which route government decides to take, but one thing that has become abundantly clear is that strong leadership and a much tighter working relationship between the public and private sector will be required to navigate the economy through what is expected to be a very challenging environment.

South Africa officially downgraded to non-investment grade

Moody’s patience finally ran out when they cut South Africa’s credit rating a notch lower to non-investment grade (Ba1) with a negative outlook – this was shortly followed by Fitch a week later, when the rating agency, which had already rated South Africa as non-investment grade, downgraded the country by another notch and maintained its negative outlook. The key driver behind the ratings downgrade is the continuing deterioration in South Africa’s fiscal strength and the structurally weak economic growth trajectory. The decision brought to an end a 26-year romance with Moody’s which has been the only one of the three rating agents that has kept the country’s credit rating consistently at investment grade. Fitch and S&P downgraded South Africa to non-investment grade in 2017, in the aftermath of the Nenegate saga.

SA sovereign ratings

|

MOODY'S |

STANDARD & POOR'S |

FITCH |

OUTLOOK |

|

|

Local currency |

Ba1 |

BB+ |

BB |

Negative |

|

Foreign currency |

Ba2 |

BB |

BB |

Negative |

Moody’s indicated that it would change the country’s credit outlook to stable if the fiscal consolidation path is broadly in line with its current expectations.

- The agent now expects a 2.5% GDP contraction in 2020, followed by only a 1.1% growth rebound in 2021.

- It foresees a gradual compression in primary fiscal deficits, with its government debt-to-GDP measure (which includes some guaranteed SOE debt) rising from 69.3% in FY19/20 to 82.6% by FY21/22 and 91% of GDP by FY23/24, where it expects it to stabilise.

Moody’s indicated that it would downgrade South Africa further if economic growth remains very weak, with a widening primary deficit and higher funding costs.

South Africa is a member of the FTSE World Government Bond Index (WGBI). To be eligible for inclusion into this index both Moody’s and S&P must rate the issuer and issuance at investment grade. To remain in the index one of the two agents must hold the issuer/issuance at investment grade.

South Africa was kept in the WGBI because Moody’s still rated the sovereign at investment grade whilst S&P had long downgraded South Africa to non-investment grade. The implication of Moody’s decision is that South Africa will fall out of the index at the next index rebalancing date with index tracking funds forced to sell their entire South African holdings in the WGBI. The FTSE has announced that the next index rebalancing will be at the end of April.

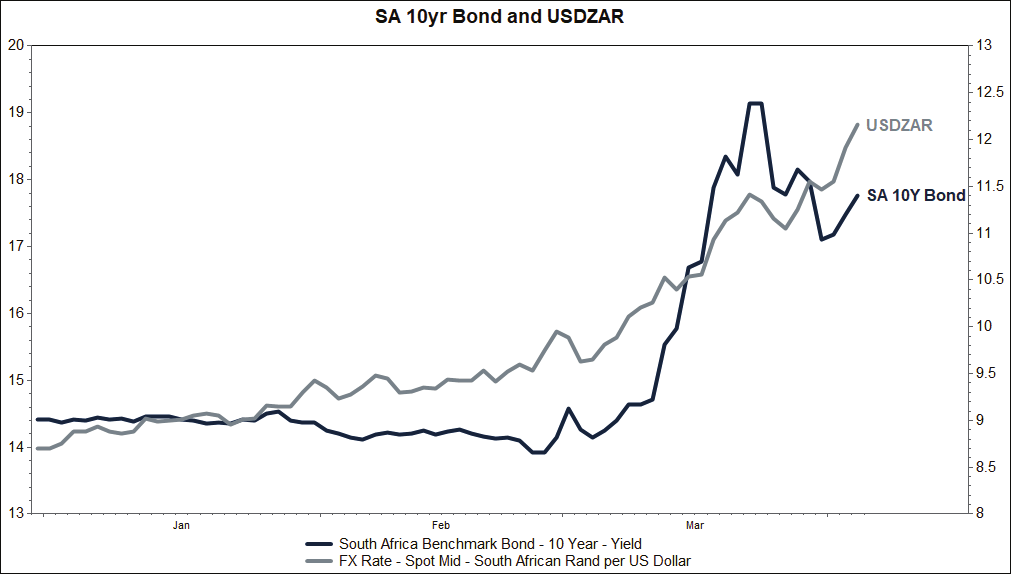

Moody’s decision did not come as a surprise with the market having expected such an outcome and reflecting it in bond prices. As a result, post the decision and after an initial sell off in the domestic bond market, the following Monday morning saw a subsequent pullback in bond yields. Moody’s decision comes during a market rout brought about by COVID-19 with a damaging impact on South Africa’s economy and fiscal position. The decision was made on the same day that the country began a twenty-one-day lockdown period to contain the spread of the virus.

Since the market had been expecting a Moody’s downgrade, we believe that investors including index trackers had by and large been reducing their exposure to South Africa over time. This was exacerbated by the selloff in risky assets as a result of flight to quality brought about by contingent effects of COVID-19. The bond market, in line with other asset classes, experienced the fastest sell off in a very short space of time in recent history and at some point, during March the losses were as high as 20% before recouping some of those losses to end the month at 9.75% down. We believe the forced selling at the end of April due to Moody’s decision will not be as severe as was initially thought, however, it is difficult at this stage to put an absolute figure on how much portfolio outflows will occur but we expect the impact on oversold bond prices will be rather muted. The same may not be true for the rand as the global economy enters its worst recession since 1947.

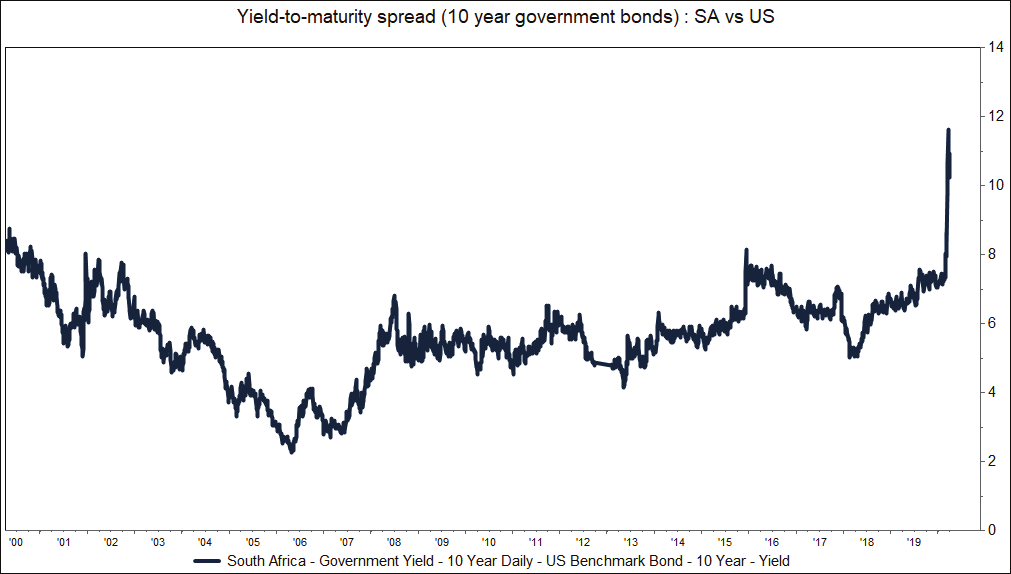

Source: FactSet

Implications for investors

The impact of South Africa’s sovereign downgrade on the economy, monetary policy, government finances and asset valuations should not be underestimated. The downgrade to “junk” has just made the country a riskier investment proposition and foreign investors will demand a higher rate of return on their investments in South Africa which includes funding of Government’s ever-growing debt profile.

The increased cost of capital will immediately affect the whole economy as it results in an increase in the cost of doing business, which will leave the private sector, households and government with less (disposable) income in their coffers and, more importantly, less willing and able to drive large scale investment spending – not good news for South Africa’s deteriorating infrastructure, troubling unemployment and socio-political challenges.

For Government, the downgrade will be a real challenge given the extent of debt accumulation since the Global Financial Crisis. The higher cost of borrowing should also be viewed against a backdrop where debt service costs are the fastest-growing expenditure item for government, crowding out other forms of public spending such as infrastructure spending and social upliftment.

Governor Kganyago will be constrained from lowering interest rates too aggressively to bolster the economy. Given the deteriorating external backdrop and SA’s vulnerable fiscal position, the near-term focus for the Reserve Bank will be to maintain financial stability and prevent continued large-scale capital outflows. Unfortunately, this will have a negative effect (opportunity cost) on the near-term growth outlook for an already struggling economy, but an important development to anchor inflation expectations and to showcase the Central Bank’s independence.

Finally, and in addition to the above, investors will also have to be content with lower valuation multiples than what they have ordinarily been accustomed to in the past, as the discount rate used to value companies, bonds or any other asset’s future cash flows, has increased, resulting in lower valuations.

Where to from here?

South Africa’s growth trajectory is on a slippery slope with the nearterm outlook expected to deteriorate. Although lower interest rates will be helpful, an improvement in business and consumer confidence would be even more powerful, but none of this will be possible in the immediate future given that the world and South Africa have entered an unusually deep and painful recession.

But in every crisis, opportunities present themselves. Winston Churchill once famously said, “Never let a good crisis go to waste” and that is exactly what investors should be focusing on during these trying times.

Asset prices have fallen sharply and offer good value for patient long term investors. We don’t try to “time the market” and have very little visibility in terms of when exactly the bottom in asset prices will be reached, or indeed if we haven’t already experienced it. But what is very evident, even adjusting for a deep global recession and South Africa’s higher cost of capital which has been a result of the recent downgrade, is that investment opportunities are starting to present themselves.

Take domestic government bonds as an example. South Africa’s government bonds have since 2017, after Fitch and Standard & Poor’s downgraded the sovereign credit to junk, been trading in line and, in some cases, at a discount to our non-investment grade peer group. The COVID-19 crisis resulted in large amounts of capital fleeing Emerging Markets and caused SA bonds to sell off sharply. At one stage as much as 15%, when the 10-year government bond reached a 12% yield to maturity. In real terms after adjusting for inflation, yields are currently in excess of 6% and more attractive than what was experienced during the GFC.

As a result, we have been selectively adding to the duration in government bonds and believe that the asset class at current valuations should form a significant component of any investor’s portfolio, especially for those that are nearing retirement or for pensioners.

Source: FactSet

Domestic equities have felt the brunt of the pain this year. The JSE All-Share index was down 21% at the end of March 2020, and when expressed in US dollars the result was even worse as the index declined by 38%. The performance from the rand hedge counters were slightly better as the depreciation in the rand provided some buffer, leaving domestically orientated shares exposed. Banks, property and retail stocks were particularly hard hit as many communicated either significant cuts to dividends this year and in some cases no dividend payments for the coming year, as these companies turned their immediate focus to Balance Sheet and cash preservation. Although these measures won’t persist indefinitely, the cost to shareholders in the near term is expected to be significant.

Source: FactSet

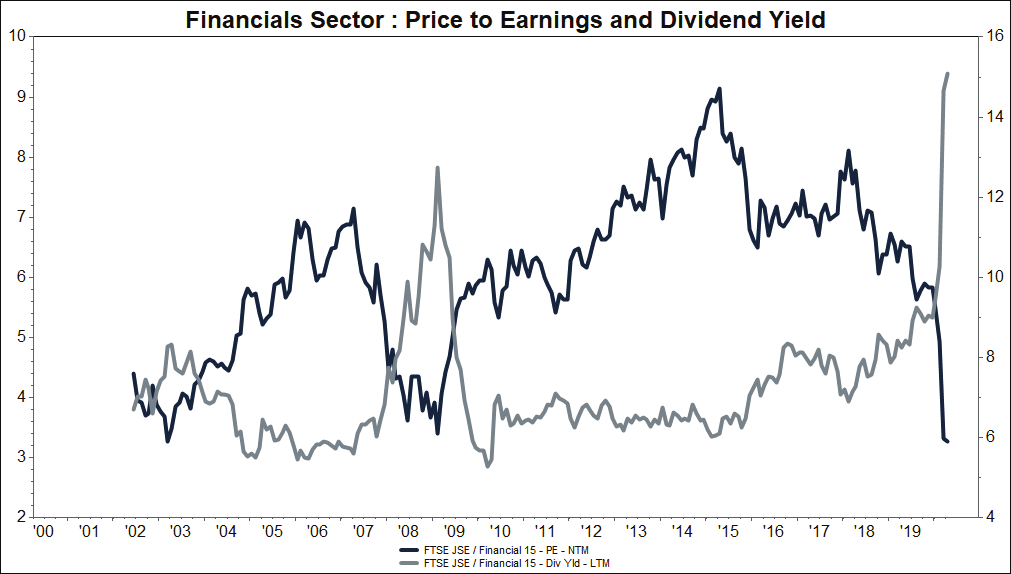

Having said that the adjustment to valuations appears overdone. Wehave used the Financial Sector charts above to illustrate the point.The charts depict the dividend yield (DY) and price to earnings (PE)ratio for this sector. On both metrics, valuations do look extreme. Forinvestors that can stomach the current volatility and are in a fortunateposition to take a slightly longer-term investment view, the math issimple. The forward PE ratio has de-rated to six times (from 15 timesin 2015) and the historic dividend yield has increased to just over 9%.

Another way to express this is through Earnings Yield, which is the inverse of price to earnings, and at current levels is just over 15% (1/6), well above the cost of equity for these shares and an indication that “the market” does not believe that these companies can sustainably grow their earnings profitably. That may be the case in the near term, but unlikely to be sustained in perpetuity.

Turning to another favourite valuation metric, namely dividend yield. At a 9% dividend yield, we believe that a whole lot of bad news is already reflected in the sector’s valuations. Granted, earnings this year will be down significantly and so will dividend payments and it is quite possible that both earnings and dividends will only return to last year’s levels (which were already depressed) in two or perhaps three years from now. But even so, investors stand to earn very attractive income yields in future by committing capital today. This is just one of many examples of attractive investment opportunities on the local bourse, and we have been adjusting portfolios accordingly to benefit from the dislocation in share prices.

“We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful.” – Warren Buffet

Our response

It has indeed been extremely testing times for investors, but the history of financial markets has demonstrated time-and-again that such sell-offs provide excellent investment opportunities for disciplined investors with robust investment processes. We have not wasted this opportunity and have already acted to build on the quality of portfolios as communicated in our two mid-month strategy updates sent in March.

Our focus going into this crisis was to increase the underlying quality and defensiveness of portfolios by reducing exposure to pro-cyclical businesses and companies that could be vulnerable from a protracted slowdown. Furthermore, the indiscriminate sell-off has allowed us to consolidate our holdings in portfolios. We have been able to increase exposures to higher quality shares which have sold off just as much as some of the more cyclical holdings, resulting in the construction of even higher quality portfolios with significant upside potential. Prudent diversification across asset classes, currencies and regions, has played an important role in stabilising portfolios, and will continue to do so.

During this period, we will be keeping a close eye on the following factors which could result in changes to the current asset allocation strategy:

- Asset price valuations at historic extremes

- A positive turn in leading indicators, such as the global manufacturing and services PMI indices

- A peak in the number of active COVID-19 cases signalling that the efforts to contain the virus have been successful – active cases refers to individuals that have tested positive for the virus minus the number of fatalities and recoveries

- The extent of monetary and fiscal support to buffer the fallout from the government enforced isolation measures

Conclusion

Our tried and tested investment philosophy, of focusing on quality and fundamentals, will stand our clients in good stead during these extremely challenging times. We therefore do not believe that it pays to try and “time” the market. It is a well-known fact that spending time in the market is significantly more profitable than attempting to take short term views, partly because the majority of returns are obtained in the period immediately after markets have bottomed. Missing out on a few of the top trading days is proven to be costly for investors. Diversification, and keeping to known long-term investment objectives, are much more important when navigating through these periods of extreme volatility.

The virus will be overcome, as history has shown with previous pandemics, and when it happens, the recovery in financial markets will be swift. But for now, and given all the uncertainties, patience and caution continues to be warranted until there is enough evidence that the number of new COVID-19 infections has stabilised, allowing leading economic indicators to turn positive.

We hope all our clients stay safe and as always, we are available at any time to answer any of your questions or concerns.

Domestic Asset Allocation

by Bernard Drotschie / Chief Investment Officer

|

Domestic Equity |

Neutral |

|

Domestic Cash |

Neutral |

|

Domestic Bonds |

Neutral |

|

Global Equities |

Neutral |

- During 2019 the global economy experienced a cyclical slowdown. The outlook improved towards the latter part of last year as the fears of a global trade war eased and monetary support by the Fed was underway. Even so, the global economy was vulnerable to any unexpected and exogenous shock, such as the Coronavirus outbreak.

- Our base case scenario was that the improvement in growth momentum (economic recovery) from late last year would continue into 2020, but that the COVID –19 virus delays the revival in growth. Even though we still believe that the impacts on the global economy will be temporary in nature, we have become more concerned as the COVID-19 virus has been spreading at a much faster rate globally than we initially expected. Previous periods of epidemics/pandemics tended to be short lived with equity markets rallying on the back of them.

- Countermeasures (social distancing) introduced by governments/ healthcare organisations in an effort to contain the spreading of the virus will unfortunately crush economic activity in the short term and pose a real challenge for policymakers to overcome.

- Since February, financial conditions have tightened significantly as forward- looking economic indicators have turned down sharply while global risk assets, including credit, EM assets and global equities have sold off aggressively.

- The duration of the virus outbreak poses the largest risk to the recovery in global GDP. If contained in the next few weeks/months, expect GDP to bounce back strongly as firms start the process of re-building stock to match pent up demand, and that the stimulus measures (lower taxes and interest rates) introduced will have the desired effects. If not, the ramifications could be serious, especially when companies are forced to cut costs/employment to protect profits.

- Global earnings peaked in 2018. Since then earnings have declined and another year of disappointing (negative) growth in profits could tip the scale into something more harmful and potentially the start of the next downward cycle.

- Fiscal stimulus measures introduced by global authorities have been aggressive, but more will be required. Global central banks have cut interest rates and stand ready to inject additional liquidity. The focus has been on providing credit lines for SMEs and households, and to provide support for credit and funding markets.

- These measures will be very supportive once the dust has settled and will play an important role in the recovery of the global economy, investment markets and confidence alike.

- South Africa will most likely have a more prolonged recovery period post the lockdown given the limited resources we have at our fiscal disposal. The SARB has intervened thus far and has some headroom to move further with interest rate cuts given the benign inflation outlook and the extremely low interest rates globally.

- The important numbers to watch remain the Coronavirus containment measures as this will guide the length of global lockdowns. Once the lockdowns are behind the world, there are stimulatory efforts that could push a global recovery, but time is of the essence. We will only be able to get more clarity on the damage and potential recovery once the world is up and running, but this must only be done in a responsible manner given the vast social implications of the Coronavirus.

- Dislocation in markets will provide opportunities for investors, but patience will be required – wait for a turn in leading indicators such as PMI (manufacturing and services) and a peak in new active COVID-19 cases.