What’s AGOA-ing on?

View PDF versionNot in the 25 years of its existence has AGOA made as many headlines as now. It has always been an important economic tool for African economies but only formed part of the lexicon of trade economists and businesspeople who were directly impacted by it.

That changed when Donald Trump put AGOA, the US African Growth and Opportunity Act, under the spotlight during his bid for the US Presidency in 2024. All South Africans suddenly wanted to know: Will Trump cancel AGOA?

When a 30% tariff on certain South African exports to the US was announced at the start of April, it pre-empted the September deadline for renewing (or not) the AGOA deal. When the tariffs kick in, it will essentially nullify the benefits of AGOA.

If we put aside the vast uncertainty that abounds on tariffs generally, let’s put AGOA and prospects of losing it in context.

What is AGOA?

AGOA is a piece of American domestic legislation that, according to the official AGOA website, "significantly enhances market access to the USA for qualifying Sub-Saharan African (SSA) countries." More specifically, it slashes import tariffs on thousands of products when sold into the USA from qualifying African nations.

This impacts a substantial portion of South Africa's exports. The USA is the country's second-largest export destination after the EU. Between 2019 and 2022, South Africa's trade surplus with the US increased from just over $2 billion to almost $8 billion. So, it would seem that AGOA is working in the country's favour.

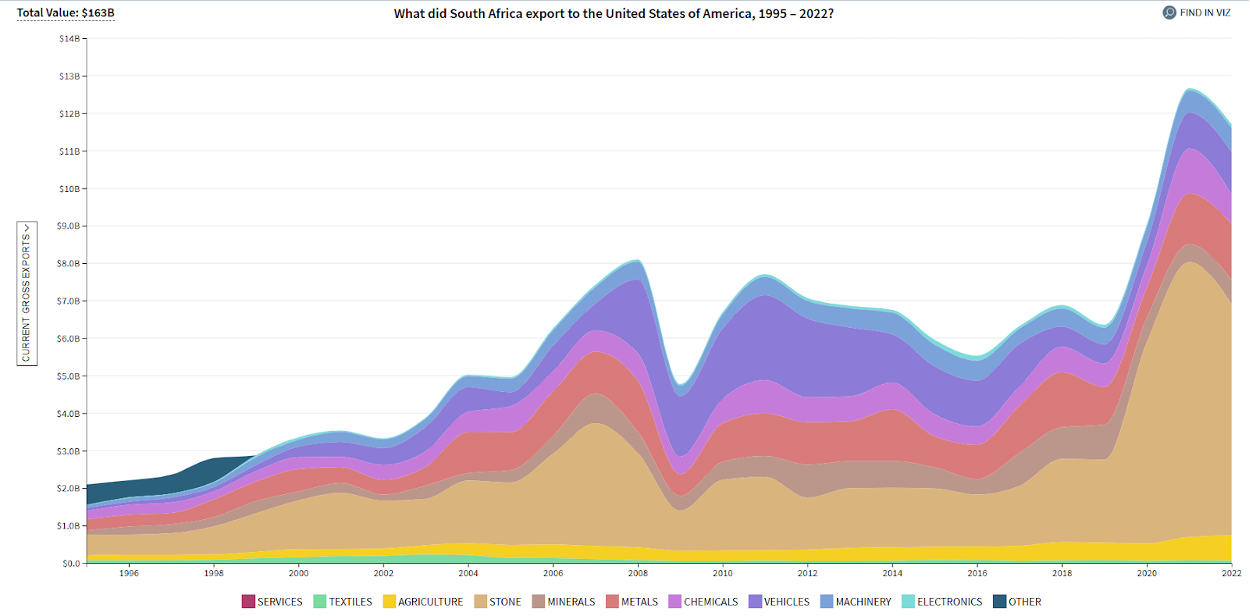

South Africa’s exports to the US (1995 – 2022)

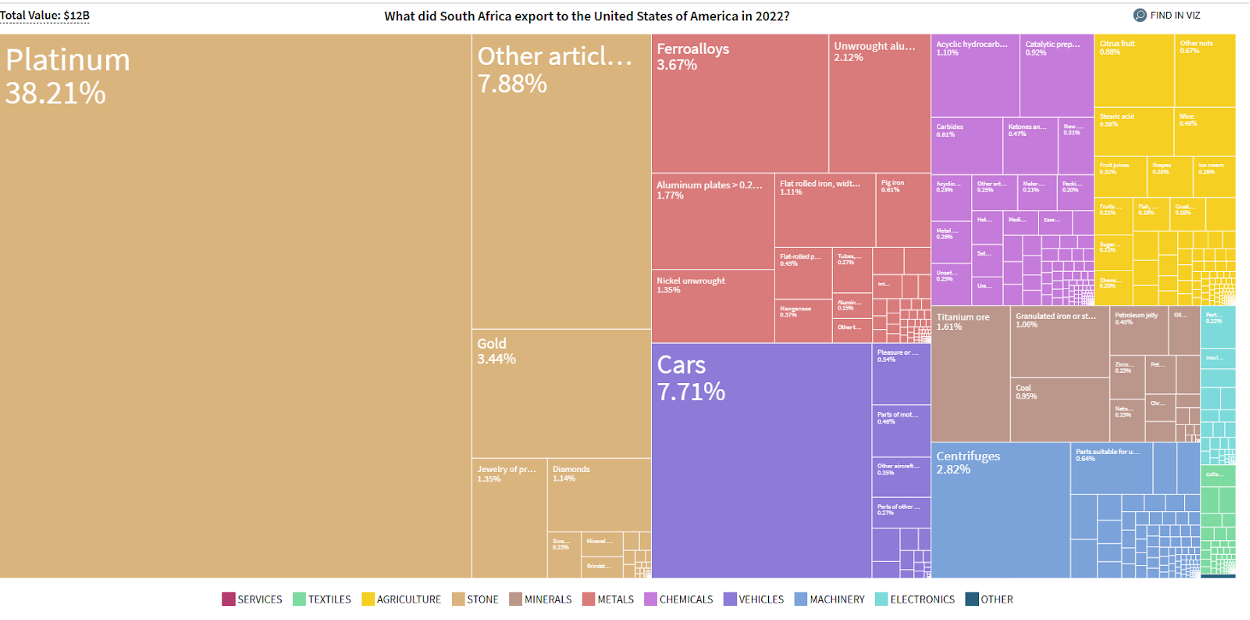

Source: Harvard Growth Lab | South Africa’s exports to the US consist almost entirely of two product types: motor cars and commodities. Platinum holds pride of place with total exports of $12 billion in 2022 (the latest year of complete data available from the Harvard Growth Lab).

Source: Harvard Growth Lab

What would be the effect of being excluded from AGOA?

Revoking AGOA privileges would make exporting from South Africa to the US more expensive. Some of the costs would be borne by exporters, and in some cases, American consumers would pay a higher price. It is impossible to know what that ratio would be in reality. What is certain is that the volume of South African exports to the US would decline.

However, it is important to put losses in context. The overall impact on GDP, for example, would be modest. The Africa Growth Initiative at the Brookings Institution has calculated likely losses: “The impact of a loss of AGOA on exports and gross domestic product (GDP) would be small. Our model suggests that at worst, South Africa’s total exports to the U.S. would fall by about 2.7%. Certain sectors would be more affected than others. The biggest losses would be felt by the food and beverages sector, with exports to the U.S. expected to fall by 16%, and the transport equipment sector, forecasted to drop by 13%. The third and fourth biggest losses would be felt by the fruit and vegetable sector (-4.5%) and the leather and clothing sector (-3.6%).”

The institution believes that ending AGOA would reduce South Africa’s GDP by 0.06%. Although small, this is a meaningful figure, especially in a fragile economy with limited growth. At a business level, it would be devastating to exporters enjoying preferential tariffs under the Act.

Why is the expected loss so small? First, the US makes up 10% of South Africa’s total export basket. Second, the bulk of these exports are commodities. Minerals and metals benefit minimally from AGOA tariff easing. So, we are talking a fraction of the 10% of total exports in play.

Nuance and narrative

As Yale professor and Nobel Prize-winning economist Robert Shiller will tell you, narratives move markets. As he asserted in a presidential address as far back as 2017: “Narratives ‘go viral’ and spread far, even worldwide, with economic impact. The 1920-21 Depression, the Great Depression of the 1930s, the so-called ‘Great Recession’ of 2007-9 and the contentious political economic situation of today, are considered as the results of the popular narratives of their respective times.”

As Shiller also said: “The human brain has always been highly tuned towards narratives, whether factual or not, to justify ongoing actions, even such basic actions as spending and investing.” If the US were to cut South Africa from AGOA, it would tell a damaging story about our country – and this negative sentiment is likely to cause headwinds for the rand and the economy in general.

How should the South African investor respond?

By not overreacting.

A well-constructed investment strategy should mean that the small fractions mentioned above are further fractionalised. South African investors have, after all, been building global portfolios for some time.

With uncertainty and change the order of the day, now is not the time to make sudden moves and take big leaps. Melville Douglas portfolios are structured with strong defences against a drop in performance by SA Inc. and calculated global exposure to quality businesses around the world.

[Disclaimer]

Melville Douglas is a subsidiary of Standard Bank Group Limited. Melville Douglas Investment Management (Pty) Ltd. (Reg. No. 1987/005041/07) is an Authorised Financial Services Provider (FSP number 595).

This article has been prepared for information purposes only and is not an offer (or solicitation of an offer) to buy or sell a product and does not constitute advice by Melville Douglas, it should not be relied upon as such. Contact Melville Douglas before acting on any information in this article, as Melville Douglas makes no representation or warranty about the suitability of a product for a particular client or circumstance. This information is not intended to be, and should not be construed as, tax, investment and/or legal advice.