South Africa’s economy: What’s under the hood and up ahead?

View PDF versionWe frequently speak about the economy as a single entity. We might talk about it in the singular, doing well or performing poorly. That makes sense from 30 000 feet. But we have to dive down to a more granular level to understand how the various components of an economy are working – or not working – and interacting with one another. In a sense, we need to look under the hood to establish which parts of the engine are operating well, which are simply holding on, and which are beyond their useful life and due for replacement.

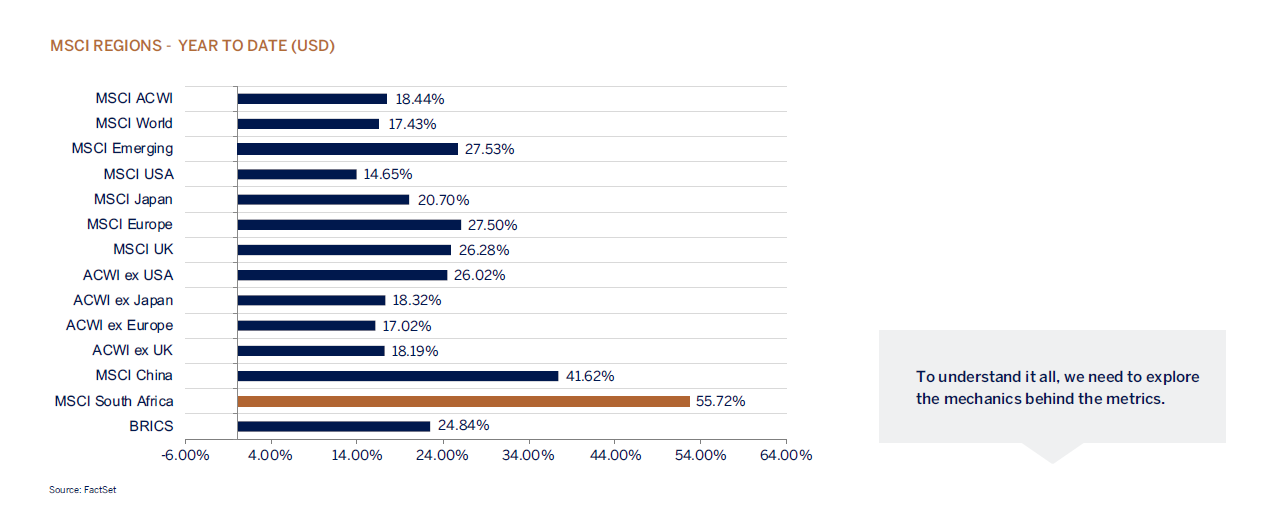

When we do this, we typically find paradoxes. South Africa is a case in point. GDP growth alone suggests a stagnant economy. Regardless of which measure you rely on, in real terms, GDP is stuck. However, if we turn to the stock market, we get a very different picture. The JSE is performing well. In fact, it is one of the world’s top performers of late. The MSCI South Africa Index has returned more than 30% dollar returns for the year to date. This is far above even the secondbest performer among the MSCI regions, China, with just under 23%.

Under the hood of SA Inc.

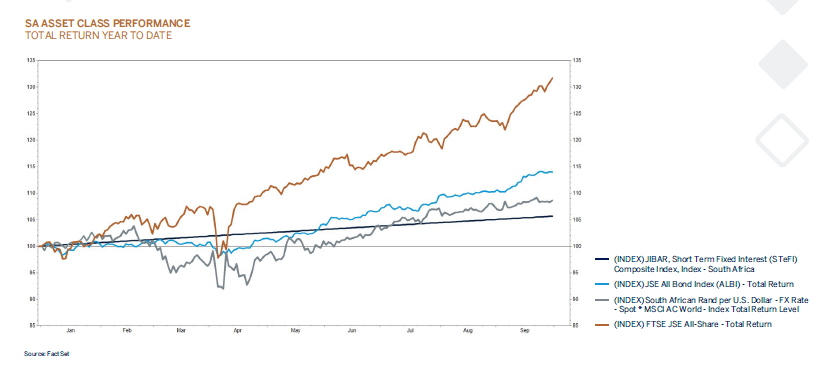

From high above, it might appear South Africa is getting everything right this year. Local assets have outshone global peers markedly. The JSE All Share Index (ALSI) can boast nearly 20% returns year-to-date, and that figure is just under 10% for the JSE All Bond Index (ALBI). This, while the MSCI All Country World Index (ACWI), an indicator of global stock performance, has offered just 6.9%.

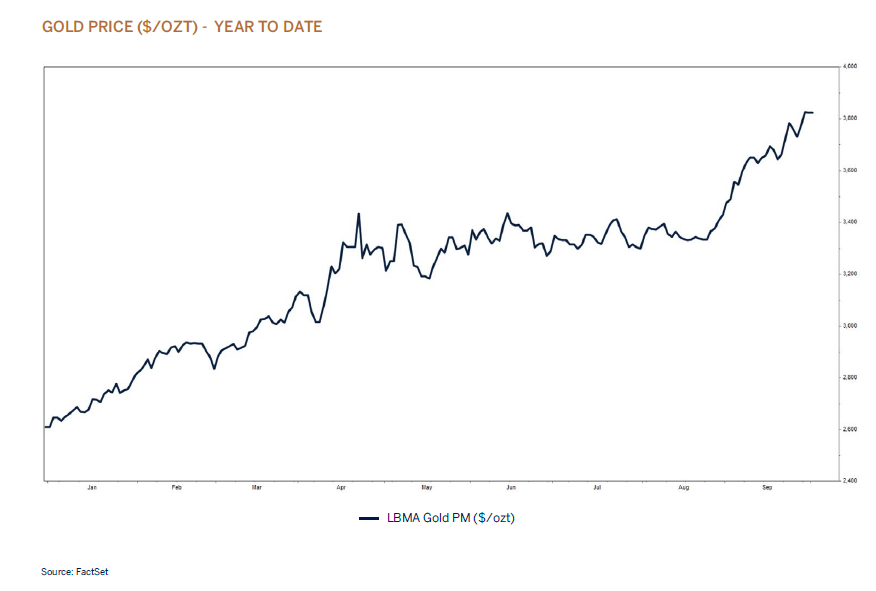

However, a slightly deeper analysis shows that a significant portion of the good performance in the country has not been a South African story. For example, the seismic rise in gold prices has resulted from global macro conditions, including a flight to safety, a weaker US dollar, and lower real rates. This has benefitted South Africa, but is not attributable to local conditions.

Fuelling the engine

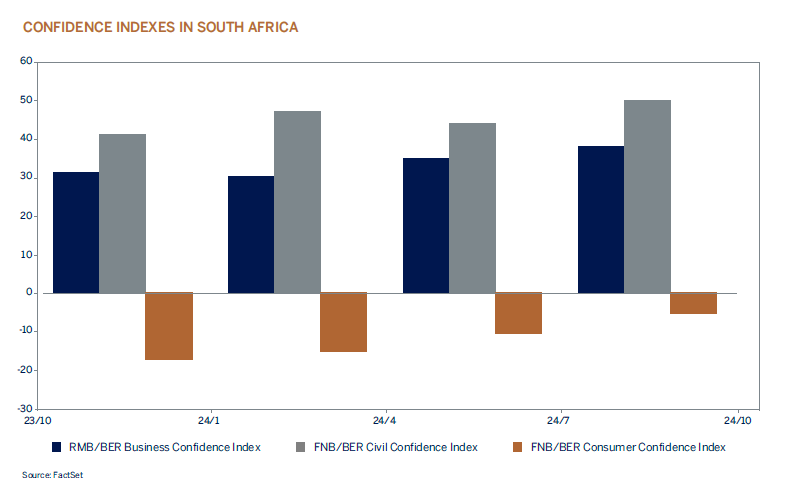

That is not to suggest South Africa is not making strides in the right direction. Multiple indicators confirm that it is. We can see this in well-regarded measures of confidence. Business, civil, and consumer confidence are moving in the right direction.

President Cyril Ramaphosa and Public Works and Infrastructure Minister Dean Macpherson have both spoken ambitiously about “turning South Africa into a construction site”. This will require major improvements on the current trajectory, where construction – like most other economic activity – is slow.

Here, it is important to note the base effect. It is no secret that South Africa’s economy is coming off a low base. GDP growth, capital investment, and infrastructure have been muted and, at times, in decline. This has been harmful to prosperity. However, it also creates prospects for outsized benefits from relatively small improvements – chiefly for those who stay the course.

With the Government of National Unity (GNU) holding, albeit uncomfortably at times, we can point to performance keystones that show signs of meaningful (and home-grown) improvements on a low base.

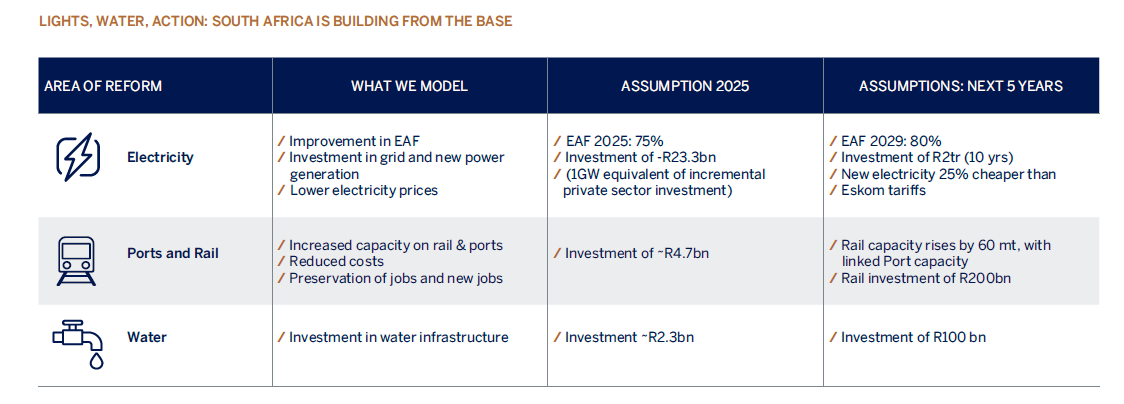

Electricity supply is one of them. Our analysis suggests improving electricity availability, growing investment in generation, and easing electricity prices over time. South Africa’s ports and rail represent a similar dynamic. Our major ports rank among the most inefficient in the world – in fact, Durban is last out of 403 on the World Bank rankings. Yet, according to the latest data, Cape Town was the most improved port over the last year, and Coega was the fourth most improved. These may be small steps, but they matter in the context.

South Africa’s inclusion on the so-called ‘grey list’ by the Paris-based Financial Action Task Force (FATF) in 2023 represents another worrying low. This was the result of a number of failures at preventing money laundering and terrorist financing. By mid-2025, according to the Financial Times, the FATF had determined that South Africa had “substantially completed its action plan” to escape its categorisation, showing a “sustained increase in investigations and prosecutions of serious and complex money laundering cases”. This should lead to the removal from the list during the final quarter of 2025 – a meaningful boost from a low base.

</br>

Watching the road ahead

Just as important as the state of the engine is the condition of the road ahead. Front and centre is the GNU. This coalition government is made up of parties with markedly different persuasions, and they will continue to tussle. However, thus far, the arrangement has held, and markets have benefitted. This relative stability should give investors a degree of confidence and a basis to plan ahead.

Inflation and interest rates are lit up on the dashboard, too. With the South African Reserve Bank (SARB) forecasting headline inflation to average 3.4% for 2025, 3.6% in 2026, and 3% in 2027, investors have clear signposting on the domestic value of their rands. The central bank has also signalled room to lower the current repo rate of 7% in the medium term.

This all reflects in our domestic asset allocation. While political risk remains, the GNU is serving its purpose as a platform for reform, and shareholders are reaping the benefits. Local equity valuations remain attractive, making earnings per share (EPS) of 10% to 15% over the next two years entirely possible. Likewise, bond yields are high and likely to outperform cash this year.

It would not be over-optimistic to begin anticipating an upgrade for South Africa’s credit rating. Small steps forward from a humble start, plus patience, add up to good things.