“Don’t put all your eggs in one basket” is a wise adage. It is also the only free lunch in finance given there is no certainty about the future. By spreading risks an equity investor ensures their hard-earned capital survives the inevitable bumps in the road to deliver compound returns over the long term.

Equally, too many egg baskets can cloud your judgement, develop a false sense of security and dilute your chances of delivering a superior result. These foibles have played a role in many of history’s financial disasters. A case in point was the collapse of the $126 billion hedge fund Long Term Capital Management (LTCM), which almost triggered a Lehmans-like global financial crisis in the late 1990s. The fund, with no less than two Nobel Prize Laureates on its team sheet, appeared highly diversified across global markets through thousands of trades. The problem was that all these trades were simply the same bet, i.e. that volatility, credit and liquidity spreads would narrow from historically high levels. Instead, these spreads blew out after the Russian bond default in August 1998, resulting in catastrophic losses for LTCM. As the old Wall Street saying goes, the only thing that goes up in a bear market is correlation.

As a stock picker, too many holdings can also crimp your chances of beating the market. This point was succinctly made by none other than John Maynard Keynes over 70 years ago. He was not only one of the 20th century’s greatest economists, but also a very successful professional investor. He wrote in the 1940s that

“to suppose that safety-first consists in having a small gamble in a large number of different companies where I have no information to reach a good judgement, as compared to a substantial stake in a company where one’s information is adequate, strikes me as travesty of investment policy.”

Diversify

Keynes’ portfolio construction philosophy resonates with ours. Truly wonderful investment ideas are not dime a dozen and therefore investors should hold meaningful positions when these rarities are uncovered. By contrast, holding increasingly lower conviction ideas for the sake of diversification is “diworsefication”. Peter Lynch, the legendary former manager of the Magellan global equity fund, made up this term in his 1980s investment book One up on Wall Street to describe management teams who spread their time and resources across too many businesses. In his book he highlighted Gillette’s ill-fated and short foray into digital watches in the 1970s. Diworsefication eventually entered the lexicon to describe how the benefits of diversification can tip into a disadvantage beyond a certain point.

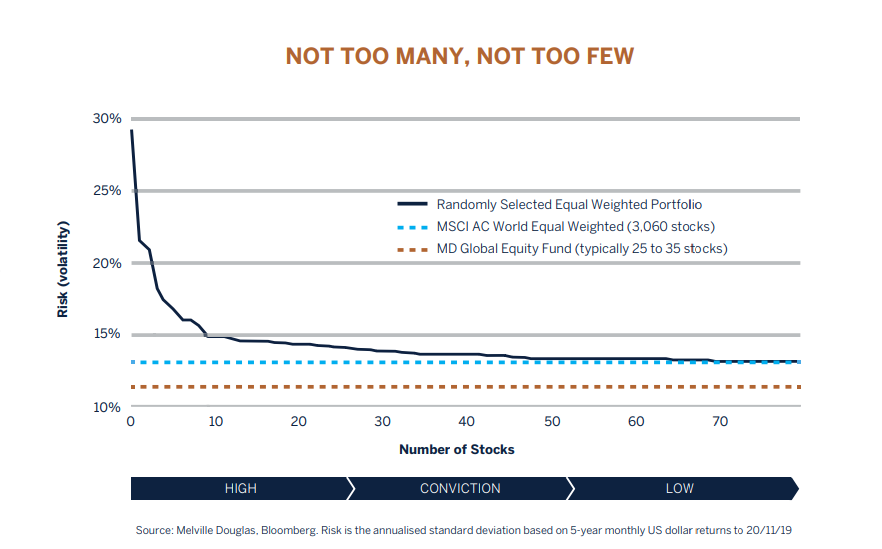

What then is the ideal number of stocks to hold in a portfolio? The investment industry, given our physics envy, tries to distil everything into a single number. Clearly this is spurious accuracy. We prefer to think in ranges, which will vary depending on the investment approach. For the Melville Douglas Global Equity fund we would typically aim for around 25 to 35 holdings.

The minimum number of stocks to hold in global equity portfolios is not as high as many would imagine. One measure of risk is price volatility. According to modern portfolio theory, diversification can lower portfolio volatility because share prices do not move exactly in tandem with each other. As more stocks are added the overall volatility of a portfolio’s value declines. As shown in the chart, you can halve the average volatility of holding one stock by simply adding a random sample of nine more names to the portfolio. Beyond this point, the volatility-lowering benefit of diversification is nothing to write home about. A ten-stock portfolio is only 20% more volatile compared to holding over 3,000 stocks in the MSCI All Country World equity index.

A ten-stock portfolio is a touch aggressive because it would only take bad news in one or two stocks to torpedo portfolio performance. Our aim is to make money for our clients through the compounding effect of sustainable returns over time. For this to work we need to be able to ride out those inevitable “known unknowns” and “unknown unknowns” (to paraphrase former US Secretary of Defense Donald Rumsfeld’s famous quote). To do so, around 25 to 35 holdings spread across different sectors, regions, themes and macro sensitivities (e.g. rates, oil price and business cycles) sufficiently covers most eventualities.

Maintaining balance is key to how we invest at Melville Douglas. Every stock held in the Melville Douglas Global Equity fund is a high conviction idea, but we construct the portfolio to ensure there is a sufficiently robust spread of ideas to withstand a few cracked eggs.