Chaos, confidence, and capex

View PDF versionChaos is one of those things we all feel at present, whether you are managing global funds or monitoring your own portfolio. From abrupt policy announcements out of President Donald Trump’s Oval Office to escalated conflict in the Middle East and shifting political moves in South Africa, a heightened sense of tumult is in the air.

But, as the truism attributed to renowned strategist Peter Drucker goes, “If you can’t measure it, you can’t manage it”. Fortunately, we have some excellent proxies that help us to quantify this sense of uncertainty.

Putting South Africa's GDP into a global context

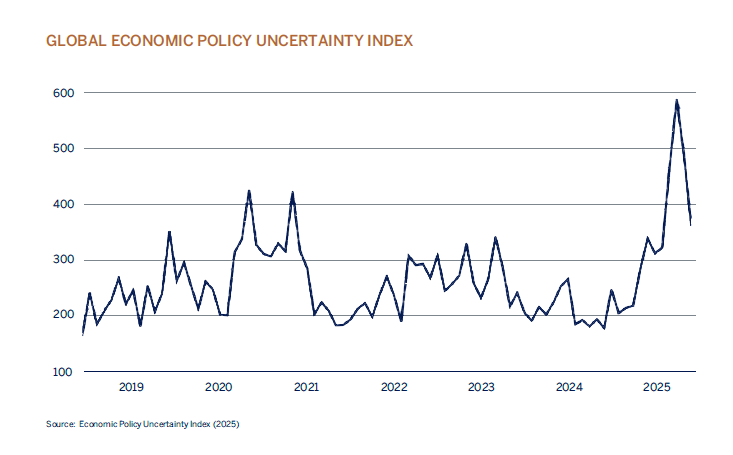

Let us start with a bird’s-eye view. The Global Economic Policy Uncertainty Index took a marked upturn when President Trump took office. This is driven by his administration’s approach to everything from oil exploration to trade. In addition to the policies themselves, the implementation matters, and he continues to inject uncertainty with the abruptness of his announcements.

The chart below provides visual confirmation of the uncertainty many feel. The recent peak in economic policy uncertainty markedly surpassed even Covid-era highs. Importantly, we recently dipped below those levels, but remain well above the norm.

GLOBAL ECONOMIC POLICY UNCERTAINTY INDEX

President Trump has imposed a 30% standard tariff on South Africa, exceeding most expectations. Products such as copper, pharmaceuticals and semiconductors are exempted. Nonetheless, this is a major blow to a number of sectors. Citrus farmers and car exporters are among those particularly exposed. Estimates are that some 30 000 jobs in total are at risk.

From chaos to capex

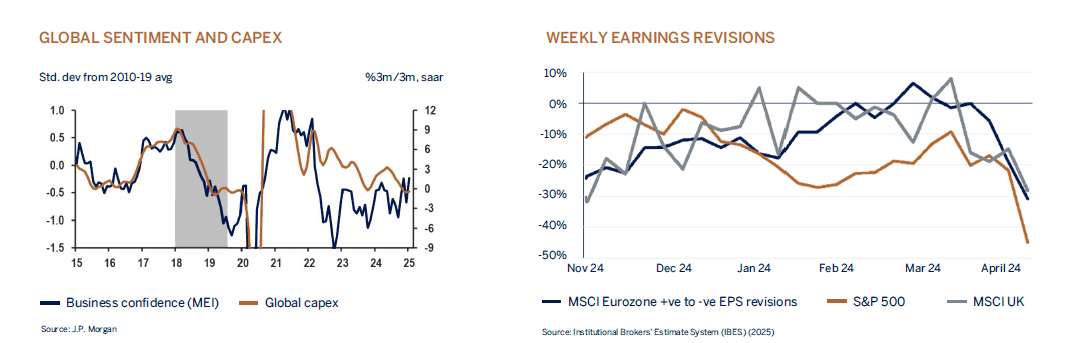

There is a strong causal link between uncertainty and inactivity. When businesses are worried about what might emerge from Washington in tomorrow’s press conference and how military activity may impact global oil prices overnight, they tend to hoard cash. In short, business confidence and capital expenditure (capex) track closely.

Uncertainty also impacts the sharp point of things: corporate earnings. Since Q2 of 2024, businesses in major international indices have been slashing their earnings forecasts. Hoarding cash comes at an opportunity cost. That money should be used to grow the business and increase productivity. Right now, caution seems to be the name of the game for investment committees.

From measurement to management

So, our worries are valid; we can measure them and translate them into economic movements and strategic shifts.

Managing our concerns and reactions starts long before the uncertainty begins and the measurement is done.

Melville Douglas does this by buying quality businesses that have enduring competitive advantages. This is the first line of defence against inevitable spells of elevated uncertainty. Diversification across industries, asset classes, and regions builds in further protection.

One of the ways this has paid off was our approach to South African equities. We have been overweight on them for some time because we believed that they were underpriced. With the JSE outperforming global indices in recent months, this strategy proved rewarding.

Of course, we continue to monitor changes in markets and, within the structure of our overall strategy, adjust portfolios with purpose.

If you have questions about the position of your investments in this challenging climate, please reach out to your portfolio manager, who will be happy to discuss this with you.