From our Fund Manager’s Desk

We regularly explore the investment rationale of one of the companies we own in the fund. In this note, we expand the scope somewhat to discuss the broader IT sector, which has been a large position in the Global Equity Fund over the past several years.

Given the topicality of increased regulatory scrutiny of the global large cap technology space – and our preference for owning some of these businesses – we thought it an opportune moment to re-test our thinking and highlight what we see as potential pitfalls (and opportunities) in this regard.

Whilst it is generally difficult to get economists to agree on anything, one fact that seems to be reasonably widely accepted these days is that the advent of the internet has created a change in how and where economic value is created. Much like the Industrial Revolution, the introduction of new technologies has profound implications for business, labour, capital and society as a whole, and many of these implications are only becoming apparent now.

One attractive business model enabled by technology – and by no means a new one – is the network model. Businesses such as Visa and MasterCard – both of which are owned in the fund – have for years grown their profits by ensuring there are enough incentives for consumers to switch from using cash to a credit or debit card, thereby increasing the volume of transactions on its network. By taking a small cut of the value of every transaction that flows over the network, Visa and MasterCard generate extraordinarily high returns on capital, which they then reinvest to incentivise their partners, strengthen their competitive position and improve their value offering.

Given our preference for investing in businesses with secular tailwinds and an attractive growth outlook, it is no wonder our investment process has delivered quite a few names that benefit from the network model within the information technology space. The combination of high[1]speed internet, affordable data pricing and a small computer (that happens to make phone calls) in everyone’s pocket enables people to access services or order goods online at a scale never before achieved.

One of the more attractive business models that has evolved from the network model is the multi-sided platform. Beyond the initial investment to build the platform and the ongoing cost of maintenance and innovation, the economics improve the more users the platform attracts, as each additional user generates higher marginal profits. Examples of this model would be Apple’s iTunes Store (connecting artists and app developers to buyers of Apple products), or the online advertising models favoured by Alphabet and Facebook (where advertisers pay for access to the data of platform users, in order to better target their marketing budget at users that are more likely to act on the advertising they see).

THE ONLINE ADVERTISING LANDSCAPE

The online advertising model in particular is a development of the Information Age. It is a business model that would not have been possible without the building blocks mentioned above. It is reliant on the consumer willingly allowing access to information about themselves to enjoy a ‘free’ service, with the implicit cost being that the information they offer will by segmented, analysed, and used to slot the user into a demographic that advertisers may wish to address.

As the recent revelations around Facebook and its handling of consumer data shows, it remains a space fraught with a lot of uncertainty around what data may be collected, and with whom it may be shared – and how informed consumers are about any of these practices. The revelations have come at a time when lawmakers, society at large and politicians seem to be in agreement that some form of regulation may be required, with Europe recently enacting the General Data Protection Regulation (GDPR) to address some of these concerns. We would not be surprised to see this as the first step to further regulation – it is a risk we have accounted for in our assessment of the investment case for these companies, as well as our valuations. In allocating capital to the online advertising space, we prefer Alphabet, which has in our opinion taken a more prudent approach in protecting user privacy.

The recent quarterly results released by Facebook highlight some of the risks inherent to the online advertising business model. A combination of regulation, user saturation in the North American market and general user mistrust of Facebook necessitated changes to the operating model that will negatively impact revenue growth and profits for some time to come, as margins will come under pressure. We think these actions are positive for the long-term viability of the platform.

However, we believe it prudent to continue watching from the sideline until more clarity emerges on what the future sustainable margins of Facebook might be.

Even then, if the regulation were to be draconian enough to effectively break the economics of the multi-sided platform model explained above, it is worth remembering that Alphabet and Facebook have billions of users because their product is free. For hundreds of millions of users, the information they can access on these platforms is invaluable, and they cannot afford a ‘paid-for’ version of Google search or Facebook that ensures their information is not shared or sold. If the choice comes down to having some version of an online advertising business that provides a valuable service to users, or regulating these companies out of existence, we think governments will err on the side of the former.

REGULATORY FOCUS BEYOND ONLINE ADVERTISING

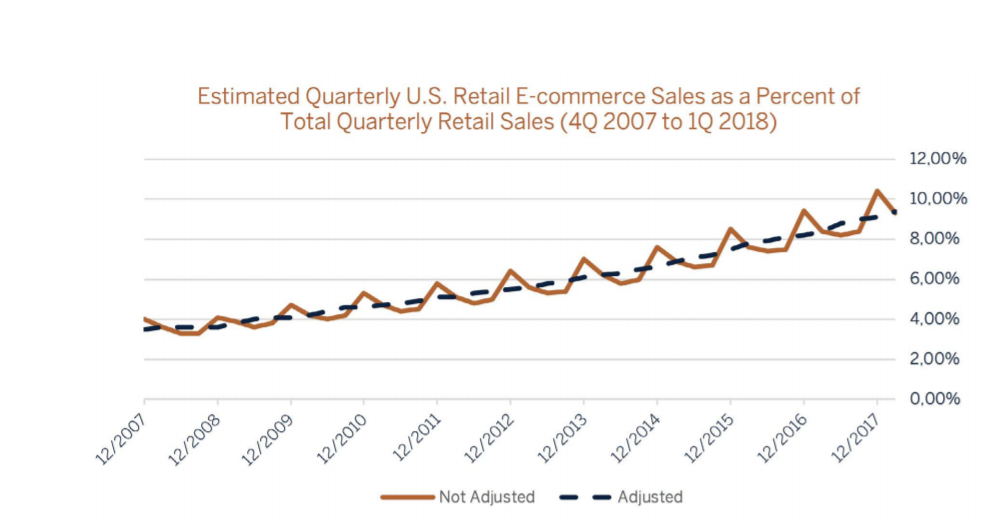

Given the fact that e-commerce as a percentage of total retail spending in the US is only around 9.4% of adjusted retail spend, the outlook for e-commerce growth in the US (and elsewhere) remains attractive.

A business such as Amazon – which has definitely had a substantial impact on traditional retailing – exists because it gives users a wide selection, competitive pricing, and convenience. These are tangible benefits that consumers value.

Given their outsized impact, Amazon has not escaped the ire of politicians, with US president Donald Trump suggesting that he thought the company should be regulated. While it is not clear whether any action will emanate from this, here too we think that anything but the harshest of regulatory intervention will see the business survive and continue to grow. It is worth remembering that Amazon runs Amazon Web Services – the largest player in the provision of Infrastructure-as-a-Service in the public cloud market. This business is almost completely independent of Amazon’s retail activities and generates the majority of Amazon’s operating cash flows. Moreover, it is exposed to a completely different secular trend playing out in the enterprise IT space (the adoption of cloud infrastructure) and will likely not be caught up in any regulation of the retail business, were such to occur.

CONCLUSION

We do not think the investment case for internet business models are broken. As mentioned earlier, we have taken many of the risks outlined above into account and have been selective about which companies we own. Of the so called FAANG stocks – Facebook, Amazon, Apple, Netflix and Google (now Alphabet, but FAANA is a much less catchy acronym), we only have exposure to Amazon and Alphabet. Of the Chinese equivalent names (BAT, for Baidu, Alibaba and Tencent), we only have exposure to Tencent. Given that the Chinese internet regulatory landscape is very different from the one in the US, UK or EU, we are much less concerned about regulation for Tencent, although we closely watch the actions of the Chinese authorities in this regard.

This also raises another point: not all IT names are created equal from a risk perspective. Visa and MasterCard are both classified as information technology companies, though we see very little overlap between their business cycle and that of ‘traditional’ IT or internet business. Equally, Microsoft and Oracle serve a very different consumer – mostly enterprise IT departments and their in-house users. While data privacy regulation will affect their cloud business to a modest extent, their business models are not nearly as exposed to the concerns currently raised.

A more reasonable criticism of some of the large IT businesses is that their tax affairs are structured so that they legally pay the minimum amount of tax in certain jurisdictions by using a variety of methods to shift profits to low-or-no-tax jurisdictions. This is an essay on its own, but suffice to say we would not be surprised to see the effective tax rate of some large cap IT names move up over time, and incorporate such risk into our valuations.

We still think that the technology sector remains attractive from a growth perspective, though we are more cautious on valuations. Our exposure looks markedly different than the IT index by design, given our assessment of risk and potential reward. We will continue to manage our position based on the longer-term outlook but are very much aware of the nearer-term risks