Snap-On Inc

View PDF versionFrom our Fund Manager’s Desk

Our quarterly reports regularly explore the investment rationale of one of the companies we own in the Fund, to articulate what we find compelling. For this report, we have chosen Snap-On Inc.

In scouring the investable universe for ideas, our investment philosophy and process delivers certain outcomes. For example, utilities don’t look attractive to us on either qualitative or quantitative measures. Equally, deeply cyclical businesses struggle to make it onto our radar, as the return profile is overly dependent on getting the timing of the purchase decision right. In addition, many deeply cyclical businesses don’t generate a return on capital in excess of their cost of capital through a business cycle – an immediate disqualifier for us.

This does not mean cyclically sensitive businesses can’t make it into the fund. However, in addition to meeting our normal qualitative and quantitative criteria, we need to do a lot of ground work to truly understand this kind of business and build the requisite amount of conviction before allocating our capital at an acceptable margin of safety. We think Snap-on Inc. is one such business.

Snap-on provides tools, equipment and diagnostic hardware (and software) to the automotive maintenance industry, targeting professional mechanics, service centres and even the auto[1]manufacturers themselves. From purely being a provider of handtools in the 1990s, Snap-on has expanded its offering to address the entire automotive service landscape. Its tools are generally considered as the best and a must-have for a professional mechanic. Snap-on is able to charge three or four times more than an equivalent in a retail store, such as Home Depot, given their quality and life-time warranty. In fact, the CEO had once described their offering to us as the “Gucci of spanners”. As a result, their products sell at a sizeable (as much as 50%) premium to the professional offering provided by their closest competitors.

Snap-on primarily does business in the USA, where the automotive mechanic market functions slightly differently to what most might expect. Roughly 80% of mechanics are independents and as such, have to provide their own tools when approaching a garage to practice their trade. The remaining 20% is split roughly 60/40 between car dealerships and commercial machinery mechanics.

Snap-on targets the independent mechanics via a unique distribution model: a fleet of vans operated by Snap-on franchisees. This represents a significant competitive advantage as it would require a lot of time and money to set up such a sales force from scratch. In effect, every Snap-on van on the road is a small, independent business, operated by someone who pays Snap-on a franchisee fee to operate the concession. In addition to the franchise fee, these operators also purchase the tools they sell out of the van from Snap-On – in many cases funding the purchase via Snap-on Credit, the in-house financing option.

Each van-owner then has an assigned route they drive weekly, selling the tools and equipment to the roughly 250 mechanics they service. Driving the route on a weekly basis is seen as an essential part of the sales strategy: not only does it build a sticky relationship between the mechanics and the Snap-on operators, it enables the operator to give real-time feedback to Snap-on to better anticipate demand. In addition, the franchisor uses this visit to collect the weekly payments on the sales they make to mechanics – a business practice successfully employed by Snap-on for several decades now. Mechanics are regular and prompt payers when it comes to their Snap-on tools, as it literally represents their livelihoods.

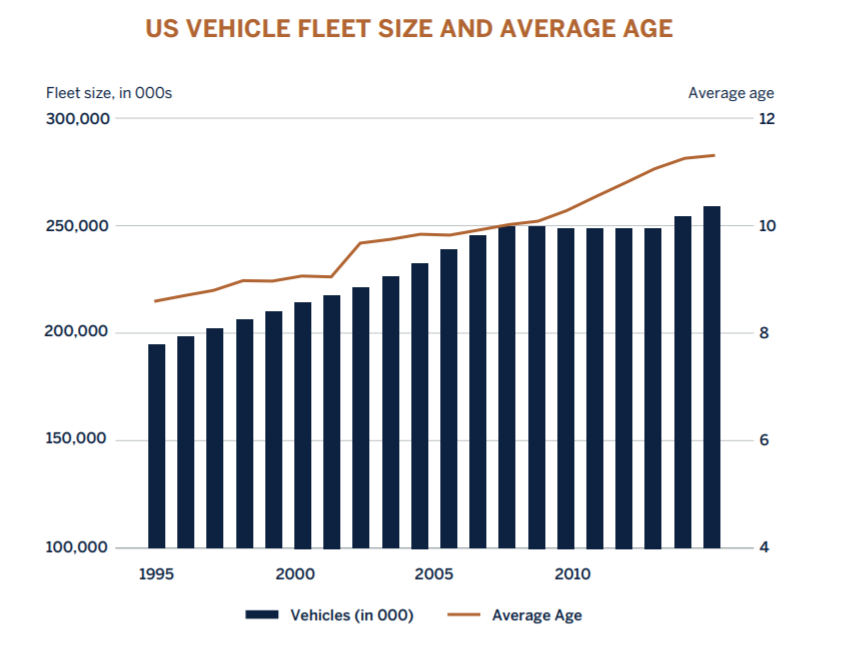

The growth of the US auto repair market is largely driven by the size of the vehicle fleet, combined with the average age of vehicles. Over the last decade, Americans have chosen to run their cars longer and opted for additional repairs over purchasing a new vehicle. The recent economic strength has seen an uptick in new car sales, which one would naturally assume causes a decline in business for independent mechanics.

Source: Company reports, HIS, US Department of Transport, Census Bureau, Baird Research

The opposite is actually true: the hugely increased technological complexity of newer cars has necessitated more repairs, with specialised equipment required to do it. Snap-on has benefitted from this trend by expanding its offering to offer diagnostic equipment in addition to tools and has expanded its addressable market as a result. Snap-on has the industry’s most advanced offering, which leverages the proprietary database of over 1bn repair records to offer mechanics the best possible diagnosis and repair decisions.

This trend towards increased complexity is expected to continue. Combined with the strength of the Snap-on brand, the quality of the product (and an extremely robust warranty programme) and the close relationship between mechanics and the franchisee force, there is an attractive case to be made for secular growth over the next few years. In addition, Snap-on enjoys the benefits of substantially lower working capital requirements than most businesses exposed to the industrial cycle due to the franchise sales model. As such, the company also has best-in-class returns on capital, which can be reinvested into the business.

Outside the US, its sales are less reliant on a franchise force. The tools and diagnostic equipment are largely sold to car dealerships or auto manufacturers directly. Even here, the brand and product quality are enough to keep buyers loyal. One would think that price competition in this space is intense, yet the warranty conditions, speedy delivery and brand perception are all cited as much more relevant in making a purchase decision than having the lowest price.

In our opinion, the combination of continued organic revenue growth (with a supportive secular outlook) and further opportunities for margin expansion equate into strong free cash flow generation for the next several years. Snap-on is a unique business in the Industrials sector, and one that has quite some runway for growth left before it.