ICON

View PDF versionWe regularly explore the investment rationale of one of the companies we own in the Melville Douglas Global Equity Fund to articulate what we find compelling. This time we have chosen ICON.

The pandemic has accelerated the pace of change across swaths of industries, highlighting the need to build flexible and efficient operating models. A case in point is how the biopharma industry undertakes clinical trials. As a contract research organisation, ICON is an enabling player.

What Is a Contract Research Organisation?

ICON is a global provider of outsourced drug development services to the pharmaceutical and biotech industry – commonly referred to as the biopharma industry. Leading outsourcers, such as ICON, IQVIA and PRA Health Services, are called contract research organisations (CROs). These companies typically step into the development process once a pharmaceutical company has identified a promising new molecule or treatment.

Pharmaceutical companies partner with CROs as they offer a more efficient, cost-effective route to bringing products to market given the clinical trial process is time consuming and resource intensive, not to mention the difficulty in navigating the regulatory pathway. CROs design the trial, source the participants, get in contact with clinics to run tests and monitor patients, analyse the data and help with the regulatory submissions. As independent companies, they offer an objective assessment of the safety and efficacy of a new drug in the clinical trial setting. Because they partner with many companies, they tend to have broader experience and expertise than if the pharmaceutical company organised the trials themselves.

Why Would a Biopharma Company Want To Outsource?

Pharmaceutical and biotech companies are facing increasing margin squeeze due to drug price pressure and rising costs. This is particularly the case as many companies continue to expand and run trials on a global basis, which can be egregiously expensive. Before the advent of CROs, pursuing the approval of a new drug was prohibitively costly and usually only occurred when there was high probability of a guaranteed approval in large markets such as the US or EU. The presence of CROs has significantly reduced costs, allowing companies to develop smaller drugs for niche audiences.

Biotech companies – especially the smaller ones – tend to outsource more as they don’t have the same level of drug development infrastructure in house. By outsourcing the majority of the development function, biopharma companies can reduce their staff complement and infrastructure required to run clinical trials, allowing for a more flexible, asset light operating model. This frees up resources to be spent on where they add the most value – in identifying new treatments.

There Are Two Main Drivers:

1. Growth in pharmaceutical and biotech research & development (R&D) expenditure

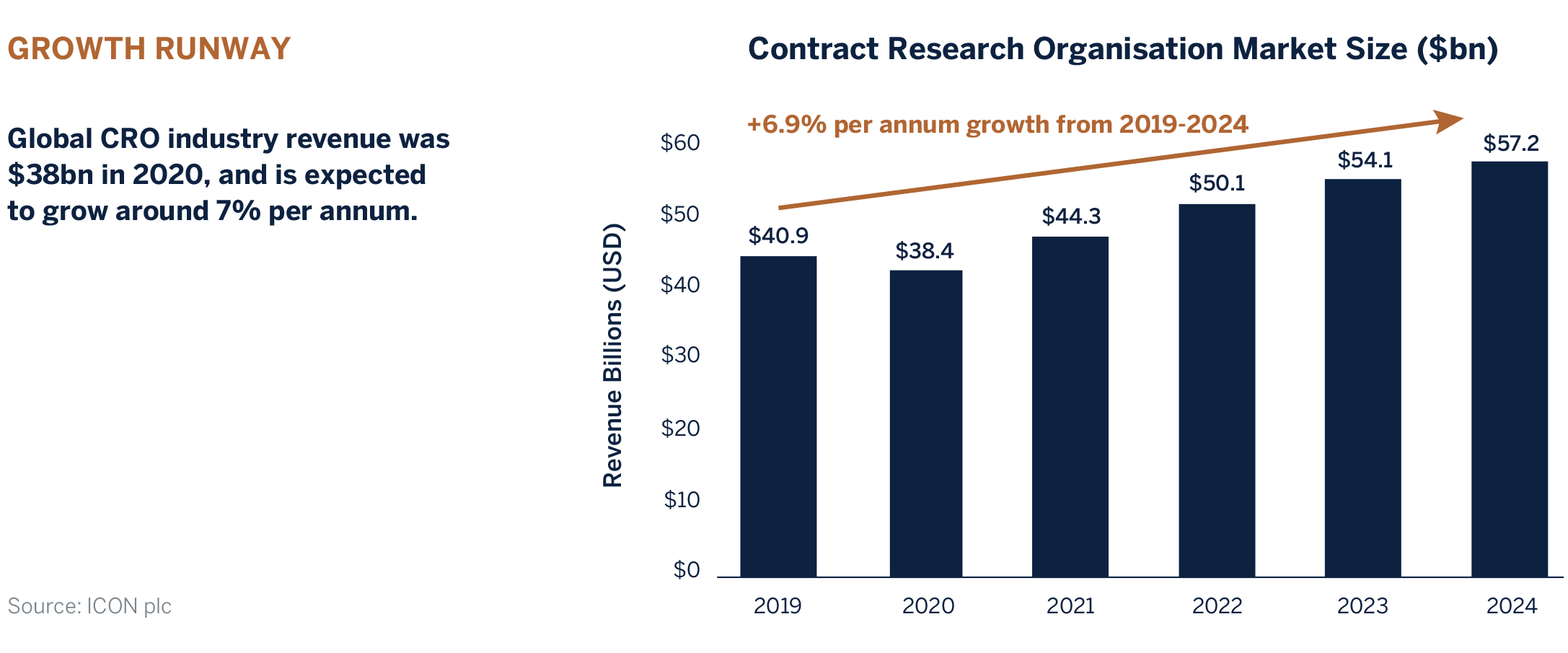

Global R&D spend by the biopharma industry is expected to grow at around 3% per annum. Two-thirds of this budget is allocated to drug development, thereby representing a sizeable potential market for CROs. It is estimated that approximately 30% of drug development is currently outsourced, with forecasts for this to rise above 50% over the next few years.

2. Drug pipelines and approval rates are on the rise

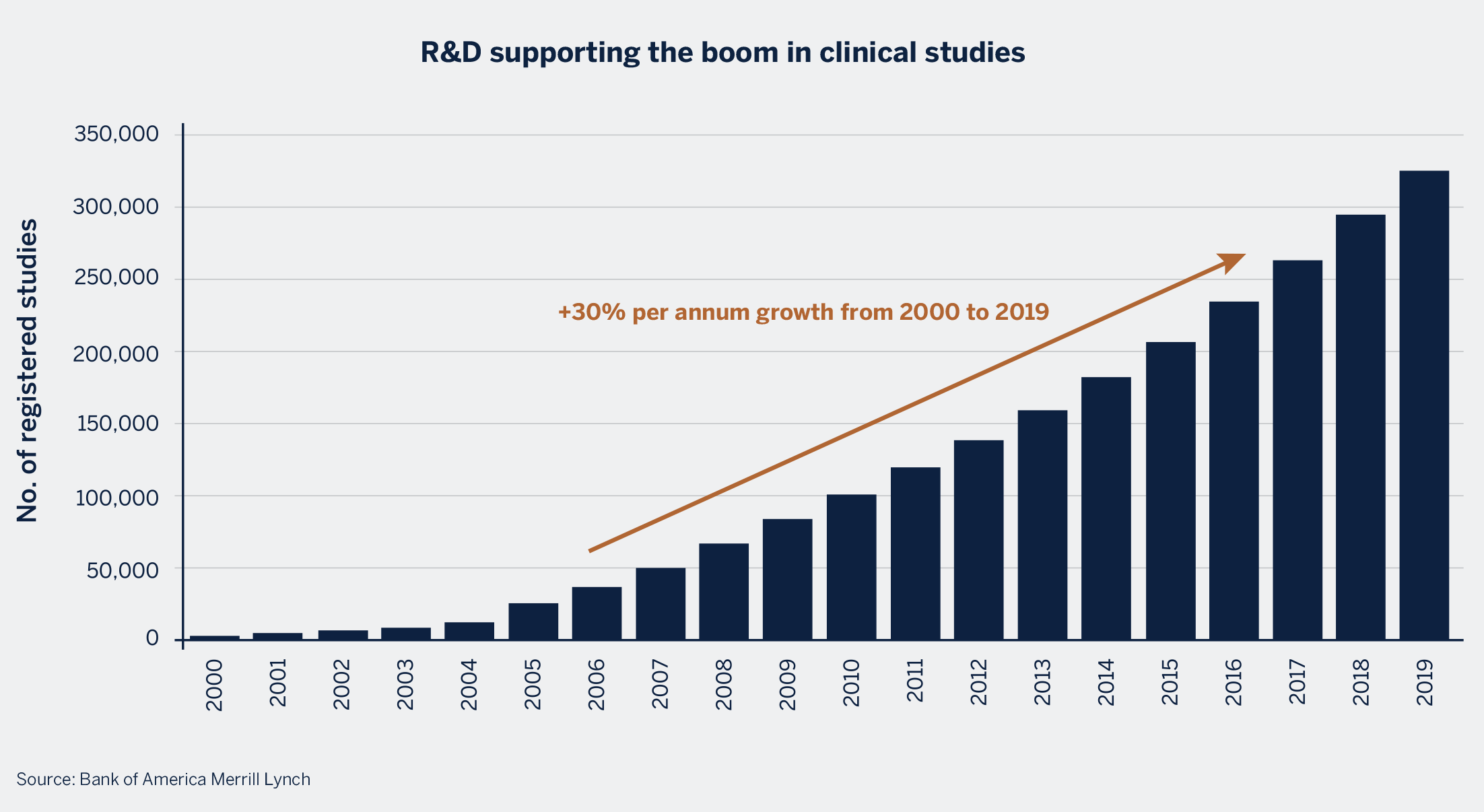

The number of active drugs in the pipeline is on the rise. Biotech funding has been a key driver of this acceleration as biotech companies have been growing at faster rates

compared to traditional pharmaceutical players, thereby becoming an important driver for drug discovery. There has also been an acceleration over the years in the number of drugs making it further along the trial process, a testament to the reliability and accuracy in which the trials are conducted.

Remote Monitoring – A Case Study in Driving Efficiencies

ICON is a pioneer in remote monitoring. This new approach (a phenomenon that accelerated during the pandemic) has been enabled through technological advances. Furthermore, remote monitoring is likely to further enhance the success rates of trials as it increases patient engagement, broadens access to a wider set of patients globally, and improves data quality.

One of the biggest challenges of traditional monitoring are in-person doctors visits and mounds of paper trails around treatment compliance. Remote monitoring is not only more convenient, but increases the accuracy and reliability of the trial results while reducing overall running costs of in-person monitoring. ICON played an important role in supporting the development of the Pfizer & BioNTech vaccine where it ran a global study involving 44,000 patients across six countries. This was made possible through high levels of remote clinical monitoring and remote source data verification.

Wearables allow data to be collected remotely, digitally and automatically, improving adherence to and accuracy of the monitoring process.

Heads I Win, Tails You Lose

The advantage of investing in CROs is that they make money on their clients’ drug development programme irrespective of the outcome. If a drug fails to live up to expectations, the CRO will still get paid for conducting the trial. Another positive is the long lead times as it can take years for a drug company partnering with a CRO to take the drug from phase I to phase IV. Typically, contract agreements with CROs last multiple years over multiple phases. If a CRO wins a compound early in its lifecycle, there can be high visibility into future revenue potential.

A growing number of trials is supportive of the trend to outsource more to the CRO industry as biopharma companies focus on driving costs lower and reducing time to bring products to market.

Source: Melville Douglas, FactSet

Why ICON?

Biopharma companies see the benefits of partnering with large CROs such as ICON for their scale, geographic footprint, and extensive therapeutic expertise, allowing them to run multiple trials at a time with high levels of success. ICON is attractively positioned across a wide array of therapeutic areas, with high exposure to some of the fastest growing fields such as oncology, anti-infectives and vaccines, and immunology. The company has a highly regarded management team who have consistently delivered attractive earnings growth with a disciplined approach to costs.

A Melville Douglas Stock

It is tempting to seek out the big winner whether it is the next Google, Amazon or Apple. Or the next cure for cancer or COVID. What investors don’t tell you is that for every Moderna and Pfizer BioNTech there are hundreds of duds. When seeking sustainable growth investment opportunities, it is often the behind-the-scenes companies that are making the profits over multiple years and decades. They are the picks and shovels suppliers in a gold rush. ICON fits this bill.