We regularly explore the investment rationale of one of the companies we own in the Melville Douglas Global Equity fund to articulate what we find compelling. This time round we have chosen Alphabet.

A rare accolade and sign of widespread acceptance is when a brand becomes a verb. Classic examples include Sellotape and Frisbee. To “Google” something is also in the lexicon. It is synonymous with searching for answers on the internet.

Google’s parent company Alphabet has successfully capitalised on its dominance in internet search to become one of the best businesses in the world, delivering ten-bagger share price returns over the past decade. We explain why the investment case has plenty of mileage in the tank. It’s as simple as ABC.

A is for Advertising

On the face of it Alphabet is a sprawling conglomerate owning a myriad of leading internet platforms and applications. As well as the Google search engine and YouTube video sharing website, the company is behind Google Maps, Chrome web browser, Gmail, Android mobile operating system, the Google Play online store and the Google Cloud Platform. The list goes on.

What brings these websites, apps and services together is a highly profitable business model primarily based on online advertising. In 2020 over 80% of Alphabet revenues were derived from selling and placing ads. It is the market leader. According to eMarketer, Alphabet had 29% global market share of digital ad spending. Facebook is number two with 24% and Alibaba is third with 9%.

The next few paragraphs will elaborate on the attractive outlook for online advertising, Google’s enduring dominance and YouTube’s potential in TV.

Online Advertising’s Growth Runway

Advertising is a growth industry. US advertising spend has stayed at around 1% of GDP over the past fifty years because it is a relative expenditure. Businesses need to keep pace with their competitors, or they run the risk of losing mindshare. This contrasts with some absolute expenditures, such as food and energy, that have become a smaller part of the economy as usage and production became more efficient. There is a limit to how much you can eat, but there does not seem to be a limit to which companies will vie for your attention.

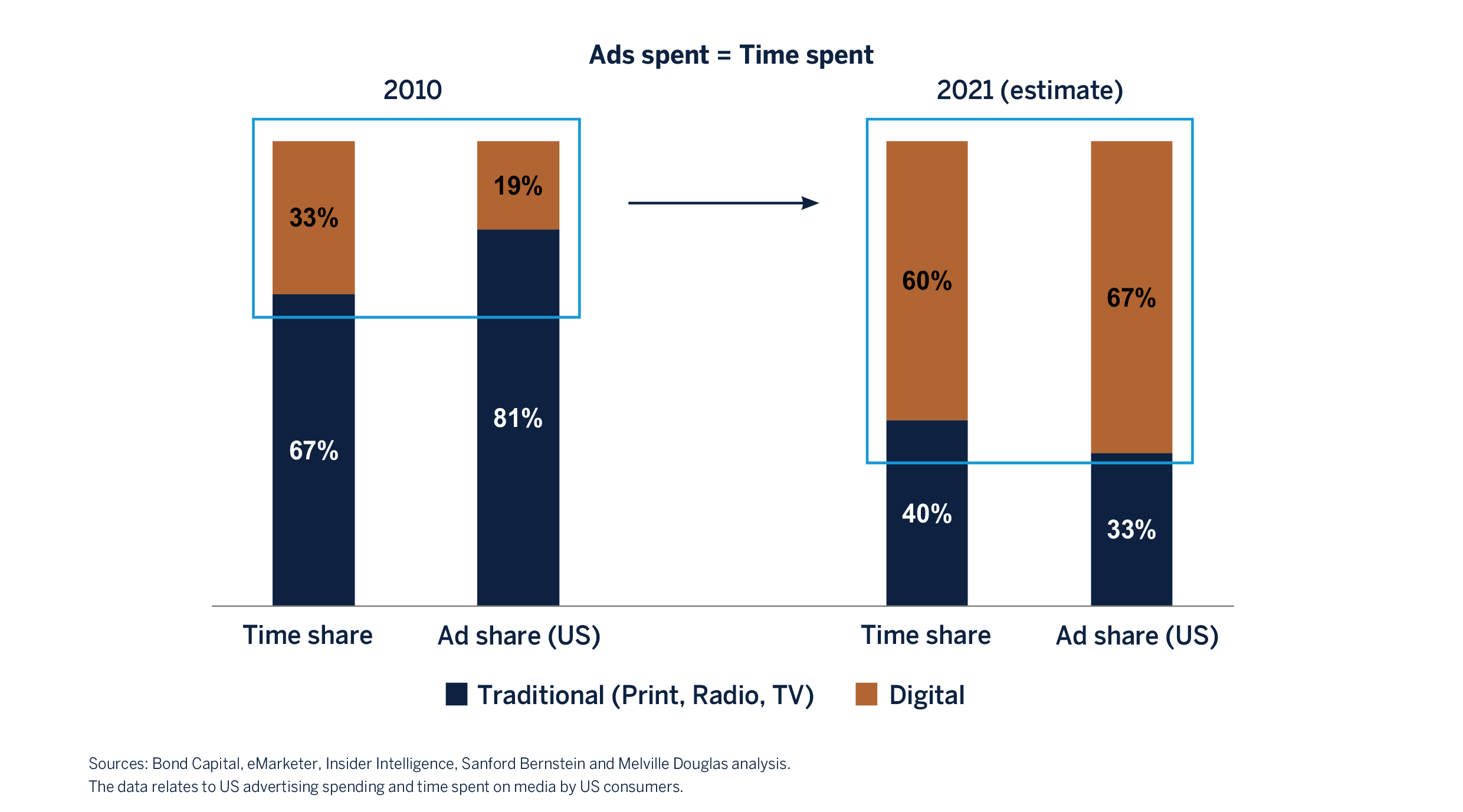

Over the past decade, digital (or online) advertising spend has been taking a larger slice of this growing pie. Advertising dollars have followed the money, i.e. their customers. The share of time spent on digital media has almost doubled over the past decade. As time spent online continues to grow, advertising dollars will follow.

In addition, digital advertising has a higher return on investment than traditional formats such as TV, newspapers, magazines and radio. Online activities offer a more engaged and accessible user experience which enables digital advertisers to undertake personalised targeted campaigns. For example, if you are googling city breaks to Italy, sooner or later you will receive a tailored booking.com advert in your search results that will likely resonate with you at that precise moment in time. As click-throughs are measurable, booking.com can rapidly scale and adjust its campaigns accordingly to optimise effectiveness.

Arguably digital media’s two-thirds share of total US advertising spend, as shown in the chart, overstates the share of corporate budgets. We are nowhere near full penetration. As more businesses move their operations online, digital advertising can unlock new budgets that were previously never accessible to the marketing departments. In the online world advertising spend can also encompass promotion budgets, product placements, rent and even some labour costs given its automated nature. A prime position on a newsfeed or search result is the online equivalent to owning a flagship store on Bond Street in London or 5th Avenue in New York.

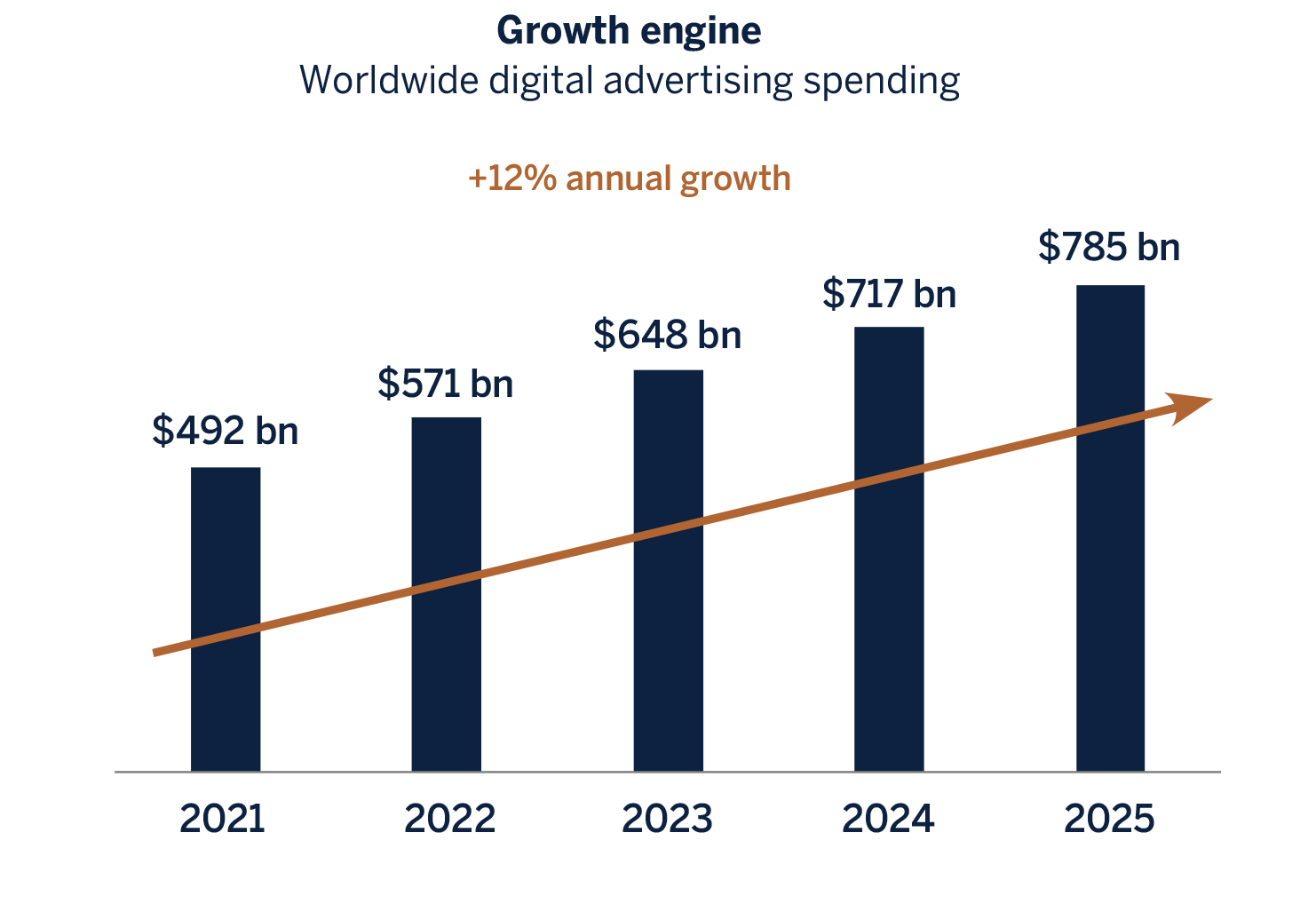

All of this adds up to an expanding and scalable addressable market for digital media winners such as Alphabet. Based on eMarketer estimates, worldwide digital advertising is expected to grow over +12% per annum over the next four years. A meaningful pace.

Google Search – Winner Takes All

Approximately 90% of the world’s data has been created in the last two years alone. According to Dihuni (2020), every day we create enough data to fill 10 million Blu-ray discs that would be the height of four Eiffel Towers when stacked.

Search engines provide a critical valued filtering device for internet users that efficiently sifts through this mind-boggling quantum of data. This recurring and interactive service is highly valued by advertisers. According to Statista, over 35% of worldwide digital advertising spend was directed to internet search in 2021.

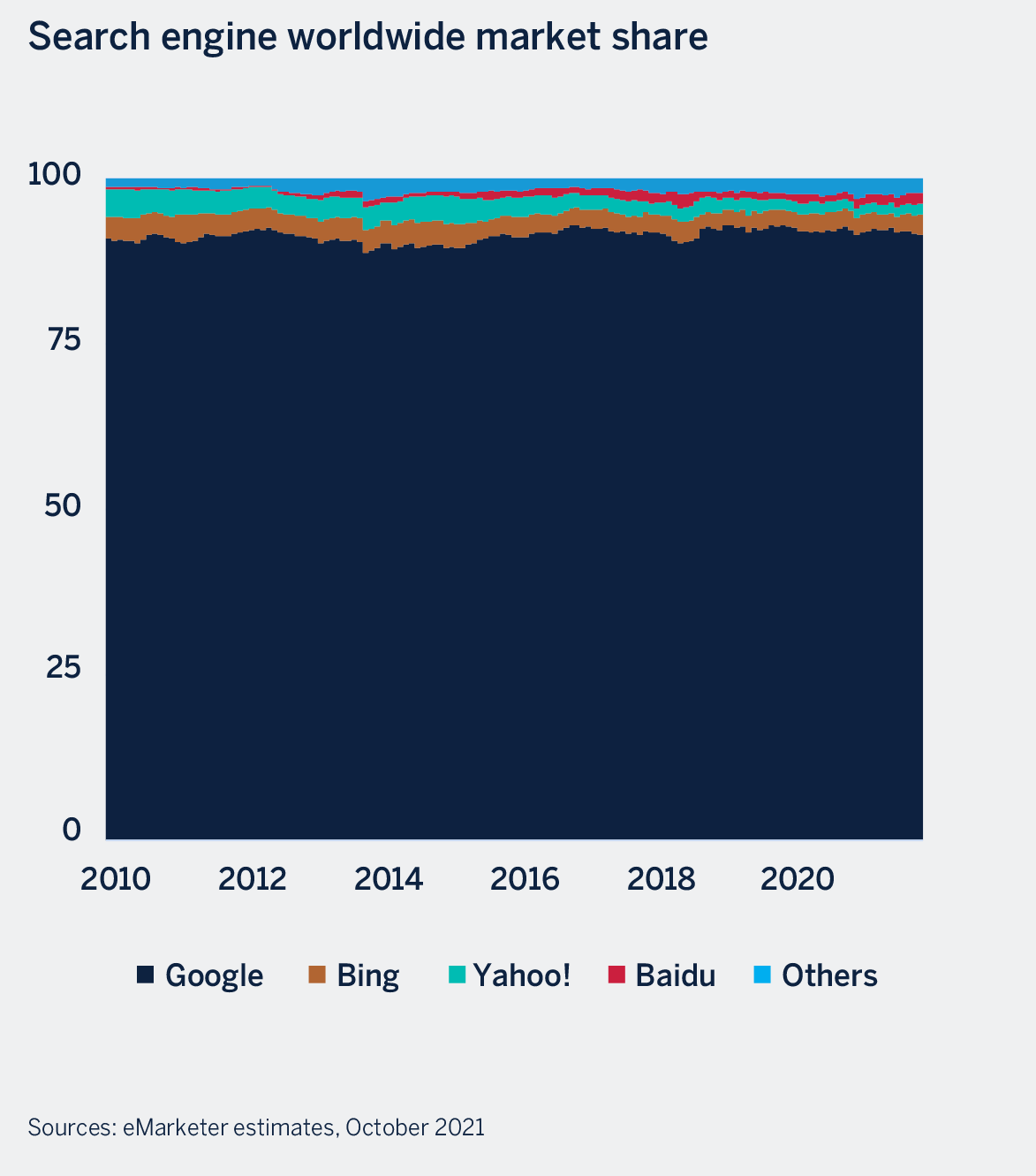

Google Search monopolises this category. Google’s dominance is a case study in scale advantage and network effects. Because Google handles far more searches than rivals Bing or Yahoo, it has more data to refine its results. Internet users see no need to use another (inferior) service. These dynamics create a virtuous circle for Google. Its accumulated learning and computer code acts as a massive economic moat. As a result, Google has cornered the internet search market for two decades with over 90% of global market share.

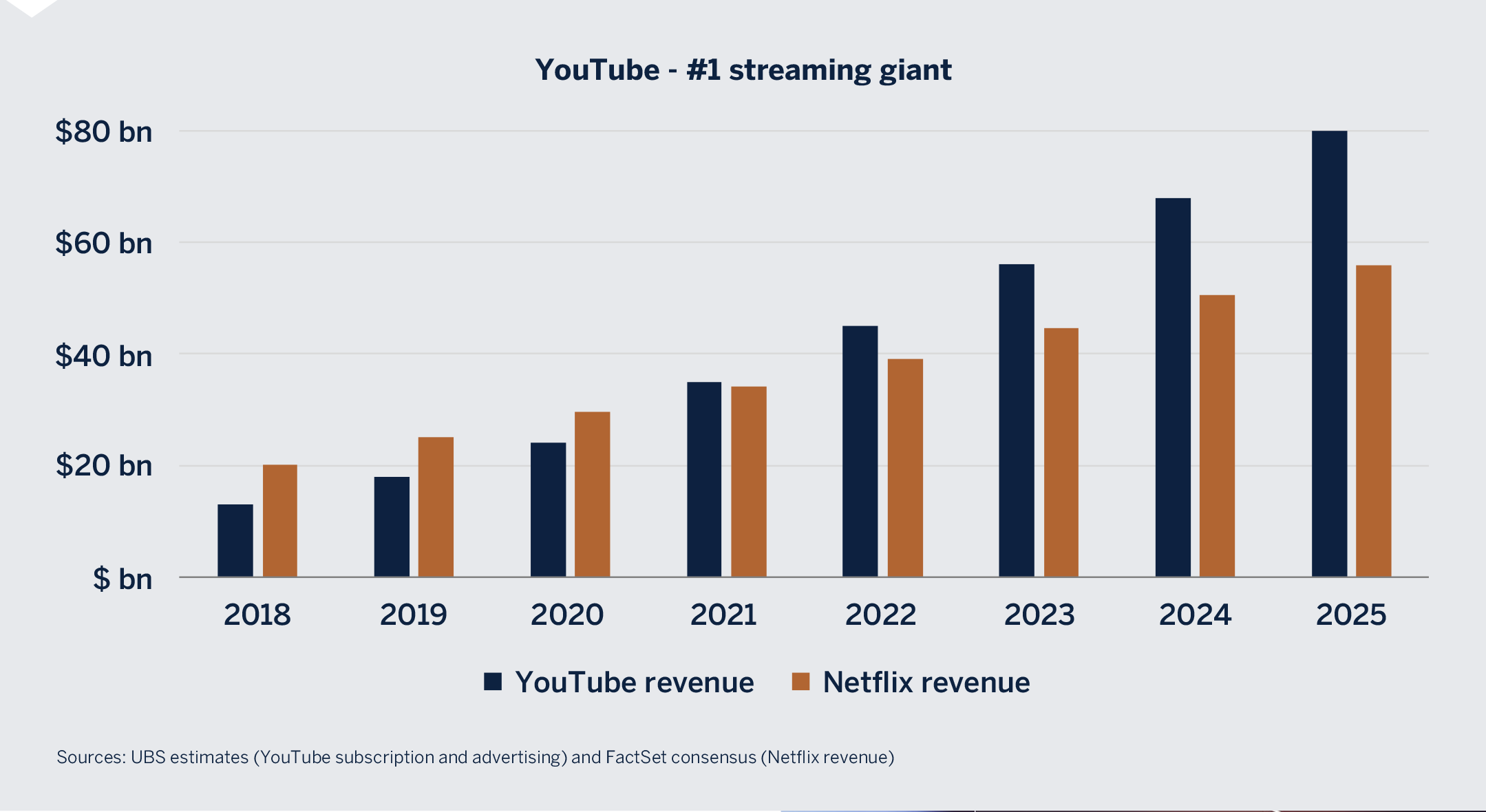

The big opportunity for both video streaming services is the ongoing viewership share shift from legacy Linear TV (take-it or leave-it programmes broadcast at a specific time) to Connected TV (a vast array of programmes delivered on-demand to a television connected to the internet). As the largest Connected TV (CTV) player, YouTube is in pole position for this share shift. 100 million US users are already watching YouTube content on their TV sets.

Despite continuing declining viewership, US television advertising spend remains high at around $70bn. This is due to live sports (about 40% of spending) and inertia. But CTV’s digital targeting and measurement capabilities and audience-size are simply too good for ad buyers to ignore. In the US, the most watched TV show is Sunday Night Football on NBC with 16.7 million views a week. This contrasts with MrBeast (a YouTube personality) with 64 million subscribers and averaging 20-30 million weekly views of his shows. The money will follow. According to eMarketer CTV’s market share of total TV advertising is expected to increase from 13% in 2020 to 29% in 2025.

B Is For (Other) Bets

There are certain species of shark that die if they stop swimming. In today’s fast changing world, business models are threatened by revolutionary rather than evolutionary change. You need to keep swimming rather than sit on your laurels. Alphabet is a past master.

To safe-guard its future the company has taken advantage of its highly cash generative advertising business, to invest high risk-high reward moonshot opportunities. These businesses are housed under its “Other Bets” division. Examples include Calico (antiageing research), Weymo (autonomous vehicles), Verily (medical devices) and Deep Mind (artificial intelligence).

Akin to venture capital, there is a high failure rate. According to killedbygoogle.com 244 of its projects have been launched and then shut down. But, by taking calculated risks, Alphabet has maintained its relevance and added meaningful growth drivers. The acquisition of YouTube in 2006 is a case in point. The $1.65 billion price paid was widely criticised at the time. Alphabet has had the last laugh. The business now generates annual revenue of over $18 billion (over ten times the price paid), contributing to over 10% of group revenue.

Another moonshot was Android. It was acquired for the measly (in hindsight) sum of $50 million in 2005. By making it freely available and open sourcing it, Android has become the world’s largest mobile device operating system. Importantly, it has been a key element in securing Google Search’s dominance in the mobile as well as desktop world.

C Is For Cloud Computing

Outside advertising Alphabet’s largest business is its Google Cloud Platform. The company leveraged off its expertise in running massive data centres for its internet search business to launch a cloud computing service in 2008. This internet-based service enables companies to rent computing capacity without having to incur the inflexibility, lack of scale and cost of building it in-house.

Google Cloud Platform is the third-largest of the “big three” public cloud vendors, behind Amazon Web Services and Microsoft Azure (both of which are also held in the fund). While its larger competitors provide a broader array of services, Google’s cloud offering plays to its strengths in artificial intelligence, machine learning and in its deep expertise around open source technologies.

The pandemic has brought to light the disaster recovery benefits of the cloud computing model as employees were able to securely and effectively work from their kitchen table or spare bedroom. Nonetheless, the transition from on-premise computing infrastructure to a cloud model is still at a relatively early stage for most companies. It represents a rapidly growing trillion-dollar addressable market for Google Cloud Platform. Once again Alphabet has struck gold.

C Is Also For Compound Growth

Our investment philosophy is based around capturing the power of compound growth by investing in highly profitable, growing businesses with sustainable competitive advantages. Alphabet ticks the box. Its leading positions in digital advertising and cloud computing could drive significant growth. Furthermore, the Other Bets division goes towards future-proofing the business in a rapidly changing and disruptive world.

What are the risks?

Big Tech is a victim of its own success. Google’s dominance has put itself in the sights of regulators looking to crack down on anticompetitive behaviour. We are reassured by our discussions with legal experts, who note the remedies that could be pursued would not leave the company in a substantially worse position. We will however watch this space.

The other big risks are technology change and competition. We do not see an existential threat over the horizon but that will not stop us from following it closely. Alphabet could miss a trick on the new big platform transition. Meta Platforms (the parent of Facebook, Instagram and WhatsApp) and Amazon remain big competitors. There are also new media platforms, such as videosharing app TikTok. At present the pie remains large enough for more than one winner.

In summary Alphabet is a rare find. It has one of the world’s best business models, a rock-solid competitive position and multiple growth runways for many years to come. It remains a core holding in the fund.