Signs of optimism as inflation trends lower and growth surprises

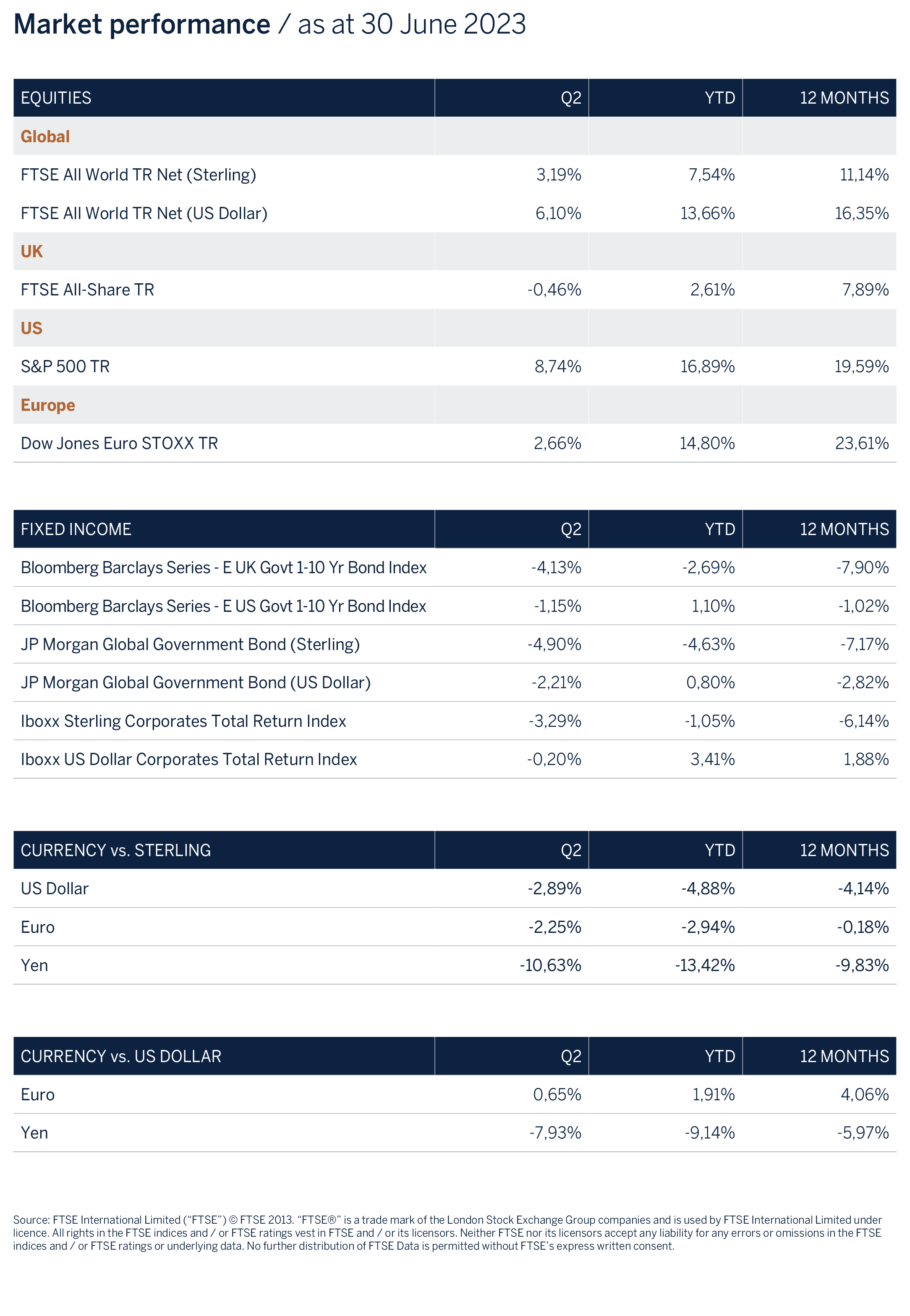

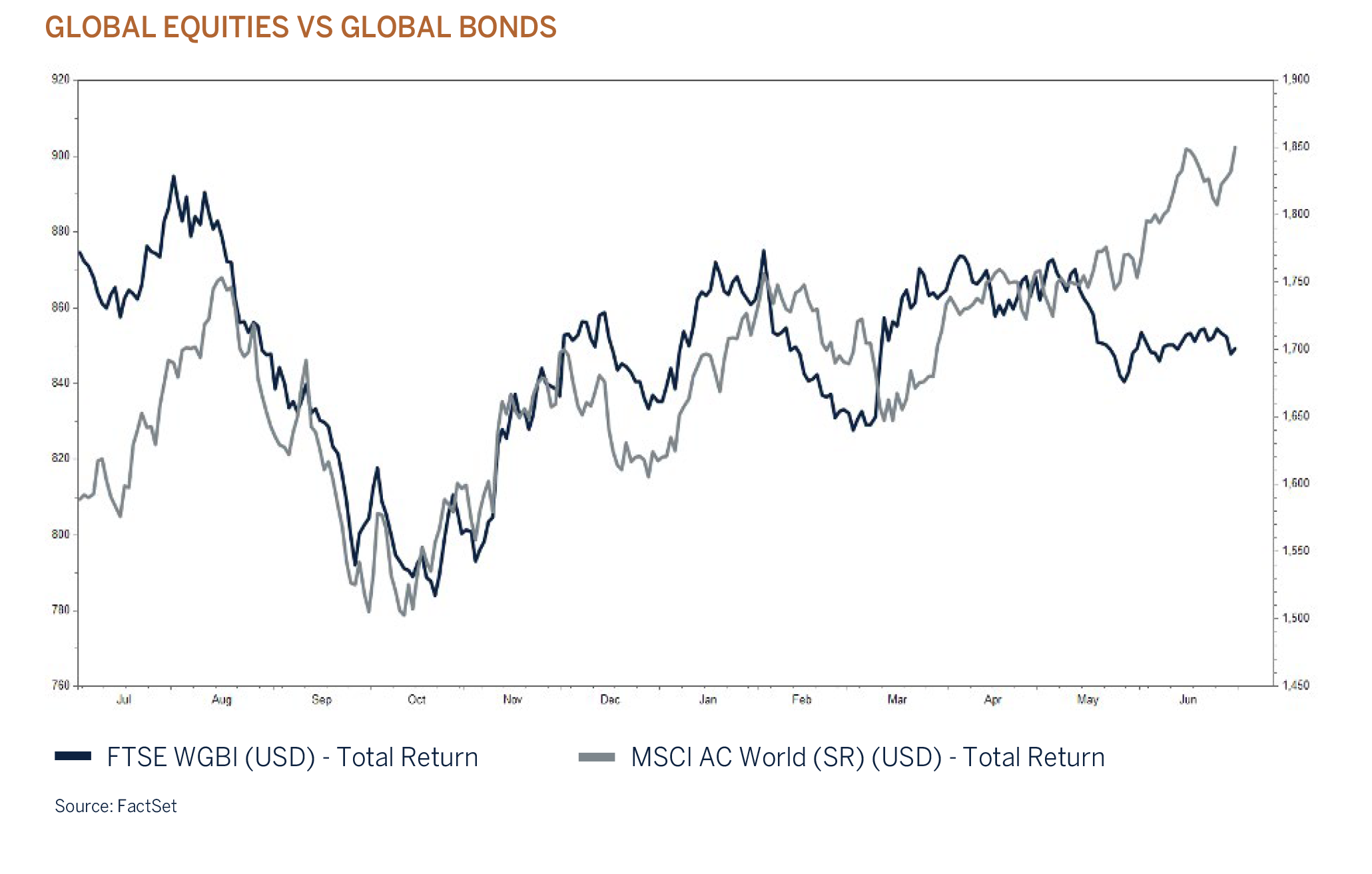

Global equity markets have not disappointed this year. At the end of June, the MSCI ACWI had returned +14% in US dollar terms and +7.5% in sterling, and in dollar terms is now up a little over 25% since the market bottomed in October last year. Slightly surprising, given that interest rates have not yet peaked, and central banks have once again turned more hawkish in their guidance in a concerted effort to bring inflation under control. At the same time, the outlook for the global economy and corporate profits remains lacklustre,after a period of stronger than expected growth. Offsetting these concerns is the disinflationary trend that is in place. Headline inflation has fallen sharply in most economies as energy, metal and soft commodity prices are significantly lower than a year ago, but core inflation has remained stickier, given ongoing strong employment markets that have driven wages higher, supporting servicesdriven economies and the housing/rental market. Lower inflation, if sustained, does however provide a glimmer of hope that the end of the monetary tightening cycle is in sight and that policy interest rates could move materially lower next year. The strong correlation between global bonds, which have been range bound this year, and global equity markets, also appears to be broken – see chart below. Fixed income investors are perhaps less bullish on the outlook for inflation due to central banks’ previous willingness to stimulate while labour markets remain tight, and consumption being underpinned by fiscal support measures, excess savings and positive wealth effects.

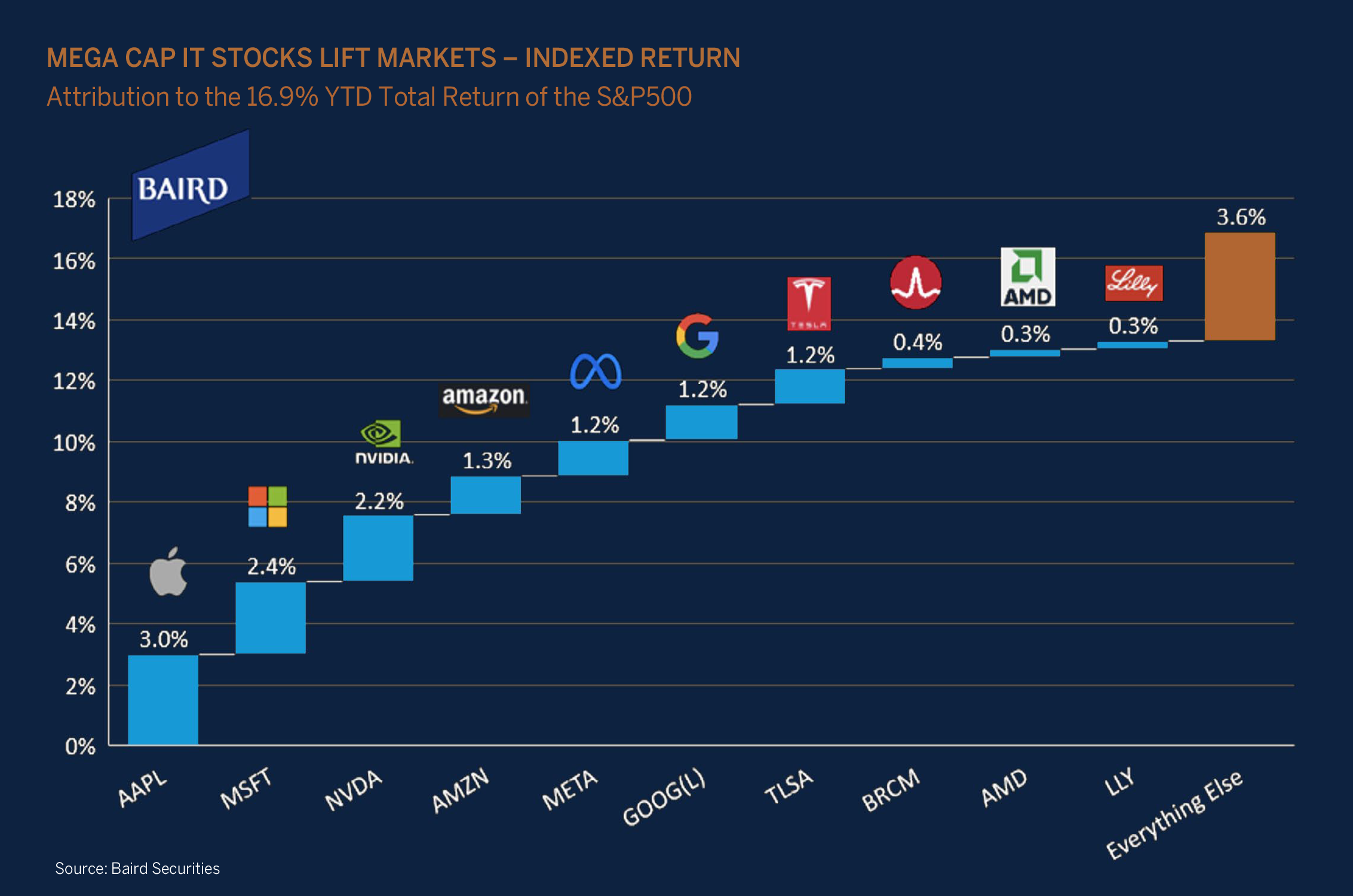

Beneath the surface, equity leadership has been incredibly narrow. It is worth noting that the strong returns from global equities are attributed to a significant rerating in valuations across mega cap tech stocks that stand to benefit from the rapid developments surrounding Artificial Intelligence (AI), as well as an improvement in risk appetite as investors position portfolios for the next upturn in the earnings cycle. The S&P 500 index has returned around +17% this year of which c. +14% can be explained by the performance of the top 10 (mostly mega cap IT) stocks and as such has certainly not been a healthy broad-based rally that lifts most sectors and investment styles.

We believe that it is too soon to celebrate the death knell of inflation accompanied by only a slowdown in economic growth given that significant headwinds lie ahead from the lagged effects of higher for longer interest rates on consumption, investment spending and credit extension. Equity markets are positioned and priced for a “soft landing”, an environment of lower trending inflation without any significant disruption to the economy and employment market caused by the lagged effects from central banks’ monetary tightening. While such an outcome is certainly possible and some say probable, current valuations for risk assets provide little margin of safety should the economic cycle or core inflationary trends disappoint as we head into the second half of the year.

Global growth surprises to the upside, but will it be sustained?

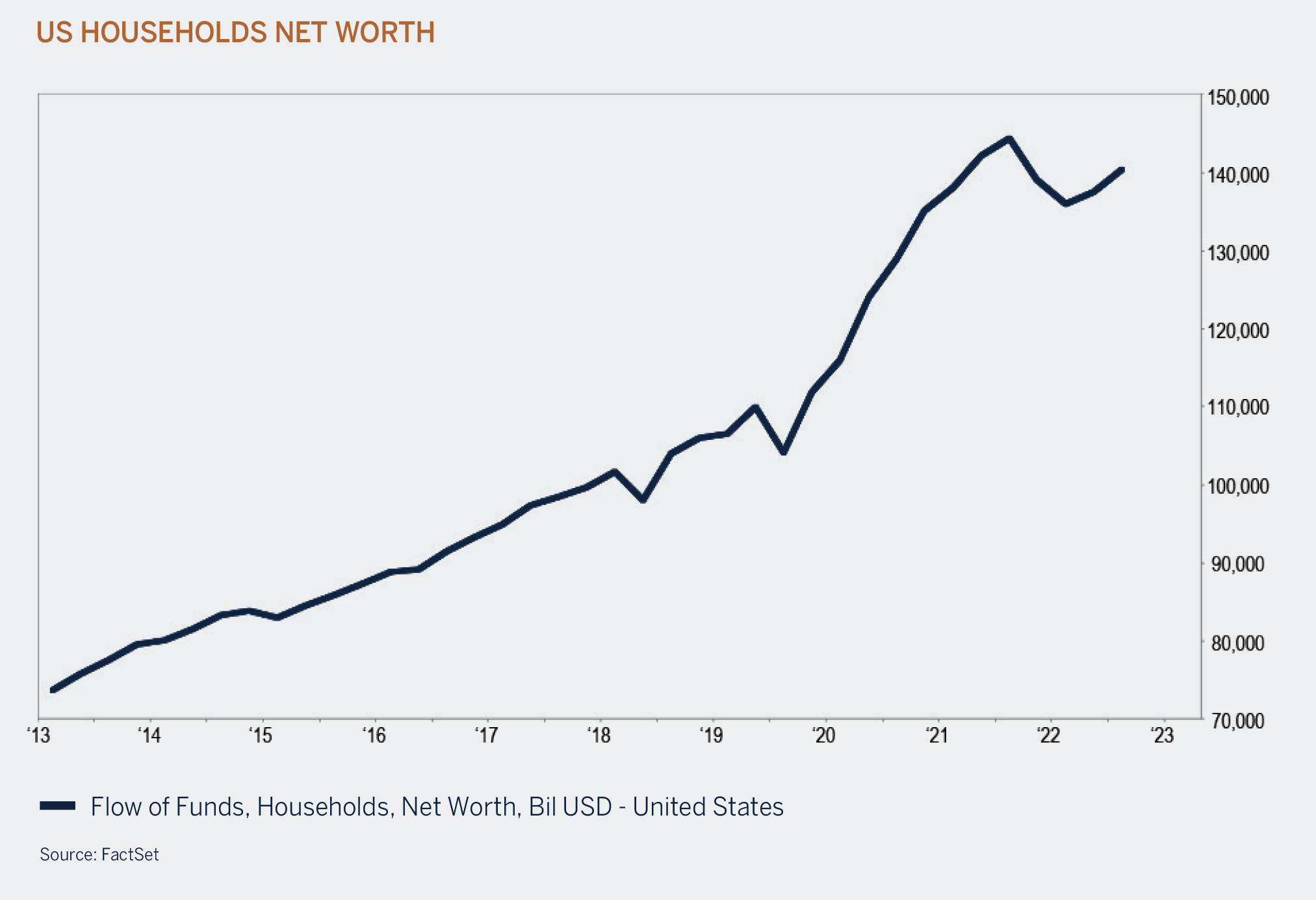

The global economy has performed better than feared during the first half of the year. Several factors have contributed positively and have been offsetting some of the negative effects caused by higher interest rates. These include China’s recovery after three years of lock-down, lower than expected energy prices, improved functioning of supply chains after COVID-19 related disruptions and Russia’s invasion of Ukraine as well as fiscal support across developed economies. In addition, the employment market has remained robust and household balance sheets are much stronger than what was experienced during the Global Financial Crisis or even during the pandemic. Consumption has further been supported by the strong growth in asset prices which includes house prices that were up significantly since 2020. Recently, we have also witnessed a sharp bounce in housing starts in the US, an important development given the shortage in inventory and could assist in normalising house prices and the cooling of the rental market, good news for inflation down the line.

Monetary tightening on the back of elevated inflation and tight labour markets is a feature of a maturing economic cycle that is usually accompanied by vulnerabilities such as elevated private sector leverage and durable spending, as well as a sharp deterioration in corporate profit margins. None of these traditional vulnerabilities during a late cycle are currently present.

"While currently things are looking benign, there are signs of cracks starting to develop."

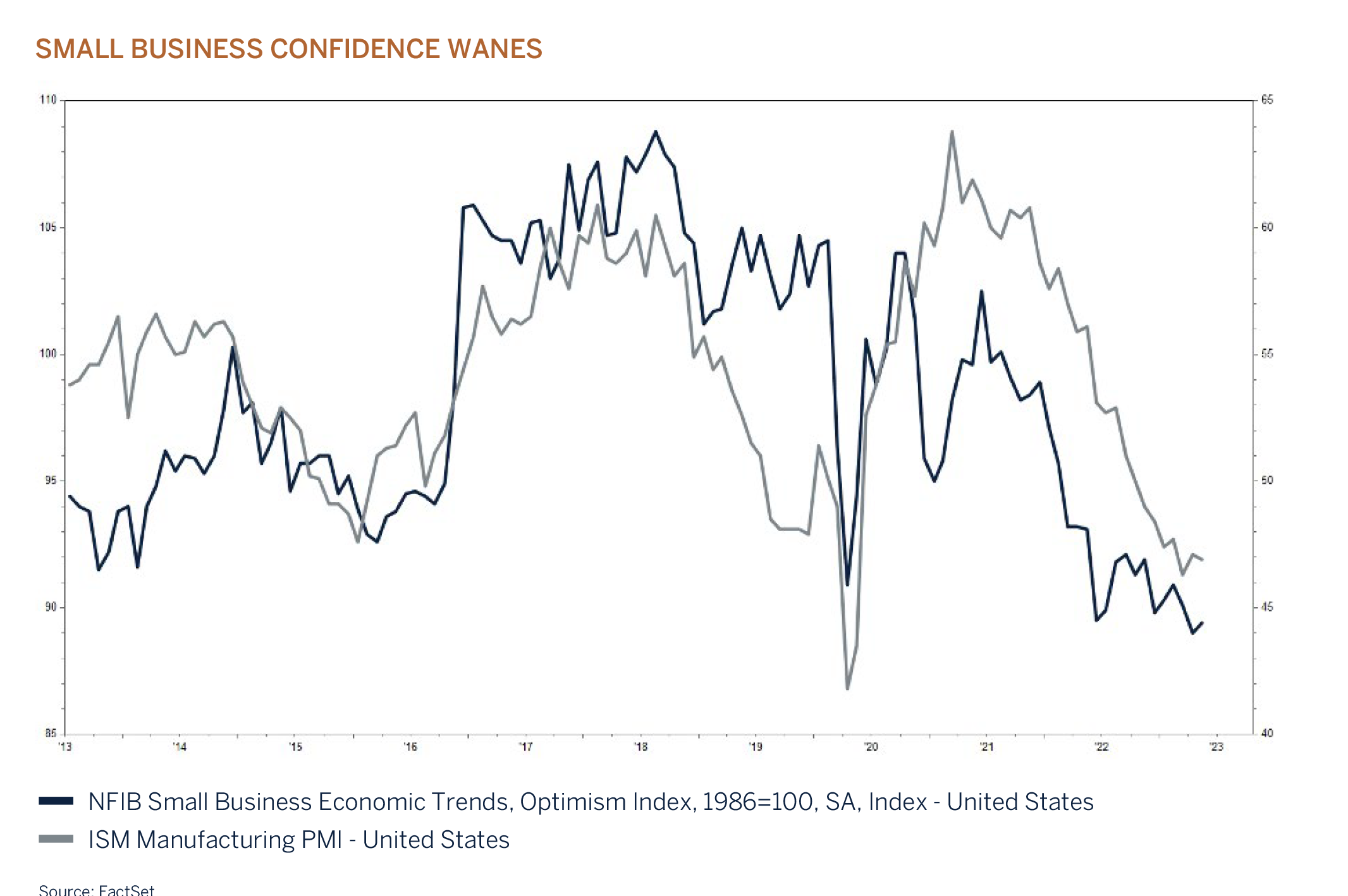

Volumes have held up reasonably well and companies have been able to pass on higher costs, thereby maintaining profit margins and supporting employment. But given that inflation is expected to trend lower and volume growth slows, elevated profit margins may not be sustained while the economic cycle matures and excess savings dwindle, posing a risk to the outlook of corporate earnings and ultimately the labour market. It would not be unusual for the lagged effects from monetary tightening to only be visible two years after the onset of the interest rate hiking cycle, in part due to the extent of fixed rate loans taken up during the pandemic when interest rates were exceptionally low. These benefits will come to an end when refinancing takes place over the next few years, increasing the interest rate burden. At the margin it is believed that one in every five households in the US will experience some strain as the student loan payment holiday which was introduced a few years ago, comes to an end in September. While currently things are looking benign, there are signs of cracks starting to develop. Leading economic indicators have recently softened, and this has not only been across the manufacturing sector, which has been negatively affected by high inventory levels and a slowdown in final demand, but also the services sector, and perhaps explains the softness in the Small Business Economic confidence index as illustrated below.

In addition, while unemployment levels across developed economies have reached record lows earlier this year and the labour participation rate has improved, jobless claims in the US were up 21% over a year ago and the three-month average of hours worked expanded by a mere 0.5% annual rate, pointing to some softness in the labour market. It is also interesting to note that bankruptcy filings from private firms have shown a resurgence and have resulted in credit downgrades across the lower quality credit spectrum, inflicting further pain, and perhaps speaks to the fact that US corporate profits after tax have turned lower and are down 7% from when they peaked in September last year.

Conclusion

Global financial markets this year have been underpinned by better than feared economic and corporate earnings growth, and a decline in global inflation which has resulted in an improvement in real disposable income and a rerating in equity valuations. This is despite liquidity being drained from the global economy and declining money supply across developed economies. While some of the leading economic indicators are pointing to softness ahead, actual fundamental data has remained reasonably robust and is showing little sign of weakness at present. In addition, earnings revisions have turned positive, albeit marginal. Central banks’ rhetoric remains decisively hawkish as inflation continues to be above targeted levels and as wage inflation drives consumption higher in real terms. Investors should be positioned for further interest rate hikes this year – global bond markets already are. Higher interest rates and a tightening in credit conditions will weigh on the economy. The IMF and World Bank are forecasting below trend growth for 2023/2024. The good news for investors is that although there may be recessions in some economies a global recession is not currently expected given the strength in household balance sheets and robust labour markets. A benign or “soft landing” outlook, by implication also means that investors should not expect a sharp recovery in economic momentum in the near term, as this would require a recession and/or sharply lower interest rates over the next year.

Equity valuations are discounting a good outcome and an upturn in corporate earnings. Risks are tilted to the downside given the magnitude and pace of interest rate increases since last year, and any disappointment in expectations could result in below par returns. While cash and fixed income are providing attractive yields in the short term, we remain defensively positioned and underweight global equity on a risk adjusted basis, despite expecting a positive return over the next 12 months.

The higher yields in the bond market have allowed us to lock in attractive inflation adjusted yields by extending duration, and we have been following a similar strategy across our short duration cash enhancement strategies. We will continue to monitor the global economic environment while keeping a close eye on valuations across asset classes and will continue to adjust the asset allocation appropriately as the environment dictates.

Changes to benchmark index providers

We have recently completed a comprehensive review of the current benchmark index data providers which we use in our composite portfolio benchmarks. Following detailed analysis, we have concluded that we will consolidate to Bloomberg Index Services Limited to provide data for the equity as well as the corporate bond indices. This change of index data provider will have no effect on the management of our portfolio solutions and will come into effect from 1st July 2023. The new underlying composite portfolio benchmarks are available upon request.

Investment performance

Our tactical underweight equity allocation has again been a slight headwind but our long-held conviction of investing in quality, well run global businesses that have pricing power, competitive advantages and ongoing attractive growth drivers has led to broadly in-line performance as investors shelter from the effects of tighter monetary policy and the resultant economic slow-down. Given the prospect of further interest rate hikes and still stubborn core inflation in the coming quarters we expect our quality growth style and stock selection to further add value in the second half of the year. Our neutral fixed income weighting in multi-asset portfolios, and our strategy to gradually extend duration to lock into higher yields, has delivered value and again led to returns being broadly in-line with benchmarks. Bernard Drotschie / Chief Investment Officer From an

Asset Classes

| Equities | Underweight |

| Fixed Income | Neutral |

| Cash Plus | Overweight |

From an asset allocation perspective, no changes were made during the quarter, and we remain underweight equity, neutral fixed income and overweight cash. Valuations for risk assets, including equities, credit and EM currencies appear to have run ahead of fundamentals in the very short term, and at current prices offer lower margins of safety. Our one year expected top-down return for global equity is in line with the other (risk free) asset classes, assuming a positive outcome from earnings growth in 2023, which we believe is unlikely to materialise. It should be noted however that some of the leading economic indicators appear to have bottomed, and this is something that we will be monitoring closely for signs of an economic recovery. The job market has also remained robust and does provide an underpin to consumer spending. The question remains however – can this trend persist against a backdrop of sharply higher interest rates?

Global Equity – Underweight

| Consumer Discretionary | Overweight |

| Consumer Staples | Neutral |

| Energy | Underweight |

| Financials | Neutral |

| Healthcare | Overweight |

| Industrials | Neutral |

| Information Technology | Neutral |

| Materials | Neutral |

| Communications Services | Overweight |

| Utilities | Neutral |

| Real Estate | Underweight |

The MSCI All Country World Index is up +14% this year, underpinned by downwardly trending headline inflation and resilient macroeconomic data, despite all the rate hikes over the past year. Favourable base effects from last year (supply chain disruptions now improving and energy prices easing) are currently providing an underpin to growth, but these positive base effects are expected to normalise as the year progresses. Additionally, outside of the technology sector, equity markets have largely been trading rangebound this year, given that certain leading indicators are pointing to some softness ahead. Banks have been tightening their lending standards which has resulted in both credit extension and credit demand slowing materially and we are now seeing corporate bankruptcies reaching the levels last seen during the Global Financial Crisis. Finally, the excess savings accumulated during the pandemic are expected to be “depleted” by the end of the 3rd quarter at the current rate of consumption. At present the not-too-hot-not-too-cold view (Goldilocks) is prevailing but we prudently remain underweight the asset class for the following reasons:

- Interest rates are not expected to decline in the near term. Core inflation remains elevated given a buoyant labour market and is not expected to decline to levels that will allow central banks to cut interest rates over the next few months, as implied by the money market. Equity markets have historically not reached a bottom prior to the end of the interest rate tightening cycle and have tended to only bottom after the first interest rate cut. The risk is that monetary authorities overtighten in their effort to curb inflation.

- The full effect of higher interest rates still needs to play out. It can take up to two years before the economy fully responds to tightening monetary policy. Higher interest rates combined with tightening credit standards, and a decline in money supply have in the past always resulted in a recession (not our base case).

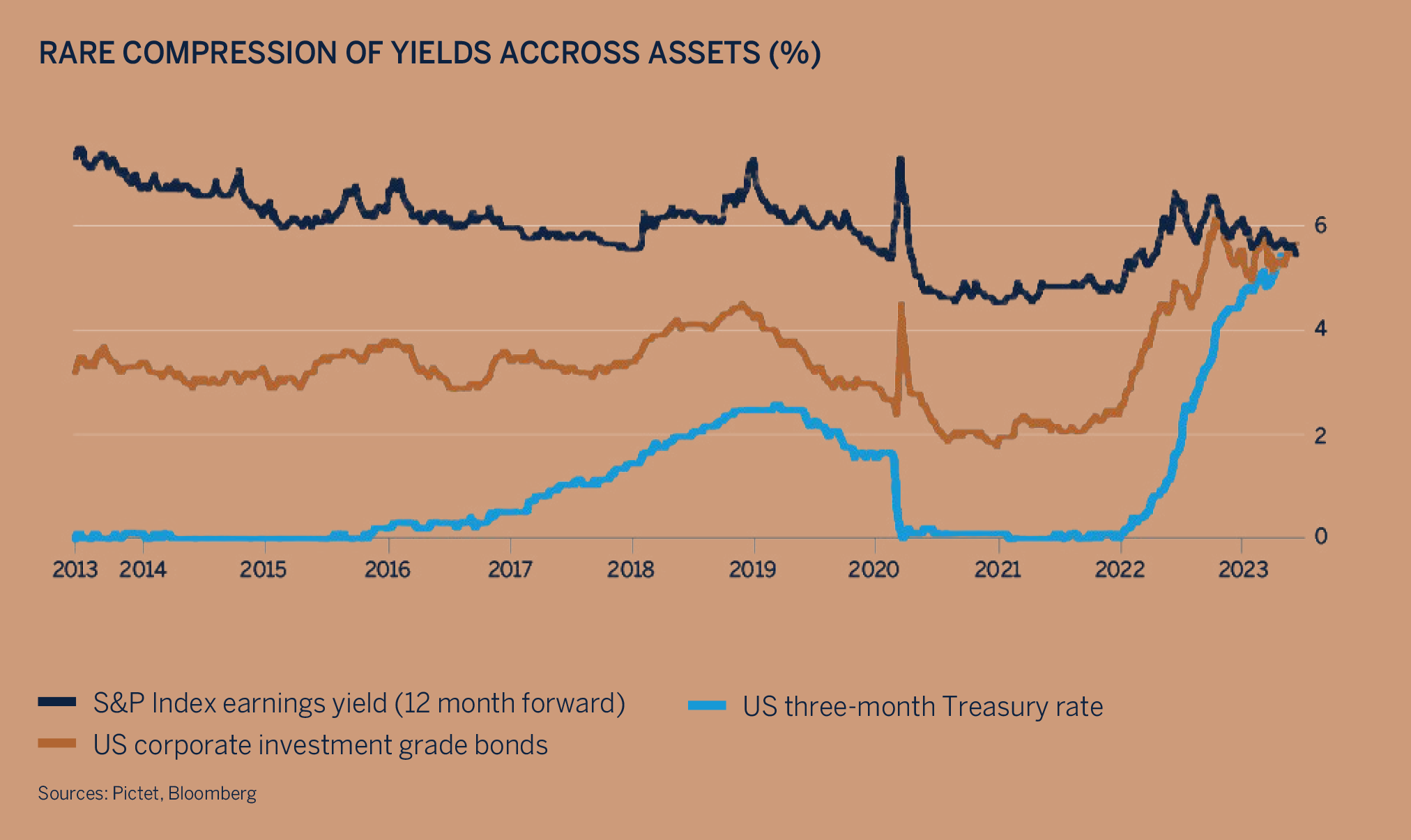

- From a valuation perspective, equities are not overly attractive on a risk adjusted basis, and even less so when compared to the interest rates on offer for cash and government bonds. Expected returns over the next 12 months are in line with those of cash and fixed income. An environment of higher for longer interest rates and elevated inflation is unlikely to result in higher valuation multiples from current levels.

- The outlook for company earnings remains uncertain and given peak profit margins and an expectation that inflation and volumes will slow could provide a challenge for many companies to sustain.

Global fixed income – Neutral

| G7 Government | Underweight |

| Investment Grade - Supranational | Overweight |

| Investment Grade - Corporate | Neutral |

| High Yield - Corporate | Overweight |

Global bond markets struggled in the quarter as higher interest rates are taking longer than forecast to dampen demand and reduce inflation towards central banks’ target levels. Headline inflation has fallen as food and energy price pressures have abated but ongoing strong employment markets have driven wages higher, supporting servicesdriven economies and, therefore, core inflation. Financial stress in March raised misplaced hopes of imminent easier monetary policy, but that has been replaced with the reality that more hikes are needed to bring inflation under control.

The latest UK inflation report came in higher than expected for a fourth month in a row, increasing pressure on the Bank of England (BOE) to extend the tightening cycle. Headline inflation remained at 8.7%, the core (ex-food & energy) rate unexpectedly rose to a 31-year high of 7.1%. Whilst the BOE expects inflation to ease sharply in the months ahead, the strong employment market and subsequent wage pressures continue to cast doubt over this forecast. The BOE unexpectedly raised the base rate by a higher than expected 50 basis points in June to 5%, citing that higher rates may still be necessary to bring inflation back to target levels.

The cumulative effect of 485 basis points of tightening should begin to eat into core inflationary pressures in the coming months but the BOE cannot afford a ‘wait and see’ approach so we expect a minimum of two further hikes to 5.5%. If core inflation does not start to slow soon then the prospect of interest rates at 6% cannot be discounted, although the BOE are acutely aware that every subsequent hike increases the risk of recession.

The Gilt market has responded by discounting further interest rate hikes with two-year Gilt yields, which are sensitive to short-term interest rate expectations, recently breaching 5%, longer-dated yields have also adjusted higher. Although longer-dated yields are trading below cash rates, we see increasing medium to long-term value ahead of the next stage of the cycle which should be dominated by both falling inflation and subsequently, interest rates. As such, we have taken the opportunity in the quarter to further extend duration closer to benchmark.

After ten consecutive hikes and a cumulative 500 basis points of tightening the US Federal Reserve (Fed) kept interest rates unchanged in June. Hopes that this would mark the end of the hiking cycle were quickly erased by somewhat contradictory projections by Fed officials that at least two more increases might be necessary this year. Clearly, the Fed are opting to buy themselves more time to absorb upcoming economic releases, but with data continuing to come in stronger than expected and the inflation battle far from over, the prospect of two more hikes before year-end is very real.

Allowing for some pockets of weakness (predominantly manufacturing), the US economy continues to hold up exceptionally well. Excess ‘pandemic’ savings built up by consumers continue to support spending with household savings and checking balances still some 40% above pre-COVID-19 levels. More importantly, the employment market remains robust and wage increases, that have largely kept up with inflation, are easing the pain of higher living costs. In fact, at a time when consumer confidence levels should be deteriorating, they have in fact rebounded to the highest levels since early 2022, before interest rates were even raised.

The lagged effects of higher interest rates will continue to act as a headwind to growth but our view, for now, remains that if a recession unfolds in the coming quarters, it is likely to be mild and potentially short-lived. Stubborn inflation, predominantly in services, should continue to decline as negative money supply works through the economy. As these scenarios unfold so should the end of the interest rate hiking cycle and subsequently the peak in longerdated bond yields. In fact, we believe these yields peaked in October last year and have been constructively locking into higher yields and increasing the duration of our strategies.

Cash Plus – Overweight

Short term money market instruments continue to provide attractive yields in an environment where the outlook for the global economy and geopolitical environment remains uncertain. These funds will naturally be deployed across the other asset classes when investment opportunities arise