Delayed effects of higher interest rates start to bite

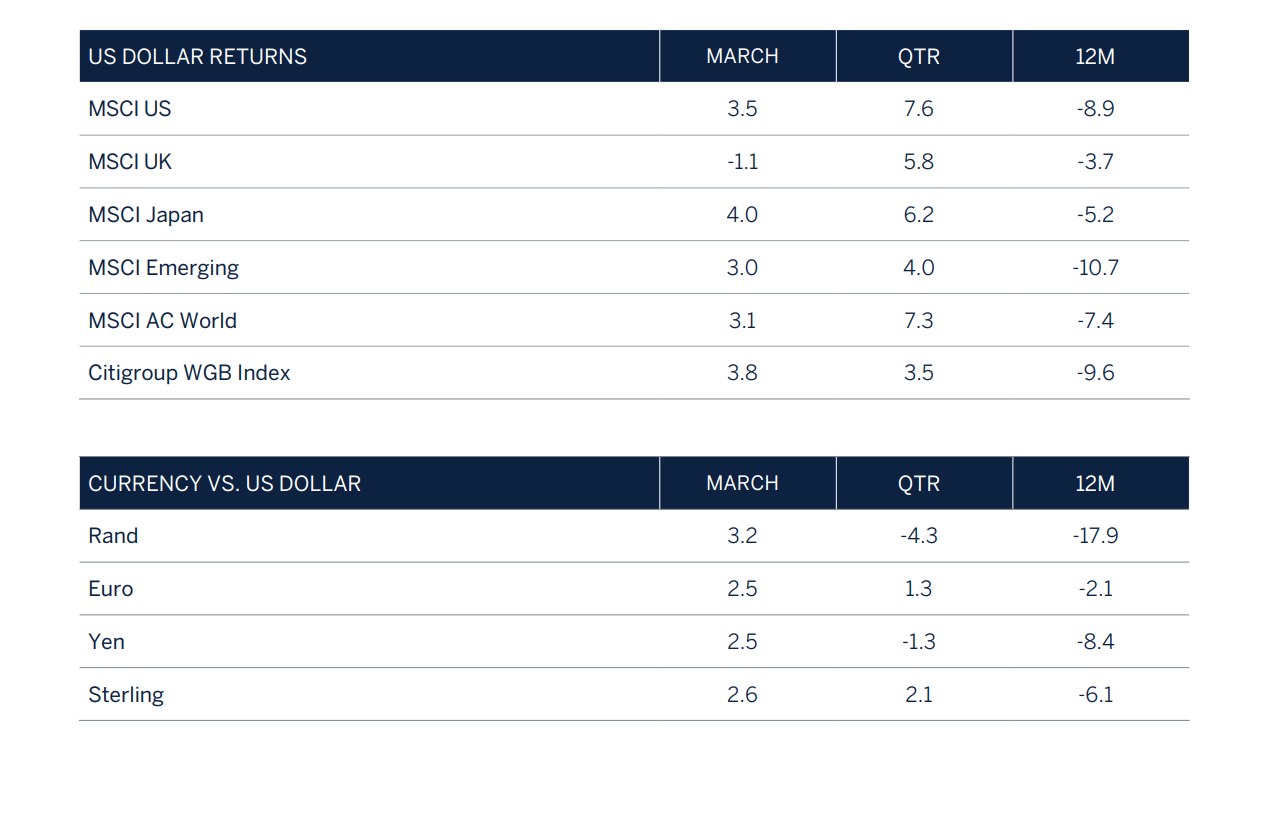

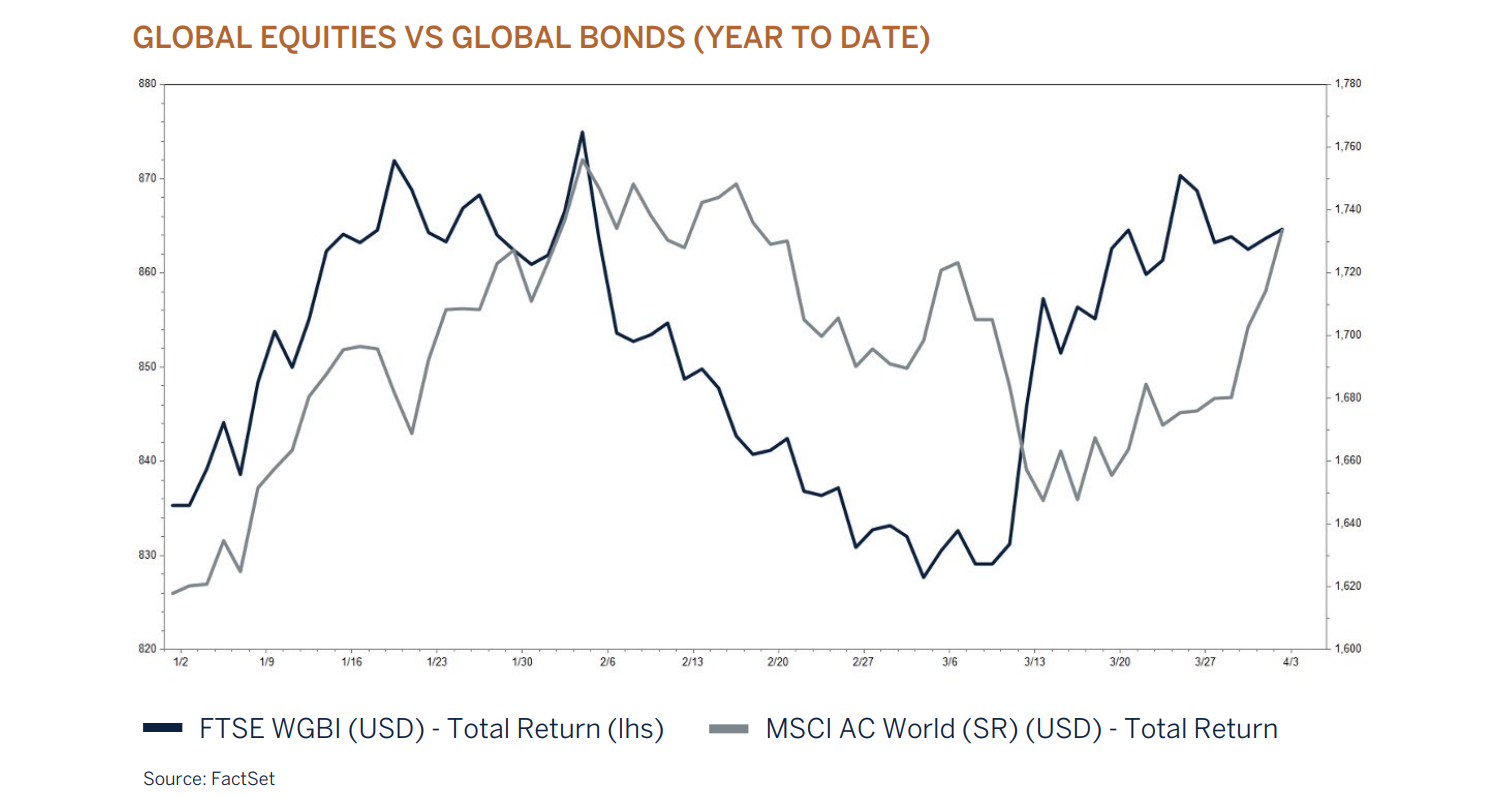

Financial markets started 2023 on an upbeat tone on the back of some positive developments, but lost momentum as the quarter progressed. China’s reopening, lower energy prices in Europe after an unusually warm winter and evidence that inflation has turned the corner all contributed to a belief that a soft landing in the global economy was achievable, and that may still be the case as confidence levels have improved from their lows.

However, persistently high core inflation fuelled by excess savings and a vibrant jobs market changed the narrative from central banks in February. They guided that a step up in the pace of interest rate increases would ultimately be required to slow demand enough to contain inflation. Asset prices reacted to the renewed risk of a policy error by monetary authorities at a time when the global economy is expected to slow as credit conditions tighten and the full lagged effects from higher interest rates start to take hold.

In recent weeks, worrisome memories of the 2008 global financial crisis were reawakened by runs on three US regional banks and by Credit Suisse’s shotgun marriage to UBS - portfolios have no equity exposure to these banks but in the fixed income weightings of some strategies there is negligible, under 0.2%, indirect exposure to Credit Suisse debt. Fortunately, the Federal Reserve (by guaranteeing deposits and by providing banks with access to loans based on the face value of their bond holdings) was much swifter in intervening to stem contagion than in 2007-2008. The long-term risk of promoting moral hazard was probably worth averting a potential systemic banking crisis. The worst appears to be behind us, although we would not be surprised to see a few more casualties during this shake-out as it takes a long time for the effects of higher interest rates to ripple through the system.

The silver lining is that central banks tempered their hawkishness lest they tip the banking sector into meltdown and the more benign interest rate outlook boosted government bond prices. This acted as a powerful countervailing force for global stock markets during the latter part of March amidst sliding corporate earnings expectations. Financial market expectations are now discounting, prematurely in our view, a series of interest rate cuts in the second half of the year. We believe the path for interest rates will primarily be determined by the outlook for inflation, and with core inflation looking set to remain stubbornly high in the short term, central banks are unlikely to be in a hurry to ease tight monetary conditions by lowering interest rates early. This raises the prospect that markets, in the months ahead, will again adjust lower on renewed fears of central bank policy error. Monetary authorities run the risk of raising rates too high, keeping them there for too long and not easing until it has become clear that inflation is under control, but by then the economic cycle is likely to have already turned for the worse leading to a recession and a natural decline in inflation, as it always does during an economic contraction.

Rising risks of recession

The global economic expansion during the first quarter of 2023 has positively surprised, albeit due to the favourable base effects from last year. China’s reopening, a European rebound from its energy price shock and a steady improvement in the global supply chain (caused by the dislocations associated with Russia’s invasion of Ukraine) have resulted in global GDP growth tracking above its potential despite the sharp increase in interest rates. Nevertheless, the lagged effects from higher interest rates have started to take their toll across various sectors in

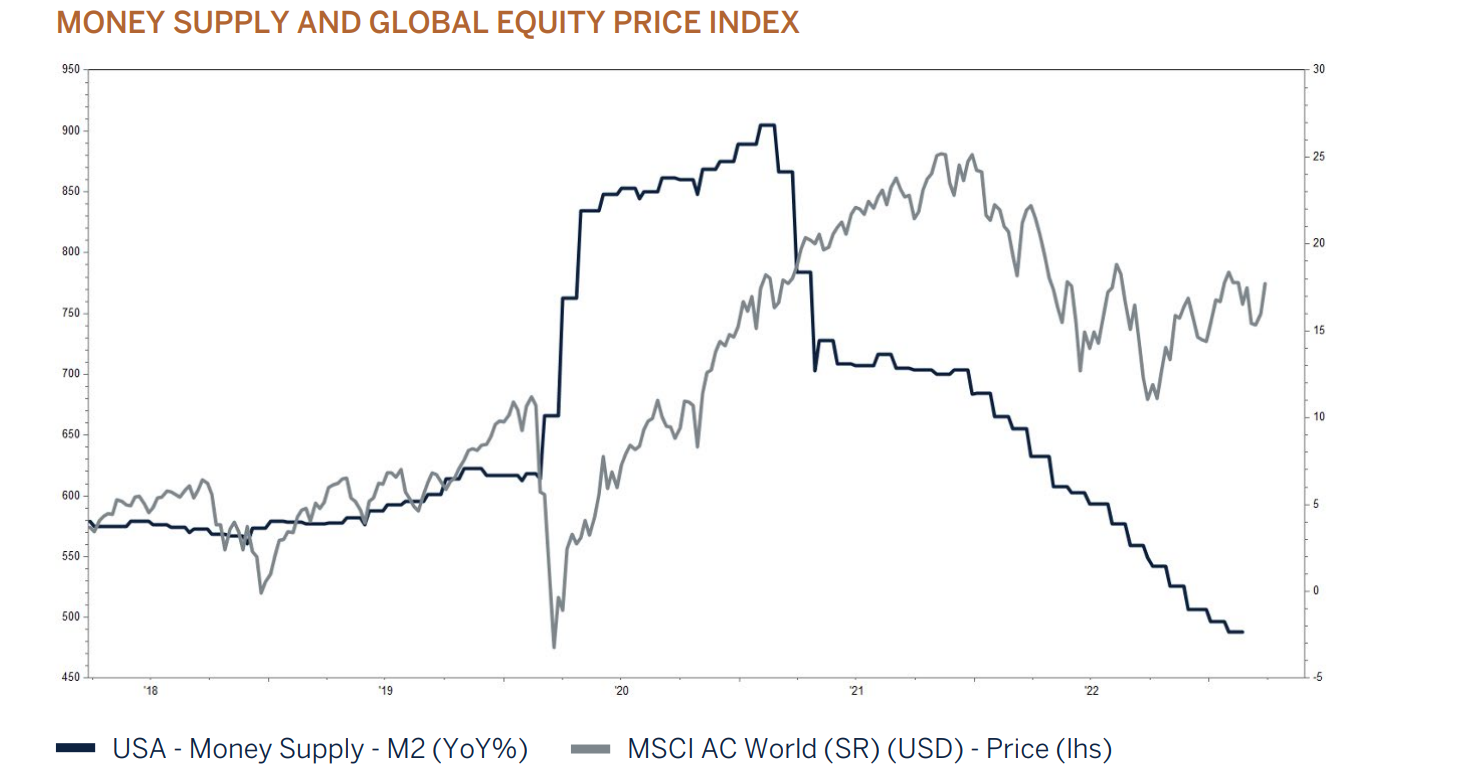

the economy. In particular, the housing market is experiencing widespread weakness as credit conditions tighten and affordability naturally slows. The sector is recalibrating after two years of abnormally strong growth which has resulted in companies rightsizing their workforce. Simultaneously, money supply as measured by M2 (notes and coins in circulation) has turned negative in the US and UK as authorities have been draining excess liquidity from the

marketplace in their effort to contain inflationary pressures by inducing weaker demand.

The turmoil in the US and European banking sector is another good example of what can happen when easy money dries up.

The turmoil in the US and European banking sector is another good example of what can happen when easy money dries up. It was interesting that so much of the focus during the turmoil was centred around the regional banks’ poor liquidity, solvency and risk management, when in fact the main cause was an increasing need for liquidity from their depositors. These depositors were predominantly crypto currency investors, venture capitalists and technology companies (concentration risk). When interest rates were low and money cheap, access to funding by these companies was plentiful and allowed these businesses to invest in growth opportunities or “the next best thing”. Money, from cash flush investors literally poured into these growth businesses. But higher interest rates have made these same investors less willing to commit new capital as the environment became more uncertain and money more expensive. As access to funding became more of a challenge the banks’ clients were forced to draw on their deposits to fund daily operating expenses, which in the end forced the banks to dispose of their assets (predominantly government bonds and asset backed securities) to meet the increase in withdrawals from their depositing clients. Although much of the pain was self-inflicted, this episode is a timely reminder of what can happen when liquidity is withdrawn from financial and credit markets. Despite this, it is not all negative, as the large incumbent banks with strong balance sheets are currently benefitting from the demise of the smaller banks, given the move of deposits from small to large, and what is perceived “safe” banks – it pays to invest in quality.

More disruptive financial market developments are likely the longer interest rates stay at elevated levels. Large companies are perhaps more insulated given that most of their debt is fixed, but many households and smaller companies as well as the struggling commercial real estate sector do not have the same luxury and will be experiencing the pain from higher interest rates as debt facilities come up for renewal at a time when access to credit is getting more difficult and lending standards tighten.

Developments in the labour market

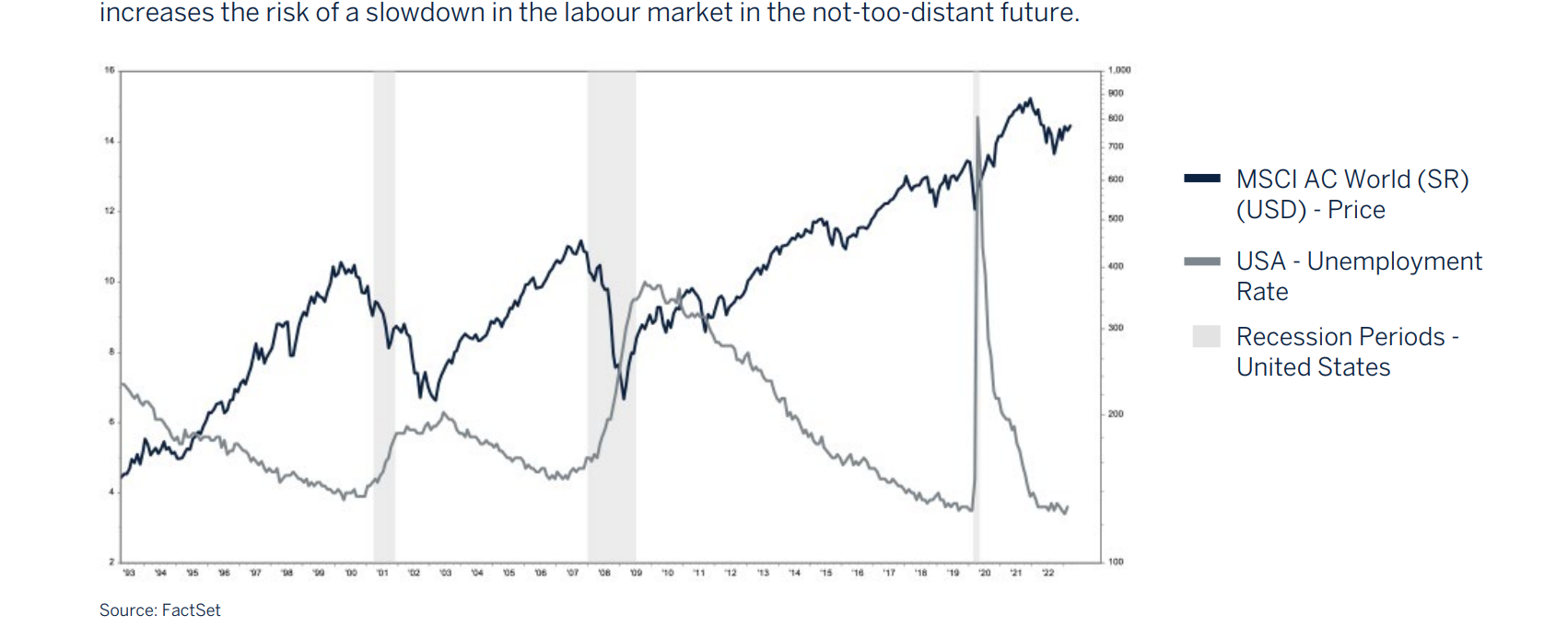

Unemployment across developed markets is at historical lows and has been an important driver, in addition to excess savings, behind the continued strength in consumer spending during a period where extraordinarily high levels of inflation would have normally eaten into households real disposable income. The labour market appears to be robust, with job vacancies plentiful. Unfortunately, the labour market has in the past not been a good signal for what is to come. The strength in the labour market has arguably reached its peak and signals that the global economy might have already reached a late cycle in its expansion phase with a rising likelihood of a recession towards the end of the year and/or beginning of 2024. Historically, the amount of time that passes between the lowest unemployment rate in the cycle, and the next recession is quite short. Although businesses are currently unlikely to retrench, the mix of high rates, tighter credit and profit margin compression should gradually impair their health and profitability, which increases the risk of a slowdown in the labour market in the not-too-distant future.

If history is to be repeated and unemployment has indeed reached its low, the next recession (albeit shallow) is perhaps not too far away.

South Africa

A challenging start the year

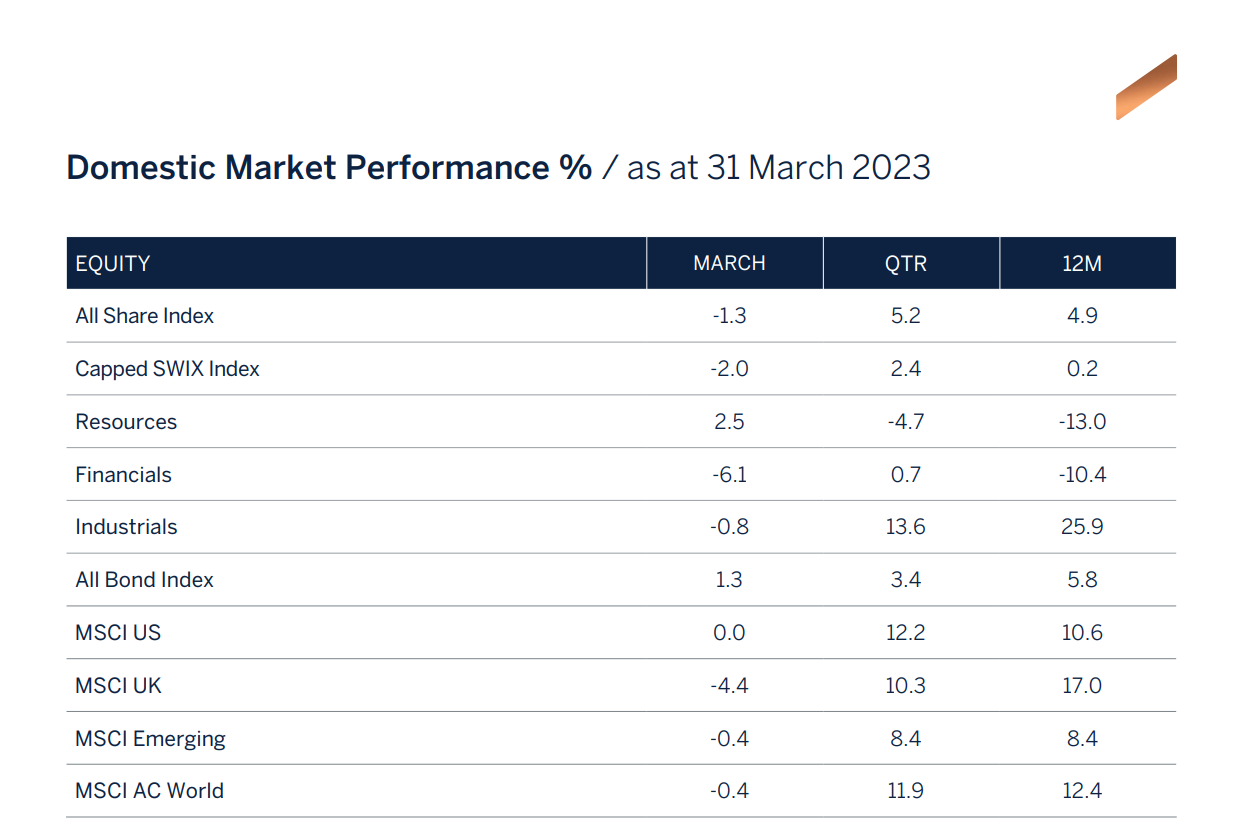

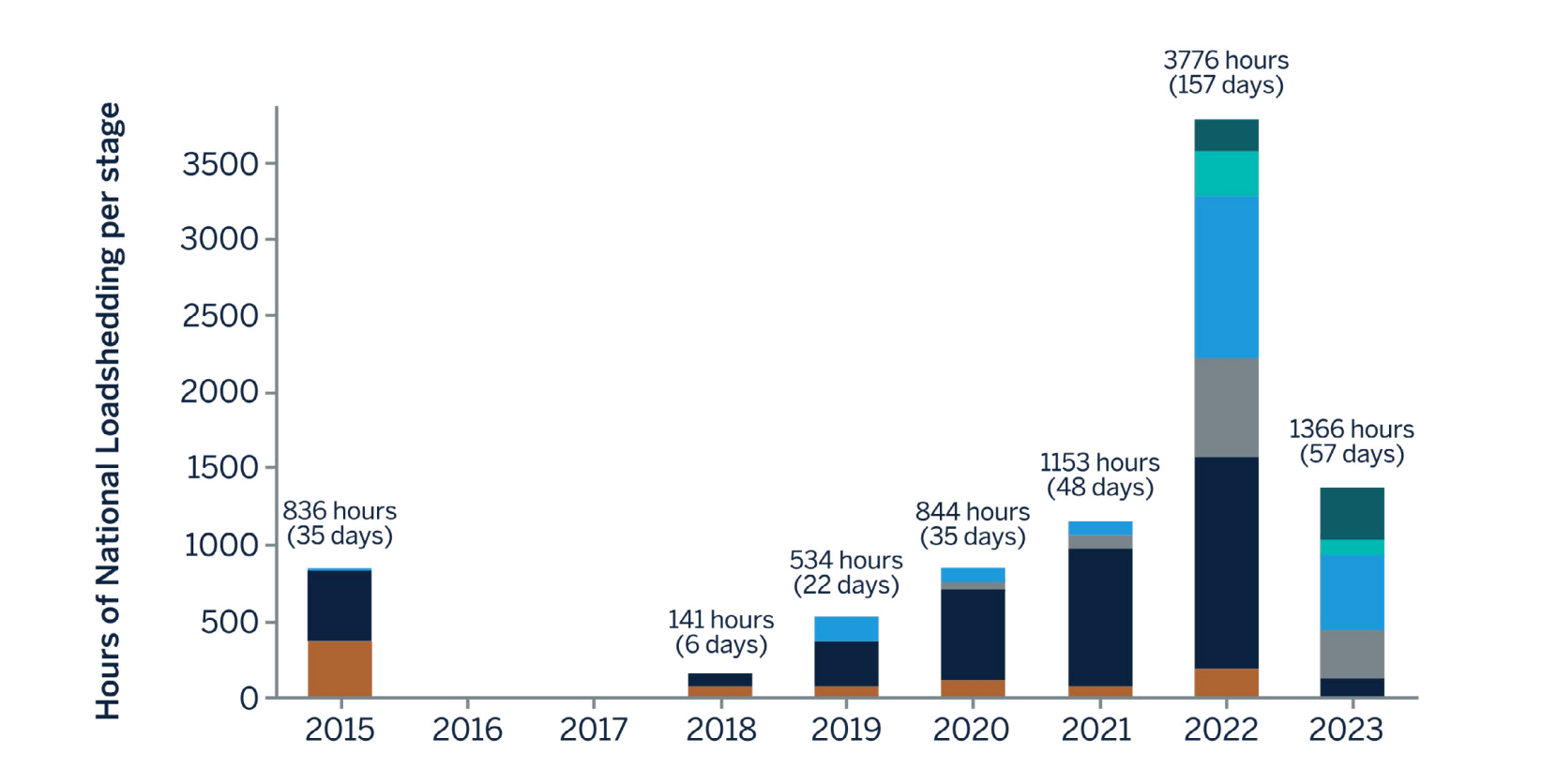

The South African Reserve Bank (SARB) continued where it left off in 2022 and at its first meeting of the year in January, hiked rates by a further 25 basis points. This upward adjustment in rates was expected as inflation continued to find resistance to its downward trajectory. By the January meeting, the central bank had increased interest rates by a cumulative 350 basis points since November 2021, when it began its tightening cycle. With the central bank having aggressively hiked rates in the past 14 months and inflation continuing to decelerate, albeit slower than what the central bank would have preferred, the market begun positioning itself for a peak in the interest rate tightening cycle. This view was further entrenched by the rhetoric coming across the Atlantic Ocean, with the US Fed beginning to tone down on its aggressive approach to rates. Pleasingly, fixed income portfolios and weightings in multi-asset portfolios also delivered positive absolute returns and were broadly in-line with benchmarks. However, this sentiment all changed with the release of February inflation data. Headline inflation, in February, not only surprised the market by printing higher (7,0% y/y), but it also reversed direction and accelerated. This print once again proved how sticky inflation is on its deceleration path and this was the second time in six months where inflation had accelerated. In its response the SARB in its March meeting, increased rates by a higher than expected 50 basis points, taking the repo rate to 7,75%, and indicated that more interest rate hikes would be on the cards if the outlook for inflation does not improve. Our assessment is that the central bank will hold rates steady for longer and we expect the SARB to only begin cutting rates in the second quarter of 2024, offering no relief to the economy in the near term. While rising interest rates are a global phenomenon, South African households and companies also face elevated levels of load shedding and fuel prices which have constrained SA’s growth ambitions. This reality has started showing up in company trading updates across all domestic sectors from mining to consumer facing industries. Electricity supply constraints remain the single largest cap on growth. Of major concern is that the country has, during the first two months of the year already experienced more stage 6 load shedding days than the whole of 2022.

South African companies have proven to be resilient through various cycles and will adapt to the challenging environment..

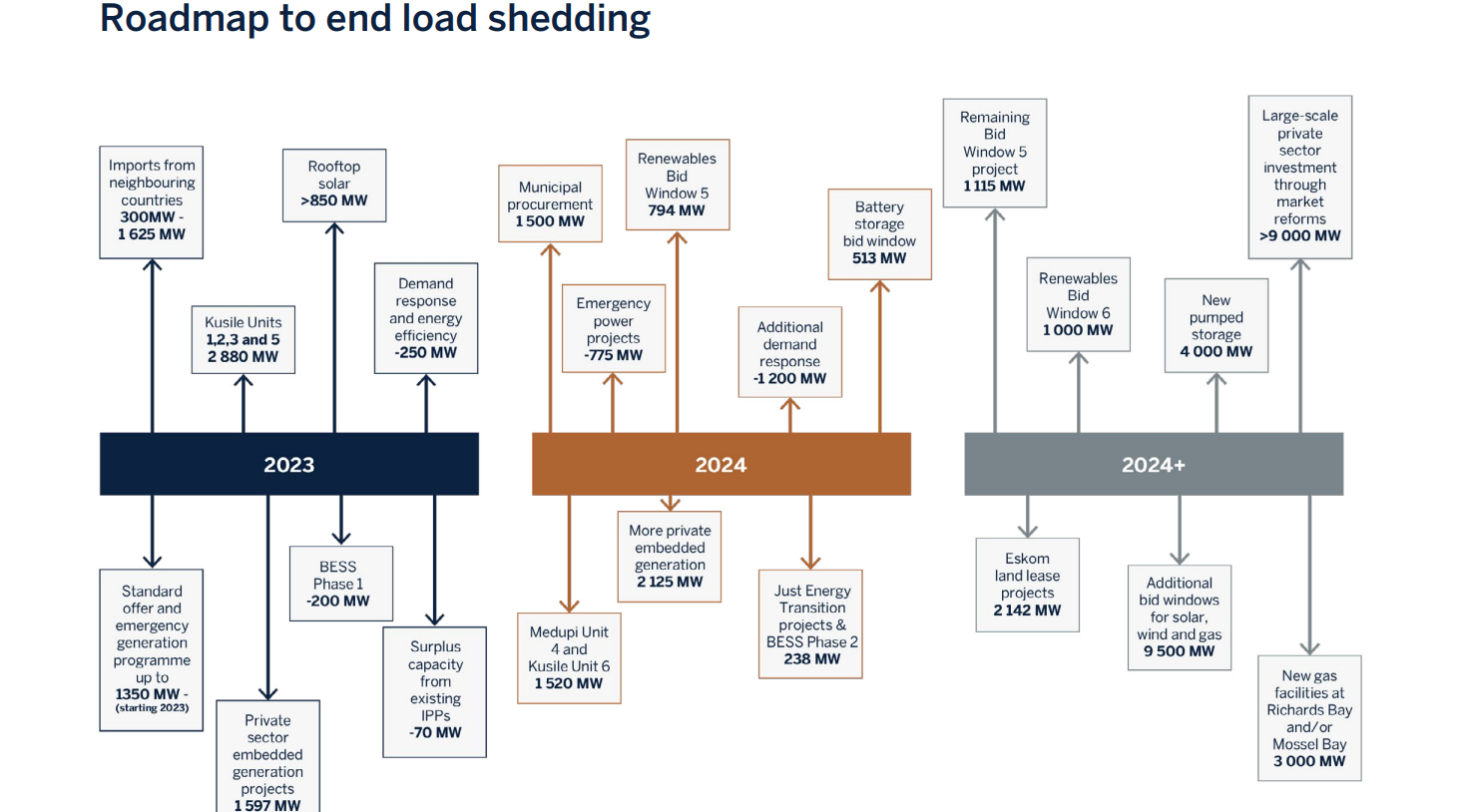

South Africans and South African companies have proven to be resilient through various cycles and will adapt to the challenging environment, albeit at a cost in the short term as companies and households invest in alternative sources of energy. In the long run however, this will result in less pollution, a greener and more sustainable energy usage and an attractive return on investment.But, base load electricity from coal-fired power stations will still be required to provide stability to the grid and herein lies the challenge over the next 18-24 months. With demand equaling 30GW during the summer months and the available energy generation only 23GW, given an energy availability factor of only 49%, there is no quick fix solution. While significant investments are expected to take place in renewable energy projects over the next few years, the benefits will only be realised later given a lead time of at least two years on some of these projects. It is therefore imperative that Medupi and Kusile contribute to Eskom’s electricity generation as planned over the next two years. If not, SA’s growth outlook will remain pedestrian at best. We have positioned portfolios accordingly by reducing exposure to stocks that are solely dependent on the fortunes of South Africa’s economy.

Conclusion

Although favourable developments in Europe and China are welcome, and indeed should be viewed as very supportive to the economic ‘soft landing’ rhetoric, we still feel that it is too early to call such an outcome. The lagging effect of higher interest rates has yet to play out, whilst better than expected demand from Europe and China will likely lead to inflation being elevated for longer, thereby requiring central banks to keep interest rates higher for a lengthier period than currently predicted. In the very short term, the ‘soft landing’ narrative is likely to support financial assets, but further out risks very much remain. Corporates, investors and households need to go through the process of adapting to an environment of higher for longer interest rates, inflationary costs and a rise in unemployment, all of which looks set to dampen end demand and consumer confidence and result in lower economic activity and corporate earnings. We continue to actively monitor the key drivers of asset class returns, which include valuations, the outlook for inflation and interest rates, the change in the direction of leading economic indicators and developments in employment. We stand ready to change tack as the environment dictates and we believe investors should look forward to a year of improved investment returns in response to lower starting valuations, declining inflation and a peaking interest rate cycle

Asset allocation

South African asset valuations have derated this year on growth concerns emanating from increased occurrences of load shedding and high interest rates. Consumers and corporates have de-geared their balance sheets since the global financial crisis and are therefore less sensitive to domestic and global shocks. Furthermore, there are no signs of excesses and/or inflated valuations across asset classes in the economy. Confidence across the economy is unfortunately at depressed levels and is expected to continue to weigh on economic activity. But it is during these difficult times that investment markets provide patient investors with attractive investment opportunities. In addition, we would expect that South African asset prices will also be supported by China’s reopening which will likely improve risk appetite towards emerging markets while developed economies slow this year. We therefore remain overweight South African listed assets.

The global economy is expected to decelerate sharply on the back of higher interest rates and further tightening in monetary policy. The risk is that central banks overtighten in their efforts to rein in inflation which has become their major concern. Higher interest rates will slow demand and banks willingness to extend credit as delinquencies increase. Many asset prices have already declined sharply, and the housing market has rolled over. Consumer and business confidence has deteriorated and as growth slows and consumers pull back on spending, unemployment is expected to deteriorate with knock on effects to the rest of the economy, as well as corporate profits.

Domestic Equity – Overweight

The medium-term outlook for earnings growth remains reasonable as companies recover from the lows during the pandemic. While certain sectors such as Resources will face the headwind from a reduction in lower metal prices and consumer facing stocks the challenges associated with load shedding and higher interest rates, we believe that much of the negative news flow is already discounted in share prices. Other sectors such as Banks will continue to benefit from the endowment effect caused by higher interest rates and strong underlying credit demand from corporates that are investing in renewable energy projects and the mining industry that is spending on maintenance and/or expansion of operations. Although not our base case, many industrial companies are well positioned to benefit from the expected infrastructure upgrading spend associated with water, railway lines, ports and electricity and these are areas that we are looking at closely for new opportunities. We would expect volatility to continue in the near term until interest rates have peaked and/or global growth has stabilised. The environment requires caution, and our strategy remains to be invested in companies with strong balance sheets and robust cash flow streams. With valuations at multi year lows, we intend to stay the course by patiently staying slightly overweight the asset class while receiving attractive dividend cash flows in the meantime. Valuations do matter and we believe that patience will be rewarded.

Domestic Bonds - Overweight

In line with developments in the global bond market, South African bond yields have been trending lower this year. Although execution risks remain, government is committed to prudent fiscal management, while tax revenues have largely been tracking National Treasury’s expectations. We believe that inflation has peaked, and the monetary policy tightening cycle is near its highest point. Given the cautious rhetoric emanating from the central bank we are of the view that the bank will hike rates by a further 25-50 basis points by mid-2023 before pausing. While we expect some level of volatility to persist, we believe the worst is behind us as inflation declines. The domestic fixed income market is not immune to developments in global bond markets but given the attractive starting income yields in both nominal and inflation adjusted terms, we would expect returns to be well above cash over the medium term, hence our overweight position to the asset class.

Global Equity - Underweight

After the strong, albeit volatile, rally in global equity markets since the beginning of this year, on the back of China’s reopening and an improved outlook for Europe given much lower energy prices, valuations for equities, in aggregate (MSCI ACWI), are no longer attractive relative to cash and bonds on a risk adjusted basis. Our one year expected top down return for the asset class is in line with the other (risk free) asset classes, assuming a positive outcome from earnings growth in 2023, which we believe is unlikely to materialise. Top line corporate earnings growth is expected to decelerate as monetary policy tightens (lower volume growth) and the inflation rate falls. Furthermore, and given the high job vacancy rate in many economies, employers will be less inclined to cut their workforce, which could result in margin squeeze. The combination of these two factors is likely to result in lower earnings over the next 12 months and will be a headwind for the asset class. Valuations for risk assets, including equities, credit and EM currencies appear to have run ahead of fundamentals in the very short term, and at current prices offer lower margins of safety. It should be noted however that some of the leading economic indicators appear to have bottomed, and this is something that we will be monitoring closely for signs of an economic recovery. The job market has also remained robust and does provide an underpin to consumer spending. The question remains however – can this trend persist?

Global Fixed Income – Underweight

March 16th represented the one-year anniversary since the Federal Reserve (Fed) embarked on one of the fastest rate tightening cycles since the early 1980s. Rampant inflation and the error of ‘being behind the curve’ have forced the Fed to sanction a total of 475 basis points of tightening, lifting the Fed Funds rate to levels not seen since 2007. Whilst the pace of hikes has slowed and, arguably, the central bank has reined in its extreme hawkishness, Fed Chair Jerome Powell has made it clear that the fight against inflation remains the top priority. The Fed is at a difficult juncture, whilst inflation is still excessively high and the economic backdrop remains solid, supported by a robust labour market and a strong services sector, the lagged effects of aggressive monetary tightening are now exposing cracks in pockets of the financial system. Over the short-term, we expect yields to surrender some of the recent slide, although a full retracement to the highs of last year is unlikely. It is somewhat ironic that the catalyst (higher interest rates and yields) behind recent volatility is actually the same one providing an attractive risk-adjusted haven for investors in times of broader market instability. Fundamentally, our view remains that inflation is at, or quickly approaching, a ‘sticky patch’ and economic growth conditions remain resilient (aided by strong employment markets) and in the absence of any additional ‘bank bail out type’ scenarios, yields have little incentive to decline meaningfully from current levels. At current yields, investors have an opportunity to lock in attractive real (inflation adjusted) yields as inflation normalises over the medium term.

Global Cash Plus – Overweight

Short term money market instruments are providing attractive yields at present in an environment where the outlook for the global economy and geopolitical environment remains uncertain. These funds will naturally be deployed across the other asset classes when investment opportunities arise.

Domestic Cash - Underweight