Quarterly Commentary: Q4 2025

View PDF versionSteady momentum across global financial markets

As we enter 2026, from all at Melville Douglas we wish to extend our very best wishes to you and your families for a healthy, fulfilling, and prosperous 2026.

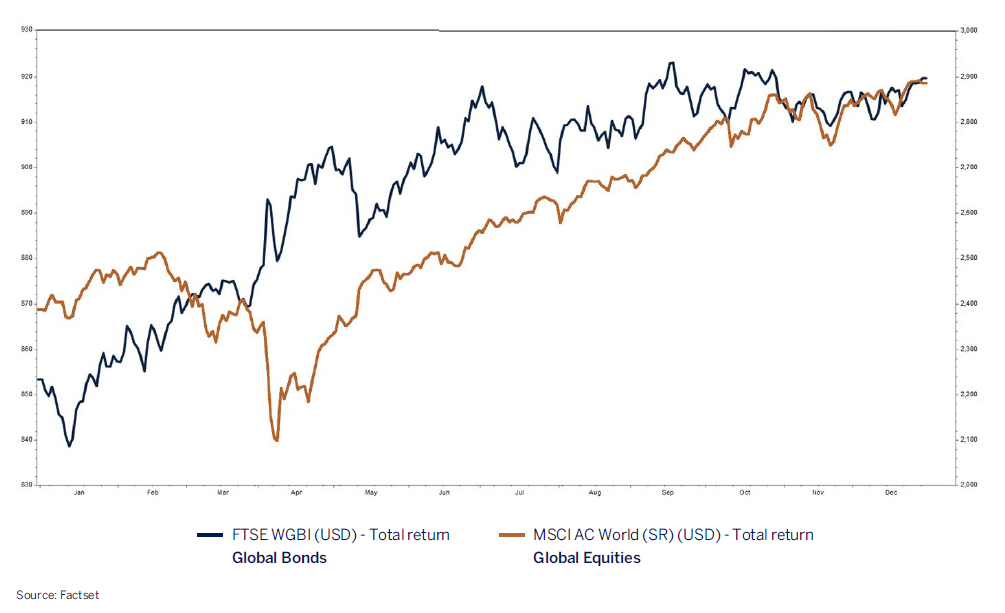

2025 will be remembered as a period defined by resilience, reinvention, and broad‑based strength across global markets. What stood out most was not the absence of uncertainty, but rather the market’s ability to absorb it. Despite political shifts, heightened geopolitical tensions, advances in artificial intelligence (AI), and meaningful policy pivots, portfolios were rewarded favourably on both an absolute and inflation adjusted basis.

Central banks, most notably the US Federal Reserve, shifted toward accommodation, supporting valuations of both equities and fixed income securities

Now, with a full year’s perspective, it’s easier to appreciate how the seemingly disjointed events of 2025 ultimately worked together to lay a stronger foundation for markets. Volatility in the first half gave way to unexpectedly powerful equity gains in the second, as earnings revisions turned positive and interest rates declined. Diplomatic progress, even when incomplete, helped appease some of the world’s most entrenched risk premia. AI moved from promise to signs of being a material economic driver through the commencement of productivity gains, whilst central banks, most notably the US Federal Reserve, shifted toward accommodation, supporting valuations of both equities and fixed income securities, whilst reinforcing confidence in ongoing global economic growth. In this review, we walk you through the key developments that shaped 2025, outline the forces we believe will matter most in 2026, and share how we are positioning client portfolios for both the opportunities and risks that lie ahead.

A year that tested conviction and rewarded discipline

The tone of 2025 was set early by a precious‑metals surge that reflected a world recalibrating risk and policy. Gold, having seen strong support throughout the year, broke to new highs above the $4,500 mark in December before encountering some natural profit‑taking; silver followed a similar but even more pronounced arc, recording stellar gains and all‑time highs in December before a modest pull back ensued as positioning and margin changes washed through markets. Those swings captured the interplay among geopolitics, inflation psychology, and rate expectations as central banks continue to allocate more of their reserves to gold whilst investors weighed safe‑haven assets against an improving earnings outlook for risk assets.