Quarterly Commentary: Q3 2025

View PDF versionResilient Growth Drives Financial Markets Higher

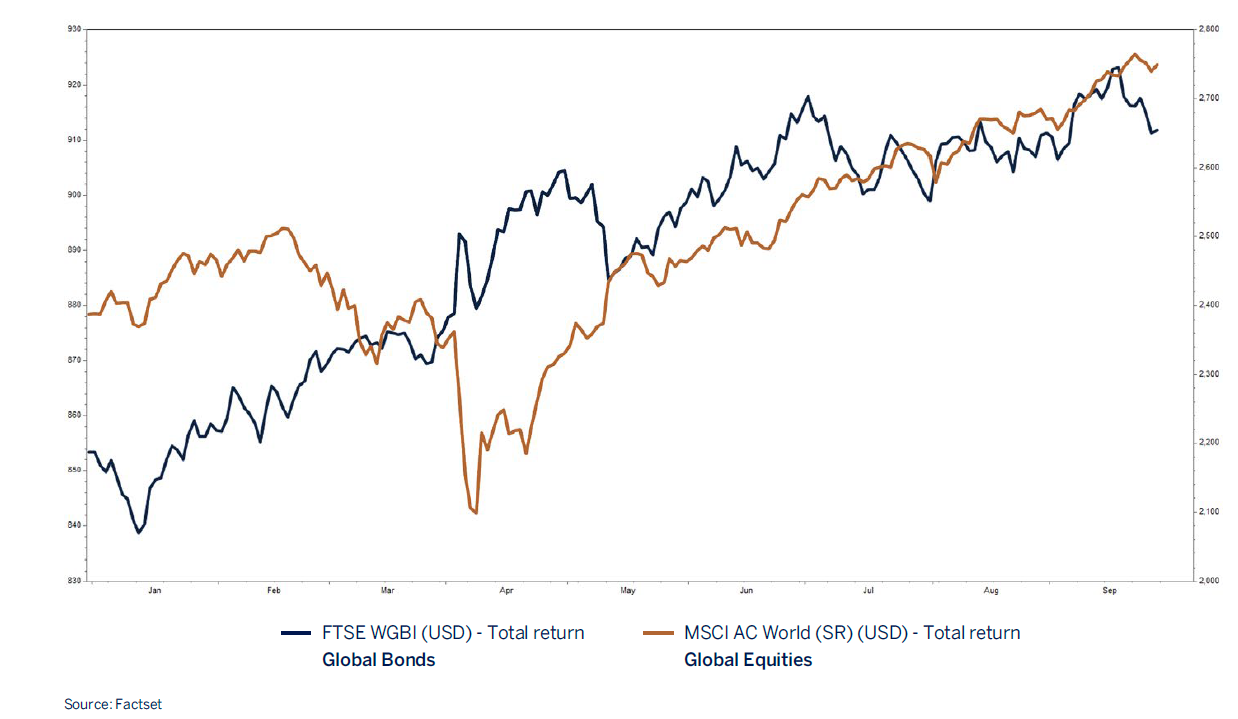

Global financial markets continued their upward trajectory in the third quarter of 2025, buoyed by resilient economic growth despite a backdrop of geopolitical tensions, policy uncertainty, and lingering trade disputes. This resilience has surprised many market participants and analysts, particularly given the complex interplay of macroeconomic headwinds and structural shifts in global trade and technology.

The strength of the global economy is increasingly underpinned by coordinated monetary and fiscal support across major economies. The United States, Germany, and China have all adopted more accommodative stances, with central banks easing financial conditions and governments deploying targeted fiscal measures to stimulate demand and investment. These actions have helped mitigate the impact of elevated tariffs and geopolitical friction, while also supporting consumer and business confidence.

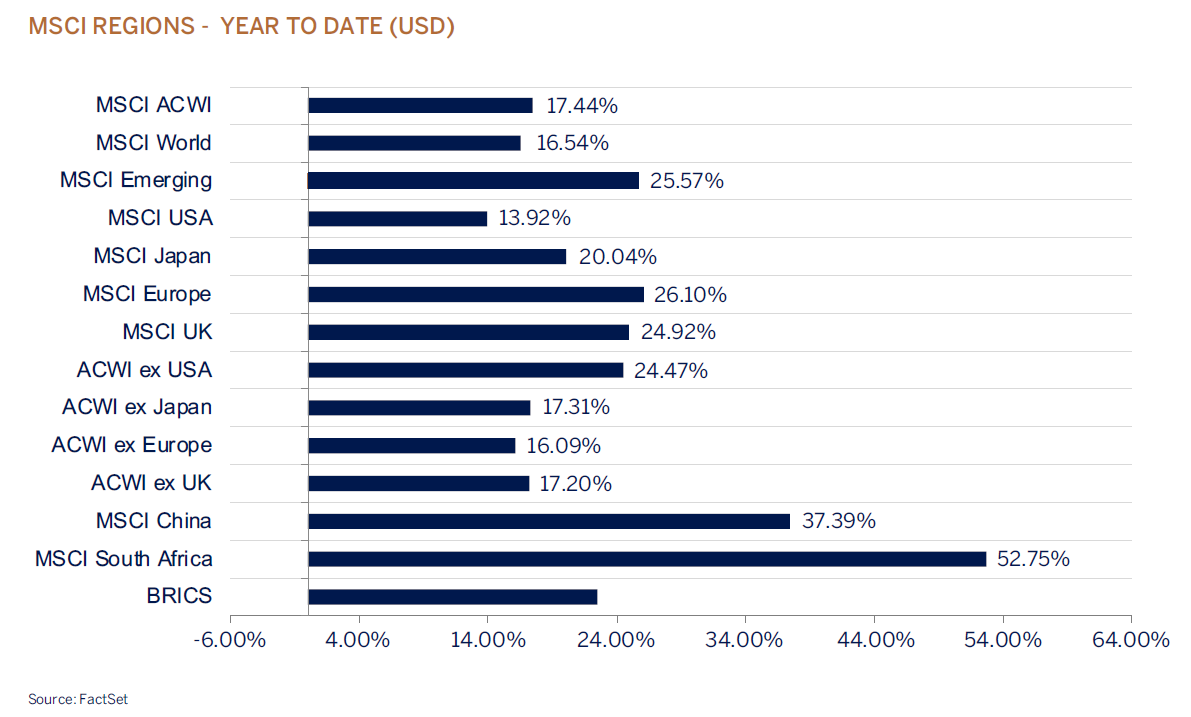

A weaker US dollar, coupled with upward earnings revisions and attractive valuations, has driven strong performance across emerging markets this year, outpacing returns in developed markets

Equity markets have responded positively, with major indices reaching new highs. A weaker US dollar, coupled with upward earnings revisions and attractive valuations, has driven strong performance across emerging markets this year, outpacing returns in developed markets. Credit markets have also rallied, with spreads narrowing to levels not seen since the pre-pandemic era. This tightening reflects both improved investor sentiment and stronger corporate fundamentals. Household and corporate balance sheets remain robust, supported by rising asset prices, falling debt servicing costs, and improved liquidity conditions. These buffers have helped insulate the real economy from elevated levels of policy volatility.

While the full impact of elevated tariffs is still unfolding, recent developments have helped reduce downside risks. The US administration’s willingness to re-engage in trade negotiations with China has opened the door to a potential reduction in effective import costs. This would be a welcome relief for US consumers and importers, who have faced rising prices and supply chain disruptions. For now, corporates are absorbing much of the cost pressure, which is compressing margins and dampening near-term inflation. However, a weaker dollar and lower corporate tax rates are providing partial offsets, helping to preserve profitability and competitiveness. Looking ahead, we expect several key drivers to support a continued rebound in 2026. These include the broadening investment cycle in artificial intelligence (AI) and automation, solid capital expenditure activity across sectors, easier monetary policy, and strong household and corporate balance sheets. Together, these factors create a constructive environment for risk assets. As a result, we are adjusting our portfolio positioning: global equities moving to a neutral allocation, while fixed income in Sterling denominated portfolios is increasing to overweight. This reflects the attractive inflation-adjusted yields available.