Quarterly Commentary: Q2 2025

View PDF versionNavigating beyond peak volatility: A more constructive outlook amid residual uncertainty

At the start of the year, we positioned client portfolios with a more cautious tilt, anticipating heightened levels of uncertainty and volatility under the leadership of President Trump, who has often emphasised the strategic value of unpredictability. While we expected a turbulent environment, the scale and nature of geopolitical developments and trade tensions that have unfolded since were difficult to foresee.

Despite persistent eye-catching headlines and market noise, underlying economic fundamentals have remained relatively stable. The divergence between soft data (such as subjective sentiment surveys and leading indicators) and hard data (actual economic performance) has widened, yet investors have increasingly focused on a more constructive outlook for the coming year. This optimism is underpinned by a supportive monetary and fiscal policy environment globally.

Global equity markets reached new highs by the end of the second quarter, completing a notable rebound from the sharp sell-off triggered by the initial ‘Liberation Day’ announcement of US tariffs on April 2nd. Since hitting a 17-month low on April 8th, the MSCI All Country World Index (ACWI) has risen by 24%, regaining all the lost ground and more.

"Trump’s ‘reciprocal tariff’ announcements initially generated significant market volatility"

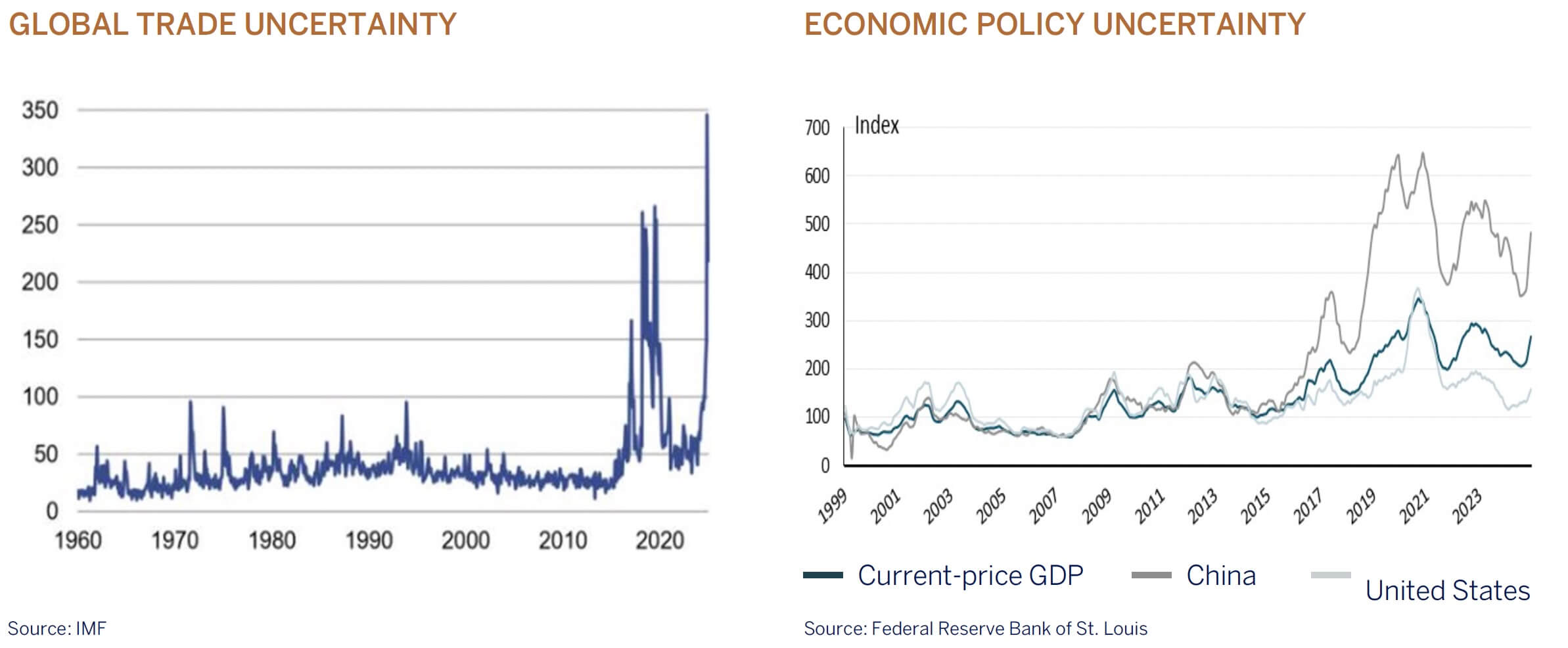

Trump’s ‘reciprocal tariff’ announcements initially generated significant market volatility and prompted many economists to rapidly revise global growth forecasts downward. The revisions were largely driven by expectations of higher inflation, which was anticipated to erode consumers’ disposable income and dampen spending on discretionary goods such as vehicles, travel, and leisure activities.

However, after a string of policy reversals and delays in tariff implementation, combined with resilient ‘hard’ economic data, investor confidence was quickly restored. The equity market rebound has stood in contrast to continued pressure on the US dollar, which has fallen to a three-year low amid growing concerns over the sustainability of US fiscal metrics and decelerating growth momentum. Measures of US consumer and business sentiment have also been affected by the unpredictability of trade policy, particularly tariffs on metals, semiconductors, automobiles, and consumer goods.

Nevertheless, equity markets have found support in strong corporate earnings, particularly among large-cap Technology companies. Moreover, fears that aggressive trade policy shifts would reignite inflation or disrupt the labour market have not yet materialised. The administration’s landmark tax reform is also expected to provide a tailwind to economic growth and corporate profitability.

Technology stocks, which experienced a sharp correction earlier in the year, have led the recent recovery—rising over 40% since the tariff policy reversal on April 9th. The narrative has since shifted back towards innovation and growth, particularly in areas such as artificial intelligence. US equities have outperformed both developed and emerging markets over this period, highlighting investor confidence in the resilience of the US economy and corporate sector.

"Trump has indicated that 'short-term pain' may be necessary for long-term gains."

Whilst the US economy looks set to benefit from lower taxes and deregulation in the medium term, the uncertainty over tariffs and the accompanying risk of higher inflation have significantly impacted both consumer and business confidence so far this year, raising concerns about potential stagflation. Indeed, the US Federal Reserve (Fed) now expects a combination of moderately lower economic growth and higher inflation in the near term, likely resulting in the Fed being forced to hold interest rates higher for longer as it attempts the difficult balancing act of containing renewed inflation risks without tipping the economy into recession. Investors will need patience as the world adapts to the changing landscape under Trumponomics 2.0.

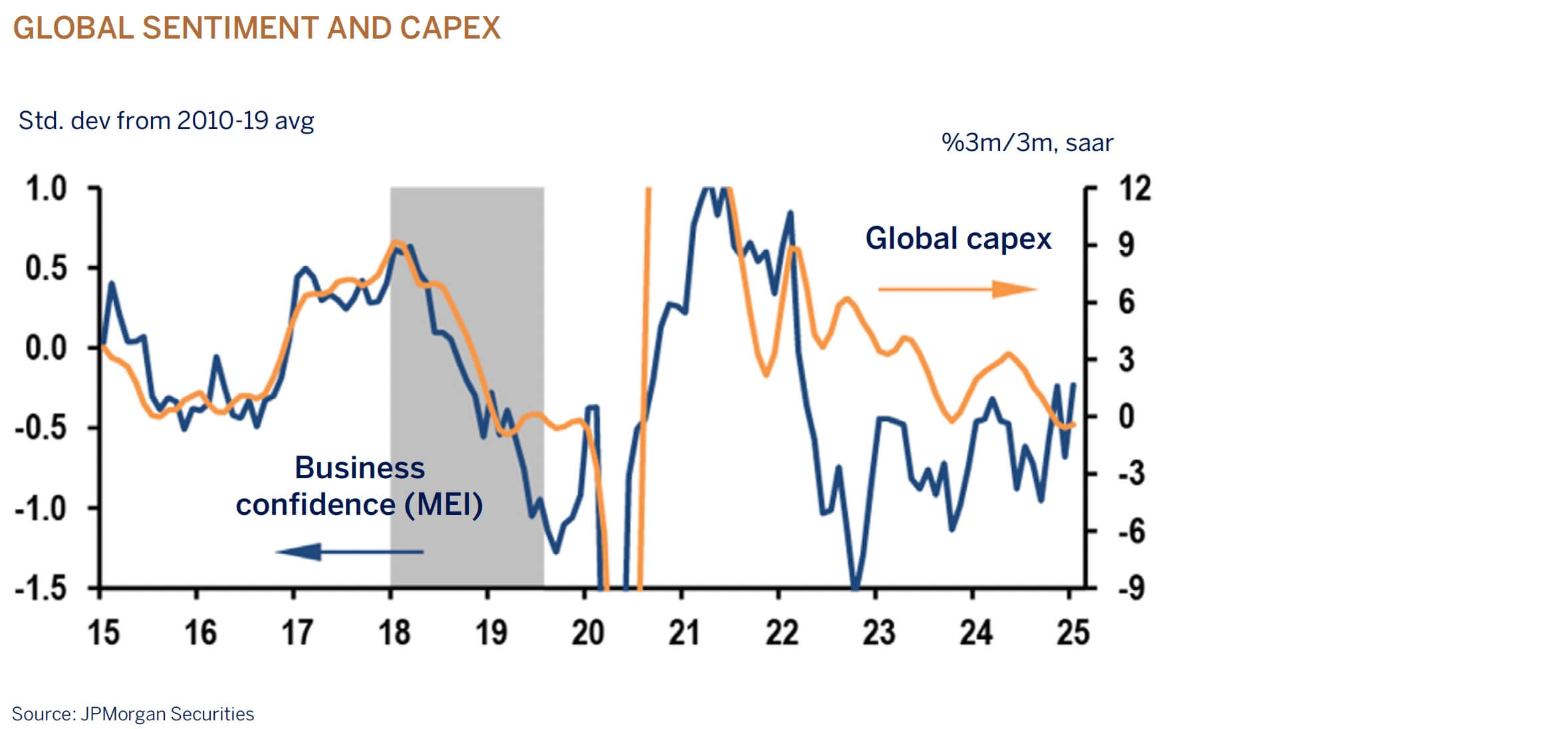

Despite generally resilient economic data year-to-date, markets have been pricing in the prospect of companies delaying investment and hiring until the new administration’s policies are clear. While Trump has called tariffs “the most beautiful word in the dictionary” and views them as a useful tool to negotiate favourable terms for the US, the risk is that retaliatory actions by its largest trading partners could escalate into a more economically damaging global trade war. This would have far-reaching implications as companies adjust their supply chains or relocate their manufacturing facilities. Recent IMF research suggests that a 10% increase in tariffs on all US imports, followed by 10% retaliatory tariffs on US exports, could reduce global growth (gross domestic product – GDP) by 0.5%, with the US bearing the brunt. The impact on GDP from supply chain adjustments is harder to quantify, but President Trump has indicated that “short-term pain” may be necessary for long-term gains—a factor perhaps not yet fully priced into financial markets.

While disruption in global trade is expected, it should be noted that businesses have strengthened their resilience since the Global Financial Crisis, Trump’s first term, and COVID-19, enabling them to navigate uncertainties more effectively. Many companies anticipate minimal impact due to diversified supply chains, a “local-for-local” manufacturing model, and proven disruption management. Currency movements will offset some effects, and tariffs will be managed through pricing strategies. Growth plans will focus more on increasing volumes rather than raising prices. Outside of the technology sector, companies remain cautious on capital expenditures, prioritizing debt reduction and returning surplus capital to shareholders.

In conclusion, while the proposed policies are introducing short-term challenges, businesses are better equipped to manage uncertainties. We will continue to monitor developments closely and focus on investing in well-managed global companies that are best positioned to adapt to the evolving environment, while keeping a close eye on broader economic trends.