Unilever

View PDF versionFund Manager’s Desk: Unilever

Our quarterly reports regularly explore the investment rationale of one of the companies we own in the Fund, to articulate what we find compelling. This time round we have chosen Unilever.

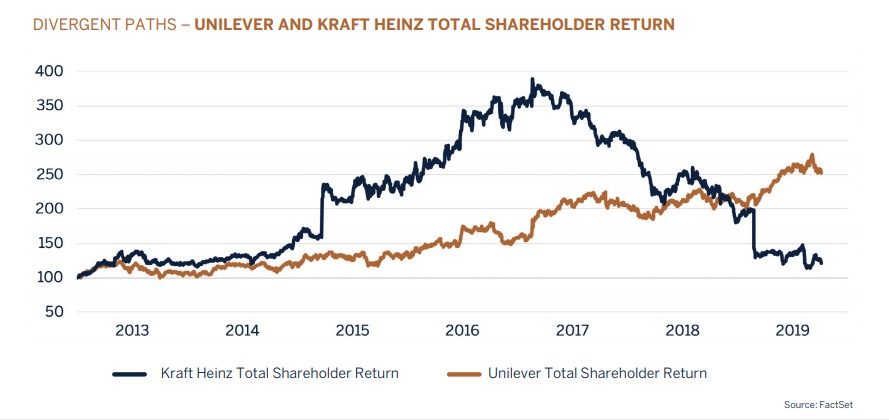

What we need to appreciate is the divergent approaches to value creation embraced by both Unilever and Kraft Heinz. Kraft Heinz’s strategy was driven by its ownership, a Brazilian private equity firm called 3G Capital. 3G was more about immediate quick fixes that could yield outstanding results over the short term. Unilever was unashamedly committed to driving long term returns by ensuring the entire business including all stake-holders placed sustainability at the core of everyday operations. Adopting this sustainability focused strategy that would benefit the company, the communities they touch, their consumers, and the environment is what led investors - including us - to believe in the company’s ability to consistently deliver shareholder value in the years to come.

As with many consumer behemoths, their size and reach often limits their nimbleness. With a revenue line of over EUR 50 billion and operations in every continent, the inherent complexities in managing global brands while ensuring these brands resonate with different consumer tastes has at times proved challenging. We have previously written about the fast changing, increasingly complex world that big branded companies have had to navigate.

Unilever successfully pivoted their business from being over-exposed to developed market food products where growth was depressed, towards higher growth emerging markets that now account for close to 60% of revenue. Countries like India, Brazil and Indonesia have a growing middle-income consumer who is now in a position to purchase everyday basic household goods. The likes of Omo washing powder, Dove soap and Lipton tea appear more frequently in shopping lists.

Another challenge has been the wave of disruption brought by rapid adoption of smart phones. E-commerce has reduced barriers to entry. Expensive advertising – a competitive advantage in the past afforded only to those with deep pockets - is now virtually free via “word-of-mouth” advertising on social media. Unilever was one of the early movers in perceiving this change, either through in-house development or buying in expertise and brands. An example is its purchase of Dollar Shave Club, an online-only brand that had gained massive popularity amoungst the trendiest bearded hipsters in California. What this purchase did was to highlight the need to adopt new ways of thinking to ensure you remain relevant in the eye of the fast-changing consumer.

On a mission to transform the business, the company has been actively managing their portfolio having completed over 30 small scale acquisitions since 2015. From Seventh Generation (a plant[1]based detergents and naturals company) to Pukka Herbs (an organic herbal tea business centered around the health and wellness philosophy), Unilever is determined to support sustainability and ensure their business is managed to the benefit of all stakeholders.

This activity has improved their end-market growth, broadened their exposure to differentiated sales channels, and deepened their reach by appealing to more niche consumer segments. As a well-run company in possession of a dependable earnings base that is supported by the attractive emerging market growth profile, Unilever is well positioned to weather the storm. We believe in the longer[1]term vision, strategy and growth prospects for the company and it remains a core holding in the fund.