The times they are a-changin’

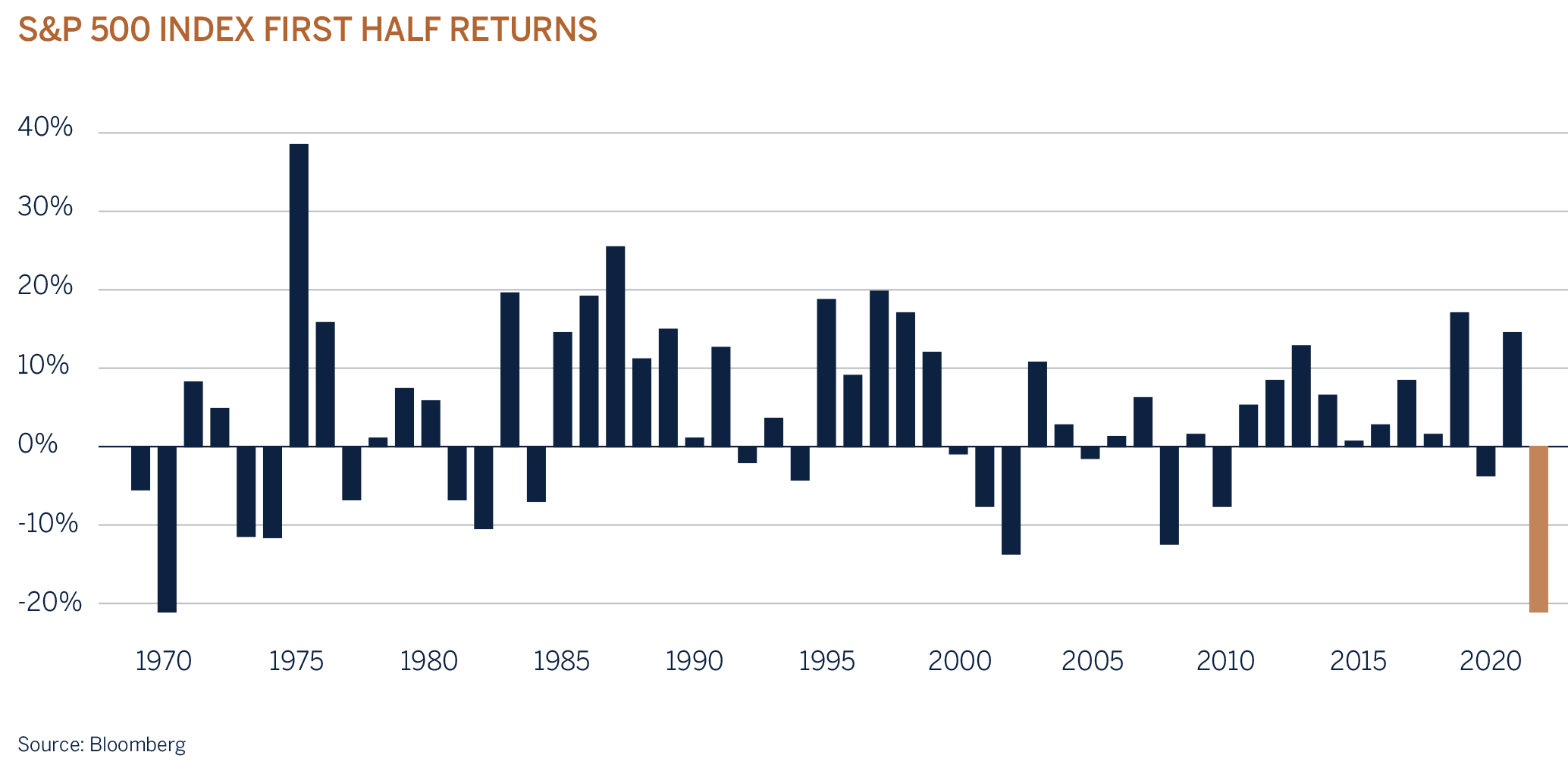

Equity markets experienced their worst start to the year since 1970 as stagflation fears set in and central banks signaled a much firmer stance in bringing inflation under control. Global equity markets have officially entered a bear market after declines of more than 20% from the peak reached in January this year. Defensive stocks have held up reasonably well, but at the end of the first half of the year, the energy sector was the only sector that printed a positive return on the back of materially higher oil prices. Growth stocks in particular (IT and discretionary) came under significant pressure against a background of higher interest rates and elevated valuations. Outside of cash, oil and gold there was nowhere to hide for investors. Global fixed income investors also experienced pain as the capital losses for the year have wiped out nearly 10 years’ worth of income, and investors that chanced their arm at speculative cryptocurrencies will be feeling severely bruised after very sharp sell-offs in their prices. Stagflation is categorised as a period of persistently high inflation and low or stagnant growth, both of which have historically been headwinds to investment markets. Although the sharp increase in inflation, caused by a combination of strong demand and supply disruptions during the pandemic and more recently by the war in Ukraine, will ease as commodity prices stabilise, production lines and supply logistics adjust and supply bottlenecks ease, investors have become increasingly concerned about the expected slowdown in economic growth, or even worse the next recession. In our opinion these uncertainties translate into a need for balance in portfolios, and why we think a more neutral allocation to risk assets and government bonds currently makes sense.

Why the sudden reaction?

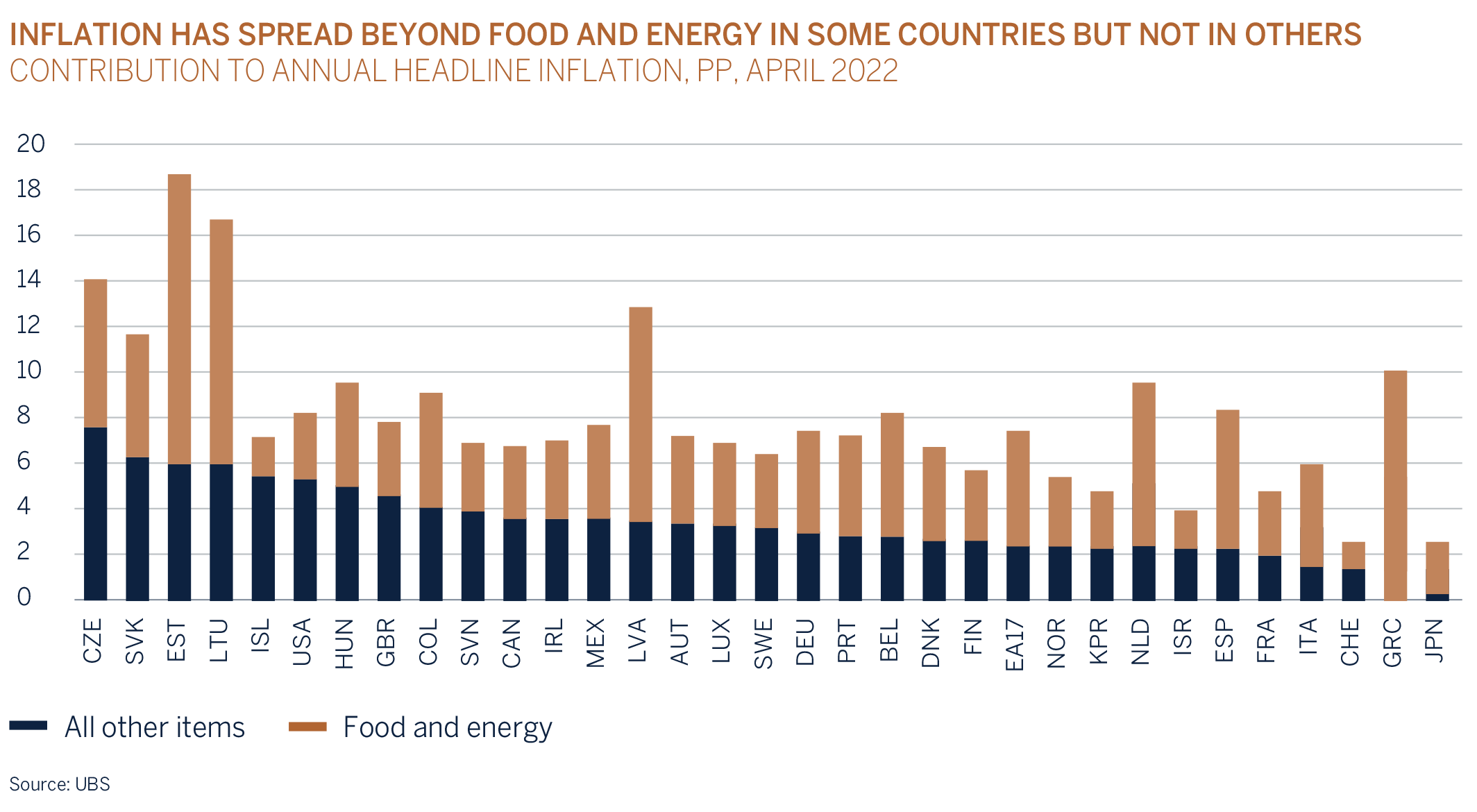

Liquidity, which is the oxygen to economic growth and an important contributor to the performance of risk assets is now no longer expected to be only gradually drained as monetary authorities have become increasingly concerned about the outlook for inflation and are guiding to a period of restrictive monetary policy for the first time in over a decade. Whereas inflationary pressures were previously viewed as “transitory”, evidence suggests that it is becoming more entrenched and has broadened outside of food and energy. Inflation levels have become too high for central banks to ignore and, as such, their guidance has become significantly more hawkish over the past few months – central banks are on a mission to “do whatever it takes” to bring inflation under control, and the consequences pose significant risks to the outlook for economic growth.

At the US Federal Open Market Committee (FOMC) meeting in June they, like many other central banks, indicated that they are willing to sacrifice near-term economic growth to prevent any lasting price spiral. Demand in developed economies is perceived to be running “too hot” after the unprecedented fiscal and monetary support since the outbreak of COVID-19. Unemployment levels are very low and in the US job vacancies are running at almost double the job seeking rate, driving wages significantly higher, which in turn has been supporting demand and consumer spending. In addition to the 75-basis point interest rate hike announced, the Fed has indicated that interest rates need to increase above the ‘neutral’ rate of 2.5% through-the-cycle to combat inflation by moderating economic activity.

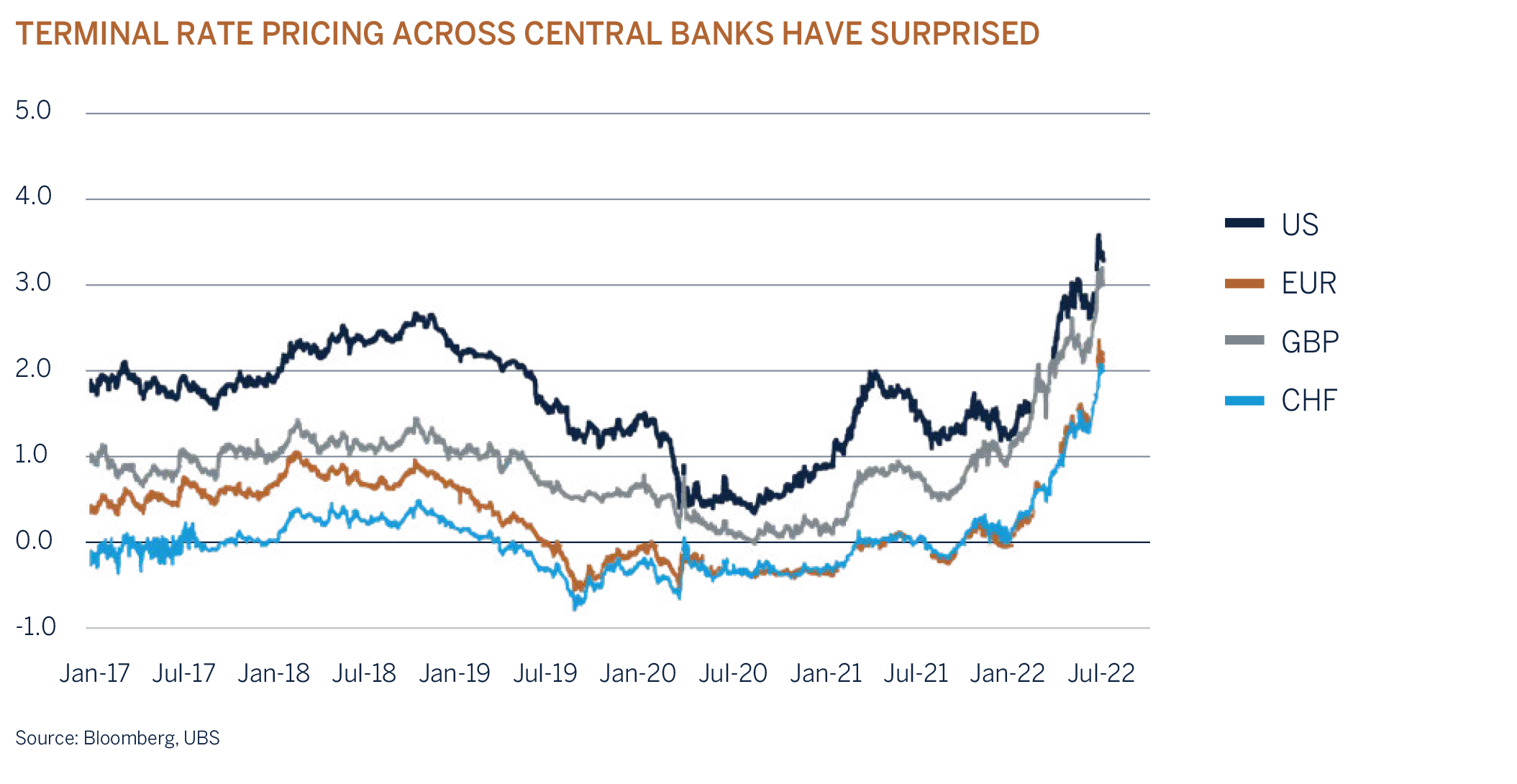

The policy rate is now expected to reach 3.5% by the end of this year and to peak at 3.8% next year, before declining again to 3.5% in 2024; i.e. monetary policy is expected to turn restrictive in the next few months. The revised estimates are significantly higher than what was experienced in 2018, when interest rates peaked at 2.5%. Guidance from the Fed at the time was also for interest rates to peak well above the 2.5% level, but the trade war between the US and China had a large enough impact on economic growth, causing the Fed to back off.

The key difference however is that inflation has become a much greater concern for central banks to overcome as they strive to defend their credibility. While the high levels of inflation have been eating into everyone’s disposable income, accumulated savings and strong corporate balance sheets are providing a temporary buffer.

Unfortunately, it is the lower income groups and poorer countries that will be most vulnerable to the significant increase in food and fuel prices. Yet it is not only the higher cost of living that will pose a headwind to consumers this year; asset prices have also been trending lower which is resulting in a negative wealth effect and in return lower confidence and willingness to spend on luxury items such as durable goods. Spending patterns have changed this year in favour of experiences (services) such as travelling and eating out.

The good news for investors is that product inflation should soon be trending lower as consumers shift their spending away from consuming goods and as supply chain disruptions ease. While inflation will be trending lower over the next year, the rate of decline remains uncertain, given how buoyant global demand currently is. The duration of the war in Ukraine poses an additional risk to the outlook of many commodity prices.

Central banks have realised that they have fallen “behind the curve” and their main concern in the near term is to reduce inflation and, perhaps more importantly, keep inflation expectations under control by draining excess liquidity in the economy through higher interest rates and quantitative tightening (no longer supporting the bond market). This is a big deal, given that interest rates for both government and corporate bonds have been kept unsustainably low through the bond buying programs by central banks over the past few years, in their effort to provide the necessary liquidity and support to businesses and households affected by the lockdowns during the pandemic.

As central banks slowly exit the bond market, fundamentals will once again determine the correct pricing for fixed income securities. Bond investors may demand a higher yield to compensate them for the potential that we have shifted into a new inflation regime, where inflation and interest rates look set to be sustained at higher levels than over the last decade. This adjustment has been costly for bond investors this year, especially those that have been participating in the fixed income market at much lower income yields. It should be noted though that US interest rates are already expected to reach levels above 3.5%, meaning a good deal of tightening is already priced into government bonds.

The second order effect of higher interest rates and the impact of the Russia-Ukraine war (supply disruptions, higher fuel and energy costs and higher food prices) is slower growth. The Fed, IMF, World Bank and OECD have lowered their forecasts for economic growth for the next two years, which are now expected to be below trend, with risks firmly tilted to the downside and reflected in moderating leading economic indicators. The Fed believe that a soft landing (unemployment rate of 4% and inflation at 2%) is achievable, but not a foregone conclusion. There is a lot for investors to digest, which explains the increase in volatility and higher cash holdings in portfolios. Cash holdings across the industry are currently above the levels experienced during the pandemic and will once again provide support to risk assets once inflation and interest rates have peaked. However, this may not be imminent, and investors should expect a bumpy ride until the rhetoric from central banks becomes more balanced.

The change in the outlook for interest rates has come at quite a late stage in the economic cycle. We cannot fault the action by central banks given what’s happened to the inflation trajectory after a period of unprecedented policy support, but it does increase the risks of a policy error which could result in the next recession/economic downturn.

Conclusion

Investment markets this year have been taken by surprise by what was supposed to be a gradual tightening in monetary policy. The terminal rate across central banks (peak in expected policy/ interest rates) has increased significantly; on average by 200 basis points since the beginning of the year as inflation turned both higher and more entrenched than what was previously expected. It is this sharply higher movement in interest rate expectations that have caused a sudden change in the discount rate used to value the future cash flows of stocks and debt/fixed income instruments.

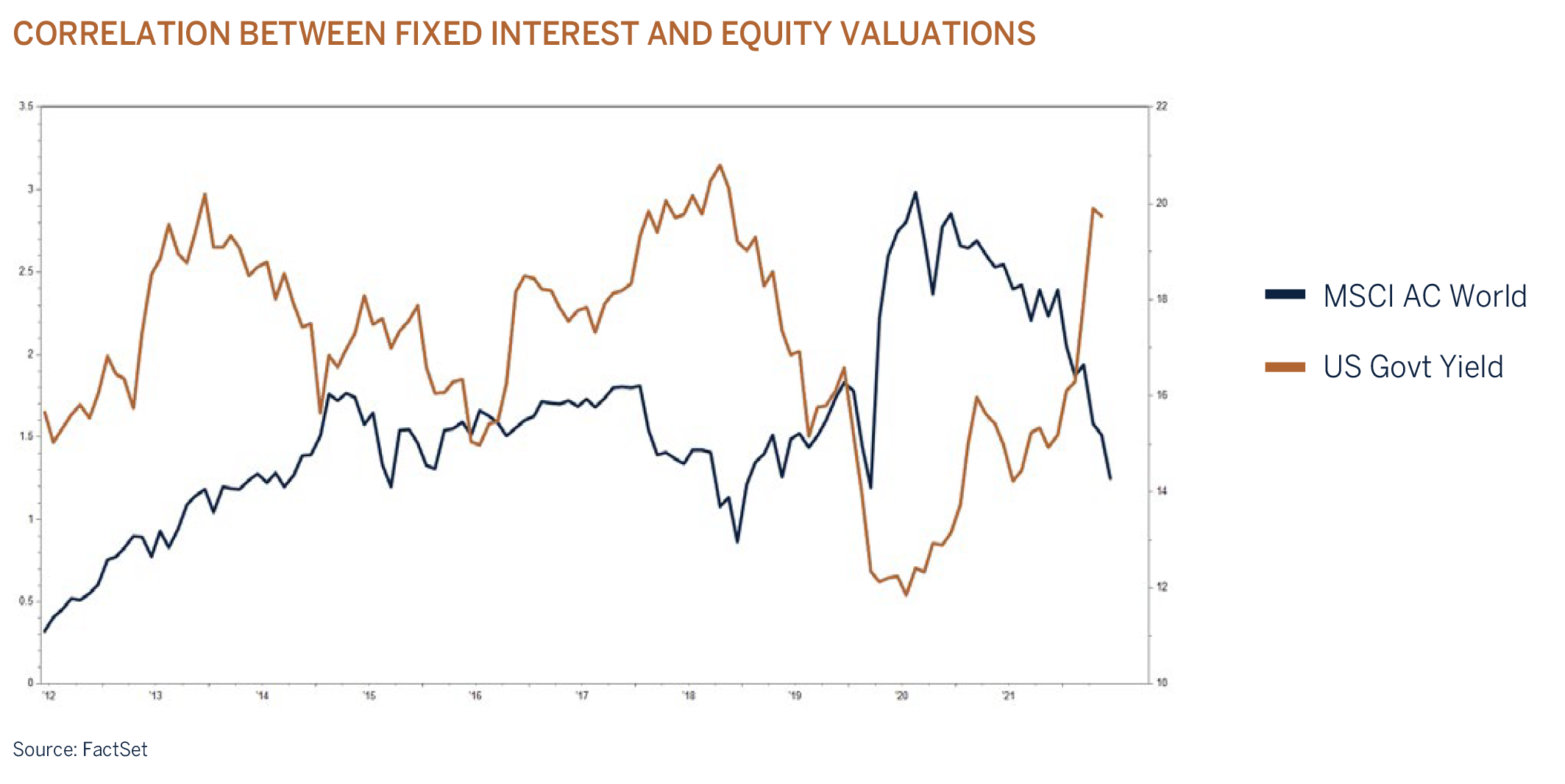

Equity market valuations have adjusted to this new reality and almost all the derating in valuations this year can be explained by higher interest rates rather than a shift in earnings expectations, which has continued to be supportive. The same way that equity markets and other risk assets benefited from abnormally low interest rates and unprecedented monetary support since March 2020, the opposite has been experienced throughout the course of this year and can continue if inflation expectations do not moderate as expected or if the outlook for earnings growth deteriorates.

Our base case is that global economic growth will slow to below trend over the next year, but that a deep and prolonged recession will be avoided given fiscal support, strong household and corporate balance sheets, pent up demand as the world re-opens from COVID restrictions, a buoyant job market and well capitalised financial institutions. In addition, China is expected to support growth as policy restrictions ease after several months of intense Omicron related lockdowns.

We are however acutely aware that the environment remains fluid and that forecasting at present is exceptionally difficult given the flurry of potential outcomes. As a result, we remain steadfast in our approach to invest in high quality companies with secular growth profiles, supported by strong balance sheets and to ensure that we don’t overpay for assets.

The current environment is sure to provide opportunities for companies with strong pricing power, unique offerings and wide moats to increase their market share and competitive position as many of the less established unprofitable companies will fall by the wayside as funding becomes more challenging and top line growth starts to slow.

Central banks have only recently changed their guidance for interest rates and are not looking to provide monetary support any time soon. Given the change in economic backdrop we are again reducing risk in client portfolios and are in the process of rebalancing portfolios by lowering equities to a neutral position and upweighting fixed income now that income yields are once again above longterm inflation expectations.

Investment performance

It was another challenging period as asset prices continued to de-rate amidst a higher interest rate outlook, lower global growth, China COVID led lockdowns and ongoing hostilities in Europe. Our overweight allocation to risk assets (equities), although reduced in March, counted against the benchmark relative-performance. There was little respite for our sector allocation (no energy) and style bias (quality growth) which again worked against us. For us, quality growth is a long-term concept. We look for companies that have competitive advantages and opportunities for innovation and growth of cash flows for 20+ years, but there can be short-term opportunities that arise when uncertainty and fear lead to indiscriminate selling as these companies historically emerge in an even stronger competitive position when the current disruptions abate.

Our long held defensive underweight and shorter dated fixed income positioning continued to add relative value for our fixed income and multi asset portfolios.

Asset Classes

| Equities | Neutral |

| Fixed Income | Underweight |

| Cash Plus | Overweight |

Asset Allocation

The outlook for interest rates and global growth has changed significantly over the past month on higher for longer inflation expectations. The Fed, ECB and BOE (alongside many other central banks) are on mission to reduce inflation and inflation expectations. Central banks have signaled that they will continue to hike interest rates until it has become abundantly clear that inflation (and excess demand) is under control. Interest rates are now expected to increase at a rate that we haven’t experienced since 1994 and the impact on economic growth has become increasingly uncertain. Many companies, industries and investors have benefitted from a prolonged period of cheap money. This is about to change as an avalanche of tighter monetary policies from central banks around the world are sure to have a rippling effect on growth globally in the coming year. Asset prices have adjusted to the change in outlook but are still only pricing in a fall to trend growth, not recession. In our opinion increased central bank policy error risks translate into a need for balance in portfolios, and why we think a more neutral allocation to risk assets and government bonds currently makes sense.

Global equity – Neutral

Equities have de-rated significantly this year and have entered a bear market after declining by more than 20%, in USD terms, from the highs reached in January this year. The decline in valuations has primarily been caused by a change in outlook for interest rates (discount rate), which have increased by c. 200 bps over the same period on the back of strong underlying growth and higher than expected inflation. Interestingly, the outlook for earnings growth (profits) for 2022 and 2023 have improved from where we started the year, a reflection of just how robust growth has been as economies bounced back from the pandemic. This can of course change as demand naturally softens and therefore guidance from management teams, as we enter the second quarter earnings season, will be closely monitored.

Higher interest rates, coupled with 40-year high inflation levels and a weaker stock market pose downside risk to consumer’s ability and willingness to continue spending at current rates, and is likely to result in a mid-cycle economic slowdown and perhaps the next recession as financial conditions tighten. Central banks are acutely aware of this but have clearly and rightly indicated that this would be a small price to pay to avoid the risk of runaway inflation over an extended period. Price stability is favourable as it allows companies to make long term investment decisions while at the same time reducing the cost of doing business. What is good for companies is good for their employees.

Although global equity markets have adjusted to higher interest rates and are now trading in line with their long-term average valuations, they do not yet fully discount a tougher environment. Given that forecast risks have increased and the outlook for both economic and corporate profit growth has deteriorated, we have decided to implement a more cautious approach by lowering the exposure in equity to a neutral position.

What we have done

| Consumer Discretionary | Overweight |

| Consumer Staples | Neutral |

| Energy | Underweight |

| Financials | Neutral |

| Healthcare | Overweight |

| Industrials | Neutral |

| Information Technology | Neutral |

| Materials | Neutral |

| Communications Services | Overweight |

| Utilities | Neutral |

| Real Estate | Underweight |

Benjamin Graham (Warren Buffett’s mentor) noted the market is a voting machine in the short run but a weighing machine long term and therefore it is important to seek out companies that can grow their earnings consistently over time. This is also our view. We have therefore taken advantage of this year’s sell-off to reintroduce luxury goods company LVMH and US bank JPMorgan Chase to client portfolios. LVMH’s iconic brands includes Louis Vuitton handbags, Moët & Chandon champagne, Dior fashion, Tag Heuer watches and Tiffany jewellery.

These “image anchors” for its aspirational customers have historically had pricing power during periods of high inflation. Its recent share price sell-off, initially on China COVID-lockdown concerns, has provided a compelling entry point to participate in the long-term growth of the middle-class cohort.

JPMorgan Chase is widely seen as one of the world’s best managed financial institutions. Profitability via net interest margin will be a clear beneficiary of sharply higher US rates. As the largest US bank, JPMorgan has a competitive edge through economies of scale and scope, as well as one of the biggest technology budgets in the industry.

Fixed Income – Underweight

| G7 Government | Underweight |

| Investment Grade - Supranational | Overweight |

| Investment Grade - Corporate | Neutral |

| High Yield | Overweight |

Government bond markets have posted deeply negative returns this year, aggressively re-pricing for the new ‘inflationary and tighter policy norm’. Many factors will dictate the direction from here but generally, yields spike most in the early phase of a tightening cycle and that currently seems to be the playbook. However, we still expect yields to climb higher, albeit at a more modest pace, whilst central banks remain firmly in hawkish mode. Our defensive duration strategy has shielded portfolios from the worst of the drawdown in bond markets and although negative returns have been unavoidable, our strategies continue to deliver meaningful outperformance versus benchmarks. While we acknowledge that bond yields could continue to climb higher, an expected slowdown in the global economy coupled with a peak in inflation will once again be supportive for bonds. We might already be close to such an inflection point and have used this year’s sharp sell-off which has resulted in higher yields as an opportunity to increase client’s exposure to fixed income securities in portfolios, while remaining underweight..

US bonds continued to sell-off aggressively in the second quarter as the Federal Reserve’s (Fed) hawkishness intensified. Interest rates have now risen three times with each individual move getting bigger and earlier expectations of rates ending the year around 2.5% have been quickly extinguished by the most recent strong inflation report which prompted the Fed to quickly unveil a revised ‘dot plot’ with an average year-end target for interest rates now at 3.4%. What is very clear now is that persistent price pressures are forcing the Fed to shift its focus from supporting economic growth to getting inflation back towards the 2% target.

It is worth noting that the Fed have acknowledged the risk of recession ‘as a possibility’ although the goal remains that of a ‘soft landing’ despite the headwinds. We have our doubts that inflation can fall anywhere close to 2% target levels without imparting considerable damage to economic growth – time will tell. Our bias is towards maintaining a defensive underweight duration strategy, however, as yields drift higher in the coming months, we aim to continue to close the gap relative to benchmark given markedly more attractive entry levels compared to only some months ago.

The UK Monetary Policy Committee (MPC) hiked interest rates by a further 25 basis points in June to 1.25%, the highest level since 2009. UK sovereign bond yields have continued to climb in the quarter, reflecting the more hawkish rhetoric emanating from the MPC’s fight against inflation. Whilst the worst appears to be behind us in respect of the severity of the spike in yields, it is quite possible that the ten-year could test 2.75% by year-end, especially if inflation surprises to the upside of already elevated expectations. The defensive underweight to duration (interest rate risk) has added significant relative value, however, looking ahead we will use periods of weakness to slowly close this underweight position.

A combination of rising government bond yields and wider credit spreads have pushed investment grade (IG) and high yield (HY) bond prices sharply lower. IG and HY bond markets remain highly correlated to the direction of risk assets and downside volatility this year has pushed credit spreads on both above long-term averages. Both markets now clearly offer more attractive yield levels, but we see few catalysts, at least over the short to medium-term, for credit spreads to tighten. We are content to maintain our current credit allocation but wish to wait for a more attractive entry level before increasing exposure. The majority of exposure throughout our strategies is concentrated at the shorter end of the maturity spectrum and has outperformed the broader market.

The US Dollar continued its ascent in the second quarter, appreciating 6.48%, taking year-to-date gains to an impressive 9.42%. Whilst central banks around the world have shifted materially more hawkish to contain spiralling inflationary pressures, the US Fed is going ‘harder and faster’ compared to most as it is in a stronger economic position to do so. Along with the benefits of reserve currency status, it is this current and forward-looking interest rate (and by default government yield) advantage that has heavily supported the currency versus counterparts such as the Euro, Yen and Sterling – each of which have their own less positive issues to contend with. If the Fed’s own interest rate forecasts are correct (circa 3.4% at the end of this year and 3.8% at the end of 2023) then we see the currency holding its value amidst ongoing attractive relative interest rate and yield differentials.

Market Performance / as at 30 June 2022

| EQUITIES | June | YTD | 12 MONTHS |

|---|---|---|---|

| Global | |||

| FTSE All World TR Net (Sterling) | -4.94% | -10.74% | -4.02% |

| FTSE All World TR Net (US Dollar) | -8.40% | -19.96% | -15.63% |

| UK | |||

| FTSE All-Share TR | -5.98% | -4.57% | 1.64% |

| US | |||

| S&P 500 TR | -8.25% | -19.96% | -10.62% |

| Europe | |||

| Dow Jones Euro STOXX TR | -9.38% | -18.55% | -13.29% |

| FIXED INCOME | June | ytd | 12 MONTHS |

| Bloomberg Barclays Series - E UK Govt 1-10 Yr Bond Index | -0.74% | -4.65% | -5.78% |

| Bloomberg Barclays Series - E US Govt 1-10 Yr Bond Index | -0.74% | -5.80% | -6.35% |

| JP Morgan Global Government Bond (Sterling) | 0.56% | -4.24% | -4.23% |

| JP Morgan Global Government Bond (US Dollar) | -3.10% | -14.14% | -15.81% |

| Iboxx Sterling Corporates Total Return Index | -3.56% | -13.95% | -14.54% |

| Iboxx US Dollar Corporates Total Return Index | -2.66% | -13.76% | -13.74% |

| CURRENCY vs. STERLING | June | ytd | 12 months |

| US Dollar | 3.63% | 11.09% | 13.33% |

| Euro | 1.21% | 2.32% | 0.26% |

| Yen | -1.82% | -5.73% | -7.21% |

| CURRENCY vs. US DOLLAR | June | ytd | 12 months |

| Rand | -2.31% | -7.80% | -11.53% |

| Euro | -5.26% | -15.16% | -18.13% |

Source: FTSE International Limited (“FTSE”) © FTSE 2013. “FTSE®” is a trade mark of the London Stock Exchange Group companies and is used by FTSE International Limited under licence. All rights in the FTSE indices and / or FTSE ratings vest in FTSE and / or its licensors. Neither FTSE nor its licensors accept any liability for any errors or omissions in the FTSE indices and / or FTSE ratings or underlying data. No further distribution of FTSE Data is permitted without FTSE’s express written consent.