We regularly explore the investment rationale of one of the companies we own in the Melville Douglas Global Equity Fund to articulate what we find compelling. This time round we have chosen Amphenol.

Amphenol is a “mini-me” of the Global Equity Fund. The company is composed of hundreds of highly profitable businesses (autonomously run by entrepreneurs) that supply to a broad range of industries around the globe. Within technology it is a reassuringly unglamorous but resilient company with a highly lucrative business model that can be locked away in your top drawer. It is the dull but reliable tortoise to the racier but ephemeral hares.

What Does Amphenol Do?

Most people would not have heard of Amphenol. But they are daily users of its clients’ products, which include Apple iPhones, BMW cars or Samsung smart TVs. Amphenol designs and manufactures the mission critical “back-of-thescenes” components that make these items work.

Amphenol is an electronics components company. Its products include electric wiring interconnect systems, sensors, antennas and fibre optic cables for a multitude of uses and end-markets. For example, its connectors are critical in ensuring that power and data is reliably and effectively transmitted through an electronic circuit. The electronification of everything means that more applications contain electronic circuits with increasing complexity and capabilities. Amphenol is an enabler of this electronics revolution.

Buying the Haystack Rather Than Searching for the Next Needle

For every Microsoft or Google there have been thousands of tech also-rans that have been poor investments. We know we do not have an edge over our peers in discovering the next Big Tech name in its infancy. Instead, we either own an established winner and take a view their competitive advantage will persist, or we buy a company that sells mission-critical equipment to the entire field. Amphenol is in both camps. As the picks-and-shovel supplier in the tech goldrush it has always made a nice turn on the hopes and dreams of the next get-rich-quick prospector.

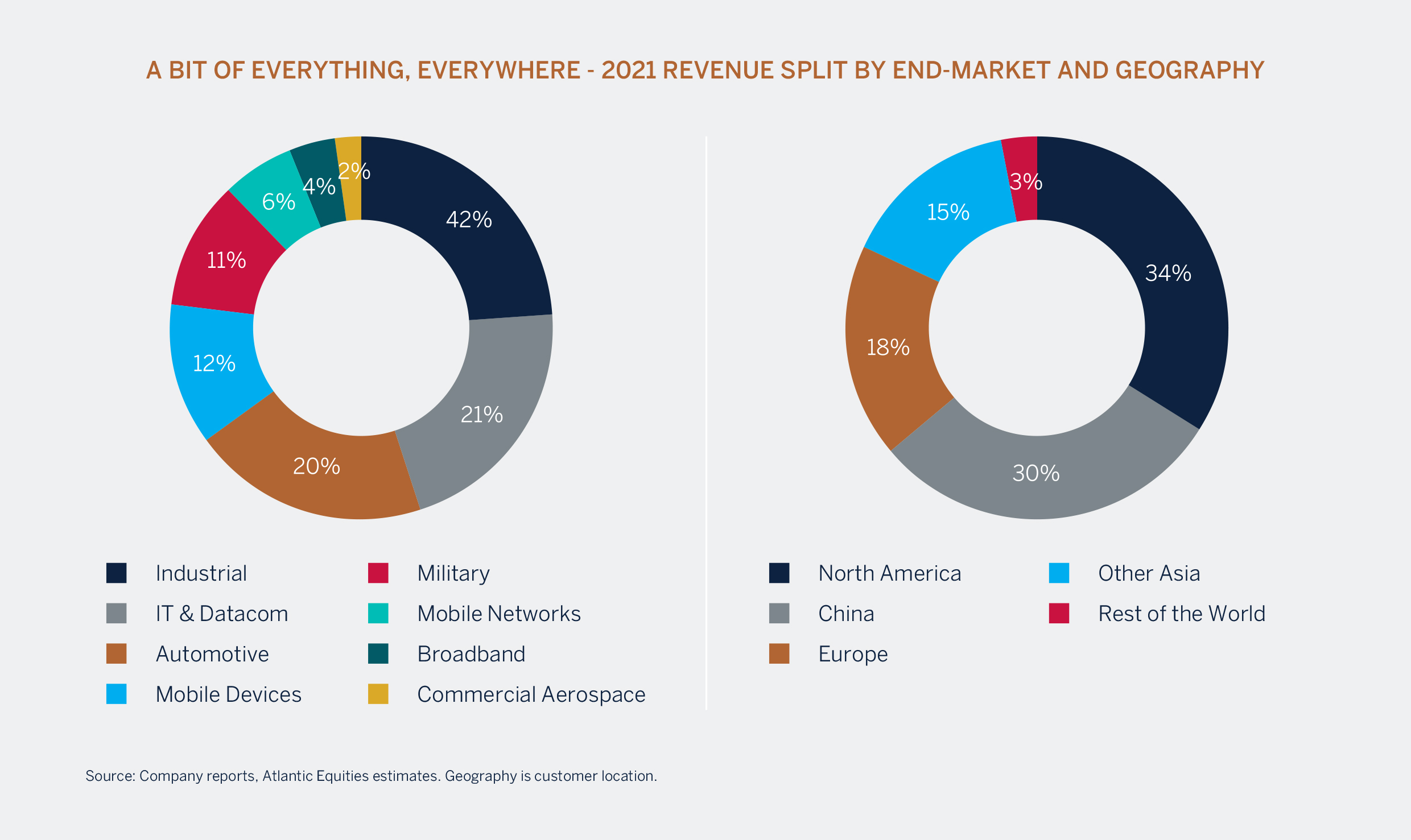

It is easy to see the electronification of everything under the sun continuing for many years and decades to come, driven by increased connectivity and automation. The proliferation of electronics has helped to increasingly diversify Amphenol over the past two decades across a wide breadth of end markets and 1,000s of products (albeit all within its sphere of expertise). Its core communications-related sales (i.e. IT & datacom, mobile networks, mobile devices and broadband) has declined from 65% of revenue in 2000 to 43% in 2021 as the automotive and industrial markets contributed to a growing pie.

New avenues for growth include vehicle electronification, manufacturing automation, next-generation 5G technology and cloud computing. For example, robotics and automation in factories are expected to grow around twice the rate of GDP. This diversification also makes the company less obviously prone to losing out to technological disruption.

An Entrepreneurial Culture

As well as growing organically, Amphenol has a long and successful track record of bolt-on acquisitions to secure new products and customers that plug into its existing business model. Importantly, Amphenol adds companies with strong and entrepreneurial management that do not need to be “fixed”. As well as boosting sales and saving costs through accessing its supply chain, these acquisitions have relatively low integration risk given Amphenol’s hands-off approach.

Amphenol’s entrepreneurial culture is a key strength. The company empowers its 130 General Managers to run their businesses as if they were the owners. Indeed, many are former owners of companies that Amphenol had acquired. They are given full authority and responsibility over their unit’s profit & loss, and their incentives are structured in a similar way to an independent business. Innovation begins with the locally based General Managers, who can quickly respond to evolving technology trends rather than wait for direction from the top.

Equally important are its close customer relationships. Working with customers at the design stage generally leads to products with higher value-added content. Simultaneously, Amphenol is also able to leverage the benefits of scale to drive innovation as its seven Group General Managers have direct oversight over the company’s 130 General Managers. These Group General Managers help to foster shared best practices, align General Managers who have significant overlap within their group, and tap into knowledge from other parts of the company. The company’s auto antenna business is a good example of this dynamic as it was built on the company’s core competency in antennas for mobile devices.

Wide Economic Moat = High Return on Invested Capital

As well as the electronification trend, there remains plenty of scope for share gains in fragmented markets. According to Atlantic Equities, Amphenol has 14% share of the $70bn connector market but only 1% share of the $110bn sensor market. Only rival TE Connectivity matches Amphenol’s scale and market diversity in the connector market.

The company’s competitive advantage (or what Warren Buffett terms economic moat) is its manufacturing scale, reputation as a technology leader and sticky customer relationships. It is nigh impossible to displace sales of its mission-critical components because customers are more interested in dependability rather than price.

A connector is typically only 1% to 3% of an end-product’s cost of goods sold. As a highly engineered Amphenol connector is specifically tailored for and embedded in a customer product, the disruptive switching costs of using a cheaper rival connector are far higher than the miniscule potential savings. Financial strength is also a critical advantage over smaller competitors as customers will want to deal with a supplier that will still be a going concern during an economic downturn.

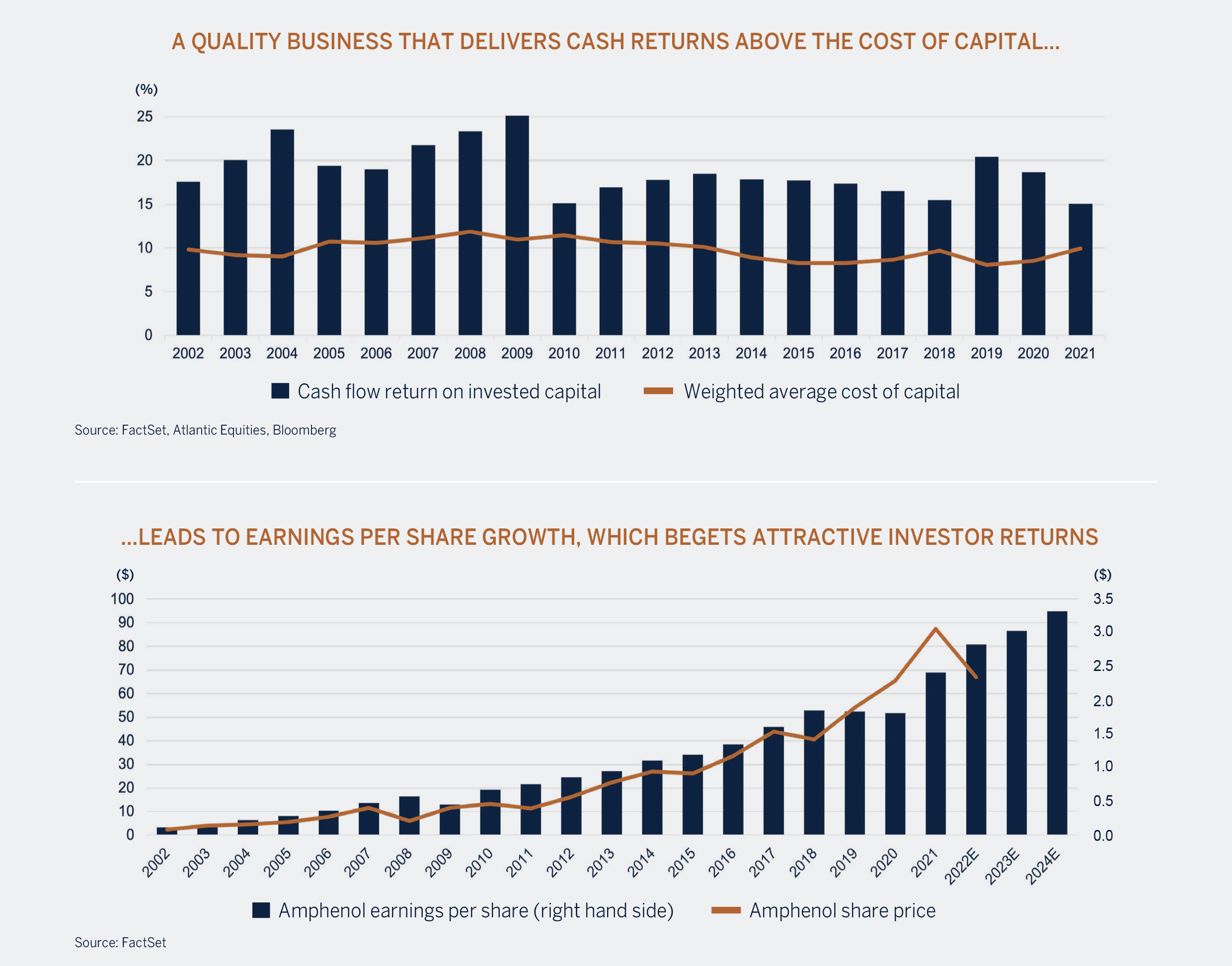

Proof is in the pudding. All the above positives have delivered cash returns on its invested capital that are at least 50% higher than the theoretical cost of that capital. This money-making machine’s moat and compelling opportunity set remains in place today.

A classic Compounder

Amphenol was founded in 1932 to provide tube sockets for radios. 90 years later the company continues to thrive. The secret sauce is an entrepreneurial bottomup culture. An investor is buying over a hundred well-run businesses, not just one, that are broad beneficiaries of digitisation everywhere. Amphenol shares will not make overnight lottery-type winnings. But being exposed to the entire tech haystack, rather than vainly finding the needle within it, is the reason for its slow burn and enduring success.